Learn

The Social Security Fairness Act of 2025: A Major Win for Public Sector Retirees That No One Is Talking About

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

Synovus Securities, Inc.

If you or your spouse is currently retired or close to retirement and worked in the public sector as a teacher, police officer, firefighter, federal employee or any other career that provided a “non-covered” government pension, you are going to want to lock-in to this month’s update.

The Social Security Fairness Act (SSFA), a bipartisan piece of legislation also known as H.R. 82, signed into law on January 5, 2025 by former President Joe Biden, represents one of the most important Social Security reforms in decades, potentially adding tens or even hundreds of thousands of dollars to your lifetime retirement income.

Who Benefits from This New Law?

The new SSFA of 2025 eliminated two provisions that have reduced Social Security benefits for nearly 3 million Americans since the 1970s and 1980s: The Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). Managing Partner, Public Sector Retirement, Brad Hope, at Daybright Financial said, “The WEP and the GPO were designed to address what lawmakers saw as ‘double-dipping.’ Essentially, these rules reduce Social Security benefits for people who receive pensions from jobs that didn’t pay into Social Security taxes.”1

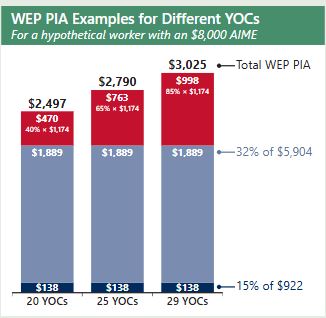

WEP PIA Example Chart (previous calculations)

If you're a public sector employee with a pension from work where you didn't pay Social Security taxes, this law directly affects you.

Specifically, the law benefits:

- Teachers, firefighters and police officers in many states

- Federal employees covered by the Civil Service Retirement System (CSRS)

- State and local government workers with non-covered pensions

- Individuals who earned foreign social security benefits

- Spouses and surviving spouses of these workers and private sector retirees

For Those Impacted: What This Means for Your Benefits

The financial impact varies significantly based on your family income situation, so your first step may be inquiring with the Social Security administration on how the new SSFA law can affect you and your family. You can go to www.ssa.gov or call 800-772-1213 to receive information directly from the Social Security Administration2

For workers affected by WEP, it’s the working individual who may have partially paid into Social Security working for a private sector employer but derived most of their working career income from a city, county, or state public sector employer with a “non-covered” pension. Your monthly Social Security benefit could increase by up to $613. For example, if you're a retired teacher who also worked in the private sector, your previously reduced benefit will now reflect your full earnings history.

For individuals affected by GPO, it predominately impacts spouses of people who are eligible for a Social Security spousal benefit (spouses who mainly worked in a private sector or self-employed individuals) or a survivor benefit. The average increase is approximately $700 monthly, with surviving spouses benefit seeing average increases of $1,190 per month. Some individuals who were completely ineligible for spousal benefits due to GPO can now claim these benefits for the first time. The law also includes retroactive benefits to January 2024. Most eligible retirees have already received lump-sum payments averaging $6,710, though complex cases may still be processing.

For future retirees, the FFSA removes the uncertainty around the retirement projections and creates further comfort for those families approaching their retirement years who are impacted by the repeal of the WEP/GPO calculations.

Keep in mind that approximately 72% of state and local public workers are already covered under Social Security, paying into both non-covered pensions and Social Security (i.e., Teachers Retirement System (TRS) & Federal Insurance Contributions Act (FICA) tax) and thus may not benefit from the new SSFA ruling.

A Real-Life Scenario

Consider James, a retired public-school teacher receiving a $3,000/month pension. Under the old WEP rules, the Social Security Administration may have reduced his Social Security income by up to $500 monthly. Now, that full amount is restored — boosting his monthly cash flow by $6,000 a year, plus a one‑time lump sum covering retroactive payments from January 2024 to July 2025, an additional $9,000 in SSFA income!

Patricia, a surviving spouse affected by GPO prior to SSFA, has been receiving $3,000 a month from her government pension. Her spouse retired and received $2,500 in Social Security benefits. After he passed away, the GPO rule would have calculated two-thirds of her pension income ($3,000 X 0.6666= $2,000) and subtracted this amount from her late husband’s Social Security benefit, leaving her with $500 of survivor benefit, or a total income of $3,500. The repeal of GPO returns her survivor benefit back to $2,500 a month, or a total monthly $5,500 retirement income, plus a one‑time lump sum of $36,000 in retroactive SSFA income.

In Summary

SSFA marks a much‑needed reform for career public servants and survivors previously penalized by WEP and GPO. Let’s face it, U.S. households earning under $75,000 annually are struggling to maintain their basic necessities. U.S. retirees remain bifurcated between the “haves” and “have not’s,” with the middle being squeezed by rising prices at your local grocery store, medical costs and insurance premiums. A failure to plan could result in your plan failing. Creating a sound personalized financial plan with a financial professional may help you understand your current and/or future income plans to insulate you, your spouse and loved ones from financial uncertainty in your retirement years.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.