Learn

Personal Trust Corner: A J.D.’s Perspective

Protecting Your Legacy: The Importance of Asset Protection Planning

By Amy Piedmont, J.D., LLM, Vice President, Sr. Trust Relationship Manager and

Katherine “Kate” Gambill, J.D., Vice President, Sr. Trust Relationship Manager

As a successful professional or someone who has built significant wealth, you understand the importance of hard work, strategic planning and meticulous attention to detail. Just as you work to build and grow your financial resources, it is equally critical to implement strategies to safeguard those assets from unforeseen risks. This is where asset protection planning comes in – a critical component of comprehensive wealth management, particularly for those with substantial assets and significant exposure.

In our series, “The Personal Trust Corner: A J.D.’s Perspective,” we aim to highlight important issues that may affect Synovus clients and strategies that may be employed to protect you and your estates. This month, we turn the spotlight on the importance of asset protection planning to safeguard your assets and secure yours and your family’s financial future.

What is Asset Protection Planning

Asset protection planning is a proactive approach to legally safeguarding your assets from potential threats like lawsuits, creditors and excessive taxes. It involves creating barriers to protect your wealth, ensuring your assets remain intact even in challenging situations. This strategy differs from estate planning, which primarily focuses on asset distribution after death, as asset protection centers on preserving assets during your lifetime.

Ignoring the need for asset protection can expose your hard-earned wealth to unnecessary risk. A single lawsuit or financial setback could threaten everything you've worked for.

Key Asset Protection Strategies

Fortunately, there are various legal and effective strategies to protect your assets. A comprehensive plan typically incorporates a combination of these tools:

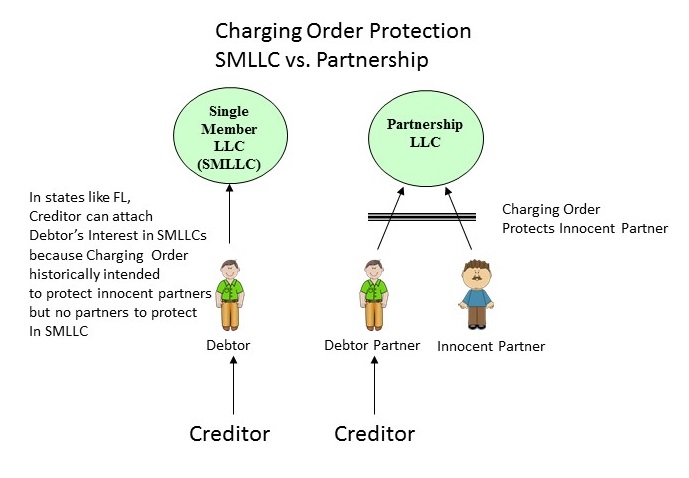

- Business Structures: For those with businesses or investments, establishing legal entities like Limited Liability Companies (LLCs) or corporations can separate personal assets from business liabilities. This minimizes personal exposure to business-related claims and personal creditors. For example, Tennessee limits personal creditors to a charging order for single member LLCs whereas Florida only applies such limitations to multi-member LLCs.

- Trusts: Trusts, particularly irrevocable trusts as explained more fully below, are powerful tools in asset protection planning. An irrevocable trust, once established, generally cannot be altered or revoked, offering strong legal separation of assets from the grantor's ownership. This separation makes it difficult for creditors to access those assets.

- Insurance: Adequate insurance coverage, including professional liability insurance, umbrella insurance and homeowner's insurance, is a critical first line of defense against potential lawsuits. By implementing asset protection strategies, you may be able to reduce the need for certain types of insurance coverage, potentially leading to lower premiums.

- Retirement Accounts: Retirement funds, such as 401(k)s and IRAs, generallyenjoy strong protection from creditors under federal law.

- Strategic Asset Titling and Segregation: Carefully titling assets and segregating them among different entities can significantly impact their vulnerability to creditors. In many states, such as Florida and North Carolina, titling assets like Tenancy by the Entirety, a joint ownership allowed only for married couples, provides the strongest asset protection from individual creditors.

- Homestead Exemptions: Many states offer homestead exemptions that protect a portion of the value of your primary residence from creditors. For example, Florida has the strongest homestead protection with your entire home not being subject to creditor claims during life or at death. By comparison, South Carolina’s homestead exemption only applies to $50,000 of home equity; thus, only a portion is protected from creditors.

- Pre- and Postnuptial Agreements: For individuals with significant assets, especially those entering into a second marriage, these agreements can protect assets from potential divorce settlements.

Types of Asset Protection Trusts:

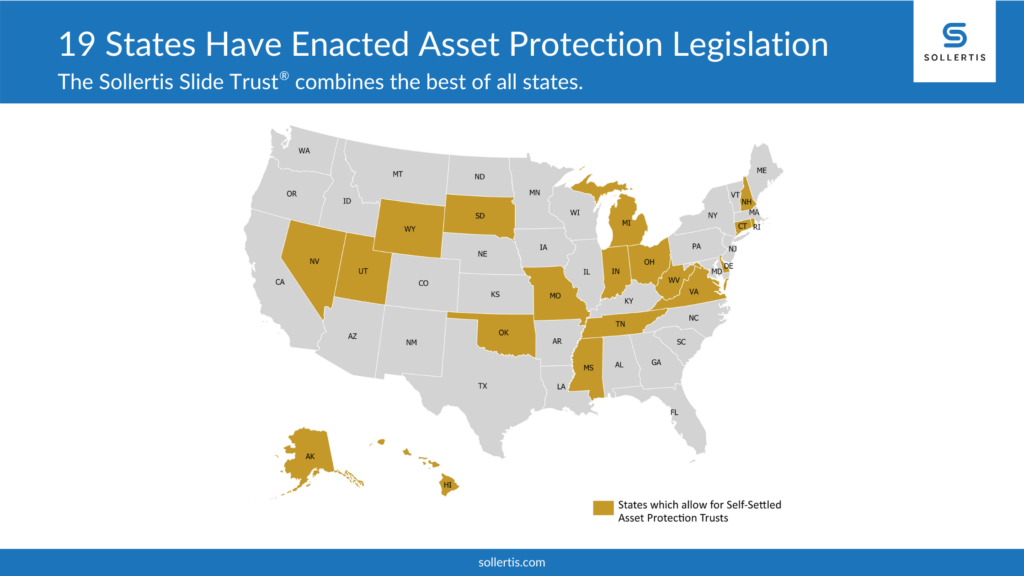

- Domestic Asset Protection Trusts (DAPTs): Tennessee and Alabama are two of the states that permit the creation of Domestic Asset Protection Trusts (DAPTs); Georgia allows for a Hybrid Domestic Asset Protection Trusts.

These trusts offer enhanced creditor protection by allowing the grantor (the person creating the trust) to also be a beneficiary, providing flexibility while safeguarding assets from creditors. There are several requirements to be an enforceable DAPT thus consulting with an estate planning professional is crucial. Further, assets transferred to a DAPT are only protected from creditors after two years or six months if creditor receives notice.

- Foreign Asset Protection Trusts (FAPTs):Also known as offshore trusts, these are established in countries with laws that offer enhanced protection against creditors. Common offshore locations include the Cook Islands, Belize and Nevis. These trusts offer high confidentiality and tax efficiency but come with higher costs and complexity.

- Medicaid Asset Protection Trusts (MAPTs):Designed to reduce the number of assets a person legally controls, these trusts can help qualify for Medicaid benefits for long-term care without depleting personal savings. However, there's a five-year, look-back period for asset transfers when applying for Medicaid.

- Special Needs Trusts: Created for individuals with disabilities, these trusts provide financial support without jeopardizing eligibility for government benefits.

- Spendthrift Trusts:These trusts contain provisions to prevent beneficiaries from squandering the funds or having creditors access them, as the trustee has discretionary power over distributions.

Why is Asset Protection Important?

A primary goal of asset protection is to create legal barriers that make it difficult for creditors and litigants to seize your assets in the event of lawsuits, judgments, or financial difficulties. A well-structured asset protection plan can give you an advantage in negotiations, as potential plaintiffs may be more inclined to settle disputes quickly when they see that your assets are well-protected. Life is unpredictable, and unforeseen events like lawsuits, accidents, or business failures can put your assets at risk. Asset protection provides a safety net to minimize the impact of such events and prevent the loss of your hard-earned wealth. Knowing that your assets are protected from potential threats can provide immense peace of mind and allow you to focus on your financial goals without constantly worrying about potential losses.

While it requires careful planning and professional guidance, the benefits of protecting your assets from potential threats can be significant. However, it's essential to understand the intricacies involved and work with experienced professionals to tailor a plan that meets your specific needs. Further, it's crucial to implement asset protection strategies before any legal threats or creditor claims arise.

Please reach out to our Senior Trust Relationship Managers: Amy Piedmont, J.D., LLM, Vice President, in Pensacola, Florida and Katherine Gambill, J.D., Vice President, in Atlanta with any questions or to start a conversation regarding asset planning. We welcome the opportunity to introduce you to how Synovus Trust Company can serve your needs.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.