Learn

U.S. Credit Market Update

Eric Krueger, Synovus Trust Senior Portfolio Manager

This month we will review recent data on the credit market in the U.S. Earnings in 3Q have been above expectations and certainly good enough for credit markets. Even though the S&P 500 has lost ground since the peak in July, credit spreads have been stable, while absolute yields are the highest in more than a decade. Yields have been on the rise as an expectation of higher for longer interest rates are finally settling in investors’ minds. Finally, supply has been extremely low, and unless the last two days of October (as of this writing) are greater than $15 billion, October will be the lowest supply month in more than a decade. All of this adds up to it being a terrific opportunity for conservative fixed income investors.

Earnings

Chris Brown covers this in more detail in his piece but suffice it to say that earnings have beat expectation so far in 3Q. Reading the tea leaves from credit spreads, it is certainly good enough for investment-grade fixed income investors. Gross Domestic Product (GDP) data has been strong and the November 3 employment report will likely confirm the strength in jobs. Even if it comes in below expectations there will be plenty of latitude due to the recent auto strikes.

Yields are High Relative to Recent History

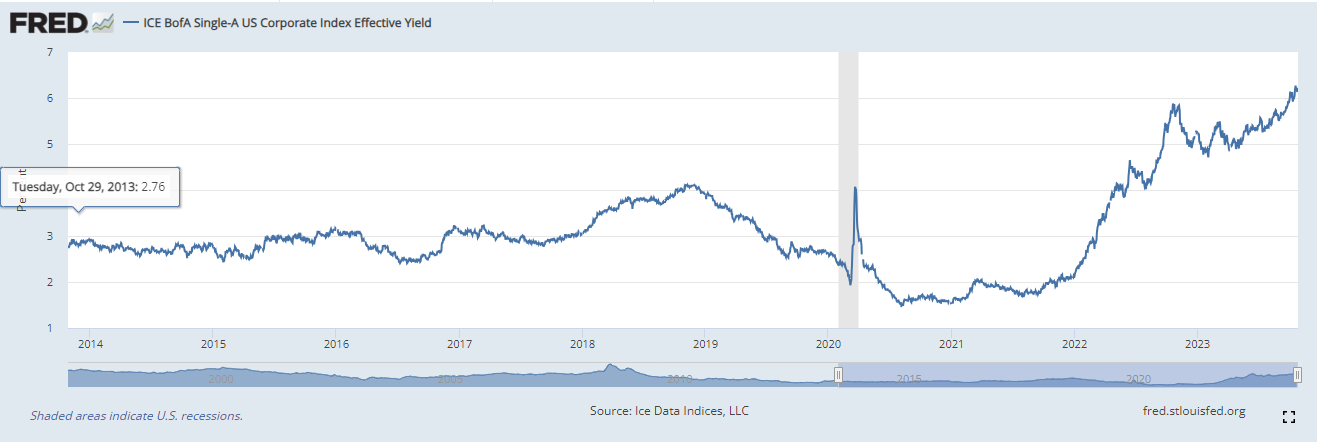

This graph paints a great picture of how high rates are relative to history:

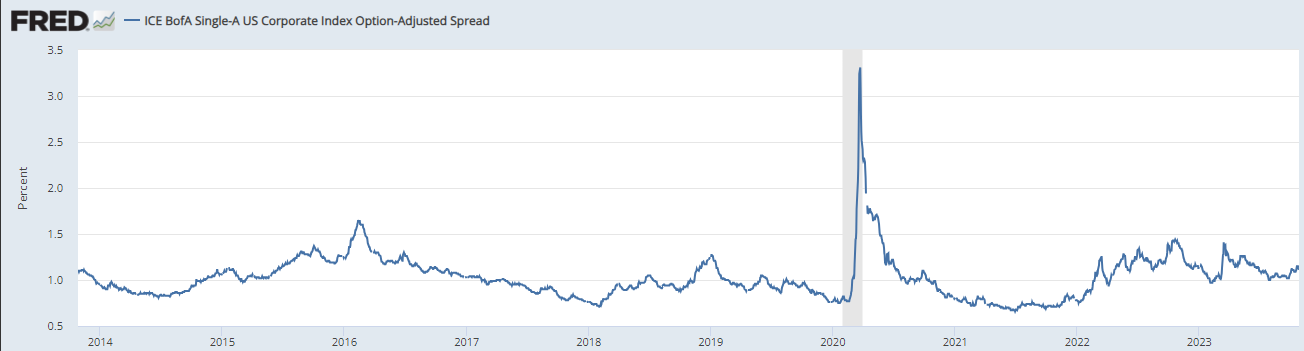

A-Rated Credit Spreads are not showing any concern from markets:

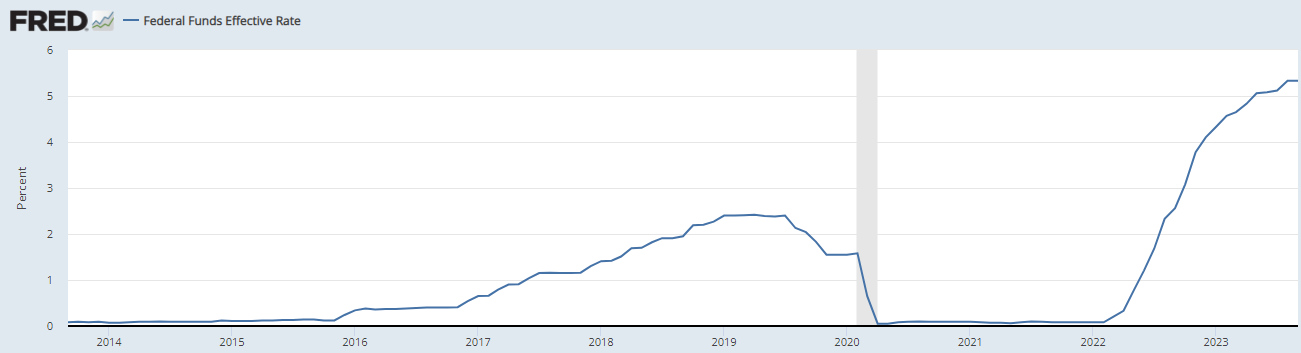

All-in yields are at a decade high because the Fed has raised short-term rates to decade highs.

So, while spreads remain at long-term averages as markets see little credit risk at this time, the total yield is extremely attractive compared to the past 10 years.

Technicals

Lastly, new issuance of high-grade credit has been scarce in October. The last time we saw new supply this low was October 2011. There are a multitude of reason for the scarcity:

1. Some think that issuance is low as corporations issued/refinanced more debt when rates were low.

2. As previously discussed, we currently have the highest all-in yields in more than 10 years, making issuance a much more difficult corporate financing decision.

3. Geopolitical risk is high.

4. Treasury issuance possible “crowding out” corporate supply.

In conclusion, regardless of the reason for lower supply, it is good news for credit investors as it has helped to keep credit spreads low while the Fed has driven risk-free rates higher. As mentioned last month, the Fed is nearing its “terminal” rate as per its own projections of rate cuts next year. Historically, that is exceptionally good news for bond holders. Given the higher coupons we are seeing this year, high quality bonds are attractive at these levels.

If you have any questions or would like to discuss how these developments may impact your portfolio, please do not hesitate to reach out.

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.