Are you ready for the mid-terms?

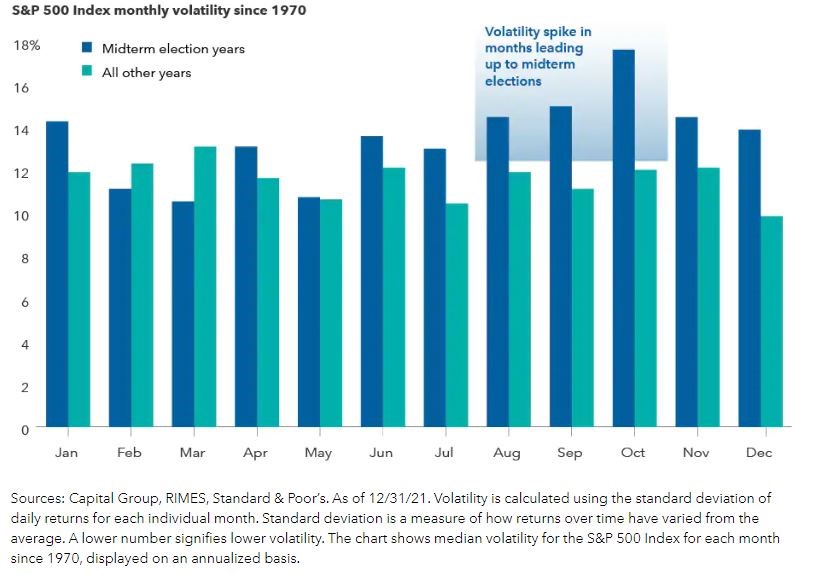

The 2022 mid-term elections will take place on Nov. 8, 2022. The importance of the mid-term election for the markets, surprisingly, is not if the Democrats or the Republicans win the House or Senate. The important factor for the stock market is a post mid-term election result. Markets hate uncertainty and invoke turbulent price swings due to the reshuffling of the congressional deck. Since 1970, the standard deviation of the S&P 500 during mid-term years is 16% compared to all other years of a 13% standard deviation. Standard deviation is a term that represents the measurement of volatility or variance of price. The volatility in stock prices in mid-term election years can move erratically compared to the normal weekly, monthly, or annual movement of the S&P 500.

Throw in the highest inflation our economy has seen in 40 years, a 300%+ increase in the fed funds rate (YTD), and a raging U.S. dollar cutting into S&P earnings equals the perfect Bear Market Souffle that even Chef Gordon Ramsey would be proud of. The standard deviation of the S&P 500 for 2022, as of this writing, is 20.25% or a 56% increased volatility in the S&P price movements compared to normal market years.1

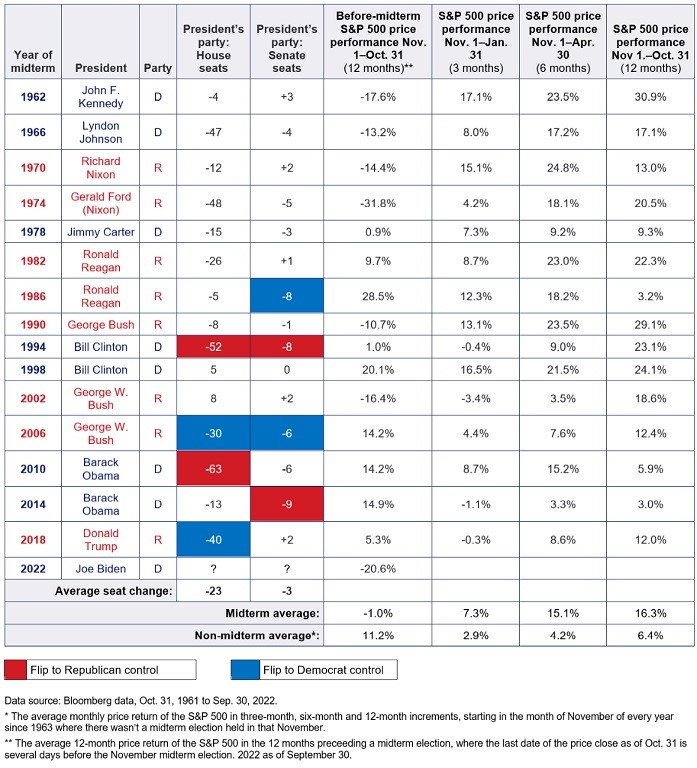

Once the mid-term results are announced and the uncertain political change becomes certain, the markets have a history of getting back on track. There have been 15 mid-term elections since 1962 and the S&P 500 performance has been positive 100% of the time from the election date through the following six months and also positive one year from the mid-term election market price.

One additional point I wanted to highlight from the historical mid-term election chart. There is no evident correlation between the elected political party and market returns following the election. This would be a good lesson for long term investors to leave politics out of your portfolio. Not to say that future fiscal policy changes cannot impact market swings or change your future tax liability on your investments. The weight of evidence does not convey any correlation to political party wins or losses for market performance after mid-term elections.

Once the mid-term results are announced and the uncertain political change becomes certain, the markets have a history of getting back on track.

Once the mid-term results are announced and the uncertain political change becomes certain, the markets have a history of getting back on track.

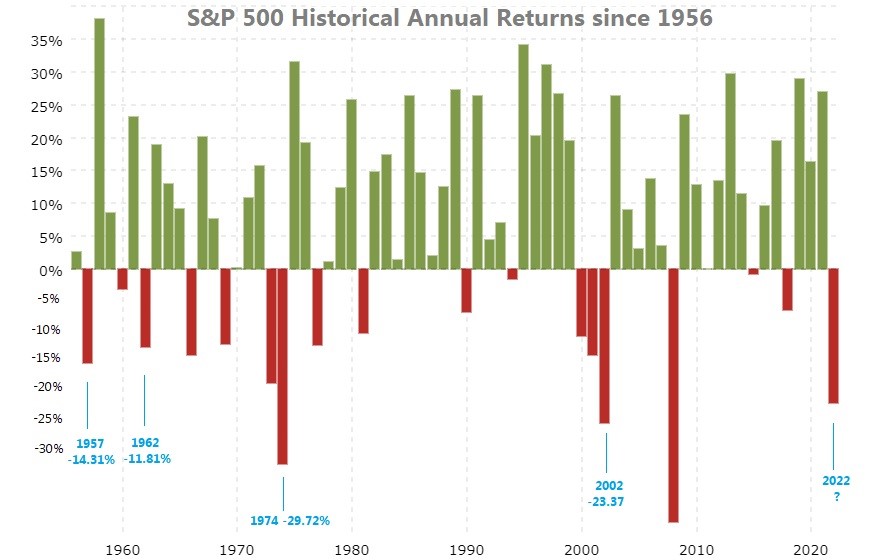

One correlation that is noteworthy is the degree of S&P returns after a negative January thru November mid-term election year (1962, 1966, 1974, 1990, 2002). I would not attribute this information to only mid-term election years. Positive market returns six and 12 months after large market drops are a natural part of market cycles, indicated in the macrotrends chart below.

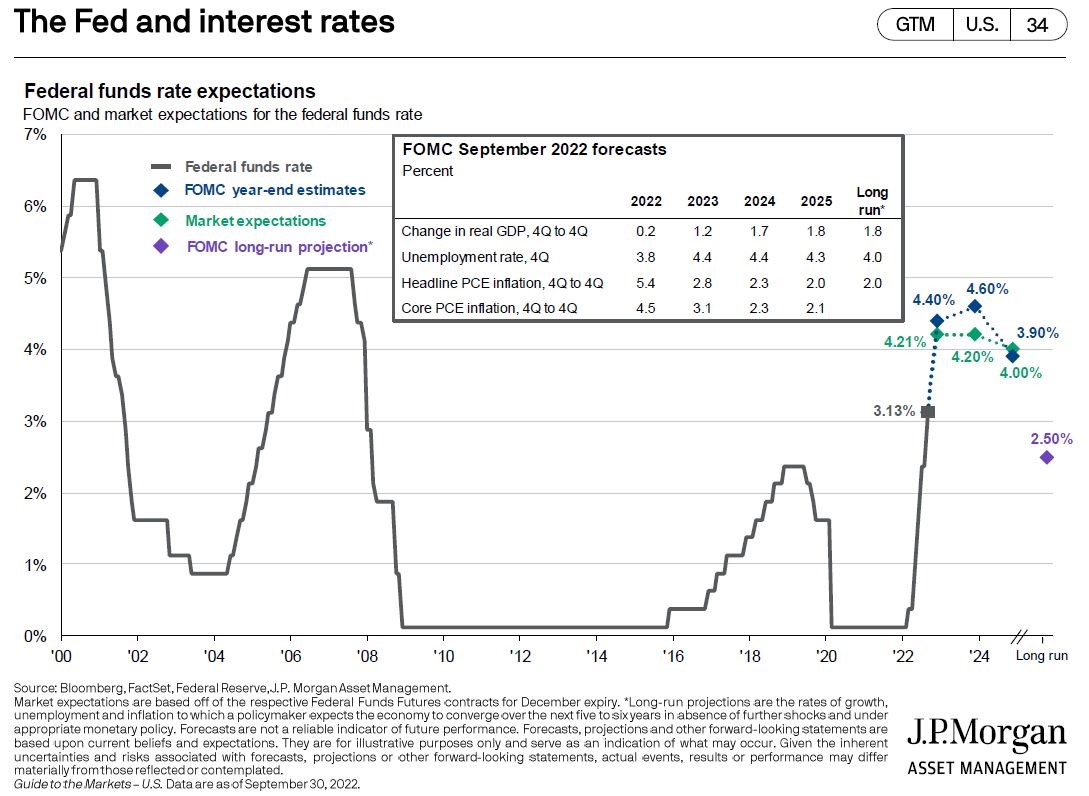

The 2022 YTD performance of the markets can be viewed as a positive set up for the next year but, we’re not out of the woods yet. Inflation remains a key component for lower performance in 2022, especially in technology and other high growth-related sectors. The October headline inflation report coming in the first week of November (AKA October CPI numbers) can determine how aggressive the Federal Reserve can remain with the blunt instrument of quantitative tightening (QT). The markets have priced in a future fed funds rate of 4.25% or approximately 1% higher than where we are now, 3% to 3.25% fed funds rate. This proposes approximately two more rate hikes before year end, 0.75% in November and 0.50% to 0.75% in December. A higher than expected, CPI report in November can extend the bludgeoning of QT and potentially create additional volatility into 2023.

I remain cautiously optimistic and rely on the weight of the evidence for further economic data as it is released. This may be one of the best opportunities for long-term investors to own financial assets in over a decade. Retirees are now able to own US Treasuries with over a 4% risk free return -- yield levels that haven’t been available for 15 years. Long-term investors of stocks are able to purchase stocks of Fortune 500 companies or broad market funds below their historic average price. The famous investor, mutual fund manager, and philanthropist, Sir John Templeton stated, “Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

Christopher Brown, CIMA®, CRPC™, Financial Advisor, Synovus Securities, Inc.

Important disclosure information

- Standard Deviation YTD for S&P 500, https://finance.yahoo.com/quote/SPY/risk/ Back