Commercial Customer Survey Results: 3Q2022

One statistic that we track in Synovus Market Intelligence is the National Federation of Independent Business (NFIB) Small Business Optimism Index, because it offers insight into the future expectations of small businesses, a sector where Synovus has a wide range of clients. At the beginning of 2022, we noticed that the index level was slipping below its 48-year average of 98, and we surmised that was reflective of future worsening economic conditions given inflation pressures and the potential for Federal Reserve Board rate hikes. Our group partnered with our Marketing Analytics team to issue a quarterly survey of business conditions to our commercial customers, very similar to various Purchasing Managers Index (PMI) surveys conducted by other companies. We administered the first survey in June, and our second one was issued in September, which incidentally marked the ninth consecutive month the NFIB Small Business Optimism Index came in below 98 (92.1).

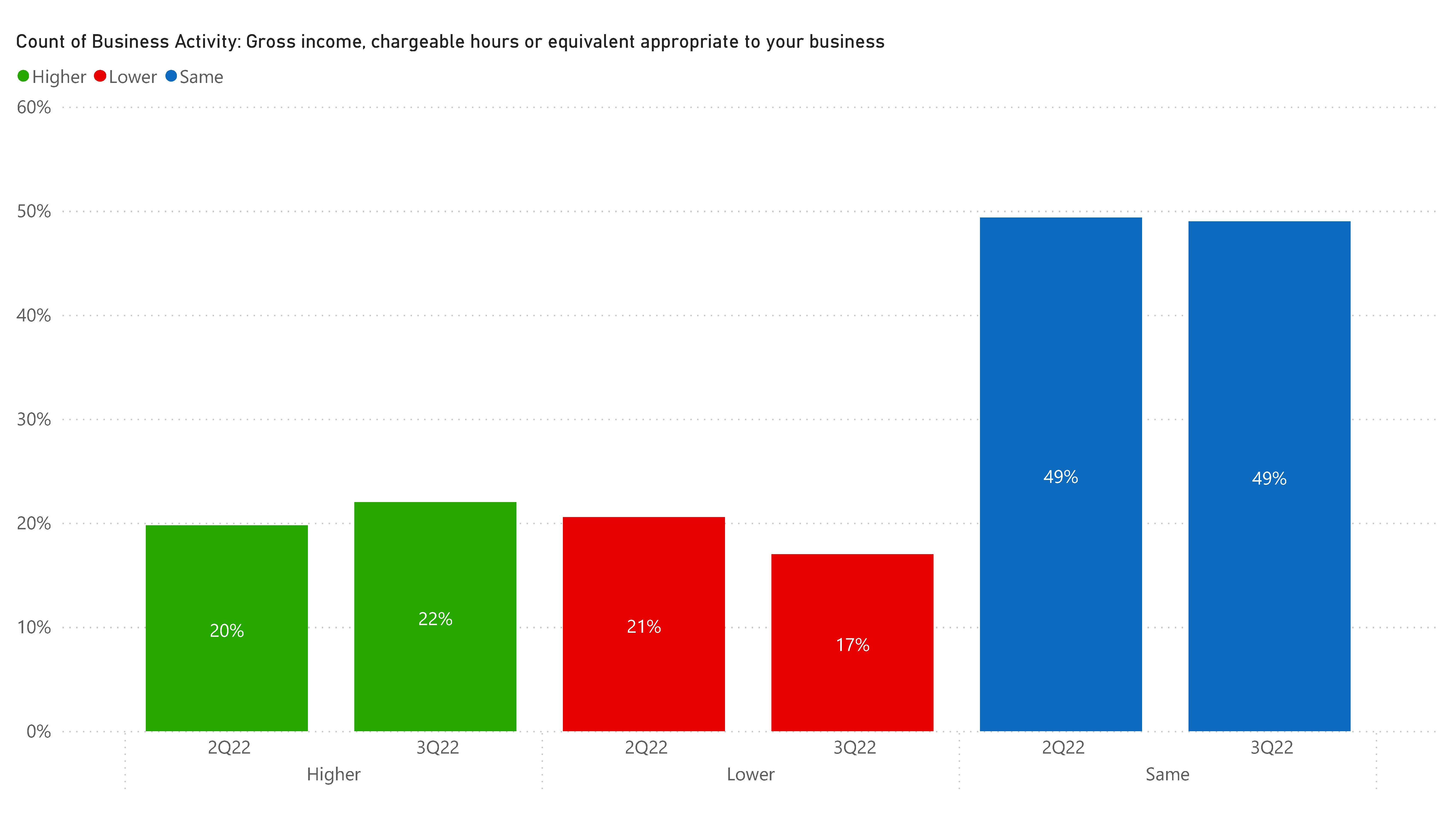

We wanted to know how are Synovus commercial customers, and more specifically Synovus small business customers (which comprise approximately 75% of our survey respondents) faring? In general, we learned, they are doing well despite an increasingly challenging economic environment. Companies reporting the same or higher volume of business compared to the previous quarter improved marginally (see Figure 1), though incoming new business stayed the same.

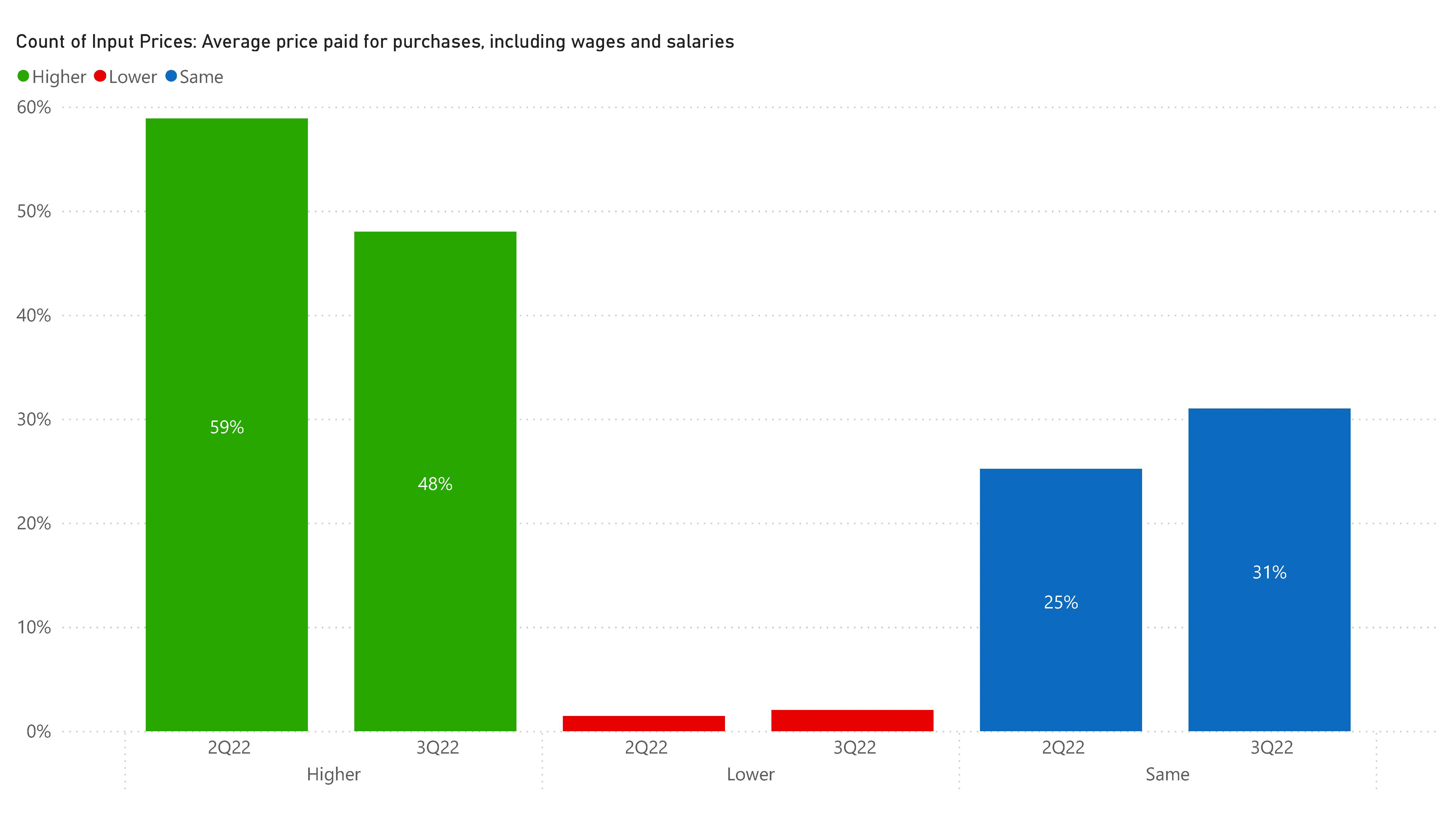

In general, the pandemic environment has never been a function of a lack of demand and the results bear that out. What ails the market is a lack of supply, and that is evident in the level of input prices versus the previous quarter. In Figure 2, you can see that more commercial clients report paying higher input costs quarter over quarter, though that rate is decreasing which could be indicative of slowing demand and/or thawing in frozen supply chains.

Synovus Commercial Customer Survey

Companies reporting the same or higher volume of business compared to the previous quarter improved marginally, though incoming new business stayed the same.

Companies reporting the same or higher volume of business compared to the previous quarter improved marginally, though incoming new business stayed the same.

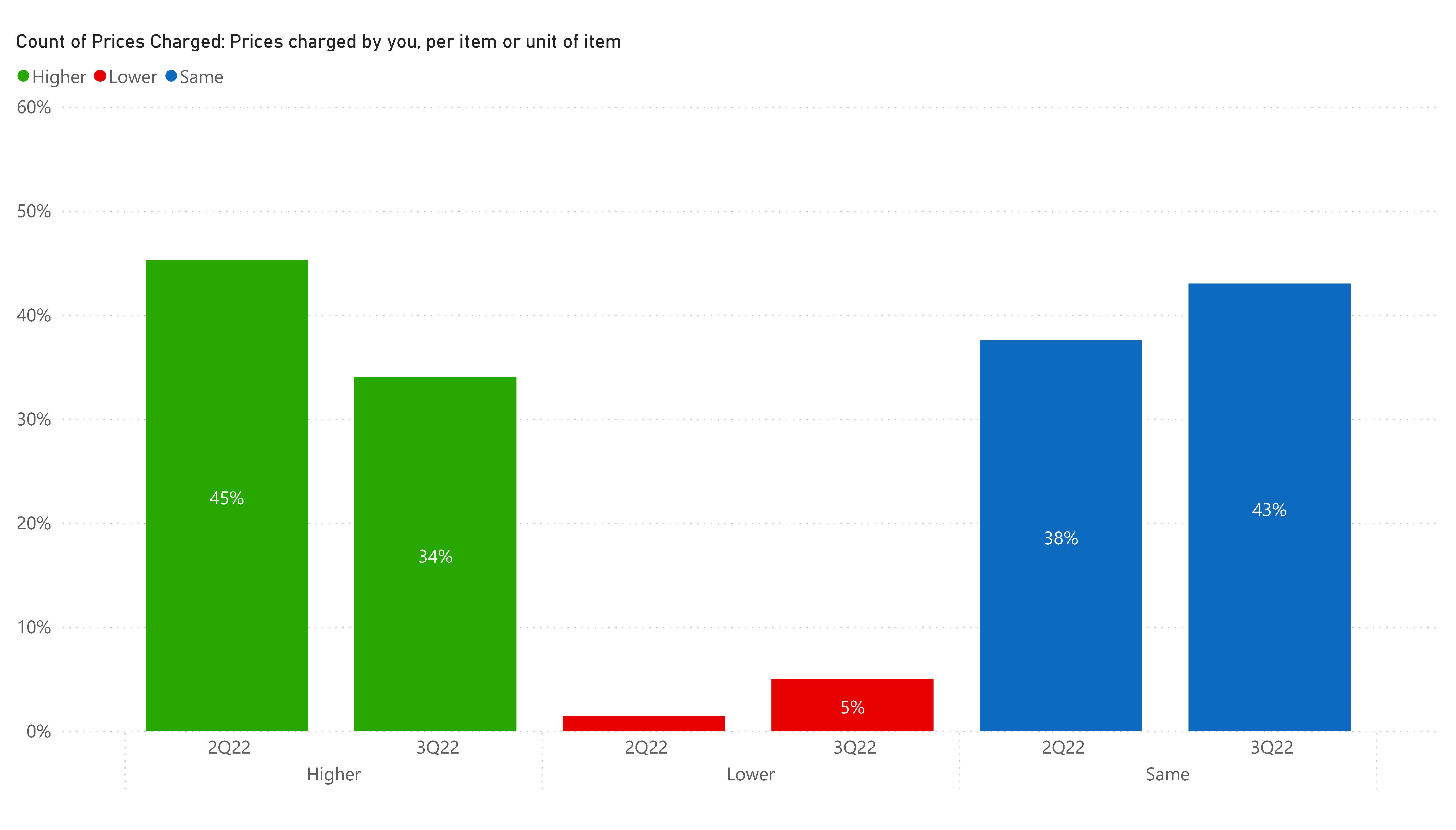

Figure 3 shows how commercial operators are being impacted. In 2Q22, 45% reported charging higher prices, yet in the same quarter 59% reported paying higher prices for inputs. The same trend was in place in 3Q22 but to a lesser extent (34% charging higher prices versus 48% paying higher prices).

Source: Synovus Commercial Customer Survey

This is margin erosion, and the results show that some costs are not being passed along to the customers of our clients. Fortunately, the degree of higher prices paid seems to be lessening, although so does the degree of higher prices being charged, and this reinforces the premise that both slowing demand and thawing supply chains are factors in play right now.

Cal Evans, Synovus Senior Director Investor Relations & Market Intelligence

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.