U.S. Cash Crops Hungering for Growth

Farmers have the important responsibility of producing crops for a growing population. U.S. crop production is a vital part of the economy. In 2023, net farm income was $155.9 billion.1 But higher production and labor costs, and lower prices are threatening the sector’s profitability. This year, the United States Department of Agriculture (USDA) predicts net farm income will drop by almost 26% to just over $116 billion.2

Cash crop receipts could fall to almost $245.7 billion.

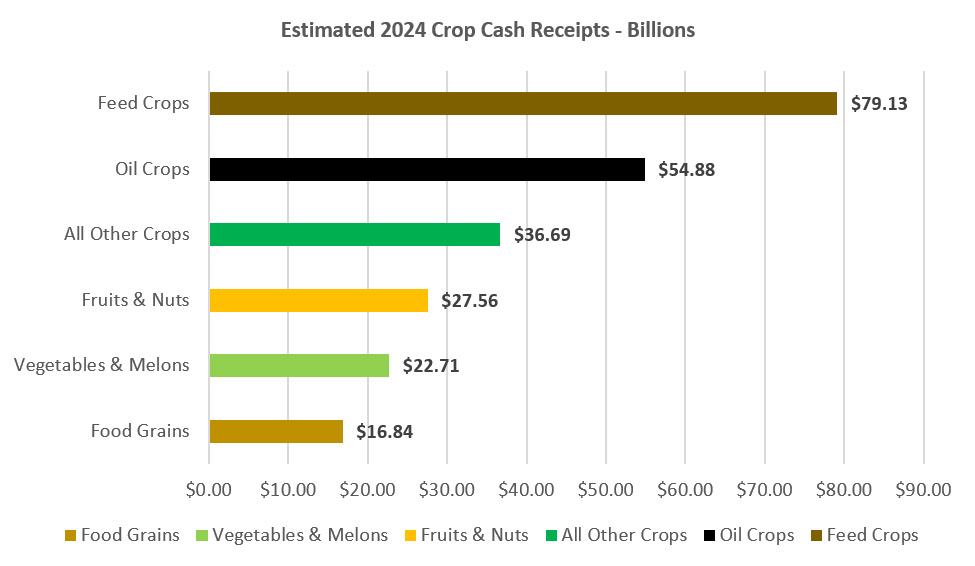

Aside from the economy, unpredictable weather — extreme temperatures, droughts, floods — is also a major factor in lower U.S. crop production. The USDA is predicting reduced nationwide crop cash receipts at nearly $245.7 billion in 2024, a drop of 6.3% since last year. Feed crops (32%), oil crops (22%), soybeans (21%) and all other crops (15%) will be the greatest contributors to overall sales from crop farming.3

Source: USDA, “Farm Income and Wealth Statistics: Cash Receipts by Commodity,” February 7, 2024

Within each category, high receipts are expected for some cash crops, but they won’t be as profitable as previous years. For example, cash receipts for wheat, soybeans and potatoes are expected to decline. But rice will rise by approximately 12%.4

Southeastern growers enrich the country’s cash crop production.

With its mild climate and long growing season, the region is ideal for crop farming. Southeastern growers are significant contributors to the crops needed for food production. Some states in the region are among the top corn and soybean producers.

- Soybeans. This crop suffered from drought last year, spurring production. However, increased production is driving down prices. U.S. cash receipts are expected to total $51.7 billion, which is 10% less than the previous year.5 In 2023, Southeastern states Tennessee, South Carolina, Alabama and Georgia produced three percent of U.S. grown soybeans.6 Though soybeans are relatively inexpensive to grow, continued droughts plague the region which could lower crop production.

- Corn. The U.S. is the largest corn producer in the world, generating almost a third (31.54%) of the world’s crops last year.7 This year the USDA expects 17 billion bushels, a 10% increase over last year’s 15.3 billion.8 While the Heartland grows most of the nation’s corn, Tennessee ranked 12th in production in 2023. South Carolina, Alabama, Georgia and Florida ranked 23rd, 24th, 36th and 40th in production, respectively.9

- Wheat. The Russia-Ukraine war continued to disrupt wheat supplies last year. Despite lower acreage and plantings, crops reached 1.81 billion bushels in 2023 — a 10% increase from 2022’s total.10 Tennessee produced just over 31 million bushels of wheat — two percent of the country’s total (1.8 billion bushels). Alabama, South Carolina, and Georgia contributed another one percent. The USDA predicts 2 billion bushels in 2024 but prices will continue to lag.

In addition to corn and soybeans, these regional growers cultivate a variety of fruits, nuts, and vegetables for food production. - Peanuts. The USDA predicts a harvest of just over 1.7 million acres and cash receipts at $1.57 billion for the year.11 However, unpredictable weather and rising production costs, including labor shortages, could eat into profits. In 2023, the U.S. Peanut Federation proposed a Farm Bill that would increase the statutory price reference and Price Loss Coverage. The Southeast’s extended growing season favors peanuts. Georgia is the region’s largest producer contributing 53% of the country’s peanuts in 2023.12

- Pecans. Pecan production dipped to around 271 million pounds in 2023. Georgia had the second highest in-shell production utilization at 88.3 million pounds.13 Producers and importers continue to support the American Pecan Promotion Board’s research and promotion program, which is intended to increase the nut’s market position.

- Cotton. Though it’s not a food crop, cotton is an important commodity that provides both fiber for clothing/textile goods and livestock protein sources. The U.S. is the fourth largest cotton producer but led exporting with 2.8 million metric tons through 2023.14 Cotton production dropped approximately 18% in 2023 and is expected to fall another 15%.15 Georgia growers produced 18% of the U.S.’s 12.4 million bales.16 Experts believe there is global pent-up demand for the fiber. The U.S. is expected to export 87% of the 16 million bales it will produce in 2024.17Cash receipts will total $7 billion.18

The region’s traditional cash crops are a vital source of income for local economies as well as the nation’s.

Crop farming requires continuing investment.

Like every other business, crop farming requires experience. Farmers and other agricultural producers must be prepared to adapt to market fluctuations – whether pricing, supply, or demand. Carefully managing cash flow, as well as timely access to capital is critical. Learn more about how Synovus Agriculture Banking can help.

Market and Industry Insights

Interest Rates News: Fourth Quarter 2025

Market and Industry Insights

Interest Rates News: Third Quarter 2025

Market and Industry Insights

Interest Rates News Update: Second Quarter 2025

-

Will Your Organization Make the Fraud 'Naughty or Nice' List?

Protect your business from holiday fraud. Learn key stats, prevention tips, and how to recognize phishing, spoofing, and account takeover scams in 2024.

-

Interest Rates News: Fourth Quarter 2025

Get the latest Q4 2025 FOMC rate updates, forecasts and borrowing tips. Learn how interest rate changes impact loans, mortgages, and business growth.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- USDA, “U.S. Farm Sector Financial Indicators 2017-2024F,” February 7, 2024 Back

- Ibid Back

- USDA, “Farm Income and Wealth Statistics: Cash Receipts by Commodity,” February 7, 2024 Back

- Ibid Back

- Ibid Back

- USDA, “Crop Production Summary 2023 Summary,” January 12, 2024 Back

- Statista, “Distribution of Global Corn Production in 2023/24, by Country,” January 31, 2024 Back

- USDA, Feed Outlook: July 2024,” July 16, 2024 Back

- World Population Review, “Corn Production by State 2024” Back

- USDA, “Small Grains 2023 Summary,” September 29, 2023 Back

- USDA, “Crop Production Summary 2023 Summary,” January 12, 2024 Back

- Ibid Back

- USDA, “Farm Income and Wealth Statistics: Cash Receipts by Commodity,” February 7, 2024 Back

- USDA, “Pecan Production Down 6 Percent from Last Season,” January 24, 2024 Back

- Statista, “Top Cotton Exporting Countries 2022/2023,” May 22, 2024 Back

- USDA, “Crop Production Summary 2023 Summary,” January 12, 2024 Back

- USDA, “Agricultural Outlook Forum: Cultivating the Future, Cotton Outlook,” February 15, 2024 Back

- Ibid Back