U.S. Meat and Dairy Production: Satisfying the World’s Appetite

Meals are as diverse as the consumers who plan, prepare, and enjoy them. There are many food choices, including plant-based options. Yet meat remains an important part of household meals around the world. In a recent survey, 86% of participants in 21 countries said they include meat as part of their diets. That percentage rises to 87% in the U.S.1

The U.S. leads global beef, poultry, and pork production.

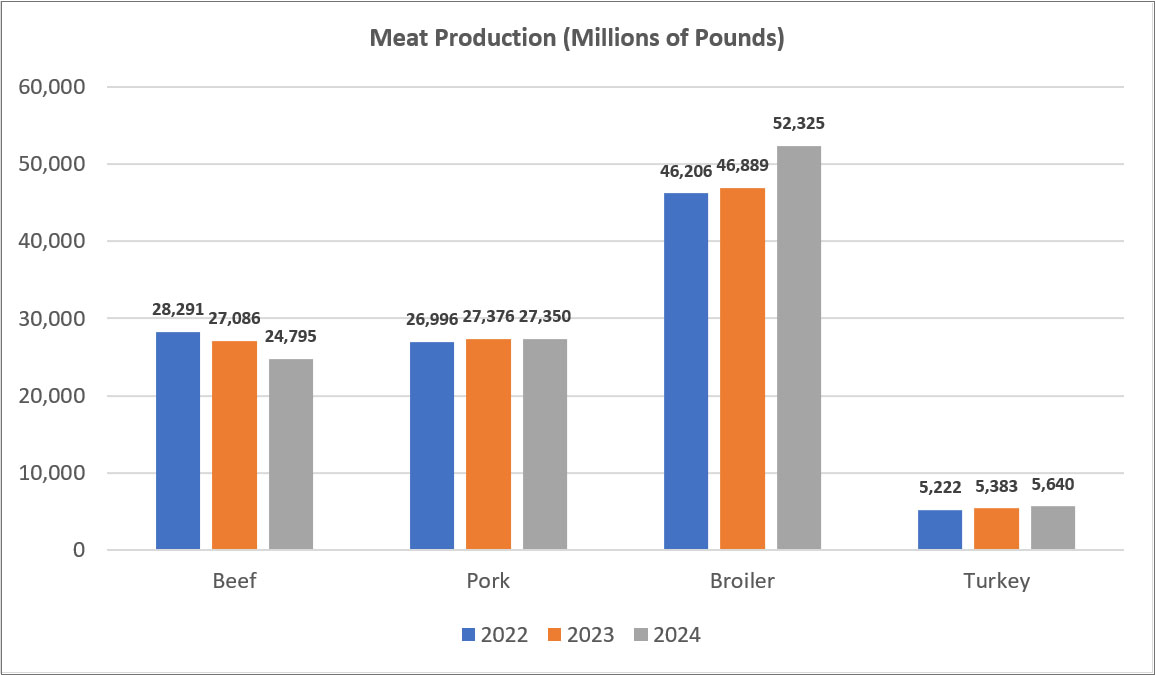

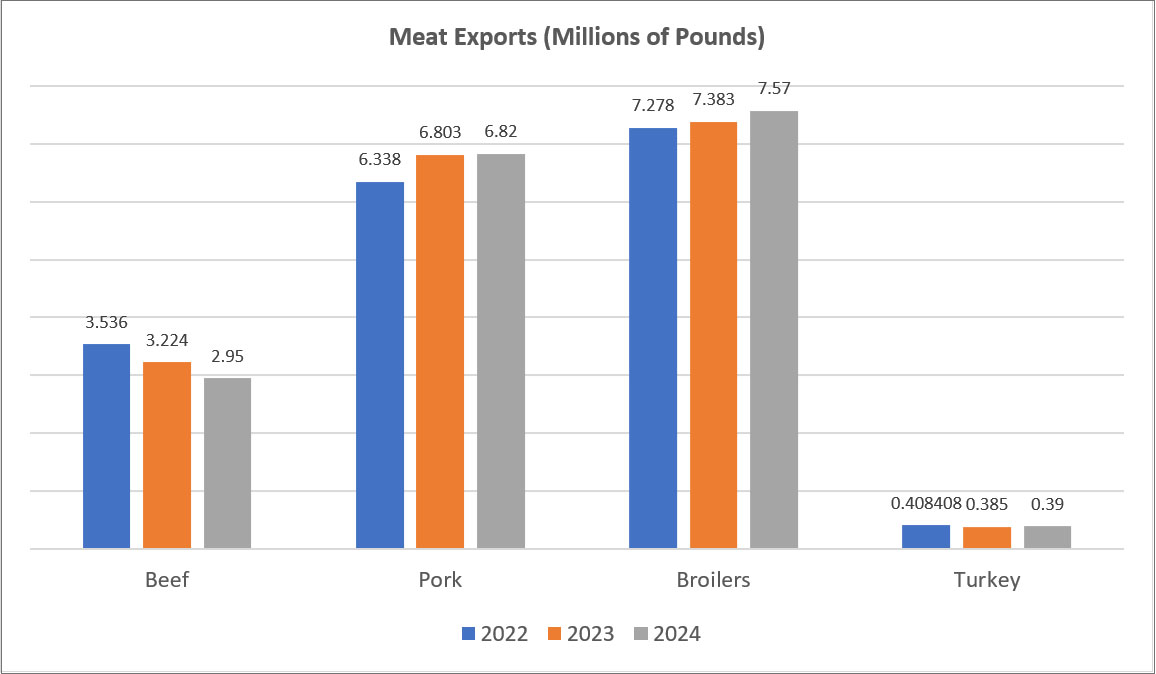

The U.S. produces more beef and poultry than any other nation in the world. It is also third in pork and second in dairy production. In 2023, beef production is expected to drop by just around 4.2%. Pork and broiler production are predicted to drop by just over 1%. Turkey production will increase by over 3%.

Source: USDA, “World Agricultural Supply and Demand Estimates,” June 9, 2023

The Southeast is among top agricultural producers.

In recent years the Southeast has been a major contributor to U.S. agricultural exports. A mild climate lends itself to growing crops. But the region is also a top meat producer.

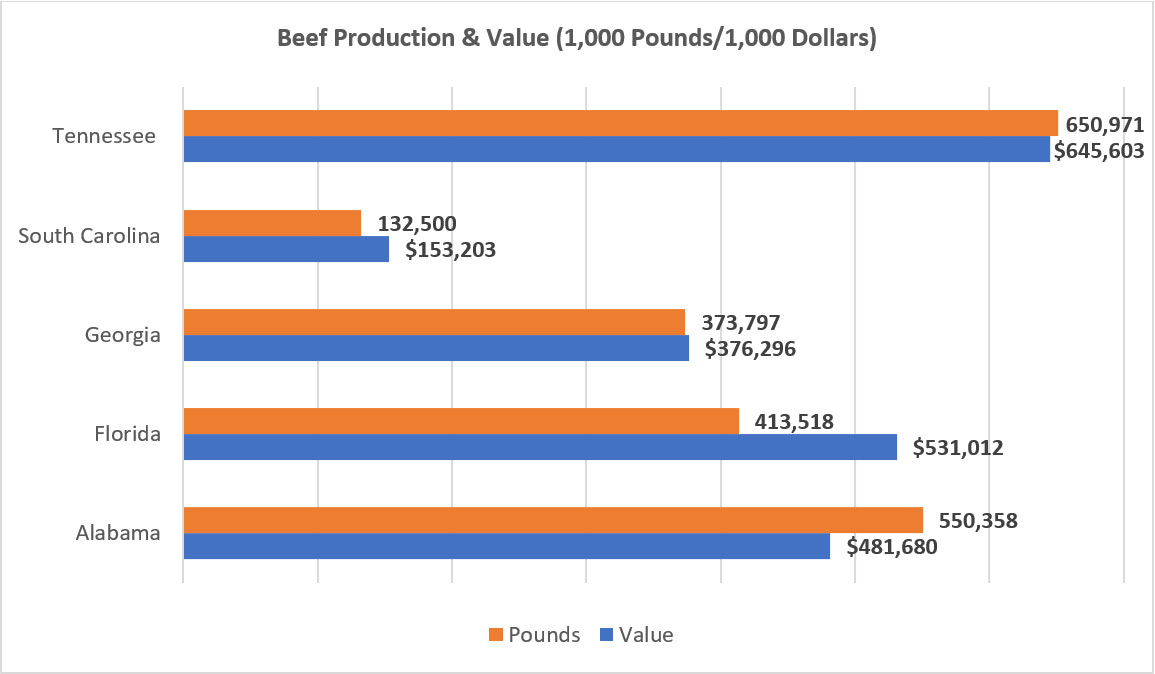

- Beef

Cattle and calves are important commodities for Southeastern states. In 2022, Tennessee led the region in production and value with more than 650 million pounds at more than $645 million. Alabama, Florida, Georgia, and South Carolina followed.

Source: USDA, “Meat Animals Production, Disposition, and Income 2022 Summary,” April 2023 - Poultry

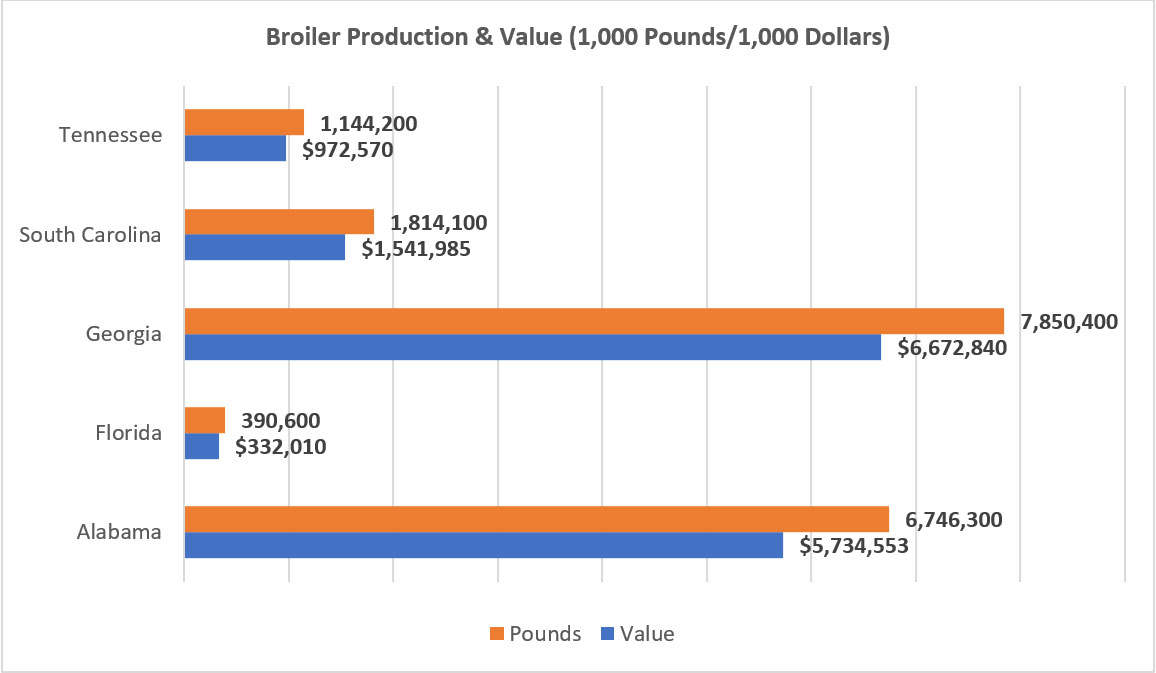

In 2022, Georgia was second only to Arkansas in broiler production. At almost eight billion pounds, Georgia produced 13% of U.S. broilers for a total value of almost $7 billion. Alabama contributed 6.7 billion, which was more than 11% at close to $6 billion in value. Florida, South Carolina, and Tennessee contributed significantly less.

Source: USDA, “Meat Animals Production, Disposition, and Income 2022 Summary,” April 2023 - Hogs

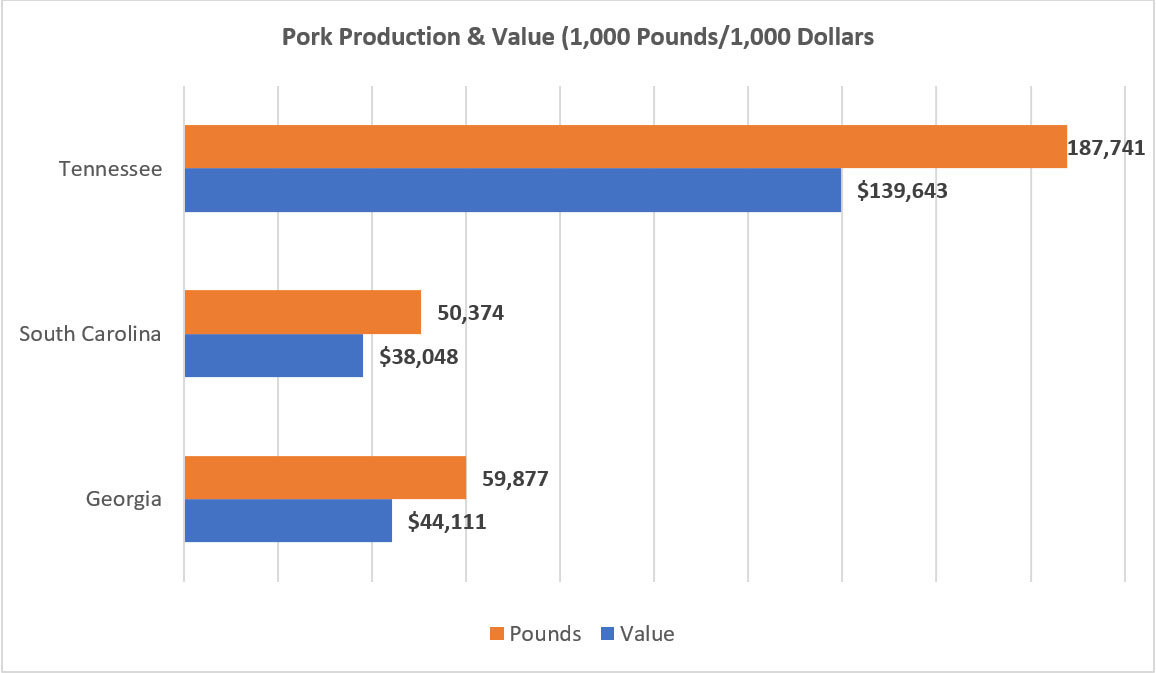

While pork isn’t produced to the same extent as beef in the Southeast, three states contributed significant value and production to the pork market in 2022. Tennessee led the region with close to 188 million pounds valued at $139.6 million. Georgia and South Carolina contributed almost 60 million pounds and just over 50 million pounds, respectively.

Source: USDA, “Meat Animals Production, Disposition, and Income 2022 Summary,” April 2023

In 2024, beef production will continue to drop due to previous herd reductions during drought. Alternatively, pork production could increase by almost 27%. Modest growth in broiler (2%) and turkey (5%) production is also expected.

U.S. meat exports feed global demand.

As a leading meat producer, the U.S. commanded $23.34 billion in exports last year.2 Always a favorite, demand for broilers is now increasing as an alternative for scarcer beef and pork. That trend is expected to continue over the next few years as farmers struggle to manage herd levels.

Source: USDA, “World Agricultural Supply and Demand Estimates,” June 9, 2023

The availability of poultry, cattle and hogs sets the stage for export prices. Year-over-year the price of feeder ($234.16) and live cattle $177.21) on June 15 was up 36% and 29.5%, respectively. However, beef prices ($17.35) were down almost 17% (16.63%). With limited livestock counts, beef prices are expected to rise in 2023 – especially if demand from China continues to grow. Poultry ($6.04) and hog prices ($91.90) dropped 21.25% and 13.49 but, as alternatives to beef, prices could also rise this year.3

Egg prices are falling to reasonable rates.

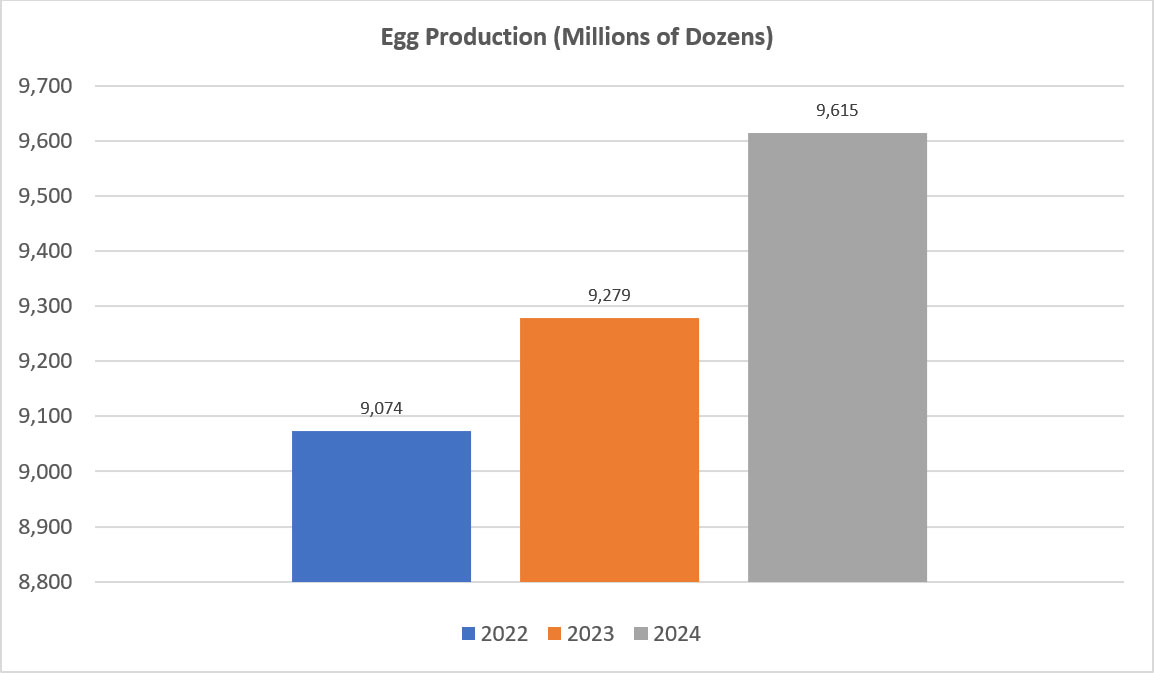

The recent avian flu outbreak wiped out millions of laying hens, driving up the cost and lowering demand for table eggs. At more than $5 per dozen in some areas, consumers reduced usage or stopped buying eggs altogether.

With the outbreak now more manageable the number of hens is again growing, though still lower than two years ago. Export egg prices, at $1.11, were almost 41% lower year-over-year. But the monthly change was still just over 44% higher.4

Source: USDA, “World Agricultural Supply and Demand Estimates,” June 9, 2023

The U.S. produced a little over 9 billion eggs in 2022. Georgia produced 5.2 billion table eggs in 2022. Alabama contributed 2.6 billion, followed by South Carolina at almost 1 billion, and Tennessee at 366 million.5

Egg production is expected to return to increased levels in the next couple years, which will likely drive pricing further down. Impacts of avian flu and California Proposition 12 rules on animal care could further affect pricing.

Milk production will marginally rise.

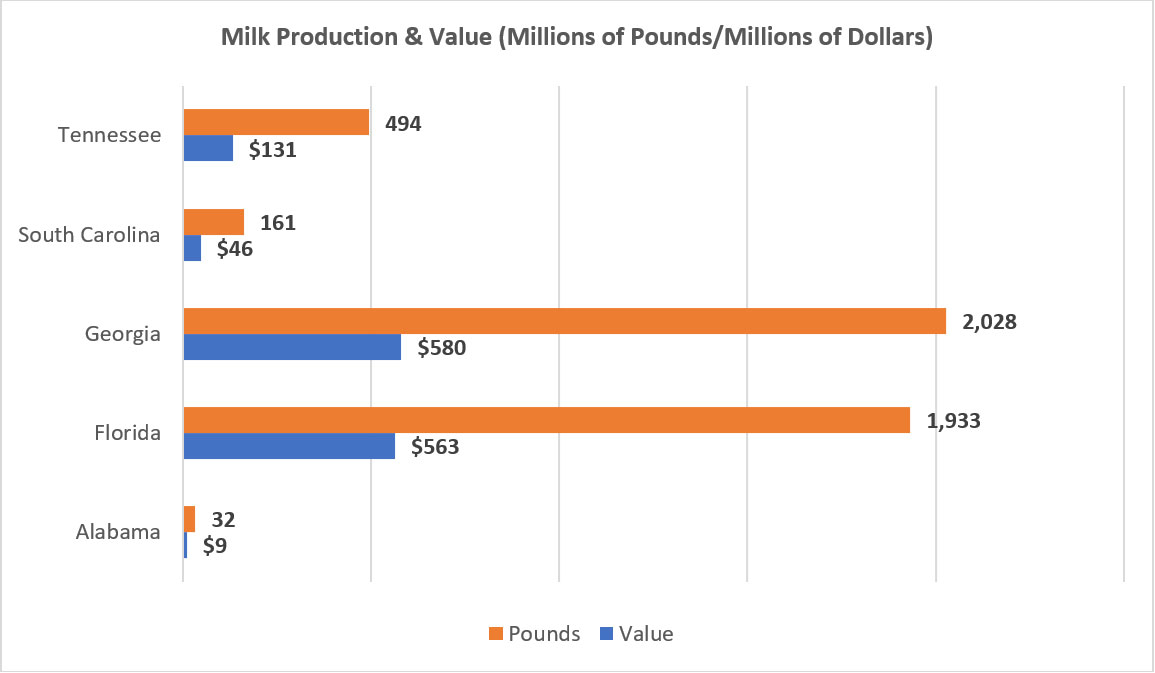

It was a good year for dairy in 2022. U.S. producers exported three metric tons of product at $9.51 billion, and the all-milk price was $25.34.6 Mexico, Canada, and China were among the largest customers.

In 2022, the Southeast produced almost 2% of the nation’s dairy at 4.1 billion pounds. Georgia and Florida ranked first and second in the region for both production and value.

Source: USDA, “National Agricultural Statistics Service,” June 15, 2023

The dairy industry isn’t expected to be as profitable this year. Though production is forecasted to rise to 228.4 (about 1%), exports will drop 11% to 11.9 billion pounds. Pricing is projected at $19.95. Wholesale cheese, butter, non-fat dry milk and dry whey prices are also expected to fall.7

Milk production is expected to slightly rise to 230.8 billion pounds in 2024. Exports are projected at 12.8 billion pounds. Projected pricing is $19.65. Cheese, butter, non-fat dry milk and dry whey prices will remain stable year-over-year.

Increasing costs undermine profits.

Meat and dairy production are expensive businesses. Feed, animal care, transportation and other costs are increasing by 4.1% in 2023. But animal product cash receipts are expected to fall by 5.7%, including milk, eggs, hogs, and broilers.8 In addition, Direct Government farm payments, along with some other supplemental programs, will fall.

Rising expenses and declining prices are limiting reinvestment in farming operations. What can you do? As with any other enterprise, farmers must prepare for the financial future. Learn more about how Synovus Agriculture Banking can provide the insights, solutions and capital you need to support your business.

Market and Industry Insights

Interest Rates News: Fourth Quarter 2025

Market and Industry Insights

Interest Rates News: Third Quarter 2025

Market and Industry Insights

Interest Rates News Update: Second Quarter 2025

-

Will Your Organization Make the Fraud 'Naughty or Nice' List?

Protect your business from holiday fraud. Learn key stats, prevention tips, and how to recognize phishing, spoofing, and account takeover scams in 2024.

-

Interest Rates News: Fourth Quarter 2025

Get the latest Q4 2025 FOMC rate updates, forecasts and borrowing tips. Learn how interest rate changes impact loans, mortgages, and business growth.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- Statista, “Eating Meat is the Norm Almost Everywhere,” March 30, 2023 Back

- Trading Economics, “United States Exports of Meat and Edible Meat Offal,” June 2023 Back

- Trading Economics, “Commodities,” June 15, 2023 Back

- Ibid Back

- USDA, “Egg Production by State, Number Produced, Million Eggs, 2022,” April 27, 2023 Back

- USDA, “U.S. Dairy Products Exports in 2022,” June 2023 Back

- USDA, “World Agricultural Supply and Demand Estimates,” June 9, 2023 Back

- USDA, “2023 Farm Sector Income,” February 7, 2023 Back