Learn

Business Basics: How to Pay Yourself as A Business Owner

When you’re starting your own company, how to pay yourself from your business is among the first questions you’ll ask. It’s a decision that can greatly impact not only your business, but also your personal finances.

Determine whether to take a draw or pay yourself a salary.

Depending on your company’s structure, there are two specific ways to pay yourself as a business owner. You may choose to withdraw compensation from your business account or pay yourself a salary.

- Withdraw money from your business bank account.

Sole proprietors, business partners and members of limited liability companies (LLCs), taxed by default as sole proprietors or partnerships, don't receive traditional paychecks. Instead, they can “take a draw” from the company bank account to pay themselves.

Draws are permissible for non-business expenses only, such as compensation, personal outlays and cash flow management, and aren’t deductible. In this scenario, the business owner reports and pays taxes for company profits on the individual income tax return, including the draw. Personal draws don’t affect the tax rate.

To take a draw, you may write a check to yourself or transfer money from your business account to your personal account. You may also withdraw cash from an ATM or from a teller at a bank’s physical location to pay yourself from your business. Be sure to keep relevant documents for these transactions.

Draws reduce the owner's share of equity in the company. In other words, taking a draw reduces asset value on the company balance sheet. So, if you pay yourself $5,000 as a monthly salary, you are reducing your equity in the company by the same amount. Remember, you’ll also have to pay estimated self-employment taxes on the profits yourself rather than automatic withholding.

If you are a sole proprietor or member of an LLC and decide to take a draw to pay yourself from your business, set a fixed monthly amount that's enough to cover your living expenses and taxes, and add a modest quarterly profit share. If you’re a partner with daily responsibilities within the company, establish compensation based on your duties. Also consider taking a distribution or dividend from additional profits if available.

- Pay yourself a salary.

Owners and officers of S corporations and C corporations, as well as members of LLCs taxed as a corporation, who work for the company are considered employees of the corporation. They receive a regular paycheck with income and payroll taxes withheld.

When deciding how much to pay yourself from your business in the form of a salary, the key is determining reasonable compensation.1 Reasonable compensation is the market‑rate salary that similar companies in your location would pay someone with your experience for the services you perform. Benchmark owner-operator salaries against third‑party data like industry surveys or Bureau of Labor Statistics ranges. Document your method, since the IRS can challenge whether a salary is reasonable.

How to pay yourself from your business depends on your company’s structure, financial goals and tax obligations. Choosing between taking a draw or paying yourself a salary as a business owner depends on your company’s structure, financial goals and tax obligations. Be sure you understand these payment methods, document your compensation and comply with IRS regulations.

Ask “how much should I pay myself from my business?”

As a business owner, the decision of how much to pay yourself depends on three factors. First, you must consider business revenue. Then, you must decide how much of that revenue you need to pay personal living expenses, as well as how much to reinvest in your business.

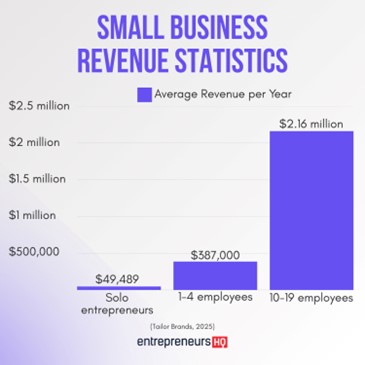

Overall, small businesses are doing well — 65.3% were profitable and 9% brought in revenue over $1 million last year.2 Since size is a factor, solo entrepreneurs typically earned less revenue than other small businesses. However, years of experience also matters and can increase the likelihood of higher revenue among this group. Small businesses with 10-19 employees earned the highest average revenue last year at $2.16 million.3

How do small business owners pay themselves? Eighty-six percent of U.S. small business owners pay themselves under $100,000 annually, but the majority earn $69,119 per year.4

Thirty percent of small business owners in the U.S. don’t take a salary, choosing to reinvest in their businesses instead.5 Returning earnings to your business supports long-term expansion, boosts future earnings, raises the overall value of the company and strengthens market share.

Over 65% of small businesses were profitable and 9% brought in revenue over $1 million last year.2

Over 65% of small businesses were profitable and 9% brought in revenue over $1 million last year.2

You should assess your company’s revenue, personal living expenses and reinvestment needs when deciding how to pay yourself as a business owner. It's also important to benchmark reasonable compensation using industry data and document payment methods to ensure compliance with IRS guidelines.

Guaranteed payments are another form of compensation for partners or members of LLCs.

Guaranteed payments are a specific type of compensation that partners or members of an LLC can receive for services or capital provided, and they are payable regardless of the entity’s profitability. Unlike distributions — which are typically tied to ownership percentages and profit — guaranteed payments provide a set amount to those who actively contribute to business operations, much like a salary.

These payments are deductible expenses for the company, but recipients must report them as income and pay applicable taxes, including self-employment taxes.

Pass-through entities are eligible to receive distributions.

Business entities may pay distributions, which represent a share of the company’s profits, to owners or shareholders rather than a fixed salary or wage. Distributions depend on the business’ available profits and ownership structure.

Distributions are generally proportional to ownership percentages for pass-through entities such as sole proprietorships, partnerships and LLCs, and aren’t subject to payroll taxes. However, the distributions may still be taxed as income on the owner's individual tax return.

In an S corporation, distributions are paid out to shareholders in addition to reasonable salaries if they don’t exceed the shareholder’s basis. These distributions are typically tax-free, provided they don’t exceed the shareholder's basis in the company. The basis includes the owner's initial investment and accumulated profits, minus any previous distributions received. Proper documentation and compliance with IRS regulations are required to ensure accurate classification and taxation of distributions.

For C corporations, owners may receive “qualified dividends,” which are considered taxable income to the recipient even though the corporation has already paid taxes on its earnings. Most dividends are classified as "qualified dividends" and are taxed at preferential rates based on the recipient’s income bracket. Qualified dividends are taxed at 0%, 15% or 20%, depending on the taxpayer's income.6

Owners should maximize tax-deductible salary payments before distributing dividends to minimize double taxation impact. Proper documentation and compliance with IRS guidelines are essential to ensure that distributions are classified and taxed appropriately.

How should you pay yourself when you’re self-employed?

If you're self-employed with a sole proprietorship or LLC, the best way to pay yourself is:

- Maintain separate accounts for company and personal finances.

- Set aside at least two to three months of operating expenses.

- Reserve 25%-35% of net profit to cover income tax, plus self-employment tax.

- Take a fixed monthly draw from remaining net profits to cover personal living expenses.

- Evaluate cash reserves each month to determine whether to take an extra “profit share” draw.

- Reduce or increase the fixed draw to ensure your business has enough capital for growth.

If you’re self-employed, speak with a tax professional who can help you understand your options to pay yourself.

Choose the best option to compensate yourself.

Determining how to pay yourself from your business is important when starting your own company, as there are advantages and disadvantages to both taking a draw or salary. Factors such as business structure, income and deductions play a significant role in determining the most tax-efficient way to pay yourself.

As an SBA Preferred Lender, Synovus offers comprehensive banking solutions tailored to helping small businesses succeed, including cash flow management, loans and lines of credit. For more details, contact a Synovus Business Banker, call 1-888-SYNOVUS (1-888-796-6887) or stop by one of our local branches.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- Internal Revenue Service, “Paying Yourself,” May 8, 2025 Back

- entrepreneursHQ, “Small Business Statistics 2026 Report: Growth, Revenue & Trends,” October 22, 2025 Back

- Ibid Back

- Ibid Back

- entrepreneursHQ, “Small Business Statistics 2026 Report: Growth, Revenue & Trends,” October 22, 2025 Back

- Internal Revenue Service, “Publication 550: Investment Income and Expenses,” 2025 Back

Do you have questions or ideas?

Share your thoughts about this article or suggest a topic for a new one