Learn

The Stock Market Likes Fed Rate Cuts … Mostly

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

Synovus Securities, Inc.

It’s that sweet spot of the season in north Georgia. The mornings and nights are cool with warmer temperatures during the day. The cool morning air reminds me that college football season is upon us, which also reminds me, it may be time to pick up that $6 pumpkin spice latte. All true about everything except the latte. Shifting gears, another seasonal change may be upon us when it comes to the Federal Reserve’s interest rate policy as it resumes another federal funds rate cut, of a quarter percent, anticipated for its September 17 Federal Open Market Committee (FOMC) meeting. Let’s pull back the curtain and provide an inside look at how the S&P 500 has received the news of Fed rate cuts and if we are in the cutting cycle that may be a future headwind or tailwind to the markets.

On August 22, Federal Reserve Chair Jerome Powell provided remarks in Jackson Hole, Wyoming stating: “The stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” This was the short sound byte that sent the market ripping at 10 a.m. that day and holding most of the gain into the market close.

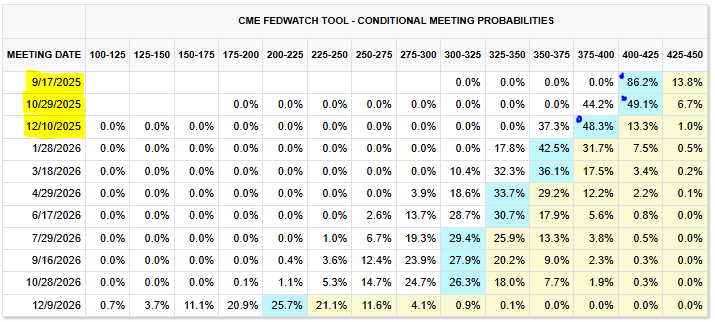

Though Powell did announce a definite cut, the language used in addressing “the balance of risks is shifting away from inflation and toward employment” and “softening labor markets could justify a rate cut” were all the hints that the market needed to send the S&P 500 above 1% and short-term rates down 4 basis points (BPS) (-.04%) in one day; this was equal to a 1% loss in the three-month T-Bill rate. For context, the three-month T-Bill rate is at the same level as it was in November 2022. Rewinding the clock to November 2022, the Fed continued to raise rate an additional 1.5% before pausing in July 2023. Below is the Fed Watch Tool showing the probability of interest rate cuts for September, October and December 2025.

Fed Watch Tool

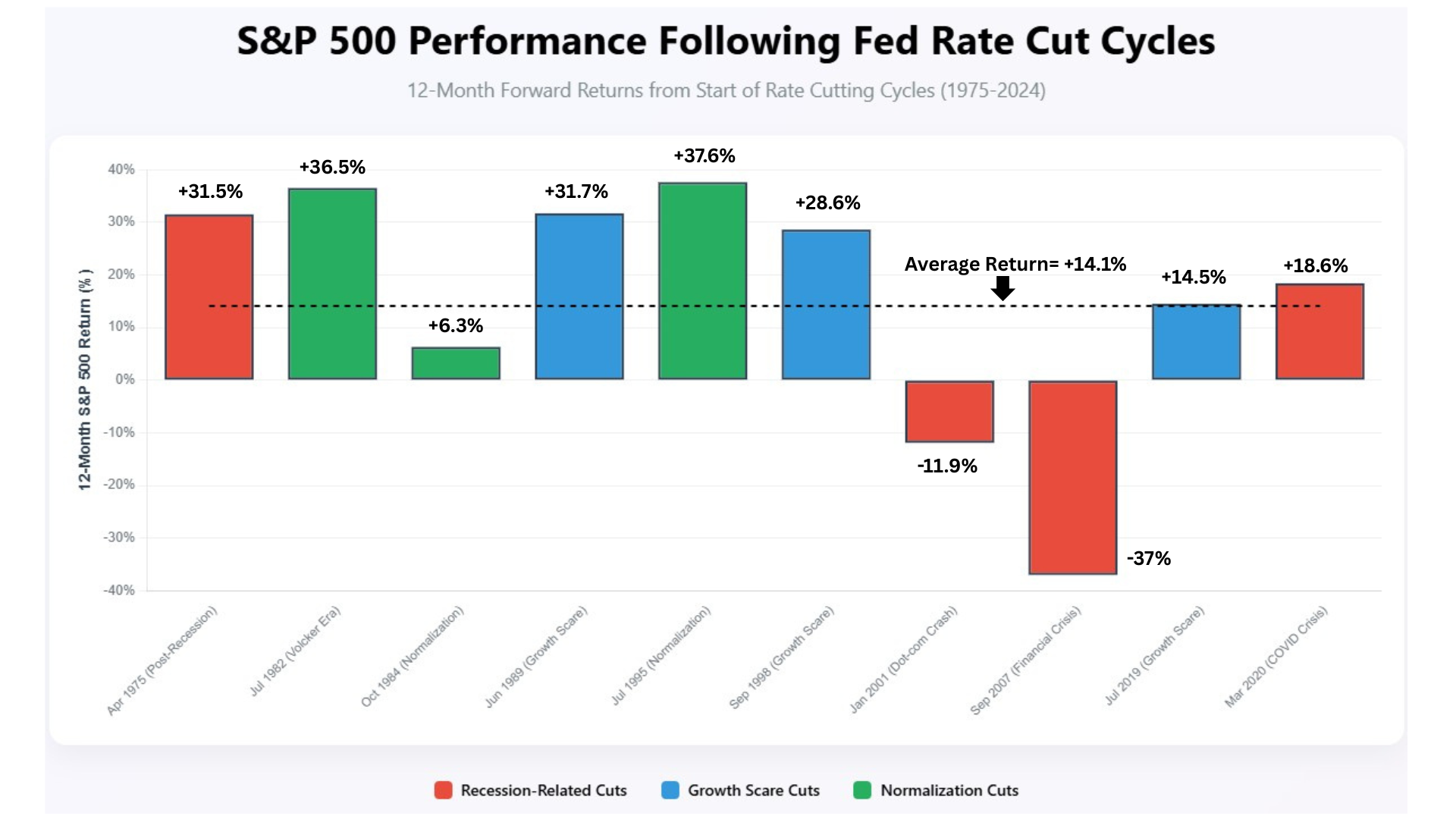

It is important to review the historical market context of why the Federal Reserve entered a rate-cutting cycle. We can break these cutting cycles into three different monetary policy responses.

1. Recession-Related Cuts: Monetary policy that preceded or coincided with a recession such as the dotcom bust (2000), Global Financial Crisis (2008) and COVID-19 (2020).

2. Growth Scare Cuts: Monetary policy that responded to short-term economic shocks such as the Savings and Loan Crisis (1989) or Russian debt default and Long-Term Capital Management economic scare (1998).

3. Normalization Cuts: Monetary policy reducing rates after multiple rate hikes to battle inflation and attempting the coveted soft-landing scenario, such as then Fed Chairman Paul Volcker’s rate hikes of the early 1980s, preservation of the economic expansion in 1984 and 1995. Normalization cuts tend to happen in mid-cycle adjustments to “keep the party going.”

The S&P 500 has had various responses to each of the three types of Fed rate cuts and will normally react based on the underlying catalyst for monetary policy change. This is why context matters, based on Powell and the Fed’s policy over the past three years. The current rate-cutting cycle is like 1984 and 1995 where we are normalizing back down to the Fed’s target rate. The resilience of the market has provided positive years in not only the normalization periods of Fed cuts, but also recession related, and the growth scare cutting periods. Over the past 50 years, the correlation between the start of Fed rate cutting cycles and the 12-month forward returns of the S&P 500 is positive overall, averaging double-digit returns, particularly when cuts were not paired with recessions.

Below is the chart illustrating this data. The average performance of the S&P 500 during this 50-year period of forward returns after cutting cycles is 14.1%.

S&P Forward Performance following Fed Cutting Cycles

What Says the Markets?

U.S. market resilience has resulted in positive forward returns in many rate cutting cycles. In all scenarios, the transmission from monetary policy to markets is shaped not only by economic fundamentals, but also investor psychology, stock index and sector valuations; also the presence of exogenous shocks. Although the Trump administration has provided a series of curveballs, global tariffs, tightened immigration policy and geopolitical flare-ups have created additional uncertainty when the Fed governors attempt to forecast future monetary policy. Visualize the Fed designing a beautiful economic forecast mosaic like a glass-encased ant farm; the Trump administration plays the role of the mean kid who grabs that ant farm and violently shakes it up and down.

For 2025, the markets are receiving rate cuts as a stimulative action that can create more affordable lending for small businesses and household lending, which perpetuates continued market growth. The risk of lowering rates too fast would be a direct contribution to spur pent-up consumer demand, which ultimately raises asset prices of stocks, real estate and additional consumer goods. The future is always uncertain. Will stimulating the markets in this rate-cutting cycle contribute to our next asset bubble or will the rate normalization continue to allow a broadening participation of equity growth beyond the Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla) and AI-related technology stocks?

One thing that I am certain about is the U.S. economy will one day have a peak, a slowdown, a recession and a recovery. In this current Fed-cutting cycle, outside of an exogenous shock, the markets will continue to create new all-time highs. This is not a prediction of positive performance over the next 12 months, but if Taylor Swift and Travis Kelce can find their happy ending in 2025, then maybe the markets can too.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.