Learn

The Personal Trust Corner: A J.D.’s Perspective

Tax-Efficient Wealth Transfer Strategies for 2025 and Beyond

By Amy Piedmont, J.D., LLM, Vice President, Sr. Trust Relationship Manager and

Katherine “Kate” Gambill, J.D., Vice President, Sr. Trust Relationship Manager, Synovus Trust Company, N.A.

In our series, “The Personal Trust Corner: A J.D.’s Perspective,” we aim to highlight strategic tax and estate planning strategies for clients while reinforcing the need for flexibility and foresight. This month, we turn the spotlight on new opportunities and challenges in transferring wealth efficiently — in light of the recent changes in legislation, specifically the passage of the One Big Beautiful Bill Act (OBBA).

What’s Changed in 2025

The most notable change under the OBBA is the increase in the federal estate, gift and generation-skipping transfer (GST) tax exemption to $15 million per person (or $30 million per couple), effective in 2026.1 This change will be particularly beneficial for those who have already maximized their previous exclusions, as it offers a renewed opportunity to minimize tax liabilities while continuing to support family and loved ones through monetary gifts.

Although the OBBA made the estate tax exemption permanent, a future change in control of Congress or the introduction and passage of repeal legislation could drastically alter the current favorable conditions.

High-net-worth individuals and couples need to be proactive in their planning to optimize their wealth transfer and minimize tax liabilities. Therefore, it is essential to act judiciously and timely, ensuring that all plans and strategies are in place before any potential legislative changes. This proactive approach will safeguard your financial legacy and ensure the efficient transfer of wealth to future generations.

Strategic Gifting in a High-Exemption Environment

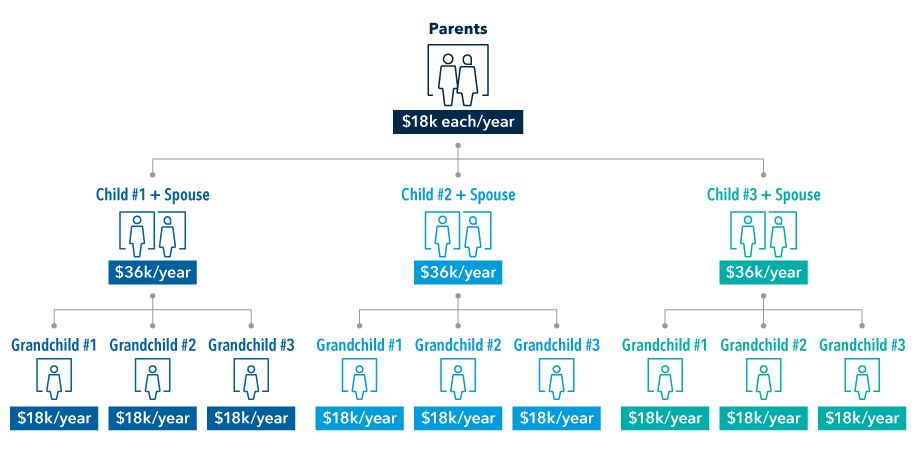

Lifetime gifting remains a cornerstone of tax-efficient wealth transfer. You can now gift up to $15 million, during your life or at your death, without incurring federal estate or gift tax, plus your annual exclusion gifts of $19,000 per recipient.2 These gifts not only reduce the taxable estate but also allow clients to witness the impact of their generosity.

By gifting assets now, especially assets that are expected to increase in value over time, you can effectively remove both the current value and any future appreciation from the taxable estate.

Trust Planning: Flexibility Is Key3

Irrevocable trusts continue to be powerful tools for removing assets from the taxable estate. Trusts remain essential tools for estate planning.

- Spousal Lifetime Access Trust or SLAT allows one spouse to create an irrevocable trust for the benefit of the other, removing assets from the taxable estate while retaining indirect access. Under OBBBA:

- The increased exemption enables larger SLAT funding without triggering gift tax.

- SLATs offer flexibility and income access, making them ideal for couples concerned about liquidity.

- Dynasty Trusts. With the Generation Skipping Tax (GST) exemption now matching the estate and gift exemption at $15 million per person, dynasty trusts become even more powerful:

- Assets can grow outside the estate for multiple generations.

- Ideal for families in states with no rule against perpetuities.

- Irrevocable Non-Grantor Trusts. These trusts pay their own taxes and can be used to:

- Shift income to lower-tax brackets.

- Maximize deductions, especially under the expanded SALT deduction cap of $40,000 per trust.

However, in a shifting tax environment, flexibility within trust structures is essential. Such flexibility can be accomplished by including the following provisions in trust documents:

- Lifetime limited power of appointment are rights given to people named in the trust to designate where assets of the trust might be appointed at his or her death. These powers can be limited, for example, only allowing the trust property to be appointed to descendants of the grantor; or they can be broad, which could be useful if the law changes or other changes are needed.

- Trust protector provision, which allows the appointment of an individual to amend the terms of the trust without necessitating court involvement. The Trust Protector provision is a newer provision incorporated in many trust documents to allow flexibility once the trust becomes irrevocable to ensure the original trust’s intention is fulfilled. The Trust Protector’s powers can be limited, such as replacing the trustee or changing the law applicable to the trust, or broadly, to include changing the trust terms if the tax or other laws subvert the initial intent of the trust.

Attorneys have many tools to build-in flexibility to your plan; therefore, it is essential to collaborate with trusted team of advisors to ensure that any plan you implement today will still serve your needs in this ever-evolving tax environment.

Balancing Estate and Income Tax Considerations

While gifting appreciated assets can reduce estate tax exposure, it may also forfeit the step-up in basis at death, potentially increasing capital gains taxes for heirs.

A careful analysis is needed to weigh:

- Estate tax savings from gifting

- Income tax costs from carryover basis

- Potential future changes in exemption levels

This balancing act underscores the importance of customized planning based on asset type, family goals and projected tax scenarios.

Looking Ahead: Planning with Confidence

The current environment offers a rare window for high-net-worth families to make impactful decisions. By combining holistic estate planning, strategic gifting and flexible trust design, clients can preserve wealth, minimize taxes and create lasting legacies. The landscape may evolve, but proactive planning ensures you're prepared — no matter what lies ahead. However, it's essential to understand the intricacies involved and work with experienced professionals to tailor a plan that meets your specific needs. Please reach out to our Senior Trust Relationship Managers: Amy Piedmont, J.D., LLM, Vice President, in Pensacola, Florida and Katherine Gambill, J.D., Vice President, in Atlanta with any questions or to start a conversation regarding estate and tax planning. We welcome the opportunity to introduce you to how Synovus Trust Company can serve your needs.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- “Five Key provisions of New Tax Law Affecting Estate Planning,” Kim Kamin and Les Carter. Accessed July 14, 2025. Back

- “Three Actions to Protect Wealth Transfer Amid Tax Uncertainty,” Kiplinger, Brett W. Berg. Accessed March 6, 2025. Back

- “Big Beautiful Bill: What Estate Planning Steps Make Sense Now?” Martin M. Shenkman and Stuart M. Gladstone. Accessed September 1, 2025. Back