Learn

From Zero to Hero: A Retirement Roadmap for the Millennial Family

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

Synovus Securities, Inc.

The amount of household income needed to raise a family, pay rent or to own a small home in the suburbs is one of the most challenging economies for young couples in 50 years. According to the Goldmans Sachs Housing Affordability Index in 2023, affordability has been at the lowest levels in history.1 Young adults in their late 20s to early 30s are navigating a challenging financial landscape in the aftermath of the COVID-19 pandemic. Home prices have soared, making it more difficult for families to purchase or upgrade their living situations. At the same time, tuition costs continue to climb, increasing the financial burden for those seeking higher education for themselves or their children, adding to monthly expenses and long-term financial stress. Unfortunately, wage growth has not kept pace with these rising costs, leaving many young families struggling to cover the basic needs required to raise a family in 2025.

Having the ability to put away a small amount of money feels like a stretch, but even small consistent deposits over time can make a large difference for a 30-year-old young professional with a 35-year retirement time horizon.

This is going to be your broad-brush stroked outline. Instead of debating the best types of accounts or specific investment holdings, our focus is on the discipline of consistently setting aside a fixed amount of money each month. This approach assumes an average rate of return over time and is built around a 35-year timeline to retirement for a young couple residing in the southeastern part of the U.S. A critical aspect to emphasize is that, for this scenario, the couple begins their journey with ZERO retirement savings at the age of 29.

We’re going to set the scene for Luke and Amanda, who are married with a 3-year-old child. Luke and Amanda both work full-time. Amanda has been crushing it at work and recently received a large promotion where they will finally have a small amount of margin to put away for retirement. They mentioned that after all their monthly expenses, they would be able to save $800 a month from their net income.

Phase 1 - Consistent and Persistent

The investment calculator below, and the Synovus financial calculator, assumes that you start with nothing; each month Amanda is able to put away $650 in her 401(k) from her gross paycheck, which reduces her monthly net paycheck by only $500. Her company matches 3% or approximately a $250 monthly match. Since Luke and Amanda said they can save $800 per month of their net income, Luke is able to save the remainder $300 a month for their emergency nest egg.

Fast forward 20 years. As we look back and review how the couple has progressed, we’ve noticed that things haven’t gone exactly as planned. Life had provided some surprises and blessings over the first few years into their plan, as Luke and Amanda welcomed another child to their family. All the intended savings ($300/month) from Luke’s portion was spent on the various increased cost of living and had never created any retirement liftoff. Thankfully, Amanda was able to stay consistent with her company’s retirement savings, although she received increased income over the years. Her savings remained the same and now her 401(k) balance 20 years later checked in at around $500,000. Amazing!

Starting with Zero

.jpg)

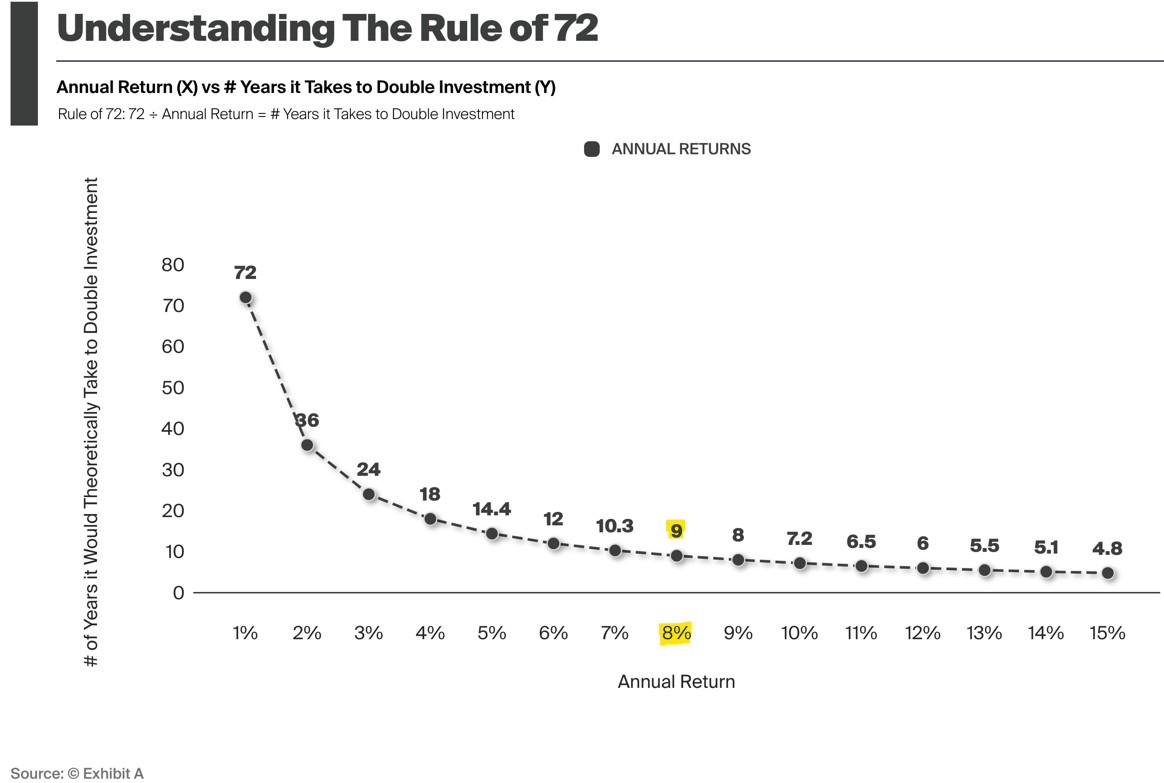

How can you start with zero and accumulate half of a million dollars in two decades without increasing your savings? This is the magical power of compounding, also known as the Rule of 72. This financial math hack affirms that if you can earn 7.2% annualized return compounding over 10 years, your money doubles. It’s due to the consistent deposits over time, along with a company match. The chart below shows the sliding scale in which an 8% annual return compounded over nine years doubles your investment balance. Small consistent deposits over time will create exponential growth if you have enough time to let it cook.

Rule of 72

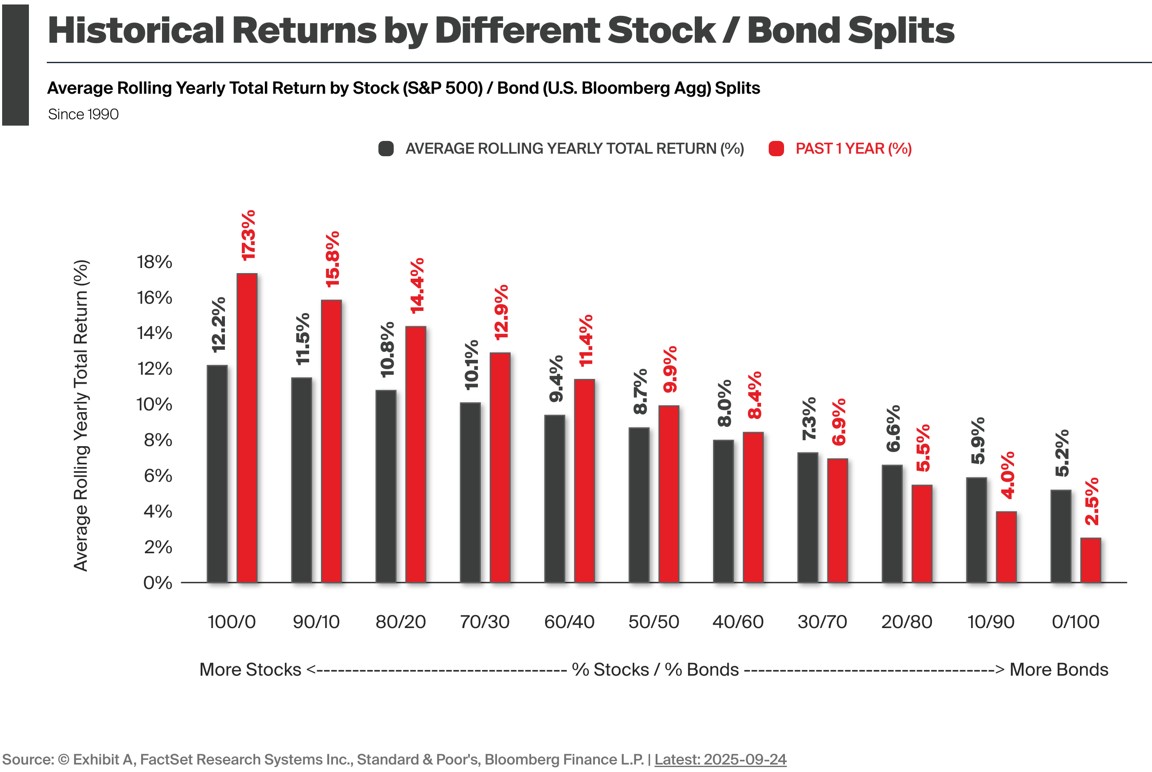

As for Amanda’s investment plan, we used an 8% long-term average. You may ask, “Don’t you have to be super aggressive to get an 8% return?” Quite the contrary. The key is being fully invested within an allocation that would provide elements of growth and income for monthly contributions. The chart below shows the average rolling yearly returns from various mixes of owning the S&P 500 along with a certain percentage of the U.S. Bloomberg Bond Aggregate, back to 1990. A 60/40 stock to bond allocation mix would have averaged an annualized return of 9.4%, all while having to endure a dot com bubble burst, 9/11 terrorist attack, the 2008 financial crisis, two Middle East wars and the rise of a global pandemic. Starting with zero but combined with small consistent deposits over time within the 60/40 moderate risk investment plan created $500,000-plus in Amanda’s 401(k) balance.

Historical Returns of Different Stock/Bond Splits

Phase 2 - Accumulation Maximization: ‘I Think I Can …’

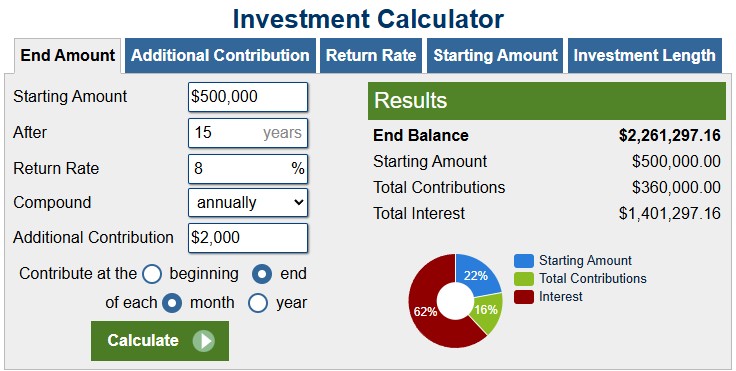

Now that Luke and Amanda are in their peak earning years and both about to turn 50, they are a bit anxious about their retirement track. But they are ready to increase their retirement savings to achieve their retirement income target of $10,000 a month by the age of 65. Luke and Amanda have managed to maintain little to no debt, except for a smaller mortgage balance that will be paid off in 10 years. They revisit with their financial planner who designed the following plan. Both Luke and Amanda agreed to increase their combined 401(k) contributions from $650 a month to $1,500 ($750 a month each). Their companies match 3% of both of their salaries, providing each with an extra $250. This is a $2,000 tax deferred monthly savings for the next 15 years but now building upon the $500,000 balance that Amanda has accumulated over the past 20 years.

We will continue to assume an annualized average rate of return of 8%. This is where the large shifts in accumulation begin. Based on the investment calculator below, Luke and Amanda have accumulated a grand total of $2.2 million! Luke and Amanda, you are officially millionaires. Congrats!

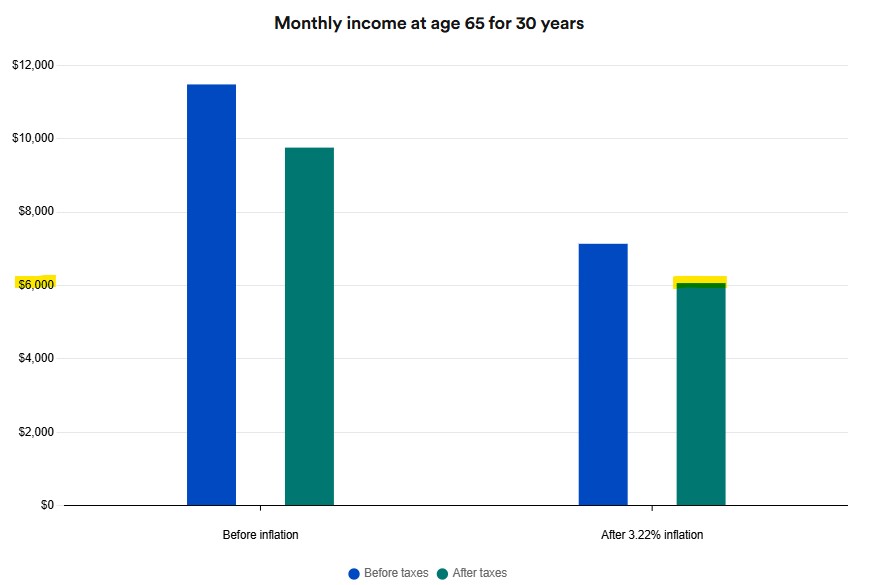

Monthly Income for $2.2 Million at 65

We need to add an additional hurdle component to their retirement income target, meaning inflation. The chart below shows a retirement income distribution that considers 3.22% inflation during their 30-year retirement, starting at 65. Due to their age, we have reduced Luke and Amanda’s annualized investment returns to be 5% with a 5% distribution. Net of inflation, Luke and Amanda’s $2.2 million retirement nest egg will provide $72,000 a year. or $6,000 a month. But what about their $10,000-a-month retirement income target?!

Believe it or not, the U.S. has been through banner years of political change, government shutdowns over the continued debt ceiling and various geopolitical conflicts the past 35 years, but it has managed to continue benefits for Social Security income.

Retirement Income Plan with Inflation

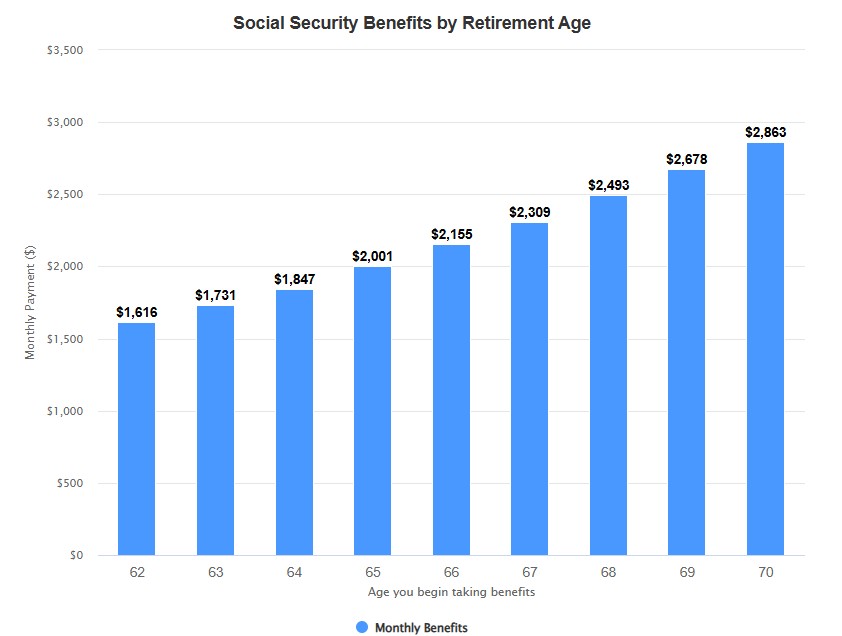

According to the Social Security Administration’s website (ssa.gov), the average monthly Social Security retirement benefit for an individual collecting Social Security at 65 years old is approximately $2,000 per person. To keep things simple, will use the $2,000 median income for each Amanda and Luke. We can get into full retirement age and cost-of-living adjustments in another writing.

Chart 6 - Social Security Benefits by Retirement Age

Luke and Amanda turned 65 a month apart from each other and started collecting $2,000 each in Social Security income, along with $6,000 net monthly income from their old 401(k) balances. They have now been rolled over to their own respective IRA accounts. They have no outstanding debt and their current living expenses total $6,500 a month. They saved more than they needed! Their advisor provided helpful ideas for Luke and Amanda to consider for the $3,500 monthly income surplus. This may include other tax efficient strategies such as a ROTH conversion, a long-term care or term life policy to insulate their family from unexpected healthcare or mortality risks that may shatter their current retirement plans.

If it could only be this easy but, remember, Luke and Amanda haven’t followed the plan exactly as provided from the beginning. However, they kept up with most of their disciplined savings plan. Given enough time, consistent savings, and compounding growth of your savings, you owe it to yourself to find ways to move the needle closer to your financial goals every month.

Let’s face it, life can be messy. One or multiple recessions, along with unpredictable expenses and financial slip-ups, can take you off your path. By establishing a thorough financial roadmap and regularly evaluating your progress at key milestones, you can transform your financial outlook. Continual assessment ensures that you stay on track with your goals, adjusting as needed to meet each financial objective. This disciplined approach can help you achieve long-term success, moving from your starting point to a secure and prosperous future – and go from “zero to hero.”

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- David Krechevsky, “Housing Affordability Biggest Challenge for Market,” Goldman Sachs, published March 23, 2023. Accessed September 30, 2025. Back