Learn

Three Critical Market Signals Before Year-End 2025

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

Synovus Securities, Inc.

As we approach the final months of 2025, investors face a market landscape that's equal parts promising and precarious. Think of it as navigating a three-way intersection where the Federal Reserve System (the Fed), corporate earnings and consumer behavior all flash different colored lights. Let's decode what really matters for your portfolio.

1. The Fed's Monetary Policy Pivot: A Cautious Easing Cycle

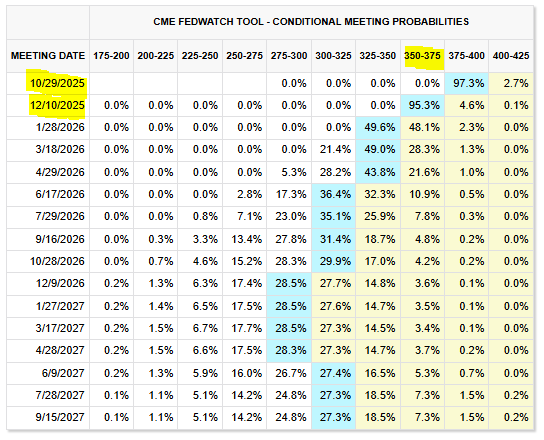

The Fed has embarked on a measured rate-cutting path, with projections showing the federal funds rate falling to the mid-3% range by year-end 2026. After cutting rates by 25 basis points in September 2025 to 4.00% to 4.25%, the Fed now targets a range of 3.50% to 3.75% by year-end.

CME Fund Funds Probabilities Matrix

Here's what's fascinating: The Fed projects inflation to remain elevated at 3.0% Personal Consumption Expenditures (PCE) — the Fed’s preferred measurement tool of inflation — by year-end 2025, and 30 basis points higher than March projections, with near-2% inflation not expected until year-end 2027. Translation?

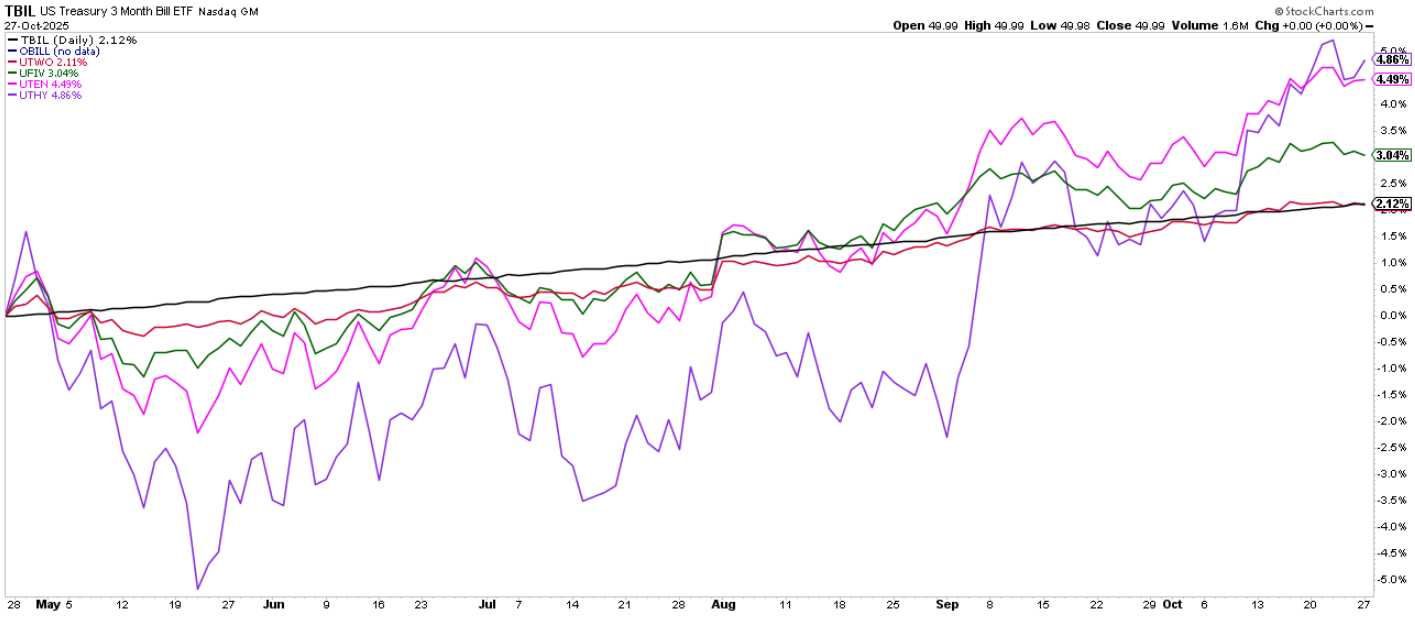

The Fed is walking a tightrope — cutting rates to support employment while wrestling with stubborn inflation. For your fixed income allocations, this suggests money market yields may deliver attractive returns through 2026, but long-duration bonds could finally catch a bid as rates descend. U.S. Treasury bond electronic funds transfers (ETFs) have already started pricing in the near-term rate cuts. Bond prices have increased from as low as 2% for short-term bonds, up to 4.8% for longer-term treasury bonds.

Portfolio Hot Take: Look for bond ETF prices to increase over the next three to six months, providing a tailwind for diversified stock and bond portfolios. Retail and institutional investors may be looking to trade a portion of their stock market risk to lock in gains and opt for a less volatile fixed income option given the current Fed rate environment.

Bond Prices Looking Up

Bottom Line: The days of 5%+ money market yields are numbered, but the journey down will be slower than many anticipate. If you've been sitting on high levels of cash, now's the time to develop a redeployment strategy.

2. Corporate Earnings: The Rising Tide Lifting Selective Boats

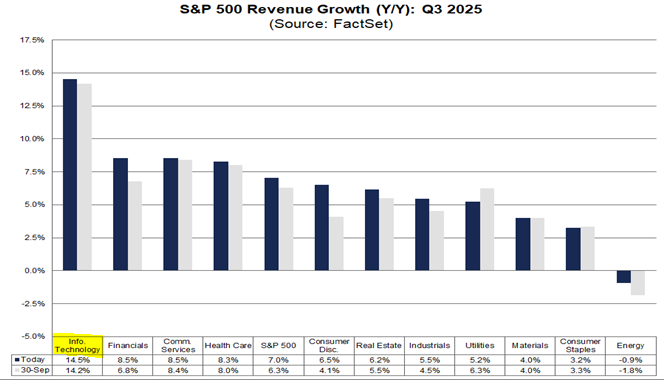

Q3 2025 earnings have defied gravity. With 29% of S&P 500 companies reporting, 87% have beaten earnings estimates — the highest percentage since Q2 2021. The S&P 500 is projected to report 8.0% year-over-year earnings growth, marking its ninth consecutive quarter of expansion.

But here's the catch—this isn't your grandfather's broad-based rally. The "Magnificent Seven" tech titans (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) are anticipated to significantly outperform the rest of the S&P 500 in earnings growth through 2025, while forward profit margins have reached record highs around 14%. The concern? At a forward P/E ratio of 22.7, S&P 500 valuations stand well above both the five-year average of 19.9 and 10-year average of 18.6.

Sector Focus: Technology led Q3 sector performance, while defensive sectors like healthcare and consumer staples demonstrated resilience. Consider rebalancing toward quality names with pricing power and strong balance sheets.

S&P Revenue Growth by Sector

3. U.S. Consumer Resilience: The Tale of Two Economies

The Great Consumer Divide

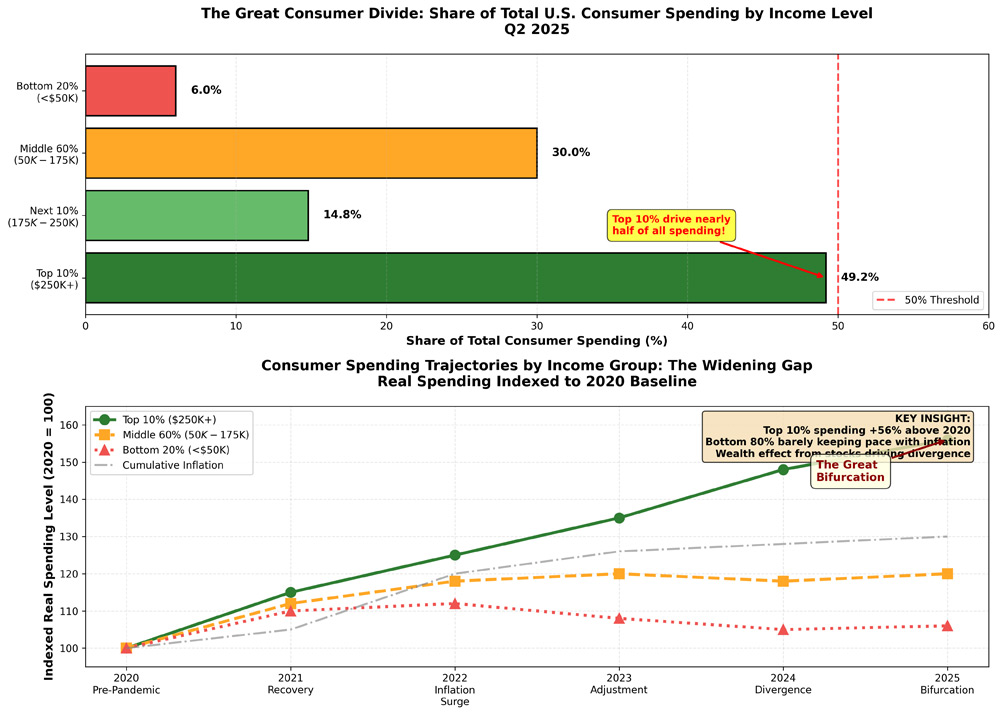

When economists say, "The consumer remains strong," they're telling only half the story — and it happens to be the wealthier half. The American consumer economy in 2025 has bifurcated into two distinct realities, and understanding this divide is critical for investment positioning and strategic planning.

The Numbers Tell a Stark Story

According to Moody's Analytics analysis of Federal Reserve data through Q2 2025, the top 10% of earners (households making $250,000 or more annually) now account for 49.2% of all consumer spending — the highest share since data collection began in 1989. Let that sink in: one-tenth of households drive nearly half of all consumption in the world's largest economy.

This represents a dramatic shift from the early 1990s, when the top 10% accounted for roughly 36% of spending. The trajectory has accelerated sharply since late 2022, creating what Mark Zandi, chief economist at Moody's Analytics, describes as an economy "tethered" to the spending behavior of the wealthy.

The Discretionary Spending Factor

Perhaps the most concerning linchpin for economic stability: higher-income spending is heavily weighted toward discretionary categories — luxury goods, travel, dining and entertainment. This spending can be "ramped up or tamped down more easily," as Morning Consult research notes, making it a "double-edged sword for the economy."

Key discretionary categories dominated by high earners:

- International travel and luxury accommodations

- Fine dining and entertainment

- High-end retail and luxury goods

- Elective medical procedures and wellness services

- Premium experiences and services

U.S. Consumer Bifurcation

This means the economy's growth is increasingly dependent on categories that are most vulnerable to sentiment shifts, market volatility, or wealth effects reversing. Rob Frank, wealth journalist at CNBC, says, “It’s not about the money; it’s about the mood.” Meaning, high income households have already experienced the wealth effect from higher interest rates, which have provided elevated interest income for their cash and more than a 220% in cumulative stock market returns in the S&P 500 since the COVID-19 lows in March 2020.

The critical question for 2026 is: will the economy maintain its trajectory if it's primarily powered by the top 20% of earners?

As Zandi frames it: "As long as they keep spending, the economy should avoid recession, but if they turn more cautious, for whatever reason, the economy has a big problem."

That "big problem" risk is amplified by several factors:

- Stock market valuations at elevated levels (S&P 500 forward P/E of 22.7)

- Potential for market corrections to trigger wealth effect reversal

- Political and policy uncertainty that could shake business and consumer confidence

- Labor market showing cracks that could eventually reach higher-income workers

The Bottom Line

The American consumer isn't uniformly resilient — it's bifurcated. The wealthy are driving growth while the majority tread water or fall behind. This creates an economy that appears robust in aggregate but is increasingly fragile, dependent on the spending whims of a narrow cohort whose fortunes are tied to asset prices. There is a similarity between the largest market capitalized companies in the S&P 500 (“Magnificent 7” stocks) and the top earning households, most of the heavy lifting remains in this section of economy. As the “Magnificent 7” and the upper crust U.S. consumers go — so goes the economy.

The message is clear: 2025's final act requires strategic positioning, not blind optimism. As legendary investor Peter Lynch might quip, "Know what you own, and know why you own it"— because 2026's script is still being written.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.