Learn

A Crucial Contingency Plan: Is Your Buy-Sell Agreement Ready for the Real World?

By Amy Piedmont, J.D., LLM, Vice President, Sr. Trust Relationship Manager and

Katherine “Kate” Gambill, J.D., Vice President, Sr. Trust Relationship Manager, Synovus Trust Company, N.A.

In our series, “The Personal Trust Corner: A J.D.’s Perspective,” we aim to spotlight one planning strategy each month. These strategies can be employed individually or in combination. This month we focus on the importance of having a well-drafted buy-sell agreement to ensure your business continues in your absence.

For most business owners, planning for future growth is a top priority. But what happens when an owner leaves the company unexpectedly due to death, disability, or a disagreement with partners? A well-structured buy-sell agreement is a vital succession tool that protects your business, your co-owners and your own family from the chaos of an unplanned exit.

Also known as a "business prenup" or "business will," a buy-sell agreement is a legally binding contract that establishes a clear process for handling an owner’s departure. Without one, the transfer of a business interest could be left to chance, potentially jeopardizing the company’s stability and triggering expensive legal disputes with a former partner's heirs.

The Key Components of a Robust Buy-Sell Agreement

A comprehensive buy-sell agreement should cover these critical provisions:

- Triggering Events: The agreement must explicitly define the events that will initiate the buyout process. Common triggers include:

- Death or permanent disability of an owner

- Retirement or voluntary exit

- Divorce, which may transfer a business interest to a former spouse

- Bankruptcy of an owner

- Valuation Methodology: One of the most contentious issues during a buyout is agreeing on a fair price for the business interest. The agreement should define a valuation method ahead of time to prevent disputes. Options include:

- Fixed Price: A stated value, though this can become quickly outdated without regular review.

- Formula Approach: A predetermined formula based on metrics like book value or a multiple of earnings.

- Independent Appraisal: A fair market value determined by a third-party appraiser at the time of the event.

- Purchase Structure: The agreement must specify who will purchase the departing owner's interest:

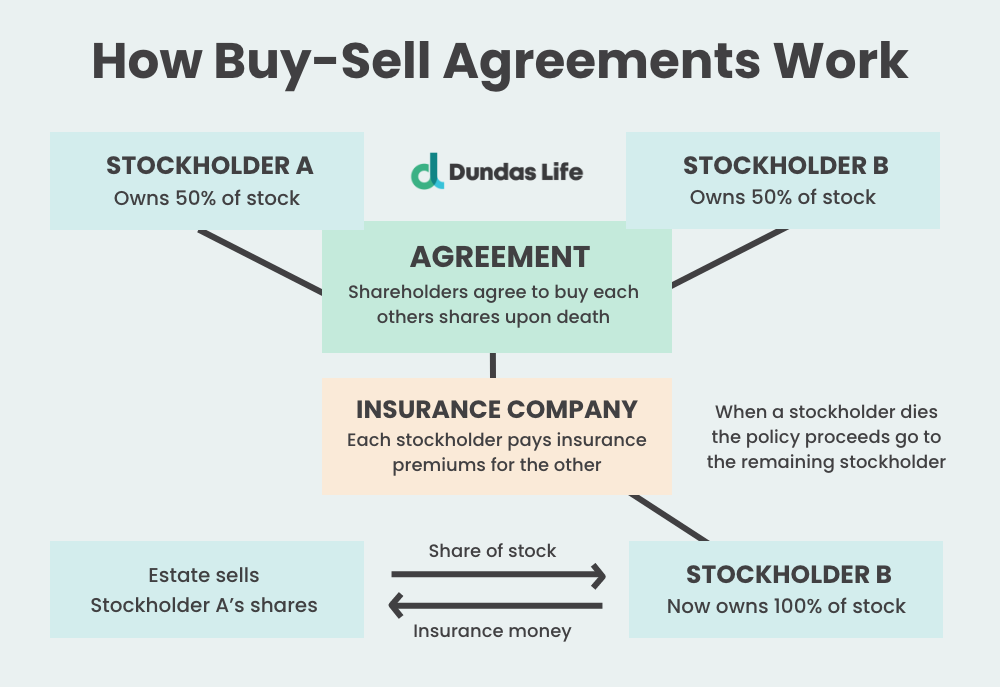

- Entity-Purchase (Redemption) Plan: The business entity itself buys the shares from the departing owner or their estate. This is often simpler for businesses with many owners.

- Cross-Purchase Plan: The remaining owners agree to personally purchase the departing owner's shares on a pro-rata basis. This is common for small businesses with few owners.

- Hybrid ("Wait-and-See") Plan: This flexible approach allows the remaining owners to decide at the time of the event whether the business or the owners will buy the shares.

- Funding Mechanism: A buy-sell agreement is only as strong as its funding. Without a plan, remaining owners may not have the liquidity to purchase the shares, especially for a large, illiquid business.

Common funding methods include:- Life Insurance: The most common and often most efficient method for a death-triggered event. The proceeds are typically income-tax-free and provide immediate cash.

- Disability Insurance: A disability buyout policy provides funds for a buyout if an owner becomes permanently disabled.

- Installment Sale: The remaining owners pay for the interest over a set period, which eases the immediate cash burden but may not provide immediate liquidity to the departing owner's family.

- Sinking Fund or Cash Reserves: The business sets aside funds in a separate account for the specific purpose of a buyout.

Why recent U.S. Supreme Court Decision in Connelly Demands an Immediate Review of Your Buy-Sell Agreement

In June 2024, the U.S. Supreme Court's ruling in Connelly v. United States significantly impacted how life insurance used to fund corporate redemption agreements is treated for estate tax purposes.

The decision clarifies that life insurance proceeds used to redeem a deceased owner's shares must be included in the company's valuation. The liability for redeeming the shares, however, does not necessarily decrease the company's fair market value for estate tax purposes.

This can lead to a higher overall business valuation, potentially increasing the deceased owner's estate tax liability. The Connelly ruling primarily impacts C and S corporations, but its implications warrant a review of all buy-sell agreements, regardless of business type.

As a Business Owner, What You Should Do Next

If you have a business with multiple owners, it is critical to address these issues proactively. Here's how:

- Schedule a review: Contact your advisory team to review your existing buy-sell agreement, especially if it was drafted before June 2024.

- Evaluate your structure: Determine whether a cross-purchase or entity-purchase structure is most appropriate given the Connelly decision and your business structure.

- Assess your funding: Ensure your funding mechanism — especially if it involves life insurance — is aligned with your buyout needs and current tax laws. Synovus has several partners who can advise you on insurance and other funding options to ensure your business has enough liquidity to execute under a buy-sell agreement. Without adequate funding, a buy-sell agreement could cause a forced liquidation/fire sale of assets.

- Communicate with partners: Maintain open dialogue with co-owners to ensure everyone understands the agreement and its importance.

Taking these steps now will help ensure a smooth transition of ownership, protect the future of your business and provide financial security for you and your family.

Conclusion

Your business is your legacy, and a thoughtfully crafted and regularly updated buy-sell agreement is the anchor that protects it. The unexpected exit of a business partner can be a turbulent event, but with a clear plan, it doesn't have to become a devastating one. By addressing critical details like valuation and funding now, you safeguard your company's continuity, provide financial security for your family and prevent future disputes with co-owners or their heirs. As your relationship manager, Synovus Trust can provide fiduciary oversight to help you coordinate with your legal and tax advisors, ensuring your buy-sell agreement is fully aligned with your overall estate plan and financial goals. The time to secure your business’s future is not when a crisis strikes, but today.

Please reach out to our Senior Trust Relationship Managers: Amy Piedmont, J.D., LLM, Vice President, in Pensacola, Florida and Katherine Gambill, J.D., Vice President, in Atlanta with any questions or to start a conversation regarding estate planning. We welcome the opportunity to introduce you to how Synovus Trust Company can serve your needs.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.