Learn

The Fed Is on the Fence: A 2025 Interest Rate Outlook

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

Synovus Securities, Inc.

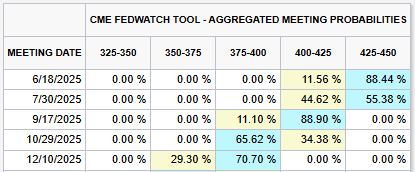

Despite economic uncertainties related to U.S. President Donald Trump's tariffs and fiscal policies, Federal Reserve officials still project approximately two quarter-point (0.25%) rate cuts through 2025. This would bring the federal funds rate to around 3.75% to 4.00% by year-end. This represents a reduction in anticipated policy easing compared to earlier projections in 2024, as inflation has proven more persistent than initially expected. The chart below shows the probability (highlighted blue) in percentages for future rate cuts through 2025.

Based on the most recent Federal Open Market Committee on May 7, the latest economic projections reveal a more cautious outlook, with slower growth and higher inflation expected by the end of this year. According to the JP Morgan March Economic Outlook, Fed officials have downgraded their GDP growth forecast to 1.7% while raising their core inflation projection to 2.8%. The central bank now does not expect inflation to return to its 2% target until 2027, significantly later than previous forecasts.1

Jerome Powell, Chair of the Federal Reserve, has acknowledged that the Trump administration’s policies on trade, immigration, fiscal policy and deregulation "will matter for the economy and the path of monetary policy," but indicated the Fed wasn't yet ready to act precipitously. Powell emphasized that if economic conditions warrant, the Fed could maintain higher rates for longer: "If the economy remains strong, and inflation does not continue to move sustainably toward 2%, we can maintain policy restraint for longer.

Chairman Powell also said, “For the time being, we are well positioned to wait for greater clarity before considering any adjustments to our policy stance.”2

Fed Stimulus Lies in the Fine Print

The Fed’s balancing act continues in 2025 as it navigates between controlling inflation and supporting economic growth. In March, the Fed announced it would slow the pace of its balance sheet reduction, decreasing monthly Treasury redemption from $25 billion to just $5 billion starting in April. This move signals a subtle shift in monetary policy while maintaining the current interest rate level. "The Fed indirectly cut rates by taking action to reduce the pace of runoff of its Treasury holdings," said Jamie Cox, managing partner for Harris Financial Group.2

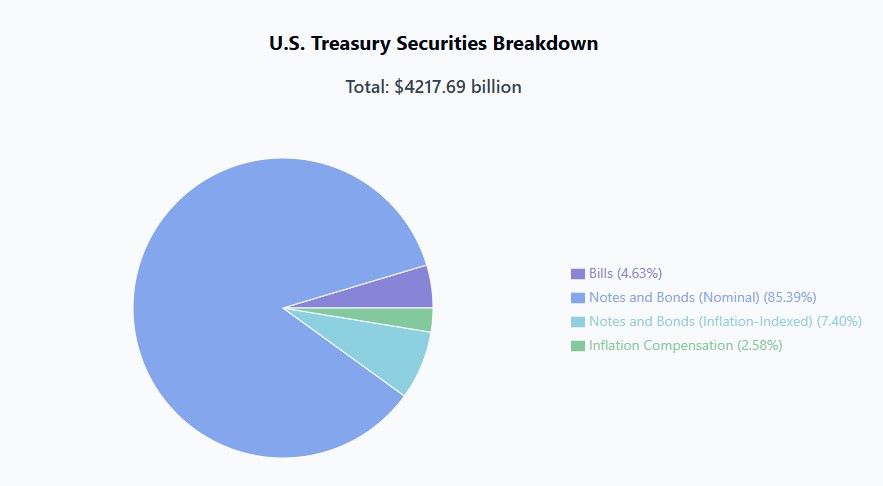

It’s important to show an estimated breakdown of what U.S. Treasuries and maturities the Federal Reserve owns to understand the simulative potential impact of the treasury redemptions going forward.

What does a slowdown in U.S. Treasury redemption mean? This is one of the subtle tools in the Fed’s arsenal where it can use to create additional economic stimulus without lowering interest rates. I would like to call it “The Art of Cutting without Cutting.” Below are some of the possible economic impacts of the Fed’s slowdown in the U.S. Treasury redemption rate.

- Increased Liquidity: Slowing the pace of balance sheet reduction (quantitative easing) means more reserves remain in the banking system. This effectively increases liquidity in financial markets, which can support lending activities and economic growth.

- Stimulative Effect: This action is considered modestly stimulative for the economy, somewhat offsetting the restrictive effect of the relatively high federal funds rate (currently at 4.5%, according to previous results).

- Market Signal: The decision signals the Fed's concern about potential economic weakening and its willingness to adjust monetary policy tools beyond just reducing the federal funds rate.

- Bond Market Impact: Treasury prices may rise (and yields fall) as the reduction in supply from the Fed's slower redemption pace affects market dynamics.

This policy shift represents a more cautious approach by the Fed, suggesting it’s trying to maintain economic stability while still controlling inflation. It provides a middle ground between maintaining tight monetary policy and beginning to ease financial conditions as it navigates uncertainty in the economic outlook.

In summary, the Fed looks as if that its finger is on the “rate cut button” in the event it feels that inflation is slowing toward its 2% target, and the U.S. economy is still fairly strong. Yes, the economy has cooled from the red-hot labor markets of 2021 and 2022. Unemployment is still showing at 4.2% and it's relatively tough to create a recession when the labor markets remain tight, households are still receiving a paycheck to spend and consumer behavior is still normal. On May 13, the New York Fed released its latest report. The report looks at whether consumer spending is weakening or household debt and credit reports show an increase in delinquencies, bankruptcies, or mortgage loan defaults, which all could be a leading indicator of further weakening for U.S. consumers and the economy.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.