Learn

It’s an Earnings Party: An Insight to the Q4 2024 Earnings Season

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

Synovus Securities, Inc.

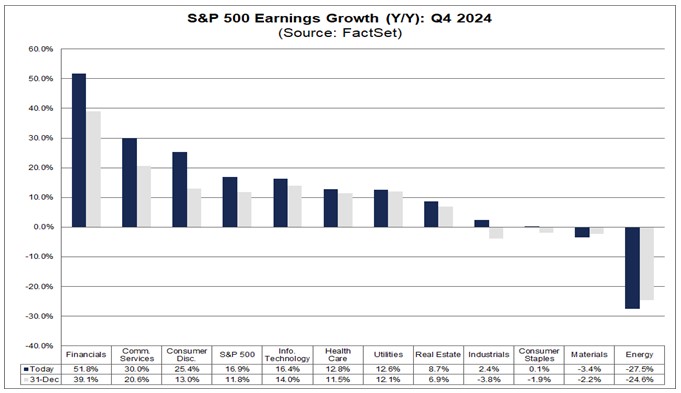

In Q4 2024, S&P 500 companies reported strong earnings, with both the percentage of companies reporting positive earnings surprises and the degree of earnings surprises rising above their 10-year averages. The blended earnings growth rate for the fourth quarter was 16.9%, the highest Year-over-Year (YoY) earnings growth rate reported by the S&P 500 index since Q4 2021 (31.4%). It also marks the sixth consecutive quarter of YoY earnings growth for the S&P 500 index.

FactSet Vice President and Senior Earnings Analyst, John Butters, said, "At this stage of the fourth quarter earnings season, S&P 500 companies are reporting strong results relative to expectations."

Nine of the eleven sectors were reporting YoY earnings growth for Q4 2024. Six of the nine sectors reported double digit earnings growth.

The six highest sectors reporting double digit Q4 2024 growth:

- Financials (51.8%)

- Communication Services (30%)

- Consumer Discretionary (25.4%)

- Information Technology (16.4%)

- Health Care (12.8%)

- Utilities (12.6%)

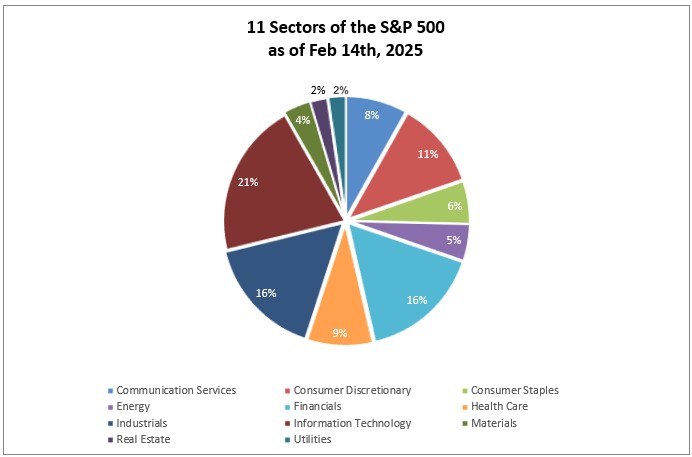

Another meaningful data point for the S&P 500 index is five of the six sectors reporting double digit growth represent the some of the largest market capitalization of the S&P 500. Technology, Financials, Comm Services, Consumer Discretionary, and Healthcare represent a total of 66% of the S&P 500 total cap weighting. Positive outlook and guidance from the forementioned sectors may provide continued performance for the US markets and S&P 500. Remember to stay nimble since the winds of change can easily blow in a different direction creating unanticipated downturns of market leaders and give rise to lagging defensive sectors of the market such as energy & consumer staples.

Future Outlook

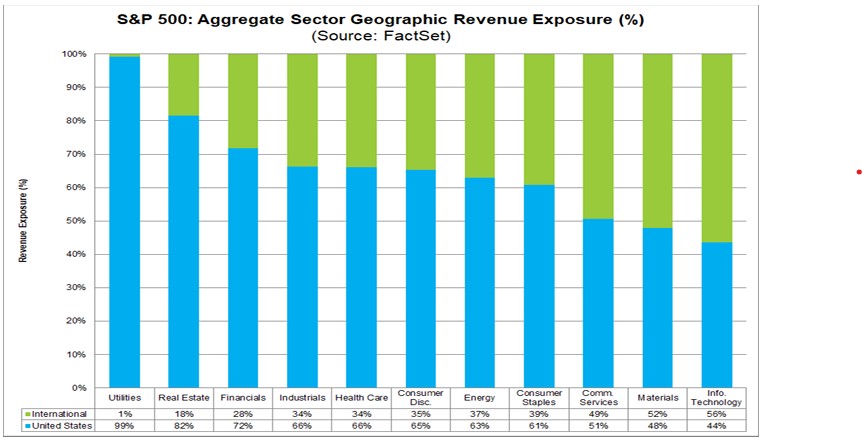

Analysts predict positive earnings growth for Q1 2025 (8.1%) and Q2 2025 (9.9%), and a full-year 2025 12.7% growth. However, the report noted that for Q1 2025, companies with more domestic revenue exposure are projected to have higher earnings growth than those with more international exposure (9.1% vs. 6.6%). This prediction may be due to continued policy fog as U.S. President Donald Trump and his administration contemplate their future tariff policies with foreign competitors. Many large cap S&P 500 companies generate upward of 65% of their revenue outside of the U.S. This could create additional headwinds for multinational company earnings going forward in 2025. S&P sectors with the most global revenue headwinds would be technology, materials and communication services.

Conclusion

The S&P 500 is experiencing a robust earnings season for Q4 2024, driven by strong performance across several sectors. Guidance for continued growth remains positive for 2025 and, as always, I remain cautiously optimistic for the continued U.S. secular bull market. While companies with more international exposure outperformed those with more domestic exposure in Q4, projections suggest a potential shift in 2025 as the Trump administration finds its footing on tariffs, reshoring of U.S. manufacturing, and not to mention the Department of Government Efficiency (DOGE). The market's valuation remains elevated beyond historical values at a price-to-earnings of 22. It's crucial to remember that these reports provide data and analysis on market sectors and economic forecasts and should not be viewed as investment recommendations. Understanding your investment objectives, risk tolerance and time horizon to accomplish your personal financial goals will be the best direction to maintain a successful long-term investment strategy.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.