Learn

Personal Trust Corner — A J.D.’s Perspective

Decoding 'Cost Basis': A Crucial Concept for Investors

By Amy Piedmont, J.D., LLM, Trust Relationship Manager, Sr. and

Katherine “Kate” Gambill, J.D., Vice President Sr. Trust Relationship Manager

In the world of investing, understanding the jargon is half the battle. Among the key terms every investor should know is "cost basis." This concept may sound intricate, but it's a fundamental principle that can significantly impact your tax liability when you sell an asset.

Unpacking Cost Basis

Cost basis refers to the original value or purchase price of an investment and includes any additional expenses such as commissions, recording fees and transfer fees. It's a tax term that essentially represents the amount you've invested in a particular asset.

The Role of Cost Basis in Calculating Capital Gains and Losses

When you sell an asset, your capital gain or loss is determined by the difference between the asset's cost basis and its selling price. Selling an asset for more than its cost basis results in a capital gain, while selling for less results in a capital loss.

Adjusted Cost Basis: A Closer Look

At times, an asset's cost basis may require adjustments. For instance, when you make additional investments, or undergo a stock split or dividend. This adjusted cost basis provides a more accurate measurement of your capital gains or losses, reflecting any changes since the original purchase.

Understanding Basis Transfers and Step-Ups

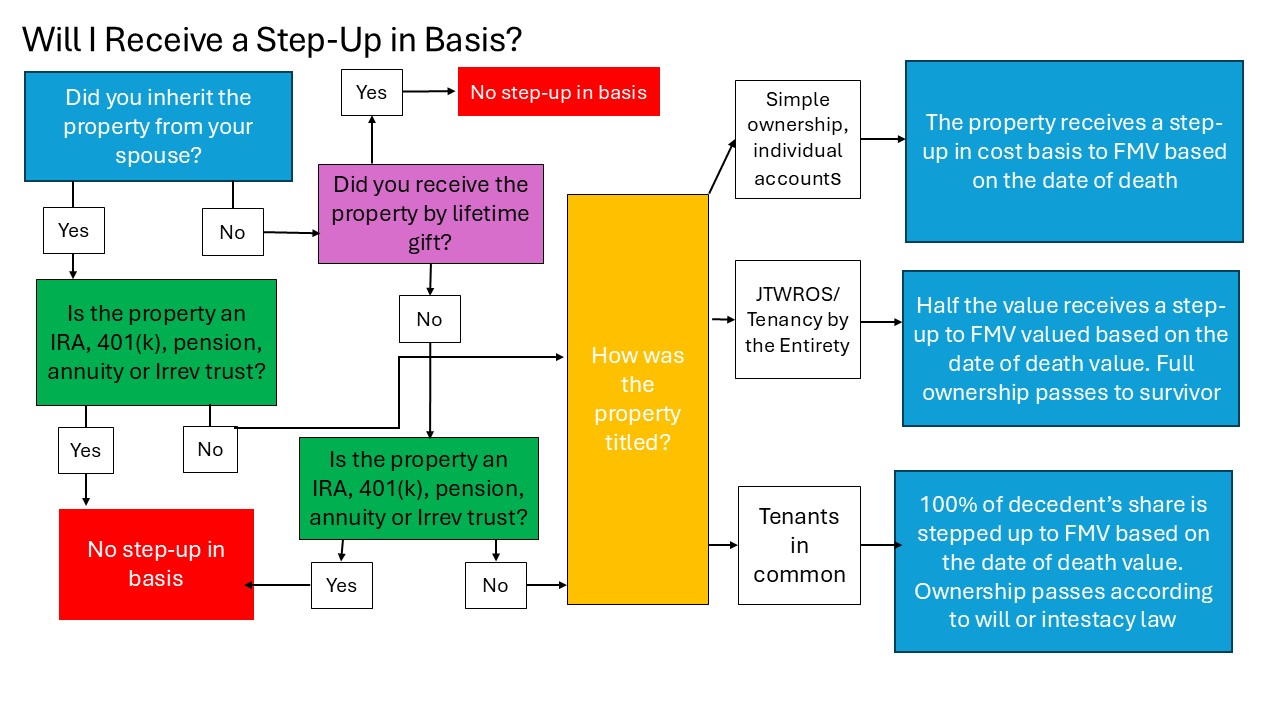

The transfer of cost basis is crucial in two scenarios: lifetime gifts and inheritance.

When you gift an asset during your lifetime, the recipient generally assumes your original basis, known as the “carryover basis.” Additionally, they inherit your holding period, which means if you held the asset for more than a year, they would qualify for long-term capital gains treatment upon sale. For this reason, clients are discouraged from gifting stock or adding a beneficiary as a joint owner to an account as this type of transfer could have significant negative tax implications for the recipient of such gift.

Estate planning offers the opportunity to take advantage of a step-up in basis to its fair market value (FMV) at the date of the donor's death. With careful planning, your low cost-basis holdings can receive a step-up in basis at the date of death. This can reduce or eliminate any capital gains tax for beneficiaries who sell or transfer the asset after decedent’s death.

For jointly owned assets, a partial step-up may apply. The asset would get a proportionate step up to the decedent’s ownership share at the fair market value on the decedent’s date of death.

It should be noted that inherited IRAs, 401(k)s, pensions, annuities and irrevocable trust assets do not receive a step-up in basis at the death of the owner.

Charitable Contributions and Cost Basis

When considering charitable contributions, assets with a low-cost basis might be a smart choice. Transferring an asset, such as securities, with a low-cost basis allows you to realize a significant gain while claiming the full fair market value of the asset as a charitable contribution.

The Bottom Line

Understanding and accurately tracking your cost basis can help you manage your tax liability more effectively. It's an essential part of successful investing and can significantly impact your financial planning. Always remember to keep accurate records of your cost basis for all assets. Knowledge is power, and in the world of investments, it can also translate into savings.

Please reach out to our Trust Relationship Managers: Amy Piedmont, J.D., LLM, Trust Relationship Manager, Sr. in Pensacola, Florida and Katherine Gambill, J.D., Vice President Sr. Trust Relationship Manager in Atlanta with any questions, or to start a conversation regarding estate planning, taking advantage of the step-up in basis that may be available at death, or charitable contributions. We welcome the opportunity to introduce you to how Synovus Trust Company can serve your needs.

Important disclosure information

The material in this article is for educational purposes only and is not intended to provide legal or tax advice regarding your situation. For legal or tax advice, please consult your attorney and/or tax professional. Synovus Trust Company offers estate planning resources and education to clients. Synovus Trust does not provide legal advice or services.

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.