Learn

Bond ‘Rizz’ on the Horizon

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

Any parent or grandparent who attempt to decipher today’s slang vernacular may be familiar with the term “Rizz.” For those who are not familiar, as my 20-year-old daughter would say, “Let me put you on.” Rizz, short for the word charisma, simply means an ability to charm and/or woo a person. Based on recent language from Chair of the Federal Reserve, Jerome Powell, bonds may have the ability to charm or woo their way back into your portfolio after suffering one of the worst down years in 2022.

According to the recent economic data in the latest BLS non-farm payroll revision — down more than 800,000 (reported on August 21) — it provided further confirmation that Powell needed to provide additional language on the first Fed funds interest rate cut this month.

According to Powell’s speech in Jackson Hole, Wyoming on August 23 he said, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.”

In Powell’s response to the recent labor market data he added, “The current level of our interest rate policy gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.”

To be clear, Powell does not communicate his direct intentions like, “Hey everyone, we’re cutting interest rates in a month and probably by .25%, unless we see further weakening economic data. Stay tuned.” Instead, Powell keeps his cards held close to his vest and tends to speak in more biblical parables in his pressers.

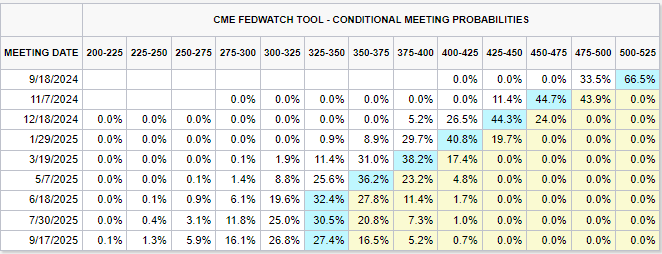

Due to the non-straight forward communication provided by Powell, we look to the markets to interpret possible interest rate movements between now and the end of the year. Based on the CME Fed Rate tool chart below, the market has priced in 100 basic points (BPS) or a 1% overall fed rate reduction by end-of-year 2024 and a possibility for an additional 1% Fed funds rate reduction through 2025.

CME FedChart Tool

Economic data can change for the better or worse between now and next year and that is why Powell has communicated in many of his pressers that they will remain data dependent and steadfast as economic conditions change.

The Case for Bonds

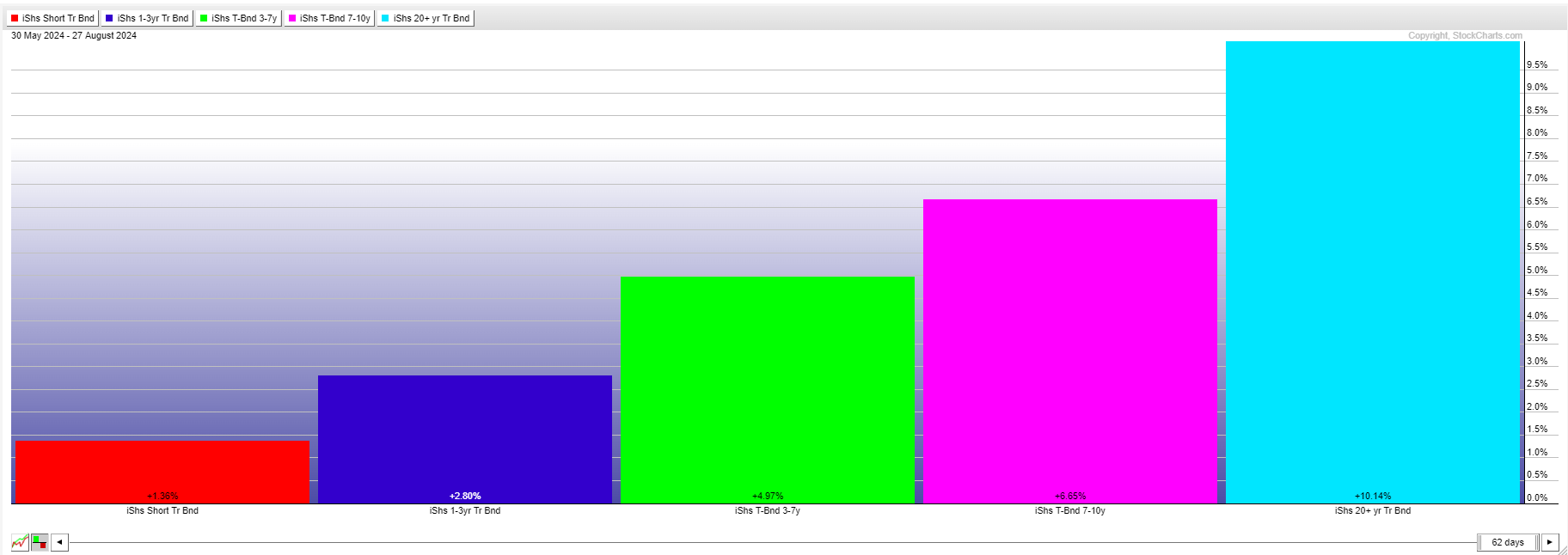

Based on this near-term Fed funds rate cut, the bond markets have responded and rallied into the summer with accelerating price momentum from June through August. IEF, the 7- to-10-year treasury ETF, is up more than 6.5%; TLT, the 20-year treasury bond ETF, is up more than 10% since June 1.

Bond ETF Chart

For those who do not understand what makes bond prices move up and down, let me introduce you to the bond seesaw. The illustration below shows how bond prices move in opposite direction of interest rate movements. If interest rates are on the rise, as they were in 2022 and part of 2023, bond prices started to fall and continued. As interest rates begin to fall, then bond prices rise as they did in 2019 and 2020.

Bond Seesaw

How Bonds Work for Investors

There are four main roles that bonds can play in an investment portfolio. The two main reasons that investors own bonds in an investment portfolio is predictable interest income and a potential diversification hedge against equity or economic volatility. The third reason that an investor would own bonds is capital preservation. Since bonds are simply debt that may be issued by a government entity (i.e., U.S. Treasuries) or by a corporation (i.e., corporate bonds) that promise to pay a stated interest rate until a certain maturity date. If you buy a new bond at $1,000 per bond, the government or corporate entity has created a debt obligation to pay you, the investor, until the stated maturity date. This is similar to being a debt holder for a mortgage on your home. You pay a stated interest rate back to a bank or mortgage company until a certain maturity or end date. Make sense? Good.

The last and most attractive reason an investor would own bonds in their investment portfolio is capital appreciation, or also known as “Bond Rizz.” Even though bonds can provide a certain fixed interest payment, there is a possibility of capital appreciation, especially in a falling interest rate environment (view bond seesaw listed above in chart three). Bonds can appreciate in price and provide a lift in a diversified investment portfolio, especially during times of stock market volatility. Most of the time bonds are relatively boring and designed to provide a fixed annual income for investors with little price appreciation, but in the right economic conditions bonds can provide a very attractive return especially on a risk-adjusted basis.

Investing in bonds is not always straightforward. There are many different types of bond investments such as individual bonds, bond mutual funds, exchange traded bond funds, corporate bonds, U.S. and non-U.S. government bonds. Bonds have their inherit risks as well, such as interest rate risk, as we saw in 2022 and 2023, credit and default risk, duration risk and liquidity risk.

Please consult your financial professional to determine your risk tolerance, investment objectives and time horizon to make sure you have the most appropriate allocation and diversification for your bond portfolio.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.