Learn

The Fed Update

By Eric Krueger, Synovus Trust Senior Portfolio Manager

The Federal Open Market Committee (FOMC) incorporated a recognition of the "absence of further advancement" in inflation this year into its statement, but Chair Jerome Powell projected a dovish tone during his press conference, implying a need for more assurance before implementing a cut.

FOMC Statement and Press Conference

On May 1, the Federal Reserve unveiled its decision to maintain the status quo, and there were only minor alterations in the FOMC Statement. Powell's firm rebuttal to the prospect of rate hikes was the highlight of the press conference. He expressed doubt over the likelihood of the next policy rate move being a hike. He further elaborated that to justify a hike, the FOMC would need evidence of the policy not being restrictive enough, which is not currently apparent. In fact, he is assured that the policy is restrictive, substantiated by numerous pieces of evidence. When questioned about the necessity of the Fed to enforce stricter financial conditions due to an economy in recovery, Powell dismissed the assumption and denied any acceleration in the economy. Addressing the FOMC's plan in case of stagnant inflation, Powell indicated that the FOMC would delay rate cuts, implying a high threshold for hikes.

Regarding the timing of a possible rate cut, Powell did not disclose significant hints. He adhered to the phraseology that the Fed's leadership has been using in recent weeks, pointing out that "the data have not provided us with the increased confidence" needed by the FOMC to execute a cut. Consequently, "It is probable that acquiring such enhanced confidence will need more time than previously anticipated."

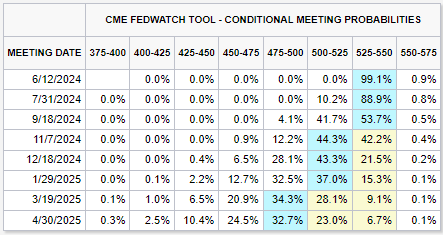

The market's expectations of cuts from the Fed have drastically shifted from January’s six cuts to currently just one by the year end:

Inflation

Inflation, alongside the labor market, has significantly influenced the Fed's expectations in this cycle. The St. Louis Fed's economic data site offers a graph that depicts the potential stickiness of core Consumer Price Index (CPI), which has decelerated its decline since its last representation in January.

.png)

Conclusion

To summarize, the recent decisions and commentary from the Federal Reserve suggest that it might have concluded the series of rate hikes, having maintained a hold since July 2023. This is encouraging news for bondholders based on historical trends. Considering the currently observed higher coupons, high-quality bonds remain an attractive prospect at these levels. On the equity front, the S&P 500 has risen by 12%. A wider market breadth is a positive indication, as the stock market performs better when a larger number of stocks are involved, rather than depending on a few rallying stocks. Maintaining a strategic asset allocation and periodic rebalancing are essential practices for long-term success.

If you have any questions or would like to discuss how these developments may impact your portfolio, please reach out to your Synovus advisor.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.