Learn

Here Comes The Boom: U.S. Boomer Wealth and The Transfer Effect

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

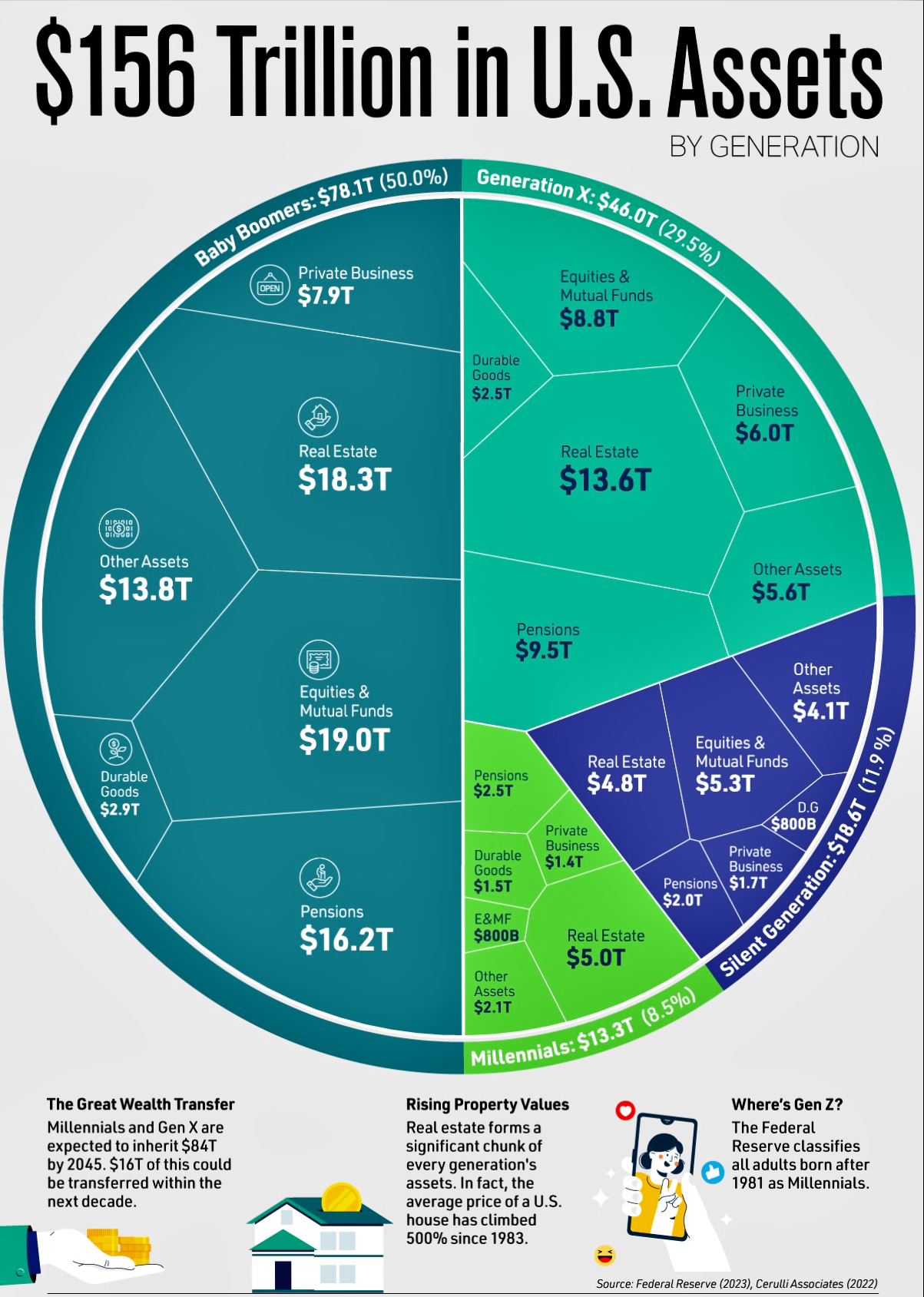

U.S. baby boomers, adults born between 1946 to 1964, account for just over 50% of the total net worth of the U.S. population. In 2023, Visual Capitalist created a diagram showing a total of $156 trillion in U.S. assets broken down by generation and asset type. Baby boomer assets totaled $78.1 trillion while the Silent Generation, U.S. citizens born between 1928-1945, account for $18.6 trillion. This graph breaks down U.S. generational wealth into six asset classes: 1. Real estate; 2. Equity and mutual fund investments; 3. Pensions; 4. Private businesses; 5. Durable goods (personal property); and 6. Other assets.

When considering a massive generational wealth transfer there are a few things that we need to consider. We will be taking out Pensions since many of them will not transfer to the next generation, other than qualifying spouses. So, we can deduct $25 trillion in pension transfers to future generations.

This still leaves approximately $71 trillion in wealth transfer of various assets over the next 30 years. Of the $71 trillion of transferable assets, approximately 14%, or $10 trillion, is assessed in business valuations of small- to medium-sized businesses. According to the Exit Planning Institute (EPI), 80% to 90% of business owners do not have an exit strategy from their business and only one-third of small businesses will result in a profitable business transfer. Even if we see an evaporation of $7 trillion of business valuations, this still leaves over $60T in wealth transfer. According to the chart provided by Visual Capital Millennials and Gen X, households are expected to inherit up to $84 trillion by 2045 with $16 trillion of assets being transferred within the next decade. There are two main focal points I wanted to share when it comes to these numbers. What does this mean for U.S. economic growth going forward and what possible societal impacts could be impacted due to this wealth transfer?

U.S. Economic Impact

As this tsunami of assets arrives to shore younger beneficiaries, one theory is that there will be a reset of new investment time horizons of funds coming from older generations to younger. This may spark new asset flow into higher risk assets that were normally held in CD’s, fixed annuities, and short-term fixed income. Since the time horizon of younger investors with newly minted wealth will be greater than their endowing benefactors, the risk appetite of younger investors with longer investment time horizons can provide further tailwinds to asset prices, including stocks, real estate, and private business venture investments. Aside from investments, the generational mindset shift from spend thrift to “spend it if you got it” may continue to drive the US consumers buying power for decades. The downside is that this could give way to a future with elevated inflation in asset prices driving a larger wedge between the “have’s and have nots” of US households.

U.S. Societal Impact

We have been having multiple legacy planning conversations with our clients and in our efforts to help maximize their legacy planning. Due to a high probability that the current estate tax exemption ceiling (TCJA 2017) will be greatly reduced in January 2026, from $13.6 million down to approximately $7 million, we share four main strategies:

- You can plan to spend all your money down to the last dollar;

- You can pass along the assets strategically through beneficiary titling or trusts;

- You can donate to favorite charitable organizations, or;

- You can give 45% to the U.S. government in the form of estate tax.

In light of the TCJA sunset in January 2026, more families are making plans to elect for Nos. two and three. The rise of Donor Advised Funds (DAFs), Legacy Income Trusts and Private Family Foundations have been a growing conversation with families with the intention of not falling into bucket four. There could be a wave of charitable assets over the next decade that can provide opportunities to fill in the wealth gap like never before. It is still unclear which charitable organizations could benefit the most, but if 5% of the projected wealth transfer, or $4 trillion, lands into the laps of nonprofits and charitable organizations, then this could lead to a Keynesian trickle-down effect to provide assistance to millions of underserved communities in need throughout the U.S.

Preparedness Is Key

According to the Milken Institute, “More than a third of Americans (35 percent) say they don’t plan on discussing the transfer of wealth with their families, despite the fact that nearly half of all Americans (48 percent) plan to leave an inheritance.”

Below are a few steps in creating a preparedness plan around future wealth transfer.

- Take inventory of assets and liabilities to determine your household net worth

One of the largest problems we see when an unexpected event occurs is no one knows where all the assets/accounts are held and how much is squirrelled away in various accounts. - Understand the tax implications when listing primary and contingent beneficiaries of your assets.

Is your strategy sound and efficient when transferring retirement accounts to non-spousal beneficiaries? Does it matter to you that your non-spouse beneficiary pays a lofty tax on your assets after inheriting the funds? - Determine whether a Revocable or Irrevocable Trust would be appropriate for your assets while you are living.

Do you need asset protection while you are living? Are there minors or special needs children to consider when transferring your funds and how are their lives negatively impacted when your inheritance transfer does not create the intended outcome?

Creating a dialogue around the topics of wealth transfer could help provide a guided plan for those who the designated assets will transfer to, when the transfers will take place and what fail-safes can be put in place to create a lasting legacy of your impact for your loved ones for years to come.

Consulting a financial professional may be a great start to get the proper guidance for your future wealth planning needs.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.