Learn

Tech Corner: 2024 Outlook - Top Five Major Themes

By Daniel Morgan, Synovus Trust Senior Portfolio Manager

Generative AI Use Sparks Server Recovery

In 2024, expect some Generative AI workloads to shift to on-premises environments, particularly for inference. This might sound counterintuitive as workloads have been moving in the other direction for the past 15 years to datacenter IaaS cloud service providers like AWS, Azure and GCP. This counter trend will be based on cost, latency, privacy and regulatory concerns. Worldwide IT spending is projected to total $5.1 trillion in 2024, an increase of 8% from 2023, according to the latest forecast by Gartner, Inc.

According to Dell’Oro Group, server and storage system revenue is forecast for growth greater than 20% in 2024, while network and physical infrastructure revenues grows single digits. HPE and Dell are expected to lead all original equipment manufacturers (OEMs) for 2024 in server revenue growth. HPE’s High Performance Computing and Artificial Intelligence segment is projected to post revenue growth of 19.8% Year-over-Year (YoY), while Dell’s Infrastructure Solutions Group is projected to increase revenues by 7.76% YoY, in 2024. This trend toward in-house data collection and storage should also favor cyber security and cloud protection players like CrowdStrike, Fortinet and Palo Alto Networks.

Public Cloud IaaS Growth Maturing

Moving forward, optimizations in the enterprise segment will continue as an ordinary course of business. However, the easy efficiency gains have already been realized, and there is likely not much left that can be optimized. Importantly, the cloud market is maturing, and the law of large numbers means that growth rates will come down over time. AWS is now at a $92 billion run-rate and estimate Azure is in the $70 billion range. While Generative AI can drive an acceleration, do not expect it to be as sharp as during the pandemic spike. The days of 40-50% AWS and Azure YoY growth may be over. Gartner now forecasts worldwide public cloud end-user spending to reach $679 billion in 2024. With all segments of the cloud market expected to see growth, infrastructure-as-a-service (IaaS) is forecast to experience the highest end-user spending growth in 2024 at 26.6%, followed by platform-as-a-service (PaaS) at 21.5%.

| 2022 | 2023 | 2024 | |

| Cloud Application Infrastructure Services (PaaS) | 119,579 | 145,320 | 176,493 |

| Cloud Application Services (SaaS) | 174,416 | 205,221 | 243,991 |

| Cloud Business Process Services (BPaaS) | 61,557 | 66,339 | 72,923 |

| Cloud Desktop-as-a-Service (DaaS) | 2,430 | 2,784 | 3,161 |

| Cloud System Infrastructure Services (Iaas) | 120,333 | 143,927 | 182,222 |

| Total Market | 478,315 | 563,592 | 678,790 |

Source: Gartner Research

Enterprise Software Growth Accelerates Slightly

Software growth rates in enterprise software vendors — such as Adobe, SAP, Salesforce and Autodesk — came down a bit in 2023 as CIOs were cautious with their IT spending, also given some degree of maturation in the SaaS market. This caution by enterprises led to smaller deal sizes and delays in approvals for new deals. There was generally less spending on large digital transformation projects in 2023. Despite a maturing of the market, growth rates could stabilize or accelerate slightly for SaaS vendors in 2024. There is some evidence that enterprise caution is easing as the economic growth appears to be slowing, but not headed into a recession. Generative AI will be a growth driver for the software market as new innovations get implemented, and adopted by customers, within enterprise software applications. According to Gartner’s Worldwide IT Spending forecast, spending on software should hit $1.042 trillion in 2024, an increase of 13.8% from 2023.

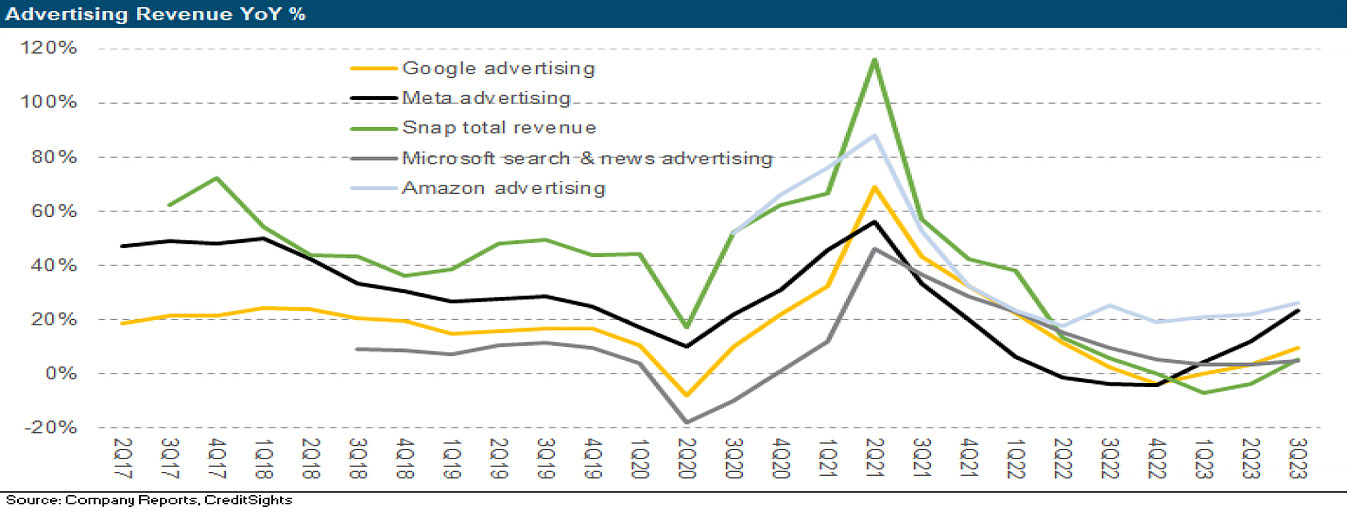

Digital Advertising Spending Rates Remain Healthy

Digital Ad spend rates for social media and search giants like Alphabet, Meta, Snap, TikTok and Amazon should accelerate into 2024, after the immediate pullback in spending following the initial COVID-19 shock. Since then, there has been a strong recovery in ad spend rates. Meta has seen the sharpest acceleration to its YoY growth rates, followed by Google and Amazon. Visibility beyond a few quarters continues to be murky, though, since digital advertising is extremely sensitive to economic cycles. There are some secular tailwinds, though, as digital advertising continues to grow as a percentage of total advertising dollars. Also, Generative AI can drive advancements in the creation and distribution of personalized digital advertisements, increasing customer ROI. With all that said, MAGNA forecasts Digital Pure-Play global ad revenue (69% share of total ad spend) to have +10.5% growth in 2023 and +9.4% growth in 2024.

Semiconductors Rebound

The chip industry over the course of the past 10 months has experienced Quarter-over-Quarter (QoQ) growth after pulling out of a valley since last February. Different sectors within the chip space — cloud/datacenter/AI, telco/enterprise infrastructure, PC/laptops, smartphones and automotive/industrial — are experiencing different recovery paces. While PCs (Intel, AMD and Micron Technology) and smartphones (Qorvo & Qualcomm) had a massive correction since the COVID work-from-home demand spike, Automotive and Industrial (TI & NXP) segments were buoyant. Since that time, PCs and Smartphones have made the biggest improvements this recent quarter, while Automotive and Industrial segments have weakened. The AI space has experienced the fastest growth, as companies like AMD, Broadcom, Intel and Marvell race to introduce chips to compete against market leader Nvidia. Recent estimates from third-party research firms call for industry growth to be comfortably in double-digit territory (Gartner +17%, IDC +20%), while the World Semiconductor Trade Statistics (WSTS) organization has a more conservative view at +13%. All in all, expect positive semiconductor sales growth momentum from the 4Q23 to carry into 2024!

Semiconductor Industry Association (SIA) Monthly Revenue

![]()

Source: Semiconductor Industry Association (SIA)

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.