Learn

A Crowded Cash Trade Misses 2023

By Chris Brown, CIMA®, CRPC™

Vice President — Investments, Synovus Securities, Inc.

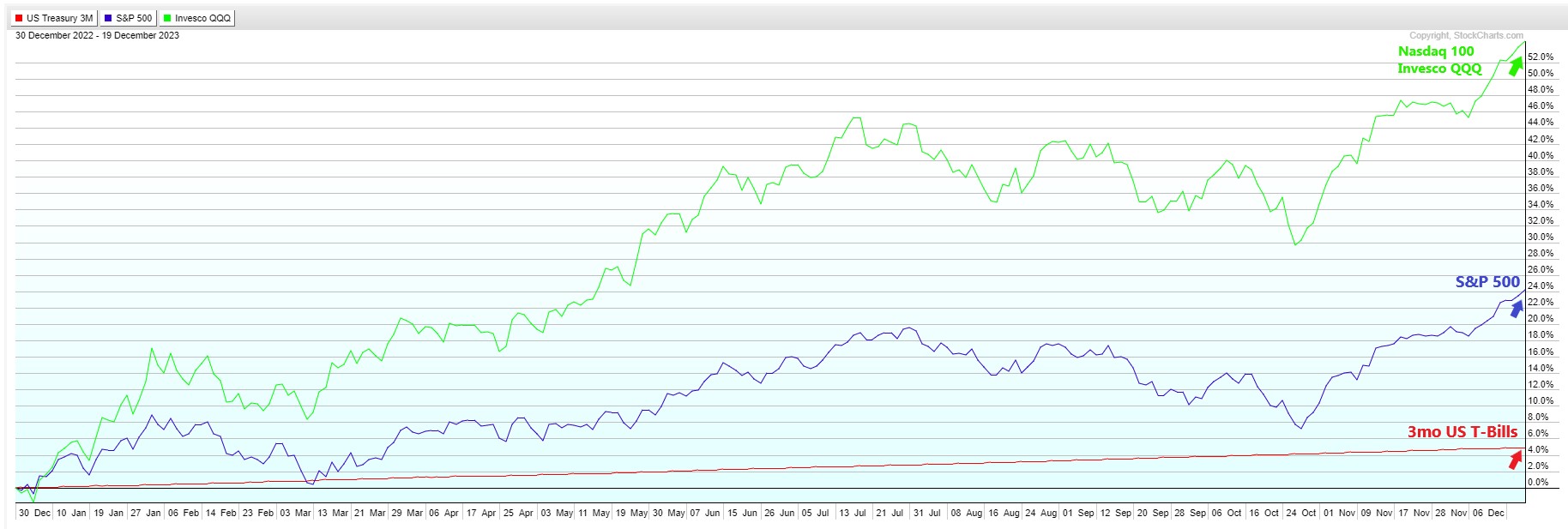

Cash savers have been rewarded throughout 2023. Interest rates jumped for money market savings accounts, certificates of deposits (CDs), and U.S. Treasury Bills (T-Bills). As indicated in my March 2023 Synovus Market Update, a regional banking storm hovering over the markets created an unlikely positive result for personal and business clients who received a crash course in the availability of higher interest rates in short-term cash alternative investments and unlimited cash coverage provided by U.S. government treasury bills. Wealthy individual savers and businesses with large cash reserves, of a million dollars or more, were able to make north of $4,000 a month in interest income. This strategy will continue to be an advantageous strategy for savers and investors with near-term liquidity needs for 2024. Conversely, the alluring interest rate environment of a “5% sure thing” has also been a detriment for nervous investors who have become wary of “recession ahead” sound bites and the wall of worry that plagued many investors in 2022 and early 2023. This pervasive bear mentality led many investors to utilize this attractive short-term investment strategy with their long-term investment capital. As a result, many investors missed out on one of the largest bull market snap backs since the March 2020 COVID-19 lows. The S&P 500 has returned 24% and the Nasdaq-100 (QQQ) has recently made a new all-time high, returning more than 55% for 2023.

As the adage goes, hindsight is always 20/20 and one of the largest takeaways from 2023 will be: even the smartest market analysts and economists are not good at predicting the future. There were zero economists or market prognosticators who predicted the wild success of OpenAI’s ChatGPT, nor would they have predicted the big tech’s complete turnaround led by the Magnificent 7 stocks, mentioned in my July 2023 Market Update article “Widening the Moat for the S&P 500.”

A tunnel-vision view of more pain to come, provided by uncertain Fed tightening policy and geopolitical volatility within a Ukraine-Russian war, put blinders on many institutional investors from all the innovation and possibilities that AI could inject into the economy. The U.S. consumer provided additional confidence that economic conditions were improving, as travel and leisure spending remained intact, and the labor markets remained resilient, creating a 200,000 average of jobs per month while unemployment remained under 4%.

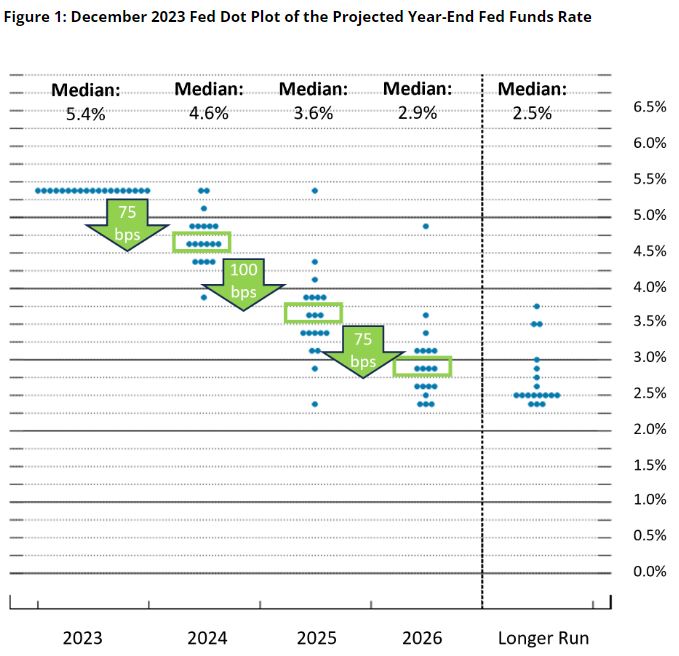

The sea change for market conditions finally came at the December 13 FOMC meeting, where Federal Reserve Chair Jerome Powell mentioned that, “It’s far too early for the Fed to declare victory, but there could be the beginning of talks for easing for 2024.”

More important, there are the Fed dot plots, which are simply black dots that each Federal Reserve regional president marks as their prediction for future rates within the next year. The “dot plots” provide an indication to the stock and bond markets on what the Federal Reserve interest rate outlook per regional Federal Reserve President. Based on the median dot plot outlook for 2024, the Fed is indicating a possible rate cut within the area of .75%. The stock market interpreted this as, “Please put your seats in the upright position and prepare for a soft landing” and it led to the Dow Jones closing above 500 points (+1.4%) and the S&P 500 above 63 pts (+1.37%) in one of the largest market closes in 2023.

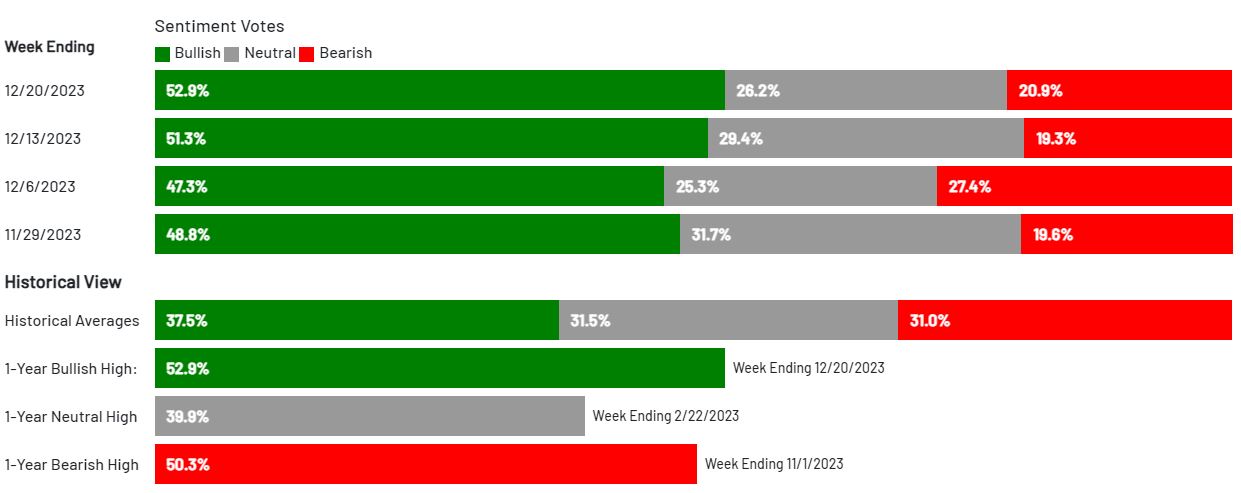

The American Association of Individual Investors, or AAII Survey, measures market sentiment for retail (non-professional) investors over the near term, usually over the next six months. The survey indicated “Optimism among individual investors for the short-term outlook is at the highest level in nearly five months. Meanwhile, pessimism fell to its lowest level in almost six years.” Bullish sentiment, expectations that stock prices will rise over the next six months, increased 8.4 percentage points to 52.9% since the end of November 2023.

Did I Miss It?

If you were one of the apprehensive investors that held way too much cash as you felt comforted by the warm blanket of 5% risk-free rates of return while the stocks returned more than 20% then, yes, you missed it for 2023. Don’t worry, it will be OK. There was a bit of exuberance in the markets as we ended 2023, in part by current investor sentiment and a recent tailwind provided by Powell’s recent comments on inflation and the potential for future easing of interest rates in 2024. After a large market run-up, it is usually followed by a price digestion period. This is the time where you may see some market give back and find opportunities to “buy the dip.” This is the point when uncertainty creeps back into the psyche since there are always bricks available to rebuild the next wall of worry. Just keep in mind, over the long term the U.S. markets are positive 83% of the time. During those calendar years, estimated every 1.1 years, the markets will experience an 8% to 10% correction. This may provide the right opportunities to buy on those down days, weeks or months. It also aligns with one of my personal favorite books on long-term investing by CIO of Ritholtz Wealth Management, Nick Maggiulli, called “Just Keep Buying.”

Time is one of the best attributes to achieve successful compounding growth. Long-term compounding growth is not linear; it’s exponential. Investment success is not found in timing the markets, but time in the markets.

Market Estimates in 2024

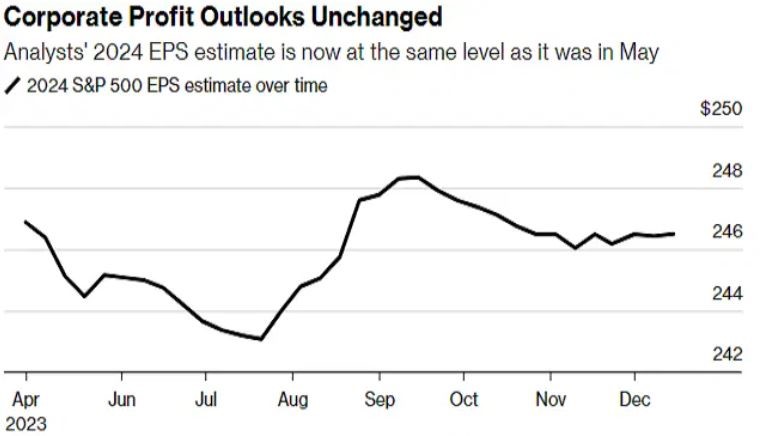

In January we will receive the Q4 2023 earnings results for U.S. corporations. According to John Butters, Sr. Earnings Analyst at FactSet, he said, “For Q4 2023, 72 S&P 500 companies have issued negative EPS guidance and 39 S&P 500 companies have issued positive EPS guidance.”

As for valuations for the S&P 500, Butters added, “The forward 12-month P/E ratio for the S&P 500 is 19.3. This P/E ratio is above the five-year average (18.8) and above the 10-year average (17.6).”

By the numbers, the market is not quite priced for perfection but, at the same time, is not a great value in historical terms. The market analyst’s consensus for U.S. corporate earnings in 2024 is between $246 and $247 in earnings per share (EPS), shown in the Bloomberg Intelligence chart below. If the U.S. economy maintains a continuation of stable labor markets, a resilient consumer coupled with lower inflation and a softer future interest rate environment, then the S&P could receive a boost, trading in the range of 20 to 21 in forward P/E. A bullish outlook estimate of $247 EPS multiplied by a 21 P/E provides a 2024 S&P 500 outlook of 5,187. This would be a 9.43% gain for the calendar year in 2024 from current S&P levels.

Market forecasting may be more art than science and the estimates listed above are not a prediction of market conditions going forward. As I mentioned at the beginning of this writing, market prognosticators and economists are terrible at predicting the future. It’s Impossible! All we can do is digest the ongoing data as it comes and create a thesis on the myriad possible outcomes. This is why it’s important to create a plan around your investment goals and objectives, understand your personal risk tolerance and your investment time horizon, so you can create an appropriate investment allocation that provides the highest conviction for you to stay invested during the good times and the bad.

Morgan Housel, author of “The Psychology of Money” said, “Financial success is not a hard science. It’s a soft skill, where how you behave is more important than what you know.”

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.