The Fed and my daughter’s Peppa Pig doll

As I write this, it’s three days before Christmas and I need to complete this article so I can go pick up my two-year-old daughter’s Peppa Pig doll set from Target. If you have young children, you do not need an introduction to Peppa, but if you don’t, she is a British piglet who helps entertain my daughter every morning as we get ready.

Believe it or not she also, in toy form, can help explain some of the challenges the Federal Reserve face in their war on inflation as they fight what is primarily a supply-side problem with a demand-side solution. How effective can they be in addressing the many factors contributing to the inflationary environment in which we find ourselves? Follow along with me and let’s try to answer that question.

A Peppa Pig doll can help explain some of the challenges the Federal Reserve face in their war on inflation as they fight what is primarily a supply-side problem with a demand-side solution

.png)

Although Peppa is British, she is manufactured in China and is most likely produced in and/or shipped from the cities of Shanghai and Shenzhen. Most of our readers will know Shanghai (population 25mm) but not necessarily Shenzhen (population 18mm), both major markets that have experienced repeated waves of shutdowns by the Chinese government. When these markets are offline in any capacity there are severe economic impacts.

Note that the populations of these two MSAs are larger than the New York, Los Angeles, and Chicago MSAs combined, and try to imagine the impact of those three U.S. markets being shut down. The shutdowns experienced in Chinese markets are not the loose southern COVID-19 quarantines we know; they involve imprisonment and government monitored home door locks. Fortunately, China has very recently loosened its policies, but the bottom line is that these shutdowns are inflationary as the inability to produce or ship Peppa Pig dolls limits supply. Can the Fed loosen Chinese national policy to address these inflationary issues? No, they cannot, only Xi Jinping can.

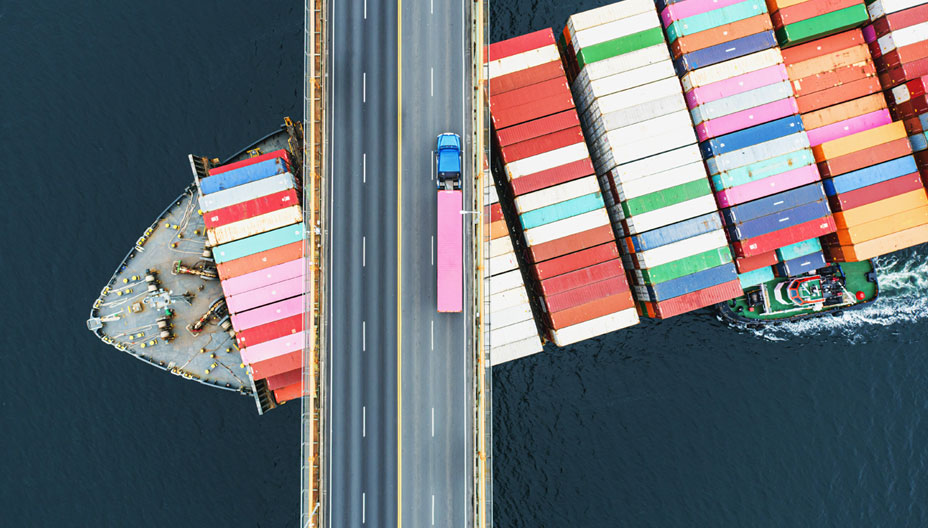

Assuming that my Peppa Pig Playground Playset can get out of China, it most likely will be shipped to a West Coast port like LA/Long Beach on a tanker powered by diesel fuel, which is produced from petroleum products. Before Russia’s invasion of Ukraine, the U.S. imported 20% of its petroleum inputs from the aggressor state, and many of these are used in the manufacture of diesel fuel. The solution to this inflationary quandary would be to withdraw Russian troops from the Ukraine and lift sanctions on Russia, which unfortunately the Fed cannot do.

The Fed also is powerless to affect labor negotiations domestically, and a constant fear of strikes and shutdowns at West Coast ports like Los Angeles and San Francisco have forced more shipments to East Coast ports in 2022. Someone has to take Peppa off of the boat and without longshoremen, she isn’t going anywhere! Provided she can get to the next stage of the supply chain, domestic delivery, Peppa runs into roadblocks presented by a shortage of trucks and truck drivers, a combination of a lack of inputs (microchips) and labor shortages (truck drivers). As with labor issues, the Federal Reserve is powerless to produce more chips or make trucking hires stickier. One alternative is to utilize rail for transport, but even that has become a national labor crisis, narrowly avoided in December by Congressional intervention.

This leads us to the point where my child’s toy arrives at Target for curbside pickup, and that is where the Federal Reserve can impact inflation-by reducing my demand for the product overall. Perhaps I was going to buy my child an equally expensive set of Legos, but I did not because the mortgage rate I am paying on the house I purchased in October is roughly twice the rate I was paying at my old house. By eroding my purchasing power via higher residential mortgage rates, the Fed has impacted demand and set in motion a chain reaction that will negatively impact anyone who gets paid to facilitate the exchange of residential real estate.

Odds are appraisers, real estate agents, and property inspectors will be tightening up their budgets in 2023 as their compensation moves downward and Christmas presents will be affected accordingly. The big question is when will the various supply chain issues the Federal Reserve cannot affect resolve themselves, releasing inflationary pressures and potentially setting up a scenario where we see an overcorrection. The timing of this and the extent to which the Fed moves will determine exactly how soft our economic landing is in 2023

Cal Evans Senior Director Investor Relations & Market Intelligence

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.