Learn

World Markets’ 2019 Performance Review

Stock markets in the U.S. and around the globe turned in a fantastic 2019, driven by U.S. equities, specifically large-cap U.S. equities. And along the way, 2019 brought plenty of records, including:

- Record Highs. As the S&P 500 climbed consistently throughout the year, it also recorded 34 new record highs and turned in the best year in more than half a decade.

- Longest Expansion on Record. Earlier this summer, our current economic expansion passed the one from the 1990s to officially become the longest on record – more than 125 months and counting.

Markets had a lot to digest in 2019 and there was one huge theme influencing the upward momentum: shifting global central banks’ policy (namely the Federal Reserve and the European Central Bank) with respect to further monetary stimulus (i.e., cuts to short-term rates). And while the ongoing trade saga between the U.S. and China was never far from front-page news, the pivot from the Federal Reserve was much more impactful.

Markets around the world performed well

Strong performance in 2019 was not confined to the U.S., however, as most global markets also turned in a positive year. Investors saw equities in developed and emerging markets rally, and the difference between growth and value widened throughout the year. Further, small caps underperformed their large-cap counterparts most of the year.

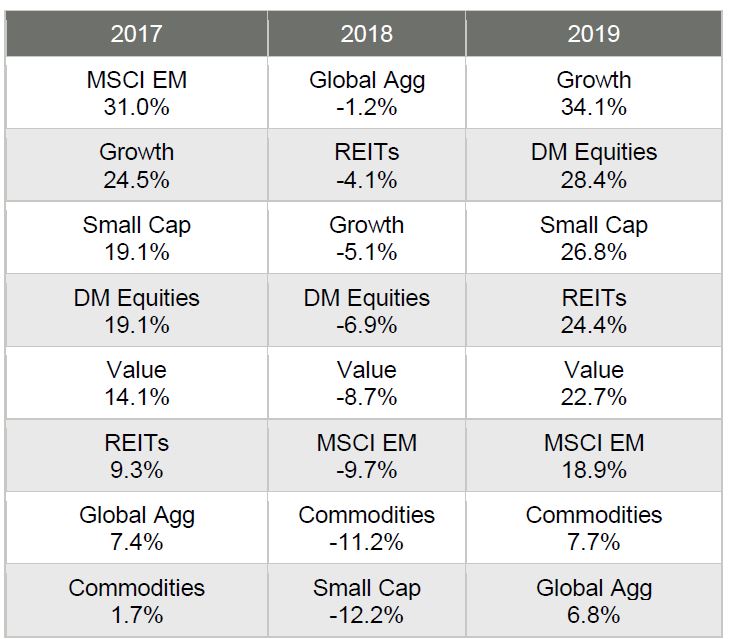

Asset class and style returns

Sure, NASDAQ and the S&P 500 turned in impressive 2019 numbers, returning 36% and 30%, respectively. But equities in developed markets around the world (represented by the MSCI World Index) are up over 28% in 2019 too.

Source: Bloomberg Barclays, FTSE, MSCI, Refinitiv Datastream, J.P. Morgan Asset Management. DM Equities: MSCI World; REITs: FTSE NAREIT Global Real Estate Investment Trusts; Cmdty: Bloomberg Commodity Index; Global Agg: Barclays Global Aggregate; Growth: MSCI World Growth; Value: MSCI World Value; Small cap: MSCI World Small Cap. All indices are total return in US dollars. Data as of December 31, 2019.

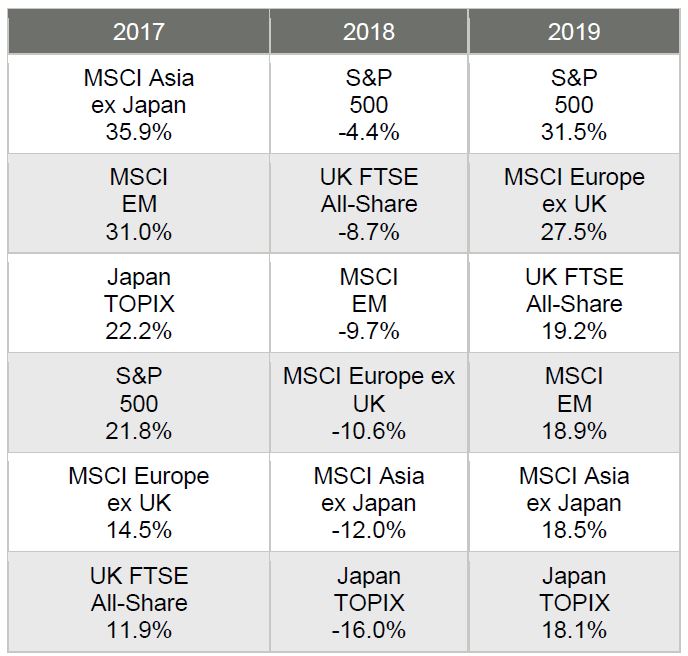

World stock market returns

Interestingly, the fourth quarter of 2019 saw emerging markets come roaring back, led by the almost 12% returns for both the MSCI EM and the MSCI Asia ex-Japan Indices. But those great returns were not enough to displace the S&P 500 from leading major global markets in 2019.

Source: FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. All indices are total return in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Data as of December 31, 2019.

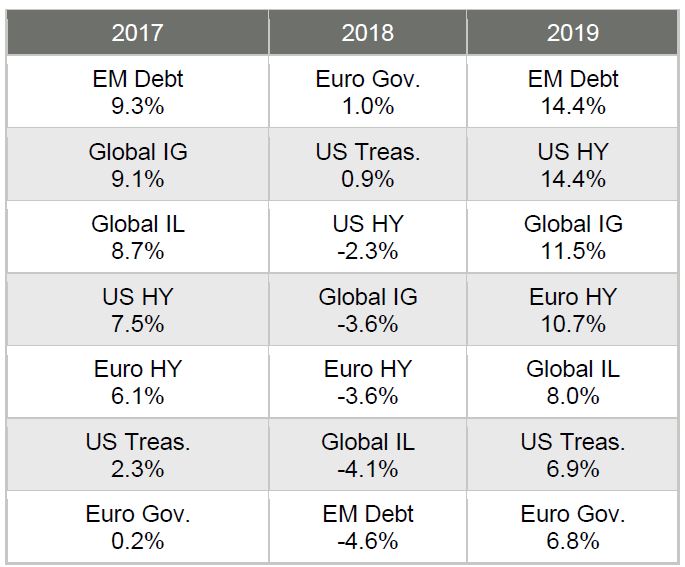

Fixed-income and sector returns

The dominant market news of the year – the pivot from the Federal Reserve and other global central banks – fueled equity markets and fixed-income markets alike.

The Federal Reserve, once the institution that rarely spoke, found itself in the news a lot this year.

- In July, the Federal Reserve cut interest rates for the first time since 2008.

- In September, the Federal Reserve cut interest rates for the second time.

- In mid-October, the Fed announced its intent to buy short-term Treasury debt at an initial pace of $60 billion a month.

- At the end of October, the Fed cut interest rates for the third time.

And as if to put an exclamation point on the global central banks’ rate cutting theme, at the end of the year, the People’s Bank of China announced it would cut the reserve requirement ratio by 50 basis points, effective January 6th. The announcement is the eighth time that the People’s Bank of China has cut rates since early 2018.

Source: Bloomberg Barclays, BofA/Merrill Lynch, J.P. Morgan Economic Research, Refinitiv Datastream, J.P. Morgan Asset Management. Global IL: Barclays Global Inflation-Linked; Euro Gov.: Barclays Euro Aggregate Government; US Treas: Barclays US Aggregate Government - Treasury; Global IG: Barclays Global Aggregate - Corporates; US HY: BofA/Merrill Lynch US HY Constrained; Euro HY: BofA/Merrill Lynch Euro Non-Financial HY Constrained; EM Debt: J.P. Morgan EMBIG. All indices are total return in local currency, except for EM and global indices, which are in US dollars. Data as of June 30, 2019.

What will 2020 bring?

Some are predicting the upward trend to continue whereas others are predicting that the markets will retreat.

But one thing we know for sure is this: Past performance is no guarantee of future results. Ever.

Important Disclosure Information

The article above was provided to Synovus by eMoney Advisor, LLC, and is used here with permission from eMoney or a third party content provider. eMoney does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. This information was provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.