Learn

Stuck Between the Sticks and Bricks: 2025 U.S. Housing Market Assessment

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

Synovus Securities, Inc.

In March of 2000, my bride-to-be and I found a cute starter home in the charming Woodstock, Georgia suburbs. It was a three-bedroom, two-and-a-half bath in a cul-de-sac for $149,000. My wife and I qualified for our first FHA loan at 8.5%. I remember having the excitement of being a homeowner tethered to a fear of taking on a large financial obligation at the age of 24.

Fast forward to 2025. That same home would sell for $420,000 in today’s housing market. This is one of many stories by other Gen-Xers and baby boomer homebuyers, who can tell tales of purchasing their house for the same price of what two burrito bowls at Chipotle might cost today. All kidding aside, home affordability has become a growing concern for young homebuyers in today’s economy. This month’s writing will examine the current state of the U.S. housing market, the imbalance of median household income compared to the current median home prices, and the buyers that can still afford to purchase a home in the current housing market.

Why Are Prices Still So High?

Though recent home availability numbers are starting to normalize, we are just coming out of a three-year trend of low housing inventory coupled with historically low mortgage rates. That allowed many homeowners to lock in their new mortgages between a 3%-4% rate and some even in the high 2% range, making mortgage loans virtually free money.

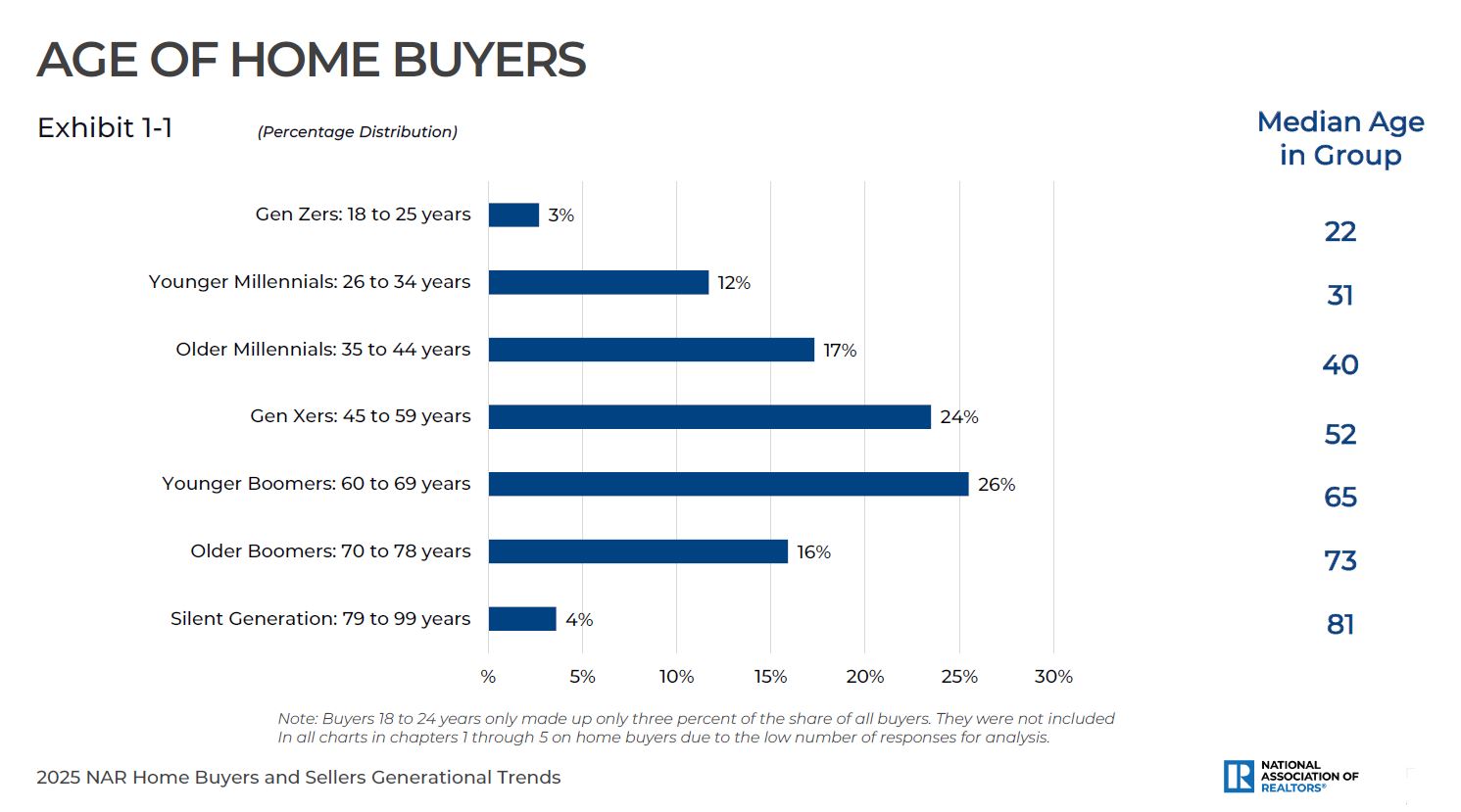

According to Ivy Zelman, housing analyst and Executive Vice President at Zelman Associates, more than 75% of homeowners are locked into a mortgage rate below 5%, with about half of those households below 4%. The American Community Survey from the U.S. Census Bureau estimates that 38.8% of U.S. homeowners own their home outright with no mortgage loan. Existing homeowners are not willing to give up their low 3% to 4% mortgage to up-size their square footage for their growing family needs. Essentially, they are stuck. As a result, this reduces overall existing home inventory across the U.S. in an already historically low inventory housing market. A high demand for housing for one of our largest U.S. demographic populations — would-be buyers, millennials (ages 25 to 43) and older Gen Z (ages 21 to 24) — find themselves also stuck in an affordability trap as home prices started to skyrocket in 2020. The state of U.S. home affordability has pushed the median age to a record high 56-years-old in 2024, up from 49 the prior year, while the first-time homebuyer’s age averaged 38, up from 35 the prior year.

NAR Chart Age of Homebuyers

Affordability

Home affordability started taking a turn for the worse starting in 2020. The median price of homes sold in Q2 2020 was $317,100, according to the U.S. Census Bureau. In Q1 2025, the median price of homes sold was $416,900 — a 31.5% increase in less than five years — while the median household income has only increased to $80,610, or 15.8% during the same period. The median mortgage payment in 2025, according to Bankrate.com and the Mortgage Bankers Association, is $2,205.00. To qualify for a $2,200 mortgage loan payment, your gross monthly income must be at least three times the monthly mortgage payment; and your total monthly debt-to-income ratio, including the mortgage payment, must not exceed 40% to 45% of your total monthly gross income.

In reality, this monthly budget affords you to qualify but essentially makes you “house poor.” If you do not have a large down payment saved — at least 20% to avoid paying monthly mortgage insurance premiums — a first-time homebuyer qualifying for an FHA loan for $400,000 would have an approximate $3,500 monthly payment (principal, interest, tax, insurance and mortgage insurance premium). The mortgage applicant would require a $130,000 total gross annual income just to qualify for the payment. That $130,000 annual gross income is 60% higher than the U.S. median household income of $80,625.

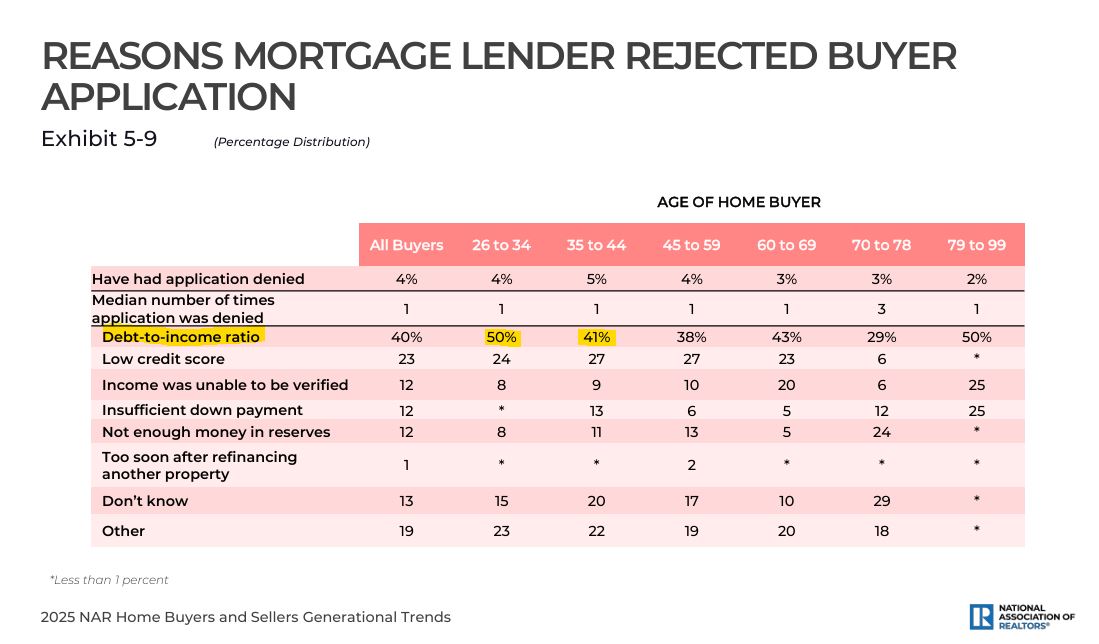

Fifty percent of declined mortgage loan applications over the past year was due to not meeting the mortgage underwriter’s debt-to-income ratio requirements.

NAR Mortgage Loan Decline

Nepo-Buyers are Growing

The “Nepo-Homebuyer” is deemed as, but not exclusive to, young homebuyers between the ages of 25 to 43 who have received or who may be planning to receive a down payment gift from parents or extended family. Over the past decade, year-over-year compounding in asset prices from stocks, bonds, 401(k) mutual funds and real estate has provided a large tailwind in accumulation for older Gen X and the baby boomer population. According to an article published by smartasset.com, approximately 75% of household wealth is held by individuals between the ages of 55 to 90. This “living” transfer of wealth by aging parents and grandparents has been labeled as the “Great Asset Migration.”

Much of this has to do with the recent rise in debt and prices, locking many younger households out of the opportunities their parents had.1 Millennials (ages 25 to 43) represent 38% of potential U.S. homebuyers. According to the 2025 Home Buyers and Sellers Generational Trends Report by NAR, of younger millennials (25-33), “33% received down payment help in the form of a gift or loan from a relative or friend”.2

Sources of Home Buyers Down Payment

A Tough Solution in Real Life

The U.S. housing market is a complicated behemoth with many federal, state and local government red tape. Land costs remain high, and restrictive municipal zoning rules coupled with excessive impact fees charged to home developers make it economically unfeasible to build smaller square footage and more affordable homes. Many zoning rules prevent home builders from constructing homes less than 1,600 square feet. Many challenges are more of a community-based grass roots level. Local government officials are more influenced by their community leaders and constituents’ voices of approval, or disapproval, than those in Washington. D.C. Many affordable home development proposals hit the local community NIMBY wall. NIMBY stands for “Not in My Backyard,” where local neighborhood advocates and community leaders vocalize their disapproval to city officials on many affordable housing projects that end up dead on arrival by the end of the zoning meeting. Going against your community leaders and constituents makes it nearly impossible to get your name on the ballot come election time. Everyone loves the thought of Americans having affordable housing, as long as they don’t build them next to my $1 million gated community.

The Easiest Solution: It's the Money, Dummy!

If the answer to home affordability is not within the realm of creating less expensive homes, then maybe it could be found in creating new legislation around mortgage financing solutions. There are currently many homeowner grant and assistance programs, but not nearly enough to move the needle for potential home buyers. New legislation creating a U.S. government-backed extended amortization mortgage term is one solution. This strategy has worked in many countries outside of the U.S., including Finland, Switzerland and Japan, which have between 60- and even 100-year amortization mortgage terms. Many mortgages have 60-year amortized payments but require the homeowner to pay off or refinance after 15 or 20 years. Over a 20-year time span, the homeowner has a reduced loan balance, accumulated home equity within their residence, and may have the opportunity to take advantage of refinancing at a lower interest rate (if given the right economic environment) or potentially sell the home to another buyer and use the money earned for a down payment on another home. Many young homeowners experience an increase in earnings potential from their careers as well as savings within a company retirement plan, making them a more financially stable and credit worthy borrower.

Plan B is just do nothing and wait for the “silver tsunami.” This term points to a 10-year period in the U.S. where many baby boomers and silent generation demographic — approximately 33 million Americans older than 70 (of which approximately 80% who own homes) — start to arrive at the sunset of their mortality. Many elderly individuals may relieve themselves with the burden of their home upkeep to take on residence within independent and assisted living housing communities. At that time, there could be a sea of inventory to choose from as Freddy Mac predicts that just more than 9.2 million homes will be available by 2035; other estimates are as high as 20 million homes available by the mid-2030s.

Save responsibly kids, your turn is coming.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.