Learn

Personal Trust Corner - A J.D.’s Perspective

Navigating the Maze of Estate and Gift Tax Exemption: A Deep Dive into SLATs

By Amy Piedmont, J.D., LLM, Trust Relationship Manager, Sr. and

Katherine “Kate” Gambill, J.D., Vice President Sr. Trust Relationship Manager

Navigating the complex universe of the unified lifetime gift and estate tax exemption can feel like journeying through a labyrinth. Our mission at Personal Trust is to provide a guiding light to our clients as they traverse these often-treacherous terrain.

A significant area of focus, at present, is the estate tax exemption for 2024, currently at $13.61 million. The powerful tool of portability amplifies this exemption, allowing married couples to share their unused exemption with one another, often equating to $27.22 million in estate tax exemption.

However, estates exceeding this threshold are subject to a hefty 40% tax on the surplus, often seen as “double” taxation as income tax was already paid on earned income during life.

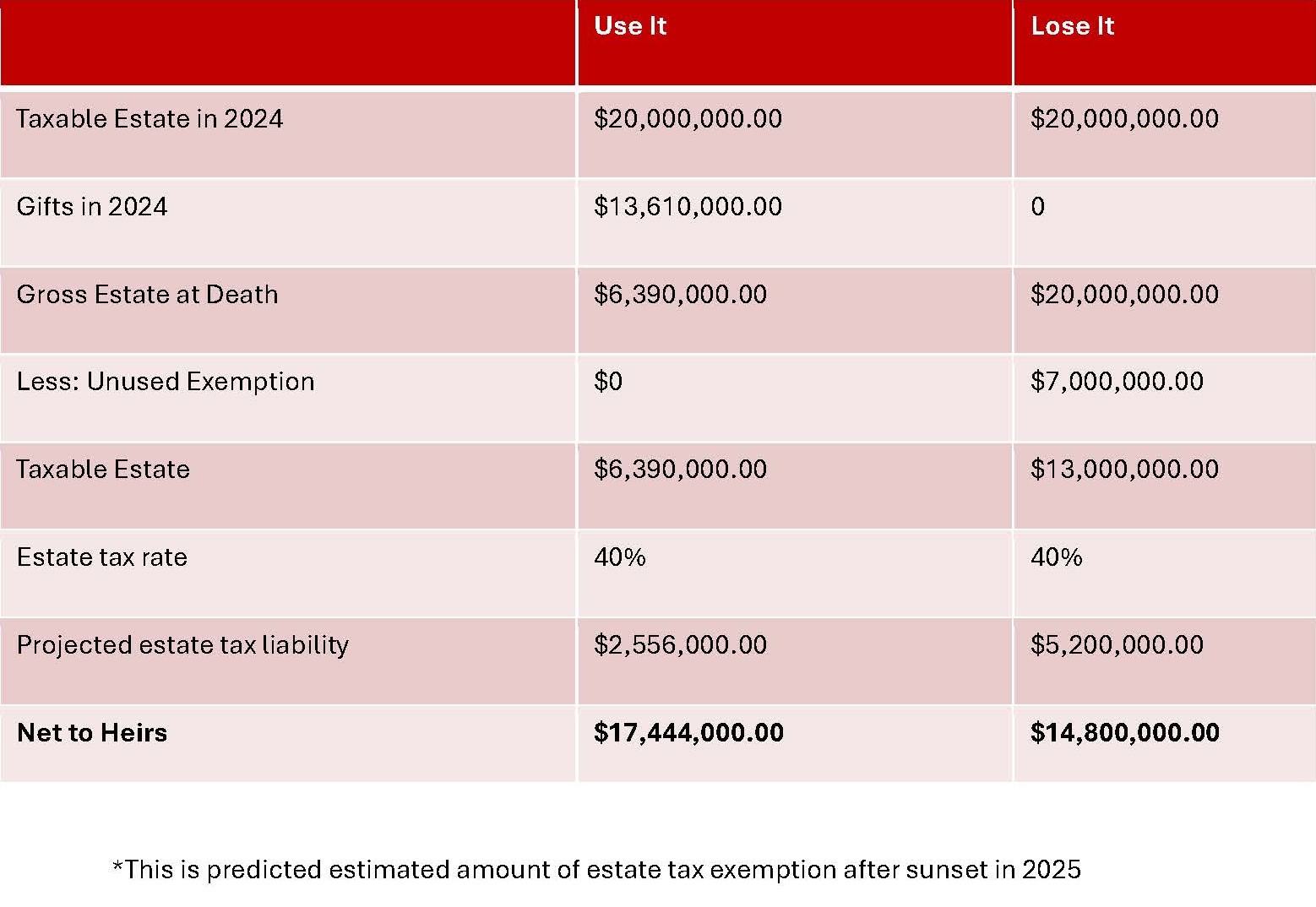

The landscape of estate tax, though, is prone to seismic shifts. Current laws are set to “sunset” at the end of December 2025. Unless Congress intervenes, the estate tax exemption will revert to a $5 million dollar exemption (indexed for inflation) in 2026, predicted to equate to approximately $7 million dollars in exemption or $14 million dollars for married couples.

In light of this impending substantial reduction of the current estate tax exemption and our current uncertain political environment, we are urging clients to plan now in order to use the current large estate tax exemption before they lose it.

In our new series, “The Personal Trust Corner: A J.D.’s Perspective,” we aim to spotlight one planning strategy each month in response to the ever-changing Estate Tax Laws. These strategies can be employed individually or in combination with other estate planning techniques.

Estate Tax Planning Highlight: The Spousal Lifetime Access Trust

This month, our focal point is the Spousal Lifetime Access Trust (SLAT), an exceptional estate planning tool for high-net-worth couples. A SLAT is particularly advantageous for couples with substantial assets who wish to mitigate their potential estate tax liability. This is especially relevant if they foresee their assets appreciating considerably over time, or if they anticipate a decrease in the estate tax exemption in the future.

A SLAT offers asset protection, making it suitable for couples in high-risk professions or those facing potential creditor claims. It also serves as an effective tool for long-term planning, ensuring the surviving spouse's access to wealth after one partner's demise. Moreover, it can be a viable option if one spouse has health issues and might require expensive care, as a SLAT could secure assets for the healthier spouse.

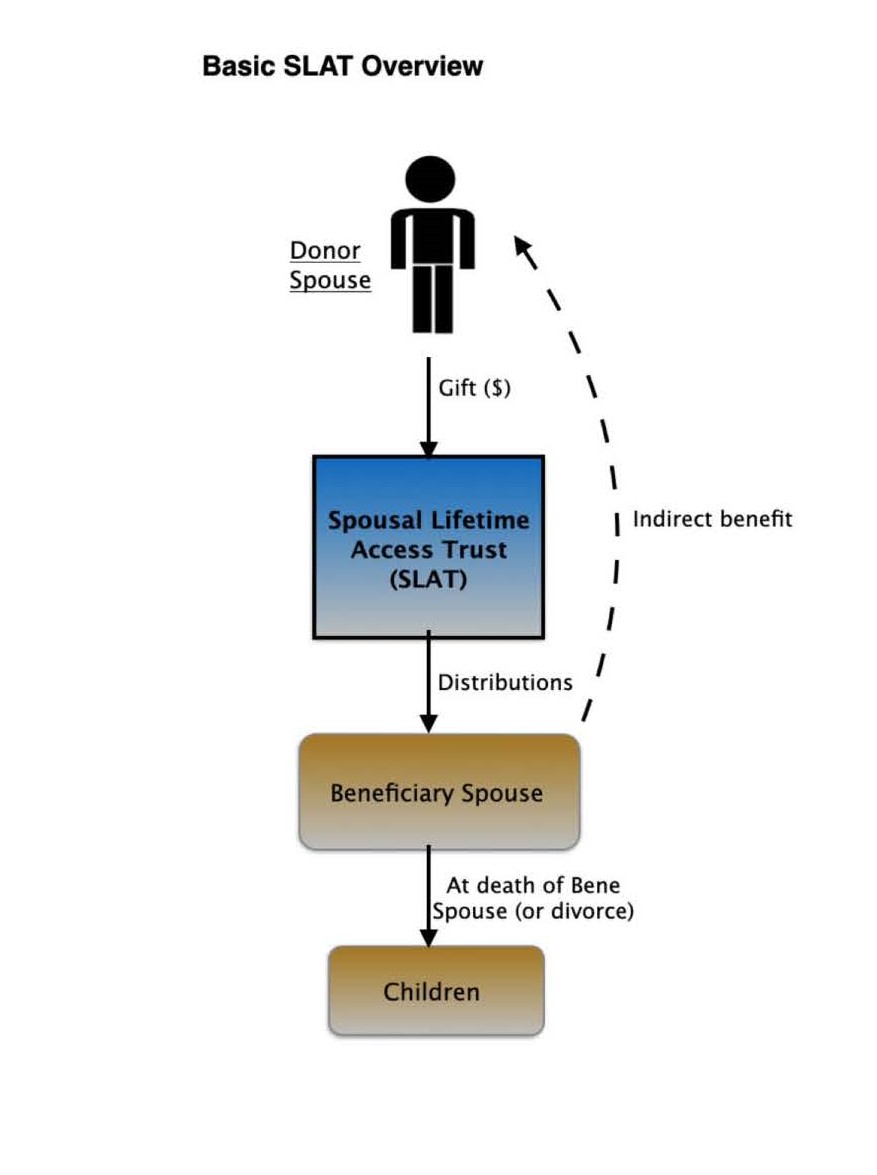

How a SLAT Works and Its Taxation

A SLAT allows the grantor to gift assets to the trust up to their current estate tax exemption during their lifetime, significantly reducing their estate’s size and potential estate tax liability upon their death. Even though the assets are removed from the grantor's estate, the beneficiary spouse can still access the assets in the trust, offering a source of income or financial support.

Further, the donor spouse can still indirectly benefit from the SLAT since his spouse is the beneficiary of the trust.

However, a SLAT requires careful consideration as it is irrevocable. Therefore, the grantor must be confident in their choice as they cannot revoke the trust later. The SLAT's effectiveness is reliant on the stability of the marriage, as the grantor may lose access to the trust's assets in case of divorce or death of the beneficiary spouse. Some states, such as Florida, allow the grantor spouse to be named as a beneficiary after the trust’s creation should the spouse beneficiary die first but the SLAT must satisfy certain standards to allow this provision. An experienced estate planning attorney may be able to mitigate some of the risks by adding a divorce clause and ensuring all required provisions are included under state law.

From a taxation perspective, the SLAT is defective for income tax purposes, and the grantor pays the trust's income taxes. Essentially, the SLAT becomes a separate legal entity but is disregarded for income tax purposes at the entity level and the grantor will pay the income taxes at their individual tax rate.

The Importance of Careful Planning

When establishing your estate plan, your attorney will address several crucial aspects to ensure optimal results. One key point to consider is the tax basis of assets inherited from a SLAT. Heirs do not receive a step-up in tax basis, which could potentially lead to an increase in capital gains taxes. However, your attorney can craft strategies to mitigate this, such as incorporating an asset swap provision to replace low-cost basis assets with assets of the same fair market value.

Another consideration is the potential invocation of the reciprocal trust doctrine by the IRS. This might occur if both the grantor and the beneficiary spouse create a SLAT for each other, potentially leading the IRS to treat the trusts as if they were never created, thereby nullifying the estate tax reduction purpose.

Moreover, the funding of the SLAT needs careful consideration. It must be sourced from the individual property of the grantor. For those in community property states, it becomes necessary to convert community property into individual property before incorporating it into a SLAT. Further, the grantor spouse may consider holding any such property in their individual name for a period to ensure it isn’t considered under the reciprocal trust doctrine by the IRS. These types of considerations further exhibit that time is of the essence with this kind of planning.

In essence, careful planning is not just beneficial but essential in estate planning. By understanding the nuances and potential pitfalls, you can make informed decisions that best serve your financial and family goals.

In conclusion, the world of estate and gift tax exemption is fraught with challenges and opportunities. Tools like the SLAT can be instrumental in effective estate planning, but they require careful consideration and strategic planning. At Personal Trust, we are committed to helping you navigate this intricate terrain, ensuring the best possible outcomes for you and your loved ones.

Please reach out to our Trust Relationship Managers: Amy Piedmont, J.D., LLM, Vice President, Trust Relationship Manager, Sr. in Pensacola, Florida and Katherine Gambill, J.D., Vice President Sr. Trust Relationship Manager in Atlanta with any questions. Or to start a conversation regarding estate planning, taking advantage of the step-up in basis that may be available at death, or charitable contributions. We welcome the opportunity to introduce you to how Synovus Trust Company can serve your needs.

Important disclosure information

The material in this article is for educational purposes only and is not intended to provide legal or tax advice regarding your situation. For legal or tax advice, please consult your attorney and/or tax professional. Synovus Trust Company offers estate planning resources and education to clients. Synovus Trust does not provide legal advice or services.

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.