Learn

Everything Xi Wants Is Everything Xi Needs: China’s New Stimulus Package

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

China has ascended over the past 40 years to be the second-largest economy in the world. Its economy has an averaged growth rate of 9% from 1980 to 2019. More than 800 million Chinese citizens had been lifted out of poverty into an emerging middle class and upper-class household.

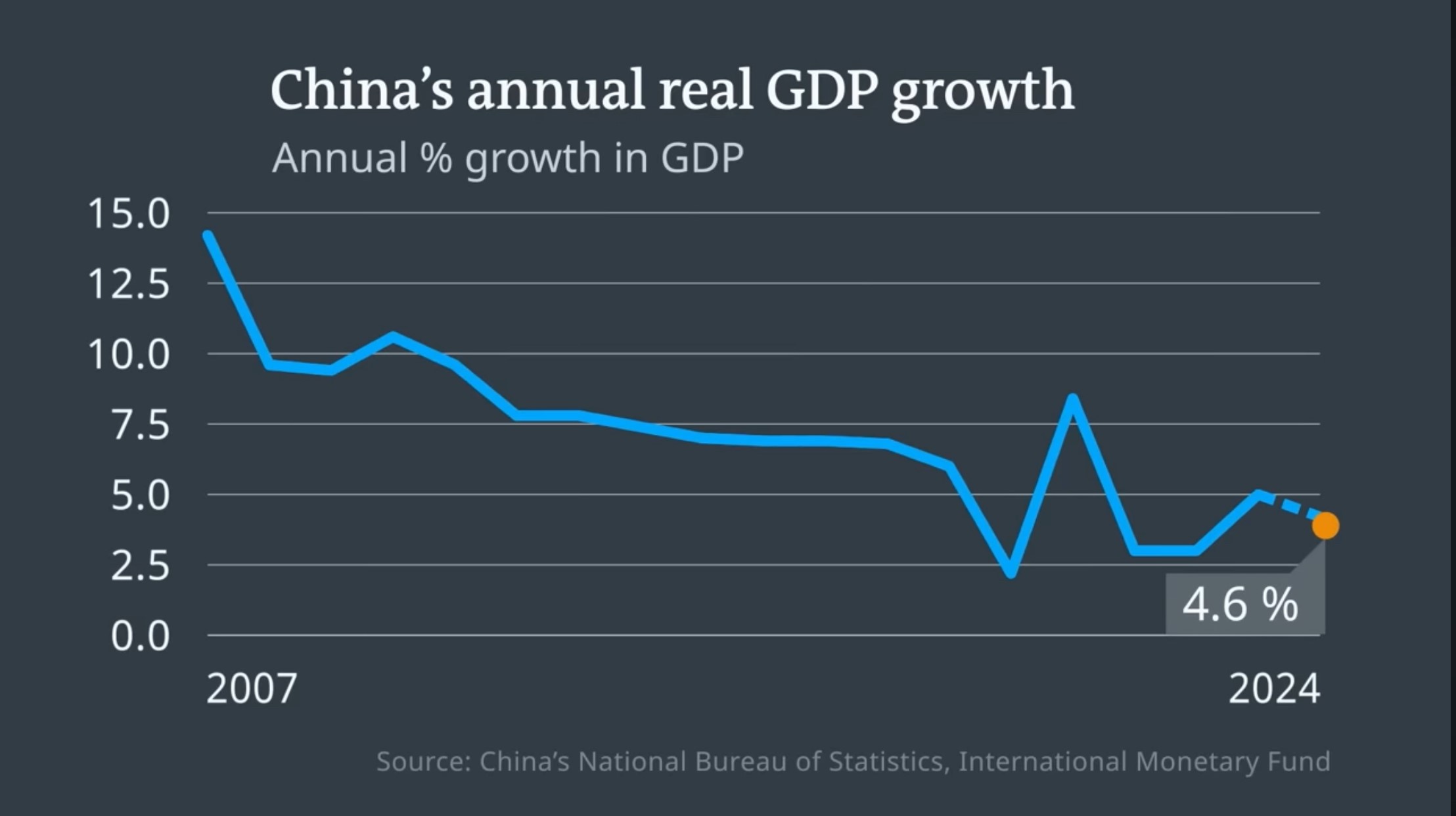

In 2024, there are 473 billionaires in China, which is more than the number of billionaires in India, Germany and the U.K. combined.1 Due to the recent downturn in China’s real estate market, the Chinese economy may have hit a tipping point when it comes to continued economic growth. The FXI (iShares China large-cap ETF) is down 45%, off of its February 2021 peak. Land sales and housing starts have reduced 70% from the peak in 2021, creating further downward pressure on the economy. China’s projected GDP growth rate has reduced from the 7.3%, down to 4.7% over the past decade.

President of the People’s Republic of China Xi Jinping has remained disciplined and steadfast on his long-term vision for China as he consolidated the powers of Chinese Communist Party (CCP) in 2016. Xi’s role as the first “one person premier,” since Mao Zedong, has altered China’s growth for the worse. The expansion of state-owned enterprises (SOEs), Xi’s zero-COVID policy and property-sector reform has reduced the expansion of capitalism and wealth creation in exchange for a more censored authoritarian system.

China GDP Falling

On September 24 the People’s Bank of China (PBOC) launched its largest economic stimulus package to help bolster its falling real estate and stock market. PBOC Governor Pan Gongsheng led a press conference that announced the Bank Reserve Requirement Ratio (RRR) will be reduced by 0.5% with another future RRR reduction of 0.25% to 0.5% “at an appropriate time,” which provides the bank with another 1 trillion Chinese Yuan (CNY) or just over $142 billion in U.S. dollar terms in future lending power. The PBOC also announced a lowering of the seven-day reverse repo rate by 0.20% to 1.50%. This allows banks to borrow funds at lower rates from the PBOC and also lend at lower rates to their retail loan borrowers. It was also announced that existing mortgages were reduced by 0.50%, “benefiting 50 million households and reduce interest expense by 150 billion CNY,” according to Pan. The PBOC also reduced the down payment ratio for first and second mortgages, by 15%.

In efforts to support the Chinese stock markets, the PBOC provided 500 billion CNY to brokerage firms, mutual funds and insurance companies to buy mainland-listed stocks through ETFs and large-cap stocks. The Central Bank created a commercial bank lending package for publicly listed companies and major shareholders for repurchasing and increasing holdings of listed company stocks at a rate of 1.75% interest. Other measures mentioned included encouraging mergers and acquisitions, promoting long-term capital in the markets, supporting private equity, optimizing the policy of renewing loans for small and medium enterprises and encouraging venture capital.

Hot Takes on the Stimulus Package

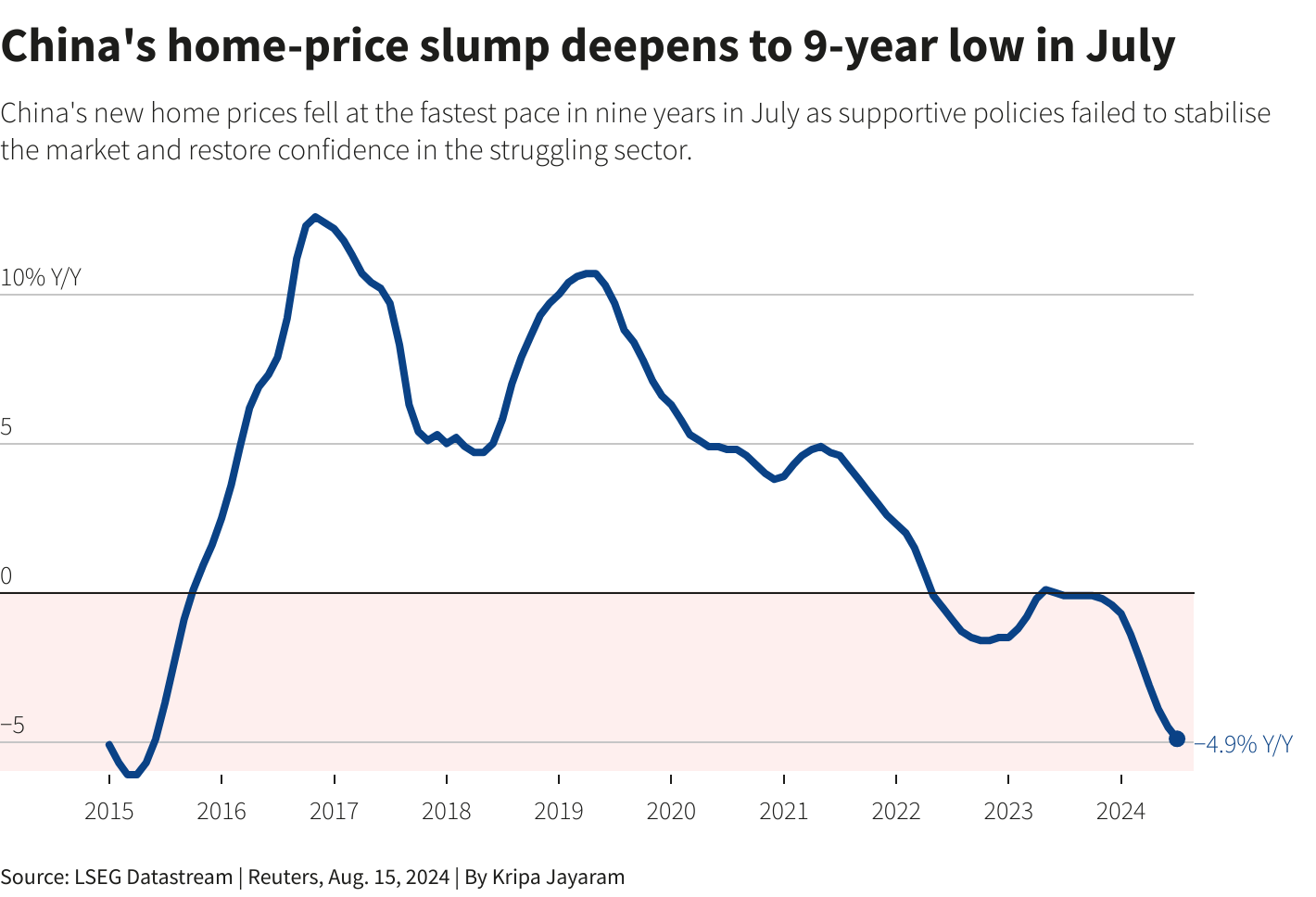

Why fire the Bazooka now? According to a recent Reuters report, China’s new home prices fell at the fastest pace in more than nine years in August 2024 as previous supportive measures failed to spur a meaningful recovery.

China Home Prices in Decline

Furthermore, China’s current real estate debt bubble has amassed to 60 trillion CNY or $8.5 trillion USD. The real estate debt in China is approximately 50% of its annual GDP for 2024. The property crisis has crippled consumer confidence since 70% of Chinese household wealth is parked in real estate, unlike U.S. households where approximately 28% of that wealth is attributed to real estate equity. This reduced consumer confidence has also been coupled with a 5.3% unemployment rate for this year.

"Households [that] are uncertain over their income prospects in a weak job market may not be willing to take on higher leverage," said Gavekal Dragonomics analysts (China and Asian based economic analyst) in a note on the latest measures.2

Winning back consumer confidence will be a hefty price tag on the PBOC since the real estate stimulus package will take time to work its way through the system. Decoupling the majority of household wealth within real estate and turning them into equity investors is a far stretch to solve their economic woes.

The Chinese economy is not without a few bright spots. Its trade surplus is one of the positive attributes in the current economic landscape measuring at $91.02 billion Year-over-Year as of August. Technological innovation has been another bright spot for China as the semiconductor and artificial intelligence (AI) race as taken off over the past 18 month. According to Nancy Qian, Professor of Economics at the Kellogg School of Management at Northwestern University, “If AI takes off, that will be great for the few highly skilled people who are working in AI but, it’s not going to help the hundreds of millions who need middle class jobs.”3

Additional economic headwinds include:

- Net Foreign Direct Investment (at 20-year lows) due to deglobalization and economic tensions.

- Massive population declines. China is facing a huge decline in birth rate, down more than 50% over the past eight years. The death rate has now overtaken birth rate, which may be soon irreversible.

- Geopolitical tensions, which may result 25% tariffs on Chinese goods to the U.S. depending on the outcome of the U.S. presidential election.

This new stimulus plan would need to not only buy the confidence of the Chinese consumer but would also need to be enough to buy the confidence in global investors. Xi and the PBOC are facing a Mario Draghi type of European Central Bank (ECB) 2012 crossroads. If Pan and the PBOC can provide the Draghi “whatever it takes” address for their fiscal and monetary stimulus plan then we may be at an economic turning point for the Chinese economy. The worst thing the PBOC can do at this point is slow play its hand since the alternative would be a painful debt deleveraging process. Taking a page out of Draghi’s “whatever it takes” stimulus measures from 2012 or the three arrows stimulus approach of Japan’s “Abe-nomics” from Bank of Japan’s Finance Ministry leader Shinzo Abe could be the financial template of success that the PBOC would need to push its economy into a new era of economic prosperity.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- World Population Review, https://worldpopulationreview.com/country-rankings/billionaires-by-country. Accessed October 1, 2024. Back

- Ryan Woo and Liangping Gao, “China's central bank unveils most aggressive stimulus since pandemic,” https://www.reuters.com/world/china/china-unveils-broad-stimulus-measures-revive-economy-2024-09-24/, published September 24, 2024. Accessed October 1, 2024. Back

- Aaron Watson, “Why China’s Economy Is About to Collapse,” https://www.youtube.com/watch?v=2rjPrIw5pFU&t=1s. Accessed October 1, 2024. Back