Learn

Fed and Interest Rates (Higher for Longer)

By Eric Krueger, Synovus Trust Senior Portfolio Manager

This month we delve into a recent Federal Reserve decision and its implications on market interest rates. The Fed has been at the center of attention in recent months as it grapples with the challenge of managing inflation while supporting economic growth. In its most recent decision, the Fed opted to keep rates level. This move was anticipated by the market, as inflationary pressures have been decreasing more slowly than hoped even after more than 500 basis points of increases (100 basis points equals 1.00%).

Fed Update

The Fed has raised rates over the past 18 months to 5.25-5.50% to curb inflation and prevent it from spiraling out of control. While higher interest rates can lead to increased borrowing costs and potentially slow economic growth, they are seen as necessary tool to keep inflation in check. The decision aligns with the Fed’s dual mandate of price stability and maximum sustainable employment.

While the markets anticipated this decision, the message from the committee’s economic forecasts was more hawkish than expected. The Fed statement was largely unchanged (economic expansion went from “moderate” to “solid”). The Summary of Economic Projections (SEP) revealed that despite inflation slowing the committee kept one more rate hike penciled in for 2023. They also lowered next year’s rate decreases from 100 basis points (bps) to 50 bps. They also raised gross domestic product (GDP) estimates for 2023 from 1.0% to 2.1% and increased GDP estimates for 2024, as well. The market seems to finally believe the Fed’s message of “higher for longer.”

Source: https://fred.stlouisfed.org/series/DFEDTARU

Fed Rate Impact on Market Interest Rates

The Federal Reserve’s action has a ripple effect on various segments of the financial markets, including interest rates. Here are how the Fed-controlled rates may impact market rates:

Treasury Yields: Typically, when the Fed raises its benchmark interest rate, it exerts upward pressure on yields for U.S. Treasury bonds. Investors demand higher yields to compensate for the increased cost of borrowing. They certainly increased after the Federal Open Market Committee (FOMC) announcement as two-year yields were up 10 bps and 10 year increased 5 bps. Given the Fed’s still hawkish leanings, we may see a gradual rise in long-term yields.

Source: https://fred.stlouisfed.org/series/DGS10

Corporate Bonds: Higher interest rates can lead to higher borrowing costs for corporations. This may affect the pricing and yields of corporate bonds, especially those with lower credit ratings. It is essential to assess the credit quality of corporates bonds in your portfolio and any potential impact on their performance.

Source: https://fred.stlouisfed.org/series/DBAA

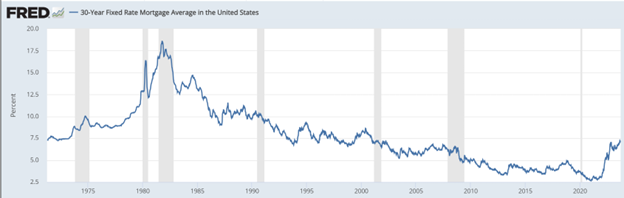

Mortgage Rates: Mortgage rates are closely tied to long-term Treasury yields. As those yields rise, we may see mortgage rates increase. This could impact the housing market and potentially slow down refinancing activity; indeed, housing affordability is near multi-decade lows given high mortgage rates and high home prices.

Source: https://fred.stlouisfed.org/series/MORTGAGE30US

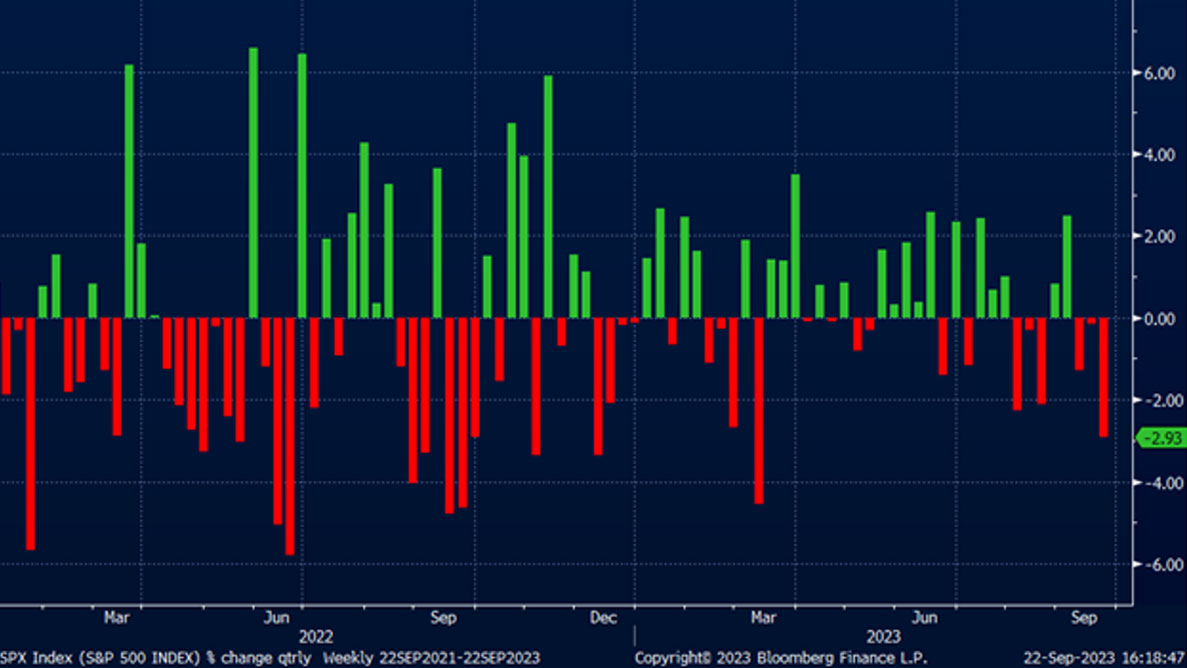

Equity Market: Higher interest rates can lead investors to reassess the attractiveness of equities compared to fixed-income investments. While rising rates can create headwinds for stocks, other factors like corporate earnings and economic growth still play a significant role in equity performance. Higher rates may be influencing equity sentiment as SPX weekly returns had their worst week since March 10, 2023.

Source: Bloomberg, Weekly Returns

In conclusion, the Federal Reserve’s recent rates decision underscores its commitment to taming inflation. While higher interest rates may present challenges, they are a vital tool in maintaining a stable economic environment. Given the speed at which the Fed has raised rates 500 bps, and its commitment to “higher for longer,” we may continue to see volatility for several more months. The good news is that the Fed is nearing its “terminal” rate as per their own projections of rate cuts next year. Historically, that is extremely good news for bond holders. Given the higher coupons we are seeing this year, high quality bonds are attractive at these levels. If you have any questions or would like to discuss how these developments may impact your portfolio, please do not hesitate to reach out.

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.