Goodbye to 2022 and hello to 2023

The new year is upon us, as we wave goodbye to 2022 and the intense volatility that shook many investment portfolios throughout the year; let’s recap in the markets in 2022 and discuss the economic conditions for the beginning of 2023.

Looking back at the 2022 market

The S&P 500 set an all-time high on Jan. 3 closing at 4,796. The Federal Reserve started indicating their plans for quantitative tightening (QT). The geopolitical landscape started heating up, which escalated into a Russian invasion of Ukraine in February as well as tensions in Asia with China and Taiwan. The Dow and the S&P had their worst start to the year since 2008. Growth stock like Amazon, Netflix, and Google were down -20% at the end of Q1 2022 and down over -30% by the end of Q2 2022, while boring, dividend paying, value stocks were down only half as much as growth stocks for the first half of the year.

Oil went up over $100 a barrel, the highest price for oil since 2014. Conservative bond investors experienced stock-like volatility with -10%+ declines in their portfolio due to a rapid rise in interest rates. The 10-year Treasury rate went from 1.50% in January to 4.20% in October 2022, a 186%+ increase. This increase in rates has now spilled over to the housing market where 30yr mortgage rates have doubled since late 2021 and home affordability has been cut drastically. The Crypto markets … don’t even get me started.

Lastly, the U.S. political landscape faced uncertainty with mid-term elections, which resulted in a flutter of the expected red wave in Congress. The culmination of all these factors created the perfect storm for a 2022 bear market scenario. Honestly, it’s amazing that the S&P 500 is not down over 30% YTD given all the negative market sentiment this past year.

Chart 1

2022 presented a great deal of economic uncertainty and systemic shocks not felt since the great financial crisis (GFC) of 2008.

What’s next for 2023?

The current market landscape for 2023 still has its uncertainties but, most of the pain in the market is in the rearview mirror. Let’s review the important aspects for economic conditions and how this data may play out for first few months of 2023.

Inflation

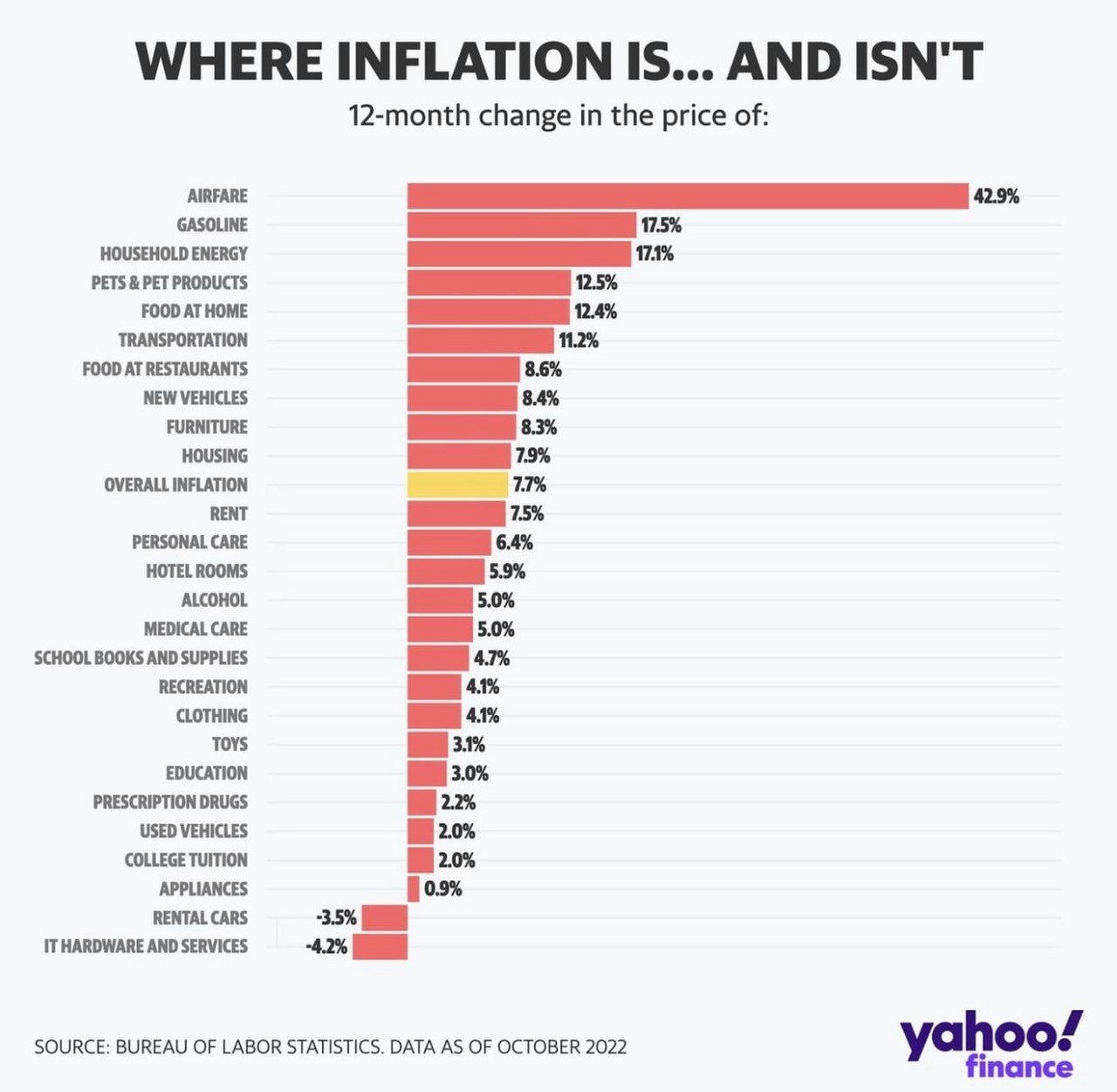

Inflation is easing as supply chains have improved. Though, we have seen a decline in the inflation rate for goods, inflation remains sticky, especially in the services. Yahoo Finance published information last month from the Bureau of Labor Statistics showing where inflation is and isn’t. The year over year (YOY) changes have shown that airfare leads the way with the highest YOY increase followed by gas at the pumps, energy, and pet products.

Chart 2

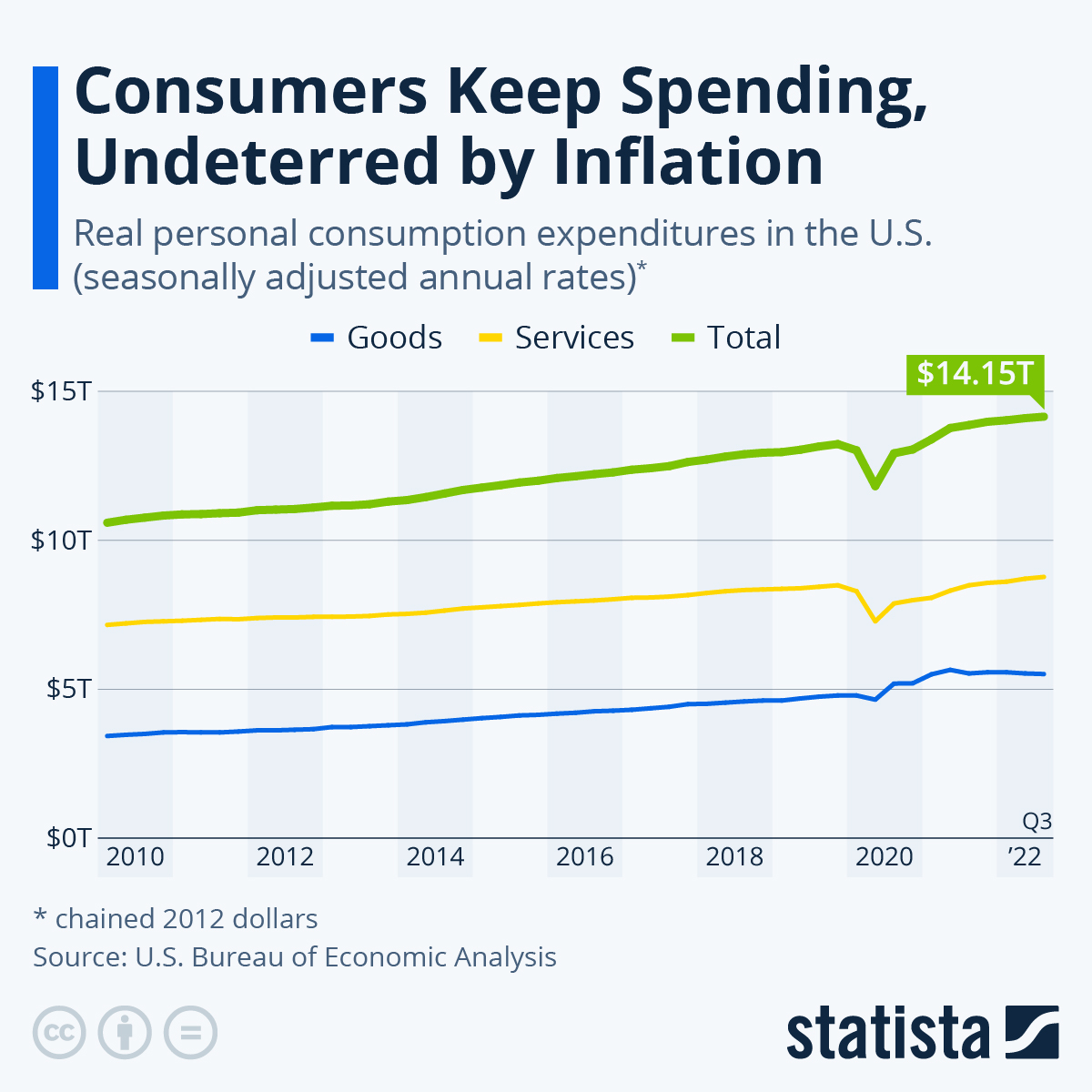

According to information provided by the World Economic Forum, consumer spending remains resilient in the face of surging inflation. Though, spending on goods such as food, beverages, and automobiles decreased, spending on services such as restaurant, travel and leisure, and healthcare increased 2.8% in Q3 2022.1 As long as the relatively tight labor market persists, U.S. consumers will continue their undeterred spending for 2023.

Chart 3

The consumer

As noted, the U.S. consumer has been extremely resilient throughout 2022 while facing of record inflation. Household savings rates has reduced dramatically over this year and the rate of credit card usage has increased. After taking a closer look at this data there is something very important being overlooked. Though, the rate at which the U.S. consumer is saving is going down, the actual amount of excess savings since February 2020 is still just under $1 trillion.

Thanks to stimulus checks and a hot labor market, the amount that U.S. households have in cash equivalent assets are still above pre-pandemic levels. As of Dec. 22, the Bureau of Economic Analysis showed that personal disposable income increased $242.4b or 5.4% in Q3 2022, an upward revision of $6.6b from the previous estimate.2 This presents the argument that consumers still have a war chest of cash to carry them through potential recessionary conditions in the new year.

The canary in the coal mine

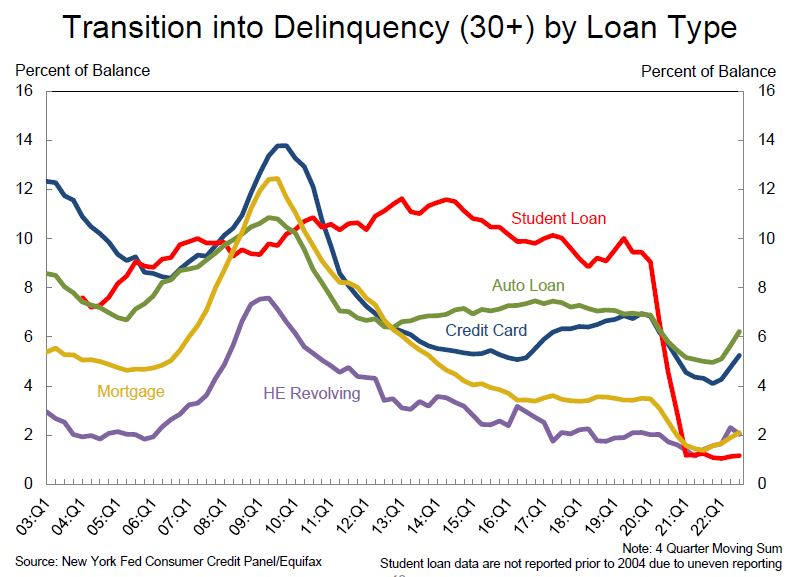

An important area that we are watching that may tip the scales of a soft landing to a full-blown recession will be consumer credit delinquencies. U.S. consumption comprises of just over 2/3 of the U.S. gross domestic product (GDP.) If GDP weakens, we may spot cracks in the foundation of consumer strength through credit delinquencies. The NY Fed publishes a quarterly report on household debt and credit. One interesting chart is the 30+ day delinquencies by loan type. This reading still shows that consumer delinquencies are well below the 20-year average. If we see consumer delinquencies climb beyond the 2005-2007 levels then, this may indicate that consumers may not have the necessary cash on hand to maintain their lifestyle nor the ability to pay their debt obligations.

Chart 5

We remain cautiously optimistic for 2023 and know there are still many headwinds for the markets in the upcoming months. We are not making a claim that the bottom of the bear market is in but, given the heavy lifting of the Fed’s QT policy being in the rearview mirror, inflation starting to ease, and a strong U.S. consumer still remains, we look to Q4 2022 corporate earnings to provide further direction for near term market performance in the first part of 2023.

Written by Chris Brown, CIMA®, CRPC™ Financial Advisor, Synovus Securities, Inc.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.