A better start for 2023, but what lies ahead?

For the week ending Jan. 27, the S&P 500 was up 6.02% YTD compared to this time last year, the S&P 500 was down -9.75% as of Jan. 2, 2022. Eight of the 11 S&P sectors are positive for the year with the highest returns coming from the Communication Services sector up 15.2%, Consumer Discretionary up 14.50% YTD, and Technology up 9.85% YTD. Keep in mind these three sectors were some of the worst performing sectors in the S&P 500, racking up losses in the range of -25% to -35% in 2022.1

https://stockcharts.com/freecharts/perf.php?XLY,XLC,XLK,XLI,XLB,XLE,XLP,XLV,XLU,XLF,XLRE

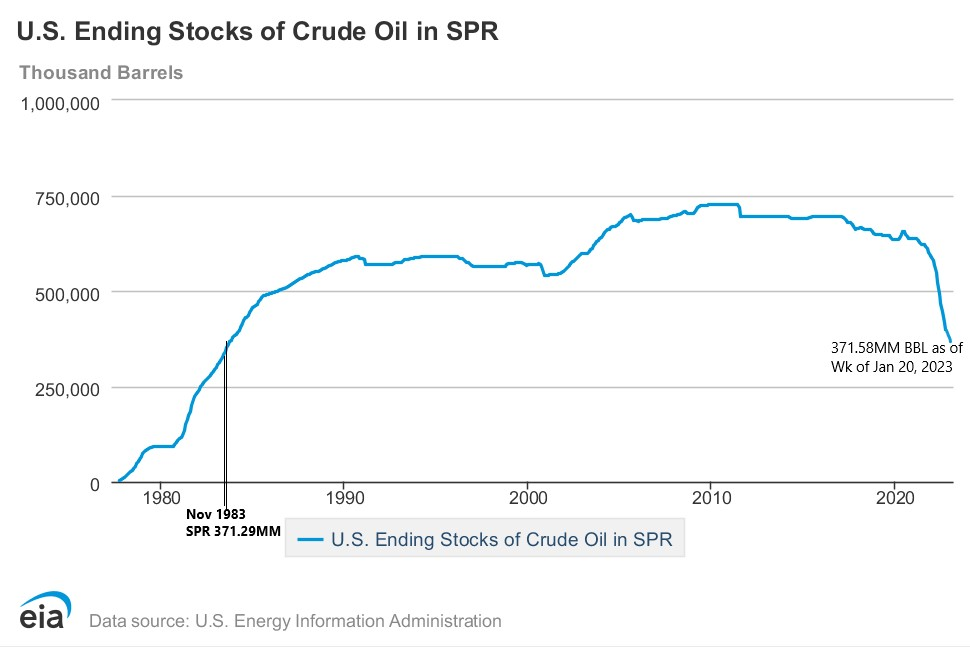

One sector showing modest but, continued strength is energy. After a banner year of a whopping 64% return for 2022, energy continues to grind higher in January, up 4.25% YTD. This continued growth has been fueled by the reopening of China’s 2022 COVID lockdowns and the lack of current inventory of the Strategic Petroleum Reserves (SPR) now at 371MM barrels. This is the lowest level of the U.S. SPR since November 1983. This will be an area to watch as energy prices may creep higher in the upcoming months now that the second largest economy in the world, China, is back open and starting to ramp up their normal petroleum use thus, creating more global energy supply constraints.

Kickoff to earnings

The markets are in the midst of a moderate start to the Q4 2022 corporate earnings season. As of Jan. 27, 29% of the S&P 500 companies have reported results. Of the companies who have already reported their Q4 earnings, 69% of the S&P 500 companies have reported a positive Earnings Per Share (EPS) surprise and 60% of the S&P 500 companies have reported a positive revenue surprise. As an aggregate of reported earnings and projected estimates for the remaining companies report throughout the next 8 weeks, earnings are on track to decline -5% year over year, the worst quarterly earnings season since third quarter 2020. Keep in mind that 2020 and 2021 the U.S. economy faced abnormal growth and demand on goods and services pulled forward from supply chain disruptions and an overabundance of government stimulus dollars that flooded the accounts of U.S. consumers.

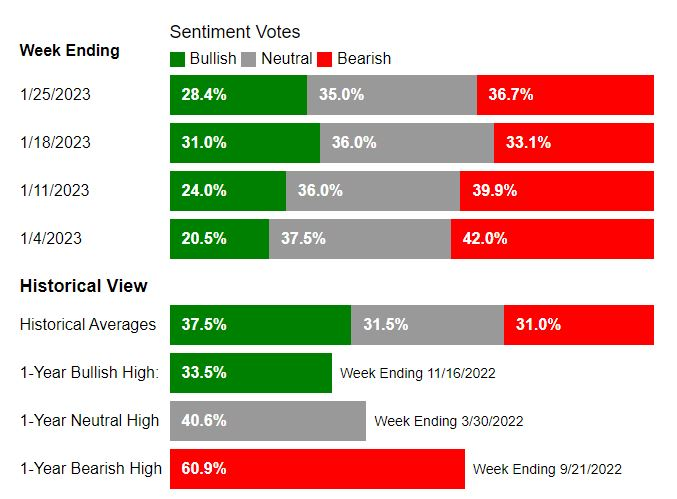

This “too far, too fast” scenario led to a 2022 bear market selloff of many S&P sectors. The 2022 stock and bond selloff, that eased in late 2022, created our current rally in the first few weeks of this year where the markets are now rewarding positive and negative Q4 earnings more than average due to some oversold market conditions. Last year, the AAII Bull/Bear sentiment was overwhelmingly negative and reached levels not seen since 2008. The AAII Bull/Bear Sentiment survey provides an assessment of "investors vibes" week over week measuring bullish, neutral, or bearish outlooks of market conditions over the next 6 months. The AAII bear survey peaked in September 2022 with a reading of 60.9% and now remains in a more neutral zone, at 36.7%. An elevated bearish sentiment, but now more normalized with historical averages.

https://www.aaii.com/sentimentsurvey

The Fed is on deck

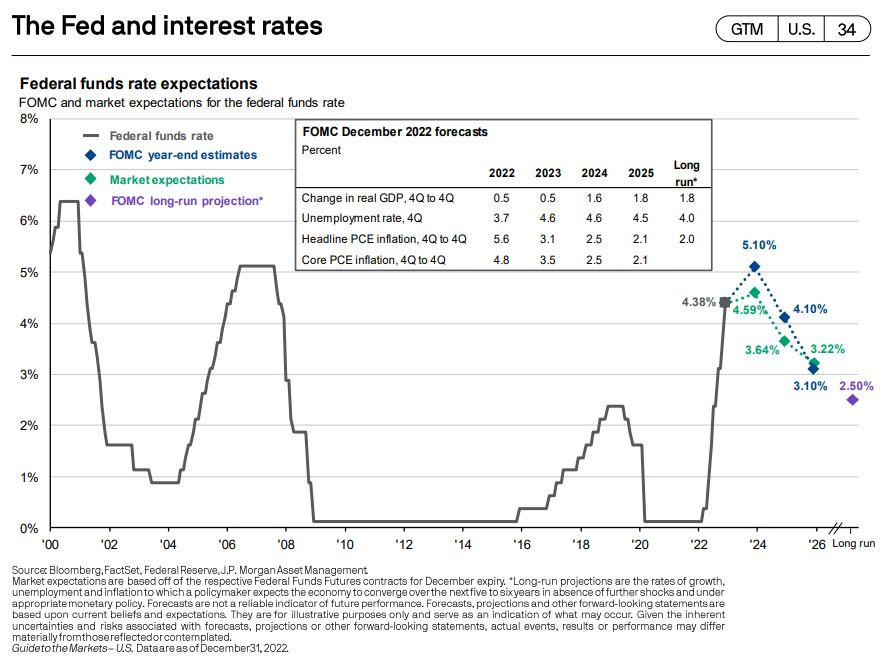

The Federal Reserve’s Open Market Committee (FOMC) met Jan. 30 through Feb. 1 to discuss their plans for the next Fed rate hike, which was announced Wednesday, Feb. 1. The market has priced in their estimates of a .25% rate hike. Jerome Powell and company will provide their outlook for future rate hikes for this year as well as the direction for how long they will hold interest rates at current levels before entertaining the idea for a future rate cut. The Federal Reserve will keep close tabs on their collection of economic data to determine their actions going forward.

As for the U.S. Economy, GDP increased 2.1% in 2022 YOY. According to the Bureau of Economic Analysis, the increase in real GDP in 2022 primarily reflected increases in consumer spending, exports, private inventory investment, and nonresidential fixed investment that were partly offset by decreases in residential fixed investment and federal government spending. Translation, the U.S. consumer is still strong due to a tight labor market and even though the rate of which households are saving money is dropping, excess savings reserves for US households are still $800b higher than pre-pandemic levels. I wanted to tie in the December 2022 GDP data with the future direction of the Federal Reserves quantitative tightening (QT) regimen because it provides a glimpse at what current drivers exist in the economy that can keep inflation at elevated levels.

Consumers have switched much of their discretionary spending in 2022 from goods to services such as travel and leisure, food services, and health care. At this time, the market is pricing in the .25% rate hike in February and a .25% rate hike in mid-March 2023. The FOMC does not meet in April so, the Fed will have time to digest their future QT plans and incoming US economic data during the late spring months. The JPMorgan Q1 2023 Guide to the Markets provides the Fed Funds Rate expectations for this year, going into 2024, and beyond based on the most recent Fed forecasting.

As we continue into 2023, there are a few things to consider. Even though there are many market conditions that are carrying over from 2022, most of the market turmoil for stocks and bonds are in the rearview mirror. Based on the forecast above, we can see a possible light at the end of the QT tunnel. The U.S. dollar wreckage has now subsided providing some relief to stocks. It’s not a coincidence that the U.S. dollar peaked on Sept. 28, 2022, the same week the AAII Bearish Sentiment high hit 60.9% (chart 1).

Again, I am not claiming that we are in the clear from further turbulent market conditions this year, but based on the weight of the evidence, we are in a slowdown compared to the past 2 year economic anomalies. Providing that context, there is a normalization curve that the U.S. economy needs to ease back into, AKA the Soft Landing. There are many challenges ahead for the markets in 2023 such as reducing inflation, the U.S. debt ceiling, and millions of businesses adjusting their balance sheets in a new interest rate environment.

If the U.S. Economy goes into a full-fledged recession, it will be the most telegraphed recession in U.S. economic history. As I have stated in our previous market updates, the U.S. consumer continues to be resilient and has a war chest of cash to weather continued economic turbulence ahead. With tight labor markets and over 9 mm unfilled jobs in the U.S., it would be difficult to reach the dire economic conditions that investors feared in 2022.

Chris Brown, Vice President Investments Synovus Securities, Inc.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.