Credit crunch time

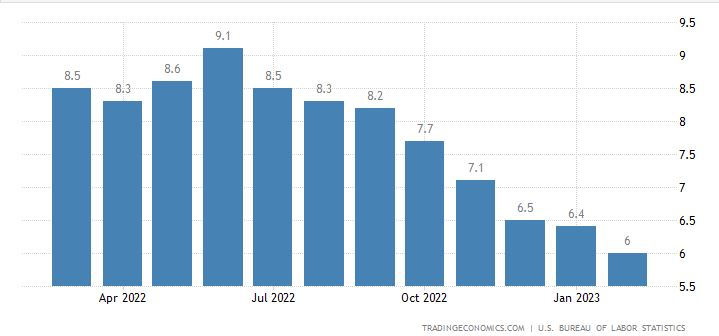

We are just past the one-year mark since the Federal Reserve started its quantitative tightening (QT) on March 16, 2022. The Fed has just completed their 9th consecutive Fed Funds Rate hike, adding another .25% on March 22, 2023. Throughout the past year, the Federal Reserve has moved the Fed rate up 500 basis points with the hopes of reducing inflation back to its target of 2%. The U.S. inflation rate has declined from its peak at 9.1% in June 2022 to 6% reported March 14, 2023. See Chart 1.

Chart 1

Source: https://tradingeconomics.com/united-states/inflation-cpi

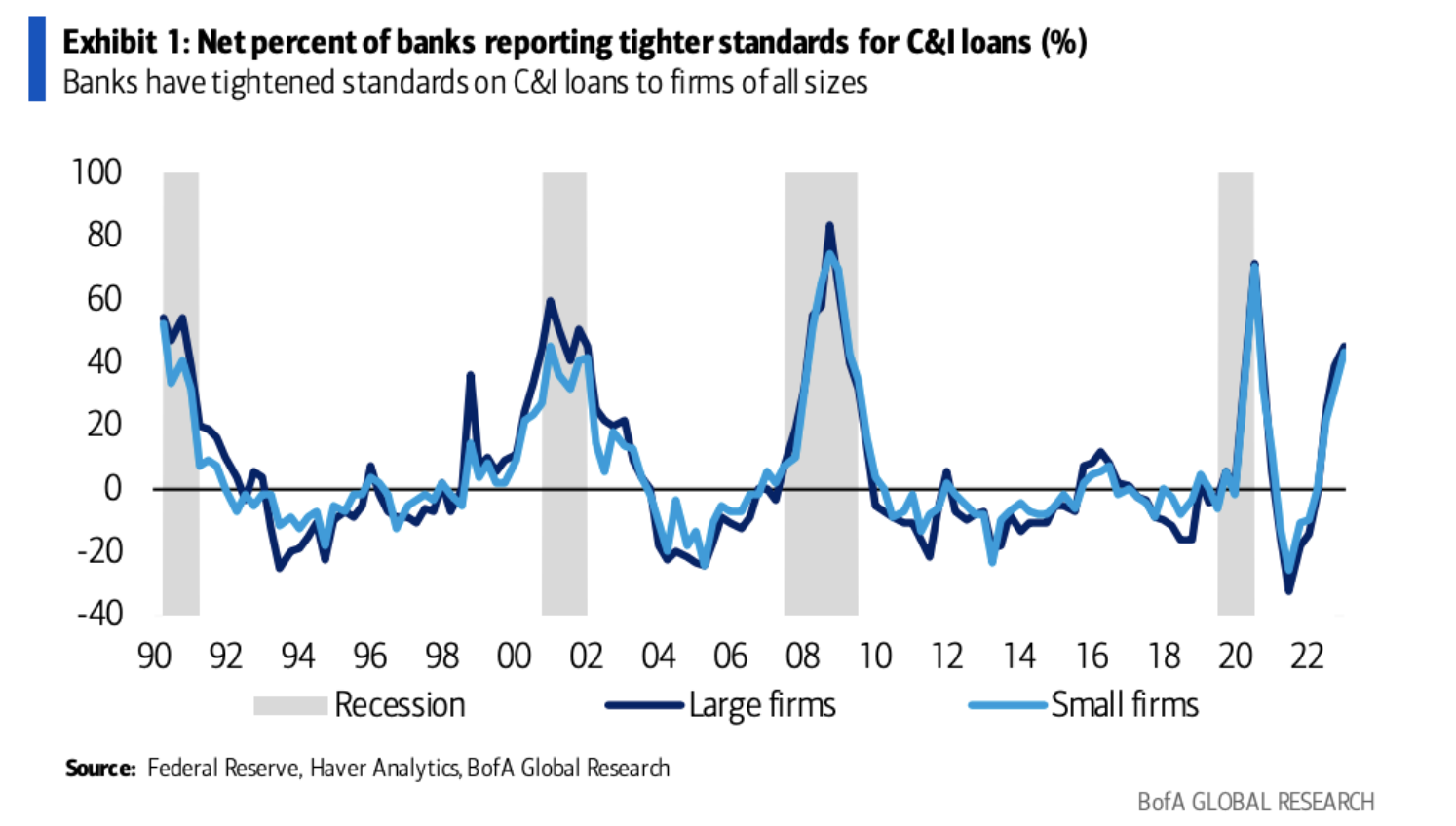

U.S. inflation has peaked and is receding, but the Federal Reserve’s blunt instrument tool of QT has recently presented cracks in the U.S. economic foundation. In the second week of March, the markets witnessed its first real Fed induced shock, since the GFC (Great Financial Crisis of 2008-2009), with the collapse of Silicon Valley Bank and Signature Bank of New York as well as contagion fears in the regional banking sector. The U.S. Treasury and the FDIC have provided some reassurance around depositor protection and may be in talks for amending the FDIC limits at this time. Regional banks as well as larger banking institutions have been tightening their lending standards for commercial real estate (CRE loans) and Commercial & Industrial (C&I loans) before the regional banking shock from mid-March. Bank of America Global Research recently published a chart showing the percentage of banks, large and small, reporting tighter lending standards for C&I loans. C&I loans is a large part of a banks business outside of checking, savings, and mortgage loans. See Chart 2.

Chart 2

Source: https://thereformedbroker.com/2023/03/27/a-shock-to-lending-standards

C&I loan balances reached $2.7 trillion in the end of 2022 for banks in the U.S. These loans have helped businesses expand their operations and hire more staff as they grew. There are two main deterrents for businesses to receive additional capital from banks. One is the higher cost of capital. The Federal Reserve has moved interest rates up almost 500 basis points in one year. A $2 million small business loan payment in 2020 may have been $7,500.00 a month and based on today’s rates, a small business may see a doubling of their payment.

Businesses love to receive the banks money when capital is cheap during low interest rate environments, but now that the cost of capital has gone up tremendously over the past year, businesses tend to second guess their need for financed capital and start to create further efficiencies on their balance sheet. On average, the largest expense on a small businesses balance sheet is their labor, consisting of 70% of a company’s bottom line expense. Slowing consumer demand coupled with tighter access to financial capital can lead to a broad layoff scenario across multiple business sectors across the U.S. In a report published on March 27, Jan Hatzius, Goldman’s chief economist, said his team’s baseline assumption is that reduced credit availability will prove to be “a headwind that helps the Fed keep growth below potential” rather than “a hurricane that pushes the economy into recession.”1

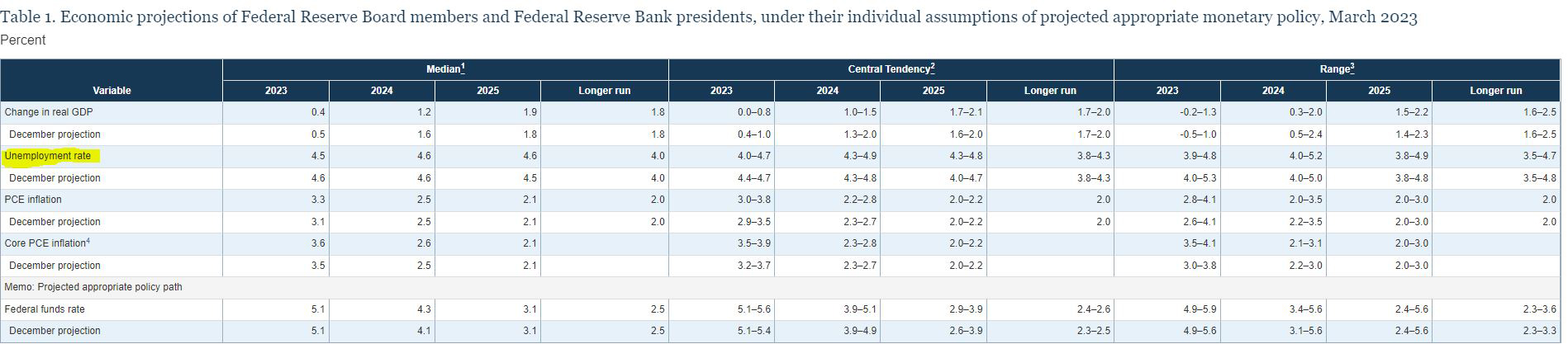

The Fed also recognizes that wage inflation is a large contributor to the current sticky inflation conditions and this cannot be resolved without sending shaking up the labor markets. The Fed’s unemployment target is at 4.5% for 2023, that means in order to take U.S. unemployment levels from its current 3.6% to the Fed target of 4.5%, another 1.4 million people need to be out of work. The Federal Reserve cannot just announce, “to fix inflation, we need 1.4 million U.S. workers to get laid off, who wants to go first?” This is just a part of their forecasted data to bring inflation back down to their 2% target. See Chart 3.

Chart 3

Source: https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm

Depending on the severity of a near-term credit crunch from banks can further aid the Federal Reserves inflation target but can shutter businesses who depend on financing to maintain their current production levels. Tougher qualification standards for loans going forward can help protect banks from the risk of credit defaults but will also eat into their overall revenues and slow future performance of the banking sector. Looking at the macroeconomic picture, this economic slowdown is the necessary “wash-out” that is needed to get interest rates back down to more equitable terms for businesses, banks, and U.S. households.

Make no mistake, the Fed is in a tough spot of reducing inflation while keeping the economic machine from shattering. We have seen the cracks in the foundation and it’s only the end of Q1 2023. Only time will tell if the Fed has the capability to gently slow the economy with minor bumps along the way or if they will have to slam on the breaks creating economic whiplash.

Chris Brown, Vice President-Investments, Synovus Securities, Inc.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.