Southeastern U.S. Commercial Real Estate Brief: Pause for Effect

Commercial real estate (CRE) metrics in the Southeast are as strong as they have ever been, fueled by in-migration from other states, an extremely strong level of new business creation (specifically in Florida and Georgia), and wages that continue to escalate. Occupancy rates are at historically high levels and rent growth has soared into the double digits for better property classes. More pertinent to Synovus and its customers, occupancy levels and rent growth rates within our footprint Metropolitan Statistical Areas (MSAs) exceed national averages in almost every category (Figure 1).

| Occupancy | Rent Growth | |||

| Footprint Avg | National Average | Footprint Avg | National Average | |

| Office | 89.8% | 83.3% | 3.1% | 0.5% |

| Retail | 96.2% | 95.6% | 6.6% | 4.3% |

| Industrial Logistics | 96.9% | 96.2% | 15.1% | 13.9% |

| Multifamily | 96.6% | 96.8% | 20.2% | 14.5% |

(Figure 1)

U.S. sales volume for CRE eclipsed the $800 billion mark for the first time in history.

U.S. sales volume for CRE eclipsed the $800 billion mark for the first time in history.

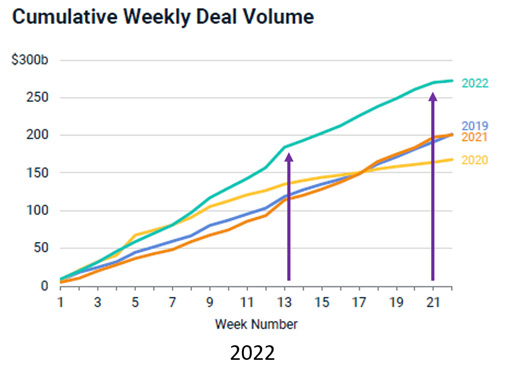

These metrics have fueled escalating values, resulting in record levels of CRE investment. In 2021, total U.S. sales volume for CRE eclipsed the $800 billion mark for the first time in history. However, recent economic shocks and the rapid rise in rates driven by a hawkish Fed are pushing investors to the sideline. A chart of cumulative 2022 CRE sales volume from Real Capital Analytics (Figure 2) shows two distinct inflection points.

(Figure 2)

(Figure 2)

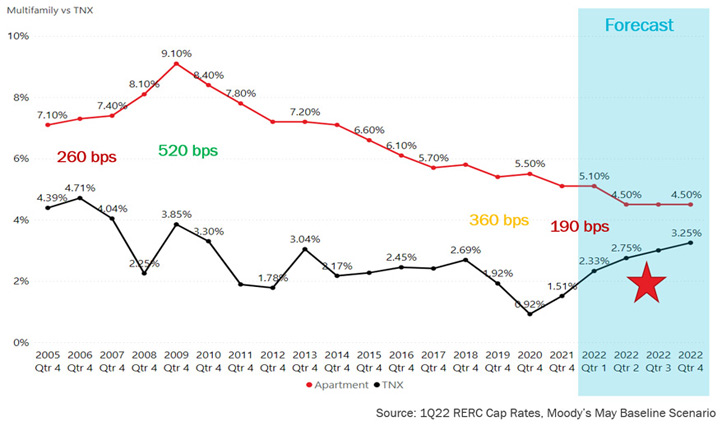

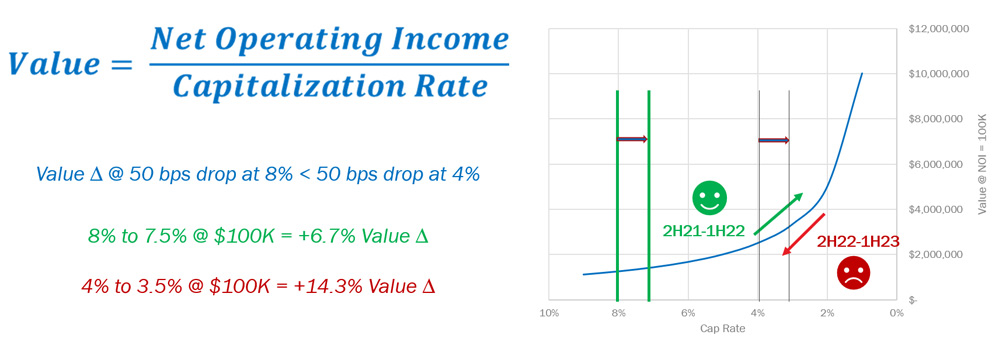

The first was in March when conventional wisdom accepted the fact that the invasion on Ukraine was going to be much more than a weekend war, and the second was in mid-May, when consensus opinion coalesced around the fact that multiple 75 basis point rate hikes could be a reality. Fundamentally, both CRE investors and lenders also noted that the erosion of the spread between capitalization rates and the 10-year yield in the first half of 2022 (Figure 3) signaled potential value loss via elevated cap rates in the second half of 2022 (Figure 4).

(Figure 3)

(Figure 3)

(Figure 4)

(Figure 4)

For investors, this meant a sizeable reduction in their risk premiums, whereas the banks saw the potential for swift value erosion when these historically low cap rates begin to rise. As would be expected, investors are increasingly moving to the sidelines and lenders have tightened underwriting for new deals. This should result in a simultaneous decrease in both the supply and demand for CRE capital for the remainder of 2022. The extent of the decrease will vary by property sector as leading categories, such as multifamily and office, will be impacted the least, and more problematic subsectors, like Class B office and Big Box retail, will see declining investment and valuations.

Historically high occupancy rates and eye-popping rent growth will help to offset negative market forces for the time being, but normalization is around the corner and should occur in 2023. If this occurs in tandem with a reversal in the Federal Reserve’s stance indicating rate cuts, the impact on CRE will be negligible. Sticky inflation, sustained rate hikes, and no or slow growth that continues into 2024 would be felt much more acutely by the market.

Written by Cal Evans, Senior Director, Synovus Investor Relations & Market Intelligence

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.