Federal Reserve Raises Interest rates again latest move to Stem Inflation

Federal Reserve Chair Jerome Powell said officials were determined to curb inflation after they raised interest rates by 75 basis points for a third straight time and signaled a more aggressive-than-expected path of rate hikes to come. “We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2%,” he commented at a press conference after the committee lifted the target for the benchmark federal funds rate to a range of 3% to 3.25%. That’s the highest since before the 2008 financial crisis, and up from near zero at the start of this year.

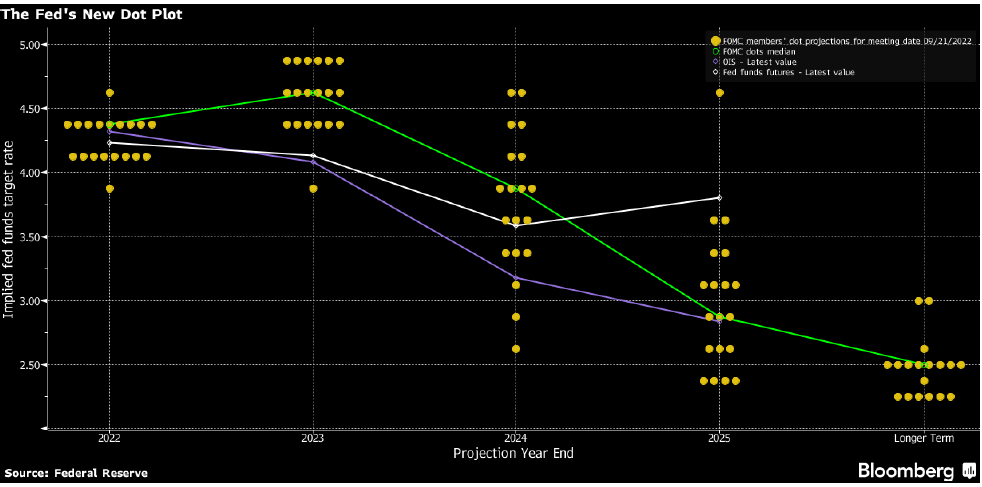

Officials forecast that rates would reach 4.4% by the end of this year and 4.6% in 2023, a more hawkish shift in their so-called dot plot than expected. The biggest surprises were in the forecast, starting with higher and tighter than expected median fed funds estimates. The FOMC median is 4.25-4.5% this year, suggesting rate hikes of 75bp in November and 50bp in December, though the dots are almost evenly split between 100 and 125 basis points of hikes at the two meetings. The 2023 dots are almost all distributed in three clusters at 4.75-5.0%, 4.50-4.75%, and 4.25-4.5%. The 2024 and 2025 dots are widely disbursed, suggesting no meaningful consensus on the FOMC.

Chair Powell commented that officials were “strongly resolved” to bring inflation down to the Fed’s 2% goal and added that “we will keep at it until the job is done.” The phrase invoked the title of former Fed chief Paul Volcker’s memoir “Keeping at It.” Policy makers now expect the key rate to rise to 4.4% by year end and 4.6% during 2023.

Bottom line: With these rate hikes slowly mixing into the economy the median GDP estimate for 2022 has fallen to 1.6%. The Fed was predicting economic growth for 2022 of 1.7%, but those estimates are falling. The 2023 median GDP forecast now calls for just 0.9% growth. Considering that GDP growth for the 1H22 has been negative with the economy technically in a Recession these estimates seem optimistic.

During the 1Q22 and 2Q22, GDP dropped -1.4% & -0.9%, respectively. In the 2Q22 personal consumption only rose +1.0%, after just a +1.8% increase in the 1Q22. The probability of a recession in late FY23 now stands at 50%. It is not clear why anyone would expect the economy to accelerate from a standstill to nearly 2% despite aggressive Fed rate hikes, but apparently some economists are optimistic.

The median unemployment forecast is 3.7% this year — a modest further increase from its current level — and 4.1% in 2023. The median core inflation (excluding food & energy) forecast is 4.7% this year and 3.2% in 2023. These figures may be overly optimistic as August’s headline CPI stood at 8.5%, with the core rate coming in above expectations at 6.3%.

Written by Daniel Morgan, Senior Portfolio Manager

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.