Oil Update

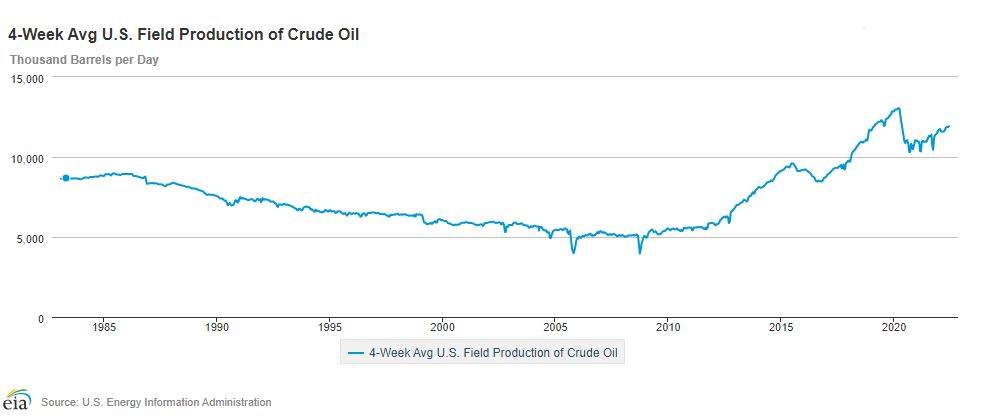

In our last oil market update, we highlighted the tight supply demand fundamental picture of the oil market. At that time, we showed that crude oil inventories in the United States were at a level lower than what has been seen in more than five years. At the time of writing this commentary, the price of oil has declined from $122/barrel to $107/barrel, a drop of 12% over the past three weeks. You may be surprised to learn that the inventory situation has not improved at all during that time. With an economy steadily recovering from the pandemic, oil consumption continues to increase while oil production is still approximately one million barrels per day below the peak production level in early 2020. Oil production in the U.S. is shown below.

Oil consumption continues to increase while oil production is still approximately one million barrels per day below the peak production level in early 2020.

Oil consumption continues to increase while oil production is still approximately one million barrels per day below the peak production level in early 2020.

In short, the fundamental picture today still argues for high and rising prices. What has changed during the past few weeks is a shift in the market’s attention to the rising risk of recession. The Fed’s tightening of policy is having an impact not on the oil market directly, but on the overall economy and market participants are now starting to discount the possibility of a recession on the horizon. We can see this shift not only in the oil markets, but in other commodity markets and in the stock and bond markets as well. Unfortunately, given the supply picture currently, the only thing that would bring about a drop in the price of oil would be a drop in demand associated with an economic recession. Given the elevated price of oil and the constructive fundamental picture for the energy markets, one would think production would be increasing at a more rapid pace. However, in a recent reporting of drilling activity in the U.S., the number of rigs drilling is roughly a third less than in 2020. As is the case in many other parts of the U.S. economy, comments from company management teams across the industry indicate shortages of equipment and labor are a contributing factor to a lack of activity. However, these constraints are only part of the problem, the American Petroleum Institute recently published a recommended list of 10 policy changes to increase energy production in the U.S. The majority of the recommendations relate to industry regulation that will likely be very difficult if not impossible to change given the current political power structure in Washington. To learn more about the list you can visit the website at API.org.

Source: FactSet, EIA

Written by Wade Fowler, Senior Portfolio Manager

Important disclosure information

The views, opinions and positions expressed are those of the referenced authors at the time of publication and are based upon information available at that time. There can be no assurance that any of the beliefs and views expressed herein will prove to be accurate, and actual outcomes or events may vary significantly from those presented. The authors’ views are subject to change and do not reflect the views, opinions or positions of Synovus Financial Corp, who makes no representations as to accuracy, completeness, timeliness, suitability or validity of information presented and will not be liable for any errors, omissions, or delays in this information or any losses, injuries or damages arising from its display or use. The information provided in this material is intended to highlight present economic and market conditions in general. It does not constitute any recommendation, and is not meant for use as personalized or individual investment advice. We encourage you to speak with your financial professional concerning your specific investment goals and risk tolerance before making investment decisions.

Investment products and services provided by Synovus are offered through Synovus Securities, Inc. (“SSI”), Synovus Trust Company, N.A. (“STC”) and Creative Financial Group, a division of SSI. Trust services are provided by Synovus Trust Company, N.A. The registered broker-dealer offering brokerage products for Synovus is Synovus Securities, Inc, member FINRA/SIPC and an SEC Registered Investment Advisor. SSI is a subsidiary of Synovus Financial Corp. and an affiliate of Synovus Bank and STC, and STC is a subsidiary of Synovus Bank.

Investment products and services are not FDIC insured, are not deposits of or other obligations of Synovus Bank, are not guaranteed by Synovus Bank and involve investment risk, including possible loss of principal amount invested. © 2022