Fourth Quarter 2022 USD reversal?

EURUSD (Neutral/Bullish)

As I wrote in my Q4 update, EUR/USD has notably broken out of the trend channel we have been in since January. It has since broken above my moving average indicators and turned positive. While I was looking for better levels to resell EUR, I have changed that to looking for better levels to BUY EUR. What has changed in a month? Ukraine has reclaimed land lost to the invading Russians and seems to have once again regained momentum in the war. Despite the Ukrainians resistance, there have been more calls for a diplomatic solution, notably from the unusual agreement from far left of the Democratic Party and the GOP. The Europeans seemed to have met many of their goals for natural gas reserves to get them through the winter.

China continues to use Covid as an excuse to keep large amounts of their population under house arrest, which has crushed demand for oil by slowing production and shipping. Inflation in the U.S. may have peaked, and though it won’t reach 2% levels from 2 years ago, the market sees the Federal Reserve ending its tightening cycle soon. Most economists are looking for another recession in 2023 (we had a two-quarter recession in 2022). Price action in USD trading has indicated the market was overbought, which could trigger more U.S. Dollar selling as the market thins out over the holiday season. Notably good value should be any move back to parity, and even better a move back to .9800.

Inflation in the U.S. may have peaked, and though it won’t reach 2% levels from 2 years ago, the market sees the Federal Reserve ending its tightening cycle soon.

Inflation in the U.S. may have peaked, and though it won’t reach 2% levels from 2 years ago, the market sees the Federal Reserve ending its tightening cycle soon.

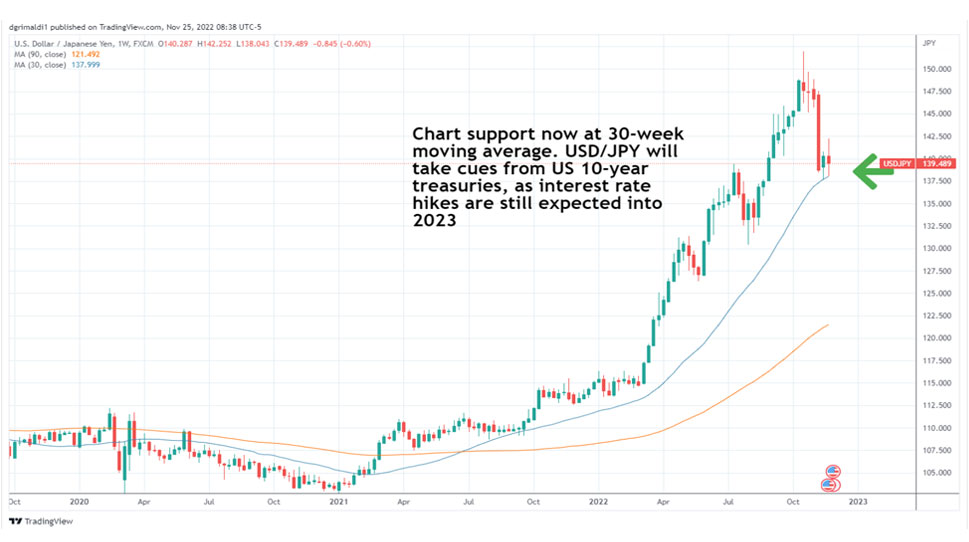

USDJPY (Neutral/Bullish)

USDJPY has had a nice correction where it looks advantageous to enter a new long position with a tight stop loss. It is important to be wary of the Bank of Japan continued operations of intervening in the currency as it approaches 150.00. The interest rate conditions in Japan and the U.S. still favor a stronger U.S. Dollar, and this could continue into the second quarter of 2023. Japan has not faced the same inflation crisis as the rest of the developed nations, as their current inflation rate is 3.7%. Japan has maintained a zero-interest rate policy through due to more favorable inflation conditions, and they won’t change that now that markets are focusing on the timing of rates hikes to stop and then reverse.

GBPUSD (Neutral/Bullish)

The growth in the United Kingdom has significantly lagged other developed countries since December 2019. GDP growth is -0.4% over this period, the lowest among G-7 countries. The Bank of England has been raising rates to fight inflation that has risen to a 11.1% rate in October. The Organization for Economic Co-operation and Development (OECD) sees U.K. interest rates rising further from 3% currently to 4.5% by April next year, while unemployment will lift from 3.6% to 5% by the end of 2024. Higher energy prices will weigh on consumption and depress growth.

Like the EUR/USD, GBP has seen a significant short squeeze, and has broken the 1.2000 psychological barrier ahead of Thanksgiving. The Daily chart is beginning to look bullish, as market players are anticipating recession in the U.S. and a slowdown in rate hikes. The weight of U.S. policy decisions will take precedent, and though we may see volatility and move lower in GBP, it could be that we have seen the bottom in GBP/USD.

Written by David Grimaldi, TM Foreign Exchange Sales Consultant

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.