Job Offer or Fraud? How Skyrocketing Employment Scams Target Job Seekers

When an Arizona woman named Rachel received a text message claiming to be a recruiter from the film review platform Letterboxd, it seemed like the opportunity of a lifetime — making up to $9,000 a month watching movie trailers.1 All she had to do was deposit $100 of cryptocurrency into an account, watch some trailers, and then get her $100 returned, plus commission.

And the first time she did it, that's exactly what happened.

"I took that money and put it in my bank account. I converted it back to cash. It was real,” she told a Phoenix news station. "I was like, great. I’m going to make a lot of money here. So, I put in $3,000."

After making more deposits and receiving more commissions, Rachel felt so confident about the scheme that she deposited $110,000 in one week. That's when it all fell apart. The commissions never arrived; the deposit was never returned. It was all a scam.

It's hard to imagine a crueler time to scam people than when they are seeking work, but job scam losses have recently skyrocketed. FBI reports showed a 276% increase in money lost to employment scams between 2023 and 2024 — from $70 million to more than $264 million.2 The fraud that ensnared Rachel is a trending subset of those reports called task scams. In just the first half of 2024, 20,000 people reported a task scam to the Federal Trade Commission (FTC), compared to 5,000 in all of 2023.3

Here's what job seekers should know about employment scams, from how they work to how to recognize when you're being targeted.

Types of Employment Scams and How They Work

All sorts of fraudulent activities fall under the umbrella of employment fraud, which the FBI defines as when "an individual believes they are legitimately employed and loses money, or launders money/items during their employment."2 This includes both familiar scams, like multi-level marketing schemes, and new, tech-based frauds like task scams.4

Employment scams have become the FTC's third-top reported fraud, with the second-highest median losses reported at $2,250 per victim.5 They are unique in that most victims fall outside the typical demographic of those impacted by fraud. Nearly all other scams extract the most money from elderly victims, but job scams disproportionately harm victims between 20 and 39.

Here are some of the forms employment scams take:

Scammers post job listings on legitimate job posting sites disguised as a real business. They lead victims through a fake hiring process with the goal of collecting the victim's personal information, including their Social Security number, driver's license number, and bank account info — information you might share with a legitimate employer. The scammer then uses the information for identity theft, to steal money directly, to sell on the Dark Web, or all of the above.

A scammer will "employ" victims to do odd jobs from home for a surprising amount of money. The task could be to receive packages at their home to repackage and ship elsewhere. But after doing this for some time, the paycheck doesn't arrive, and the "employer" disappears. This is a reshipping scam, where scammers outsource the handling of stolen goods to unknowing victims. Another task could be to resell "luxury" products after buying them at a steep discount — but after paying for the goods, they never arrive or are too low-quality to resell.

These are often called "nanny" or "caregiver" frauds because, for whatever reason, scammers tend to post jobs for caregiving roles in this scheme. After interviewing and "hiring" the victim, the scammer sends them a check, either as a prepaid first paycheck or to buy job supplies. However, they then claim they've overpaid or have an emergency and need all or some of the check immediately. The victim pays them back before the "employer's" original check bounces, and then the scammer disappears with the money.

FBI reports showed a 276% increase in money lost to employment scams between 2023 and 2024.

A Massachusetts woman lost $6,000 in a similar scam, but instead of sending a bad check to her, the fraudster supposedly paid off her credit card. The payments bounced, but not until after she'd bought and sent the scammer thousands of dollars in gift cards.9

Pay-for-Access Job Scams

These scams involve a potential employer or job placement service that requires payment for access to job listings, training, or certifications. This is frequently seen in job postings for mystery shopper opportunities, government or postal job listings, or fraudulent job placement services. While there are legitimate versions of all the above, none of them should ever charge job seekers for any reason. Staffing agencies, for example, charge hiring employers, not potential employees, for their work.

Cryptocurrency or Task Scams10

As described in Rachel's experience above, cryptocurrency job scams, or task scams, make a game out of doing tasks in exchange for a commission after the victim pays a cryptocurrency deposit. The game escalates until the scammer asks for a very large deposit, which they keep before disappearing.

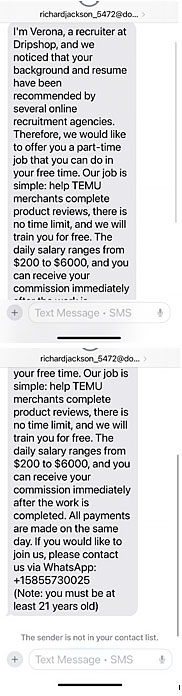

Below are real examples of text messages in which a fraudster targets a potential victim with an employment opportunity that seems too good to be true:

How to Spot a Job Scam

While employment scammers' methods vary widely, many share some red flags. While on the hunt for work, job seekers should stay alert for these warning signs:7

- The potential employer asks for money. Whether it's for access to training, job listings, or as a deposit before doing tasks, this should never happen in a legitimate job.

- The employer tells you they're sending you a check in advance of your work. This alone is fishy, and if they suddenly need all or some of it back, it's a sure sign of a scam. Do not pay them back, no matter what they say. Their advanced check is sure to bounce.

- The entire interview and hiring process happens remotely, without video calls or other face-to-face interactions.6

- The opportunity appears out of nowhere, via text, email, or another message platform.

- The job appears on a job listing site, but not on the company's website.

- The job involves doing odd tasks, such as liking posts or watching videos, that don't seem worth the promised pay.3

For every promising job listing, the FTC recommends job seekers do an online search for the name of the employer or position and "scam," "review," or "complaint."7 Also, describe the offer to someone you trust; if they are skeptical, you should be too.

People are particularly vulnerable when searching for jobs, and the advent of online job searching can make that vulnerability public. If you believe you've been victimized by a job scam, it's important to know that you're not alone. The FBI received 20,044 employment scam reports, and the FTC received 130,075 victim reports in 2024.2,5

The FBI asks victims to file a report with the Internet Crime Complaint Center or contact their local FBI field office.11,12 The FTC recommends filing a report at ReportFraud.ftc.gov, as well as contacting your state attorney general.13,14 And to protect yourself from further financial harm, read up on What to Do if You Are a Victim of Fraud.

-

Looking to Improve Your Credit Report? Avoid These Scams.

Looking to repair your credit? Don't get scammed along the way. Watch for these credit repair scams to protect yourself.

-

5 Ways to Protect Yourself From Identity Theft

Identity thieves can damage your credit, steal your money, and disrupt your life. Here are ways to protect yourself against ID theft.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- Gary Harper, "Phoenix woman loses $110K to job scam in one week," AZ Family, published July 24, 2024. Accessed August 5, 2025. Back

- Federal Bureau of Investigation, "Internet Crime Report 2024," FBI Internet Crime Complaint Center, published April 23, 2025. Accessed August 5, 2025. Back

- Federal Trade Commission, "Paying to get paid: gamified job scams drive record losses," FTC Data Spotlight, published December 12, 2024. Accessed August 4, 2025. Back

- Federal Trade Commission, "Multi-Level Marketing Businesses and Pyramid Schemes," FTC Consumer Advice, published July 2022. Accessed August 5, 2025. Back

- Federal Trade Commission, "Consumer Sentinel Network Data Book 2024," published March 2025. Accessed August 4, 2025. Back

- Federal Bureau of Investigations, "FBI Warns Cyber Criminals Are Using Fake Job Listings to Target Applicants’ Personally Identifiable Information," FBI EL Paso Press Releases, published April 21, 2021. Accessed August 5, 2025. Back

- Federal Trade Commission, "Job Scams," FTC Consumer Advice, published March 2023. Accessed August 5, 2025. Back

- Federal Trade Commission, "Nanny and Caregiver Job Scams," FTC Consumer Advice, published December 2022. Accessed August 5, 2025. Back

- NBC Boston, "How a job scam turned a Mass. mom's search for remote work into a nightmare," published February 29, 2024. Accessed August 4, 2025. Back

- Federal Bureau of Investigation, "Cryptocurrency Job Scams," FBI National Crimes and Victims Resources. Accessed August 4, 2025. Back

- FBI, "File a Complaint," Internet Crime Complaint Center. Accessed August 5, 2025. Back

- Federal Bureau of Investigation, "FBI Field Offices," accessed August 5, 2025. Back

- Federal Trade Commission, "Report Fraud," accessed August 5, 2025. Back

- National Association of Attorneys General, "File a Complaint," ConsumerResources.org, accessed August 5, 2025. Back