Learn

5 questions about Bitcoin

If you've been watching the skyrocketing prices of Bitcoin lately, you already know that they’ve made a spectacular, almost-gravity defying run in 2020. In fact, a single Bitcoin was valued at about $7,300 at the beginning of 2020 and by the end of 2020, it was valued at almost $29,000. And the record-run continued into 2021, as Bitcoin prices rocketed to a new all-time high of almost $42,000 on Jan. 8, only to then plunge over the next few days to about $31,000 on Jan. 11 and then moving to about $33,000 the next day.

Those who invested in Bitcoin a year ago are likely patting themselves on the back. But should you join their Bitcoin party? Or should you be allocating to Cryptocurrencies as part of your investment portfolio?

Understanding currencies

Currencies are traded on the foreign exchange market – Forex, FX or just the currency market – a global, decentralized market for buying, selling and exchanging. Forex is comprised of institutional investors, governments from around the world, large corporations, banks, as well as currency speculators.

Forex differs from the stock markets that you’re familiar with in that those markets are housed in central physical exchanges, whereas Forex is an over-the-counter, decentralized market completely housed electronically.

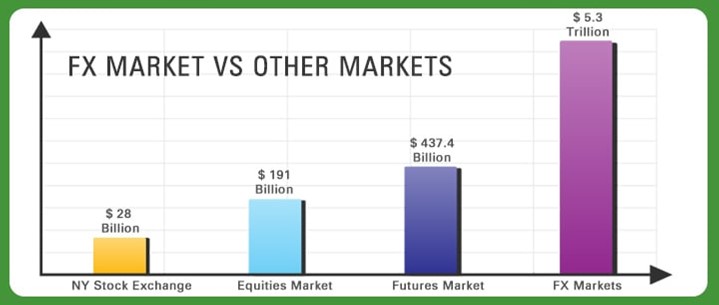

In terms of trading volume, Forex is by far the largest market in the world. In fact, according to the Bank for International Settlements, foreign-exchange trading averages more than $5 trillion a day – which is about $220 billion per hour (it’s open 24-hours a day in different parts of the world). Comparing it to the volume of the NYSE – 30 days of trading on the NYSE equals one day of trading on Forex.

Source: fideliscm.com

As you might suspect, the US dollar makes up most of all Forex trading volume, followed by the Euro and then the Japanese Yen.

And along came Bitcoin

First invented in 2008 on the heels of the financial crisis of that year, Bitcoin is different from other currencies traded on Forex in that Bitcoin does not require and is not backed by a central authority. Instead, Bitcoin is a peer-to-peer system for online payments that runs on a decentralized network of computers around the globe that keep track of all Bitcoin transactions, similar to the decentralized network of servers that makes the internet work.

You can buy Bitcoins with dollars or euros, just like you can trade any other currency. You then store your Bitcoins in an online “wallet.” And then with that wallet, you can spend Bitcoins online as well as in the real world for stuff. But there are no intermediaries – it doesn’t go through your bank or someone else’s bank.

Currency of the future?

That’s hard to say of course, but the reality is that if you have a bank account or credit cards or even use PayPal you are already using digital currency. Same thing goes for when you trade stocks – you’re using digital currency.

Let’s say you and I placed a trade to buy 100 shares of Apple stock. I’m not expecting you to show up to my office with a bag of money that I can then go deliver in exchange for your Apple shares, right?

The reality is that unless you actually use real cash – and how many of us use cash today? – every time you swipe your credit card or debit card, you have to go through an intermediary like your bank or credit card company. And they of course have fees for this service.

Bitcoin, on the other hand, sets up a system where the buyer and seller deal with each other directly.

Or a currency for the shady?

Throughout its existence, Bitcoin has been in the news after a few ransomware attacks. The malicious software locks down computers and files and won’t lift the lockdown unless they are paid a ransom in Bitcoins. Why Bitcoins?

Well, because with Bitcoins, the transactions you make are completely anonymous. Instead, whenever you trade a Bitcoin, you use a "private key" associated with your “wallet” to generate computer code that is then publicly associated with your transaction – but with no personal data. For criminals, this makes Bitcoin very attractive.

Thinking of investing in Bitcoin?

As a financial advisor, Bitcoin represents a few very interesting thoughts. One of the first, and maybe most interesting, is that Bitcoin could prove to be the model for digital currency going forward – if it’s not already. But there are still a lot of things to be ironed out and those are topics to be covered at another time.

While there are a lot of things to consider when thinking about buying Bitcoin or making Cryptocurrencies part of your asset allocation plan, here are five very fundamental questions you need to ask yourself.

Question #1: Bitcoin or Cryptos?

The first question you should ask yourself is whether you want to invest in Bitcoin directly or Cryptos as an asset class? Did you know that there are over 2,000 Cryptocurrencies besides Bitcoin?

Here is an analogy: in 2020, Tesla was the best performing stock on the New York Stock Exchange with an eye-popping price change of 743% in 2020. Tesla is categorized within the Consumer Discretionary sector of the S&P 500 and the Consumer Discretionary sector gained over 32% in 2020.

Should you consider a single component of a sector (like Tesla) or are you bullish on the entire sector (like Consumer Discretionary)? The answer to those questions then leads to additional questions, like which sector or sectors do you reduce.

Question #2: What about inflation?

When you invest in Bitcoin or any other currency or commodity – including gold, oil or pork bellies – you are investing on the prospects of price appreciation alone. More specifically, you are investing on the prospects of the price of Bitcoin rising relative to the U.S. dollar. And while the recent price surge makes inflation look silly, you should evaluate currencies and commodities with respect to inflation.

Question #3: Can you tolerate extreme volatility?

The price appreciation of Bitcoin in 2020 underscores the extreme ups and downs. Consider this:

- Bitcoin went from $7,300 to $29,000 in 2020. But it also dipped to about $5,000 in mid-March during the beginning of the pandemic.

- Bitcoin rocketed to a new all-time high of almost $42,000 on Jan. 8. But then it plunged to about $31,000 on Jan. 11.

That’s two bear markets in less than a year.

Need more proof of volatility? Well, think about this:

- In early 2017, the price of Bitcoin was under $1,000

- By the end of 2017, it was almost $20,000; and

- By the end of 2018, the price was about $3,700.

Question #4: Do you really understand it?

This one requires you to be completely honest. Do you understand how Cryptos work or even why Bitcoin’s price has skyrocketed? Do you understand Bitcoin mining and how it works? Can you explain it beyond the headlines or the 5-second stories?

Here is one of the best stories:

- The first Bitcoin payment occurred in Florida on May 22, 2010, when a man bought two Papa John's pizzas worth $25 for 10,000 Bitcoins. At that point, four Bitcoins equaled one penny.

- Today, those 10,000 Bitcoins would be worth $350 million (give or take a few million and using the price as of Jan. 12).

If you don’t really understand an investment, should you make it? And if you can’t explain an investment to a 5th grader, should it be one of your investments?

Last Question: Why?

It’s impossible to give blanket advice on any investment to a large group of investors. Everyone has different risk tolerances, goals and plans. But it’s not impossible to remind investors that most of the time they will be a lot better off if they choose a long-term investment strategy that isn't dependent on a single security and is not quite so volatile.

Investors should always diversify as much as they can, so they don’t ruin their portfolio if one investment heads south real fast.

Could Bitcoin or Cryptos make sense as an investment for you? Sure, it could. But you should strongly consider limiting your investment to an amount you can afford to lose and prepare yourself for a long and choppy ride.

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.

Do you have questions or ideas?

Share your thoughts about this article or suggest a topic for a new one