Learn

Huge sector performance range in Q1 2021

Over every single time period, sector performance will be driven largely by factors one would expect, such as the overall state of the economy, underlying corporate earnings, current and predicted interest rates, and inflation, among other factors.

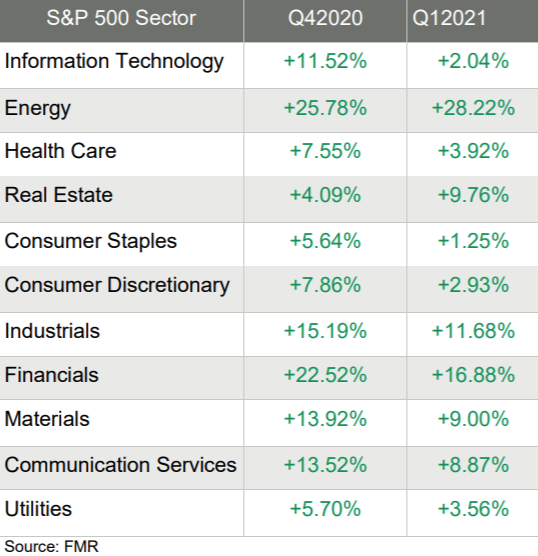

Reviewing the sector performance for the first quarter of 2021 (a very short time-period), two things become very clear:

- First, sectors do not move in lock-step with one another and will often provide very divergent returns for investors – depending on timing and the current economic climate, and

- Second, the first quarter of 2021 brought significant divergence in sector performance despite all 11 sectors posting positive numbers for the quarter

Sector highlights through Q1 2021

The overall trend for sector performance for the first quarter was very good, but the performance leaders and laggards did rotate throughout the past few months, suggesting that a sector rotation might be underway.

For perspective, recall that this time last year, the first quarter of 2020 ended with every single one of the S&P 500 sectors painted red. In addition, 6 of the 11 were negative for the month of February this year too.

Looking at past quarterly returns, we remember that:

- Q2 2020 ended with every one of the 11 sectors turning in positive numbers

- Q3 2020 ended with 10 of the 11 positive, and

- Q4 2020 ended with all 11 sectors positive

For the first quarter of 2021, every one of the 11 sectors was painted green. Here are the sector returns for the shorter time periods:

Reviewing the sector returns for just the first quarter of 2021, we saw that:

- All sectors were painted green for the first quarter

- The Energy sector once again came roaring back, driven by price of oil jumping another $12

- The Financials sector had another wonderful quarter, helped by the Federal Reserve’s stance of keeping rates low through at least 2023, and

- The differences between the best performing and worst performing sectors in the first quarter was very wide, as the Energy sector’s return was about 23x greater than the Consumer Staples sector’s quarterly return

What does it mean for investors?

At a very basic level, the differences in returns for the 11 S&P 500 sectors support two fundamental principles of financial planning – asset allocation and diversification.

At your next portfolio review, let’s revisit the differences between asset allocation and diversification. And we can discuss how to ensure that your portfolio is consistent with your risk profile and personal goals.

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.

Do you have questions or ideas?

Share your thoughts about this article or suggest a topic for a new one