Learn

Wondering if you missed the recovery?

It is only natural that investors would want to find some way to sit out bear markets and get back just in time for the next bull run. The belief that you can foresee the direction of the stock market is a seductive one.

Some investors are confident that they can time it perfectly and snap up equities when prices are low and shift into cash or bonds when the market hits its peak. But investors run a big risk by selling when they believe stocks have reached their peak. They may turn a profit when cashing in their equity holdings, but they could also miss out on some of the market’s best cycles. Being absent from the market for only a few of the days or weeks with the highest percentage gains can decimate a portfolio’s returns over time.

Market timers who sell frequently also lose money to transaction costs and taxes and miss out to a large extent on the compounding effect that benefits investors who remain in the market consistently. Instead of trying to time the market, most investors are generally better off taking a buy-and-hold approach – but with the right investments.

Gains in year one

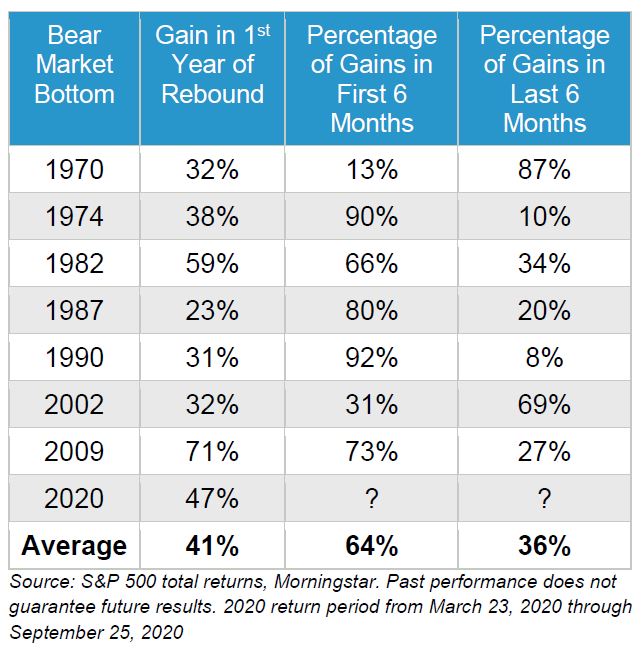

Looking at the distribution of market gains coming off of the past 7 bear market cycles, we see that on average, 64% of the gains were captured in the first 6 months of year one. But that’s not to say that gains were absent in the next 6 months – the gains just slowed down.

Will 2020 be different?

No one knows. But consider that coming off of the 2020 bear market bottom, the S&P 500 returned 47% from March 23 to September 25. Maybe in another six months we will look back and recognize that those first 6 months off of the 2020 bear market bottom captured 92% of the gains, just like what happened in 1990.

Or maybe we will realize that those first 6 months only captured 31% of the gains, like in 2002.

Where should you go from here?

Trying to pinpoint the exact right time to invest in the stock market is an exercise in futility. If you have a longer period to invest, owning equities provides one of the most effective hedges against inflation and taxation available. Since it is impossible to know where the market might go from here, it makes sense to start investing now and continue investing on a regular basis, regardless of market conditions. Remember, long-term investment success is achieved not by timing the market, but by time in the market.

Important Disclosure Information

This information is intended to provide general advice We do not provide legal advice and you are encouraged to speak with your personal attorney prior to making decisions as it pertains to guardianship of older adults.

The article above was provided to Synovus by eMoney Advisor, LLC, and is used here with permission from eMoney or a third party content provider. eMoney does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. This information was provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.