Learn

S&P 500 Sector Performance in 2019

Over every single time period, sector performance will be driven largely by factors one would expect, such as the overall state of the economy, underlying corporate earnings, current and predicted interest rates, and inflation, among other factors.

Reviewing 2019’s sector performance, two things become very clear:

- First, sectors do not move in lock-step with one another and will often provide very divergent returns for investors – depending on timing and the current economic climate; and

- Second, 2019 saw quite a bit of divergence from the previous two years.

Sector returns through end of 2019

Let’s look at the sector returns for a few different time periods through December 31, 2019. We can draw some interesting conclusions:

- 11 of 11 sectors were positive in 2019;

- Only 3 of the 11 sectors outperformed the S&P 500 in 2019;

- 10 of 11 sectors were positive for the 3-year and 5-year time periods;

- Only 3 of the 11 sectors outperformed the S&P 500 over 3-years and only 2 outperformed over 5-years;

Here are the sector returns for the time periods through the end of December 31, 2019:

What a difference a year makes

Looking at the sector returns through the end of the 2019 and we realize that from a big picture perspective, a lot has changed as the better performing sectors have rotated from year-to-year (and from quarter-to-quarter and month-to-month).

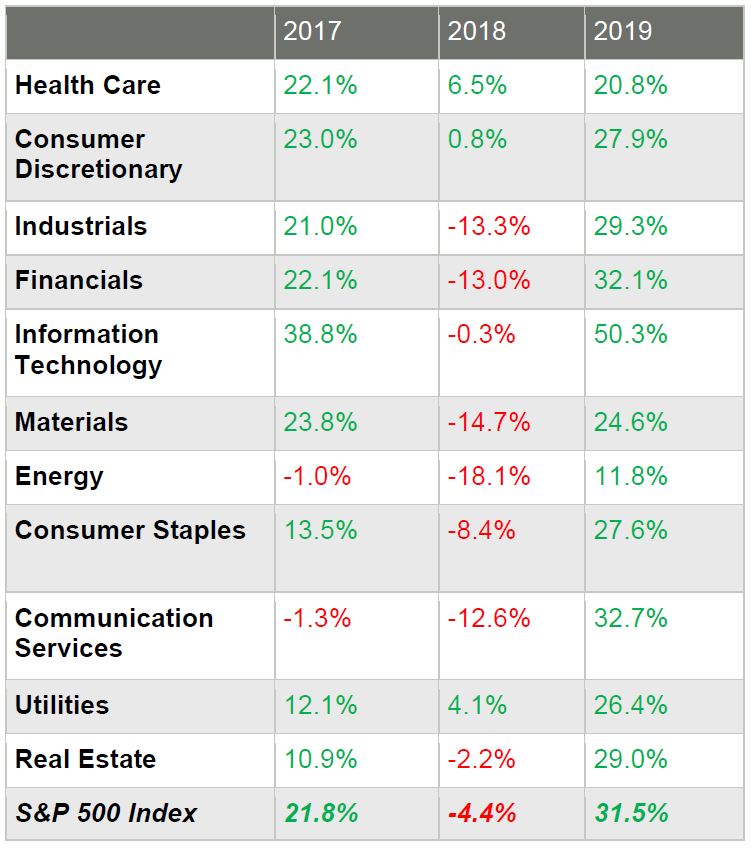

Here are the sector returns for each of the past 3 years through December 31, 2019:

Why it matters: the swings are huge

At a very basic level, the differences in returns for the 11 S&P 500 sectors support two fundamental principles of financial planning – asset allocation and diversification.

In very simplistic terms, the performance of the 11 different sectors will bounce around from year to year, moving from being among the best performers one year and then maybe among the worst performers in the following year.

Take a look at the defensive-oriented Utilities sector for example. In 2017, the Utilities sector was among the bottom four performers, then in 2018 it was in the top two, then in 2019 it was back to being among the bottom four.

Nothing illustrates this bouncing around – called sector rotation in advisory-speak – more than the historical performance over the past 10 years.

Reviewing the sector performance over the past 10 years illuminates a few trends and casts a spotlight on the huge swings in performance from best year to worst year. Here is the annualized performance over the past 10 years, plus each sector’s best and worst year. The swings are huge.

All these performance charts underscore the need for diversification and asset allocation. And remember, the two are very different from one another.

At your next portfolio review, let’s revisit the differences. Because we want to ensure your portfolio is consistent with your risk profile and personal goals.

Important Disclosure Information

The article above was provided to Synovus by eMoney Advisor, LLC, and is used here with permission from eMoney or a third party content provider. eMoney does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. This information was provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.