Learn

Currency risk's invisible threat

The hope for a stronger U.S. dollar is very much in the news lately. But most Americans, other than tourists beyond our shores, don't focus on what that means to them. For U.S. investors, the upshot is not always great. In fact, for most, currency fluctuations worldwide (and not just that of the dollar) are an invisible force that they don’t reckon with until it’s too late.

Calculating currency valuations from one country to another is complex and, if you’re like most people, you don’t give the subject much thought until you get ready to travel. You might visit your bank to swap greenbacks for a few euros, but usually you just plan to use a credit card to cover your tab on the Spanish Rivera or at the Tuscan villa. For corporations and mutual funds, though, fluctuating currency rates carry much more weight.

The Swiss

Let’s look at one recent global monetary event. In 2015, Switzerland reaffirmed the commitment to keep its franc at $1.20 to the European Union’s euro – then suddenly changed its position, sending the euro falling, the franc soaring and world markets reeling. (in April 2018, the franc touched a three-year low of $1.19 euro).

So what? Maybe you never plan to go to Europe. Your portfolio, likely containing international investments in its mutual funds, likely still felt the fallout.

For one, German businesses suddenly found it much more expensive to buy Swiss watches, chocolates or cheese and Switzerland’s exporters were caught in a battle literally overnight. Meanwhile, Swiss citizens enjoyed welcome wealth.

Unlike Americans who may plan only an occasional trip to Paris, Swiss citizens commonly drive to France for the day. The currency move suddenly put an extra 15% to 20% of buying power into the hands of Swiss who visit France.

We live in a global society and understanding currency fluctuation means much more than calculating our travel costs and daily vacation spending. Exporters win or lose every time currency valuations change.

The Dollar vs. the Euro

The Euro was introduced on January 1, 1999 as the new “single currency” of the European Union and peaked just shy of $1.60 vs. the U.S. dollar in 2008 and has since declined to about $1.23 today.

But don’t feel too flush with the dollar’s comparative value. In simple terms, that new Mercedes is more affordable here but the Apple iPhone costs much more in Germany than in this country. But here is why investors should take note: Nearly half the earnings in the Standard & Poor’s 500 come from companies based outside the U.S.

While a strong dollar will benefit some, it will negatively impact others. Here are some things to consider.

Benefits of a Strong Dollar

- Travelling overseas is cheaper

- Imports are cheaper

- Foreign companies investing in the US will benefit

Negatives of a Strong Dollar

- Tourism in the U.S. is more expensive

- Exports are more expensive

- U.S. companies that conduct business outside the U.S. will suffer

For investors

For most of us, we don’t really think about the strength of the U.S. dollar vs. the Euro or any other of the 180 global currencies. In fact, most of our “currency risks” are usually imbedded in our mutual funds. But remember, there are currency risks in just about all of your equity mutual funds, not just the international or global ones. For example, that U.S. Large Cap Growth fund by definition invests in large U.S. companies that are exposed to currency movements because of their underlying business.

As such, it’s absolutely worth knowing whether a portfolio manager is “fully-hedged” against currency risk or not. Many portfolio managers simply hedge currency risk away – at a price of course – which makes that mutual fund more expensive. Others hedge the major currencies. Or don’t. Irrespective of their decision to hedge or not, currency movements will play a role in their total returns – and yours as well.

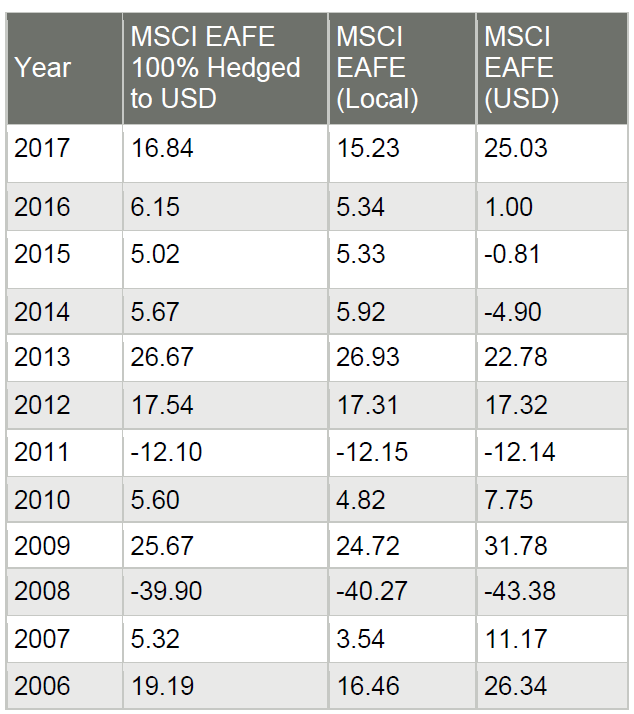

MSCI EAFE – Hedged vs. Unhedged

The MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. (and technically Canada). Let’s look at yearly returns of the MSCI EAFE Index – hedged and unhedged. From MSCI.com:

The MSCI EAFE 100% Hedged to USD Index represents a close estimation of the performance that can be achieved by hedging the currency exposures of its parent index, the MSCI EAFE Index, to the USD, the "home" currency for the hedged index. The index is 100% hedged to the USD by selling each foreign currency forward at the one-month Forward weight. The parent index is composed of large and mid-cap stocks across 21 Developed Markets countries and its local performance is calculated in 13 different currencies, including the Euro.

Final Thoughts from a Financial Advisor

Like all financial decisions, the further out you plan your trip, the more successful your journey.

Important Disclosure Information

The article above was provided to Synovus by eMoney Advisor, LLC, and is used here with permission from eMoney or a third party content provider. eMoney does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. This information was provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.