ATM Banking Frequently Asked Questions

What activities can I do at the ATM?

In addition to dispensing cash, a Synovus ATM is where you can:

- Change your PIN

- Manage your accounts

- Set preferences

- Deposit checks and cash at deposit-capable ATMs

How do I make an ATM deposit?

For either checks or cash, insert your ATM check card into a Synovus deposit-capable ATM and enter your PIN.

Checks:

- Endorse the back of the check with your signature.

- On the Main Menu screen, press “Deposit Checks” on the touchscreen.

- Insert up to 30 checks into the “Cash/Check In” slot. No envelope or deposit slip is needed.

- The ATM will total the amount and present a summary screen for your review and approval.

- Select “View/Edit Check” to view an image of an individual check and make edits if needed.

- Press “Continue with Deposit” to complete the transaction.

- A picture of each check and summary of the deposit will appear on the receipt.

Cash:

- To deposit cash, you can insert up to 50 bills at a time into the “Cash/Check In” slot. No envelope or deposit slip is needed.

- Verify the details on screen and press “Continue with Deposit.”

- The funds from mobile deposit transactions made before 7 p.m. ET on business days are generally available the next business day. However, it could take up to three business days depending on weekends and holidays.

The ATM won't accept my check. What could be the problem?

Here are some tips on making sure your check is accepted:

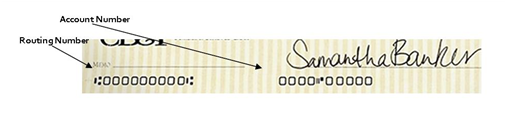

- Place your check face up, with the MICR line/Routing and Account numbers on the right, in the “Cash/Check In” slot.

- Make sure the routing number and account information at the bottom of your check is clear of any ink marks or writing.

- Make sure the check is not torn or crumpled.

- Review our list of check types eligible for ATM deposit. Not all checks can be accepted.

What type of check can I deposit?

You can deposit checks made payable to you in U.S. dollars that are drawn on a U.S. financial institution into a checking or savings account which is tied to your ATM card.

Among the items not eligible for ATM deposit are: international checks, treasury checks, money orders, traveler’s checks, cashier’s checks, savings bonds, altered or fraudulent checks, checks that are remotely created (which are not in original form or are substitute checks), checks that have been previously deposited in any manner, stale-dated checks (six months or older), and future-dated checks.

What is the cut-off time for deposits made at the ATM?

The cut-off time for ATM deposit transactions to be accepted is 7 p.m. ET on business days. If an ATM deposit transaction is conducted after 7 p.m. ET, the deposit will be processed on the following business day.

When will my ATM deposit be available?

If the ATM deposit is made prior to 7 p.m. on a business day, then the funds will generally be made available the following business day.

Is there a limit on how much money I can deposit using the Synovus ATM?

No, there is no limit on the amount of the deposit you may make using the ATM.

Do all Synovus ATMs accept deposits?

Many Synovus ATM locations accept deposits, but not all. Find a deposit-capable Synovus ATM.