Keeping track of your transactions and going paperless is now easier than ever.

The latest My Synovus upgrades are here.

As part of our on-going effort to improve your banking experience, we just released the next round of My Synovus enhancements. Now, viewing, recognizing, and monitoring your transaction details online is easier. Plus, you can go paperless with just a couple of clicks.

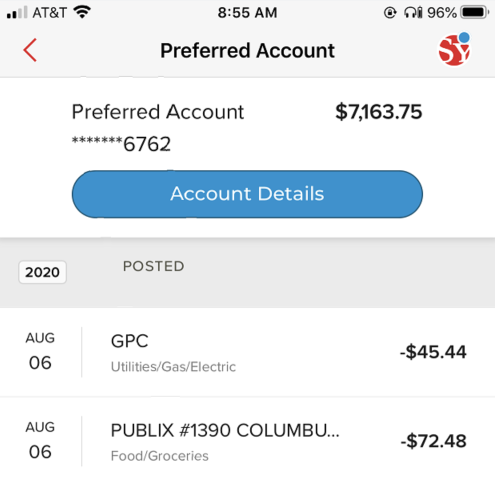

Before

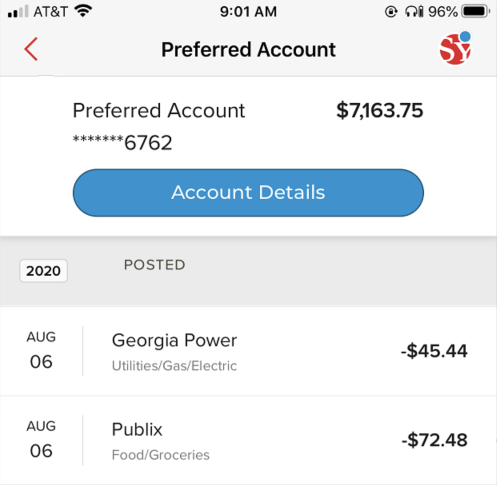

After

Easy-to-understand transaction descriptions help you...

- Quickly reconcile your account activity

- Better monitor your account for fraud

- Avoid spending time researching transactions you don’t recognize

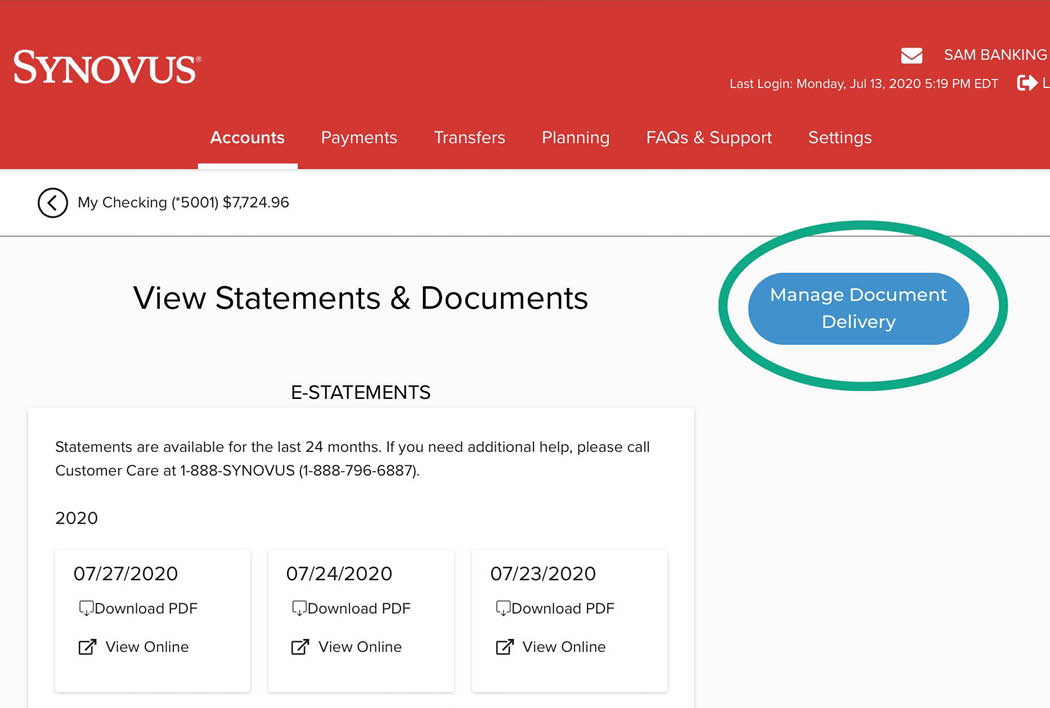

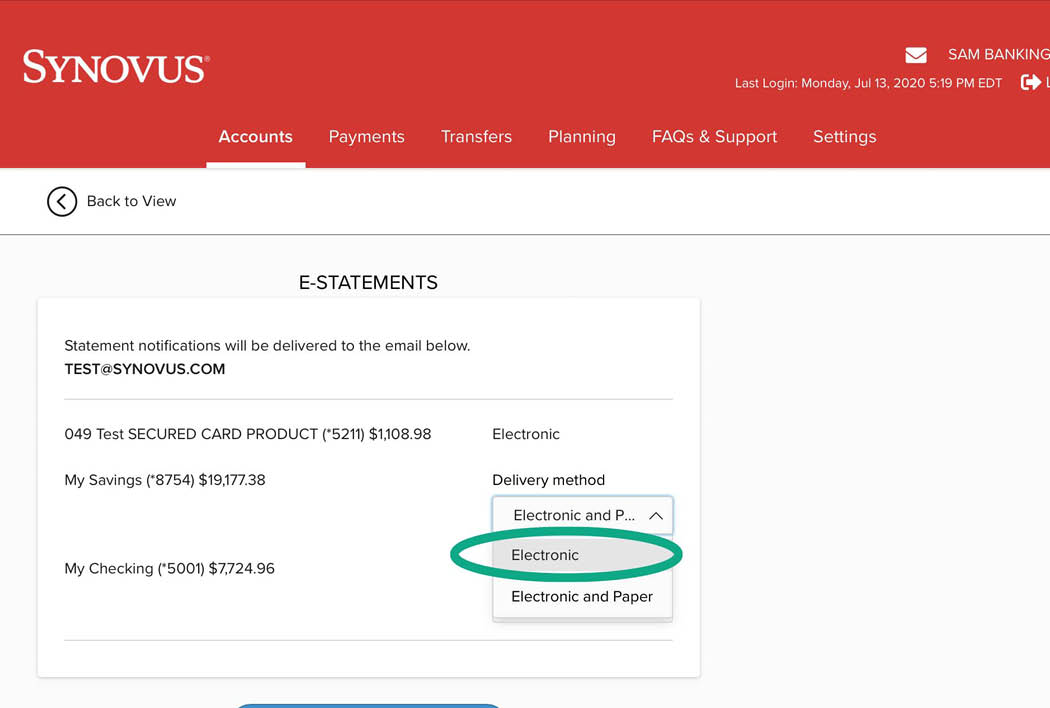

Go paperless!

It’s easy and the responsible thing to do.

Choosing to receive paperless statements will reduce the amount of paper mail you receive. You’ll have access to your documents online 24/7, and with the latest My Synovus enhancements, switching to paperless is easy. Simply turn off Paper Statements from your Statements page by selecting Manage Document Delivery. Then, select Electronic from the Account Delivery Method dropdown and click Save. That’s it!

Important Disclosure Information

Use of the My Synovus mobile app requires your mobile service provider’s data and/or text plan. Message and data rates may apply. Minimum system requirements: For mobile apps, iOS®11 and above or Android™ version 5 and above. My Synovus supports the most most recent versions of Internet Explorer, Microsoft Edge, Chrome, Firefox, and Safari and any previous versions that are still supported by Microsoft, Google, Mozilla and Apple respectively.

Your use of My Synovus online banking, mobile banking, and other account access services is governed by the My Synovus Agreement and Digital Banking Schedule of Fees and Charges.