Personal Credit Cards

Understanding Your FICO® Score

Your FICO® Score is a three-digit number calculated from the data on your credit reports at the three major consumer reporting agencies—Experian, TransUnion and Equifax.

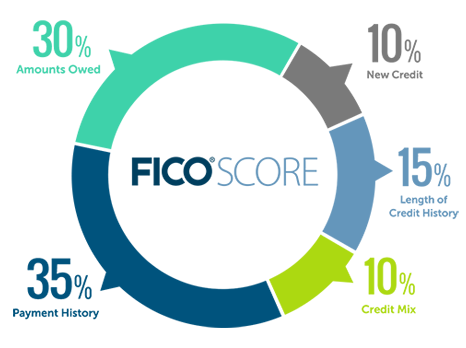

FICO® Scores are calculated from the credit data in your credit report. This data is grouped into five categories as shown here to the left.

Your FICO® Score predicts how likely you are to pay back a credit obligation as agreed. Lenders use your FICO® Score to help them quickly, consistently and objectively evaluate potential borrowers’ credit risk.

How can FICO® Scores help me?

While your FICO® Score is only one of many factors lenders consider when making a credit decision, there are a few ways your FICO® Score may benefit you.

- Get credit faster - Your FICO® Score can be delivered almost instantaneously, helping lenders speed up credit card and loan approvals.

- Unbiased credit decisions - Factors such as your gender, race, religion, nationality and marital status are not considered by a FICO® Score. When a lender uses your FICO® Score, they’re getting an evaluation of your credit history that is fair and objective.

- May save you money - A higher FICO® Score can help you qualify for better rates from lenders—generally, the higher your score, the lower your interest rate and payments.

- More credit available - Because a FICO® Score allows lenders to more accurately associate risk levels with individual borrowers, it allows lenders to offer different prices to different borrowers. Rather than making strictly “yes-no” credit decisions and offering “one-size-fits-all” credit products, lenders use a FICO® Score to approve consumers who might have been declined credit in the past. Lenders are even able to provide higher-risk borrowers with credit that they are more likely to be able to manage.

How can I access my FICO® Score?

Primary personal credit cardholders with Synovus will soon be able to opt in/out to receive their FICO® Score each month. The primary customer will be able to call 1-888-SYNOVUS to opt in for the service in late April 2020, and his/her monthly score will display on the monthly statement.

Looking for more information?

We’ve covered some of the basics here, but we encourage you to check out FICO's FAQs, or watch the videos below to learn more.

Important disclosure information

Synovus and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. Synovus and Fair Isaac do not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.