Customer Info

Thank you for choosing Synovus. Please click the dropdown symbol + for sections below to view information ranging from payments and payoffs to statements and escrow. To contact us, see the information included with each topic. To learn about the Adjustable Rate Mortgage Index change from LIBOR to SOFR, click here.

Our new online mortgage experience is here. Access and manage your mortgage account anytime, anywhere:

- See real-time account information.

- Update account information.

- Make one-time and recurring mortgage payments.

- Pay principal only, escrow payments and more.

- Set up email delivery of statements.

- View statements and statement history.

To set up your online mortgage access:

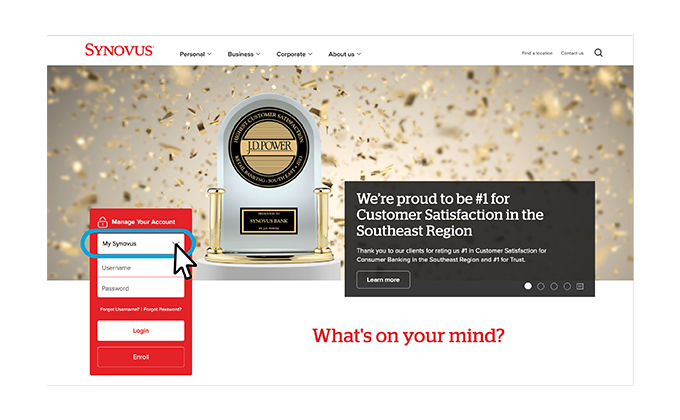

- Visit Synovus.com and click the dropdown arrow in the red box titled Manage Your Account.

- Select Mortgage.

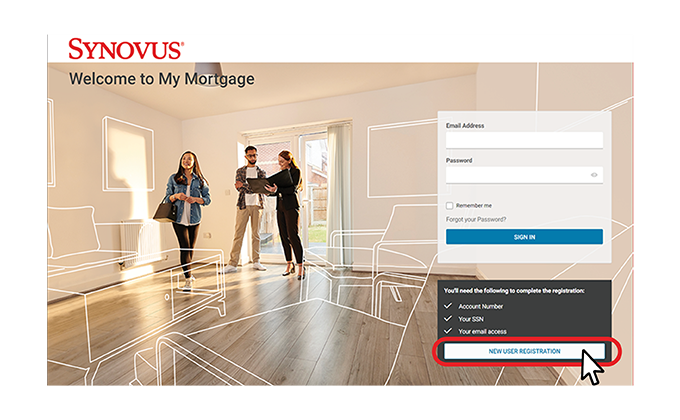

(If you already have online banking with us, note your mortgage account is separate from any accounts in My Synovus.) - On the My Mortgage screen, click New User Registration to create your account ID and password.

- View and agree to Terms & Conditions.

- Check your email to activate your account by clicking the activate button in the email.

- Then, on the My Mortgage screen, enter your email address and password and click Sign In.

- Next, enter your loan account number, zip code of the financed property, and your Social Security Account number to finalize your account registration.

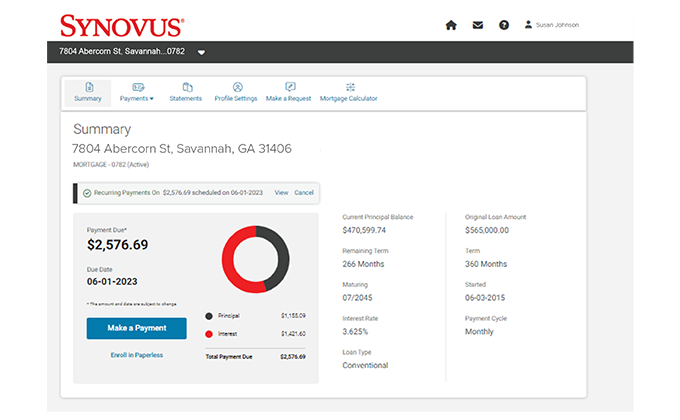

Once you have completed that information, your mortgage summary will appear.

If you have questions or need assistance, please contact Mortgage Customer Service at 1-800-803-0803 between 8:00 am and 5:00 pm CST.

Thank you for choosing Synovus.

Contact Us

-

Customer Service, General Inquiries, and Requests

Call: 1-800-803-0803

- Speak with interactive virtual assistant “Jamie” any time for general information such as next payment due, last payment received, taxes or insurance paid.

- Follow prompts to speak with a representative Monday - Friday 8:00 AM - 5:00 PM CT (Federal holidays excluded)

Mail:

Synovus

Attn: Customer Service – MS-130

800 Shades Creek Parkway

Birmingham, Alabama 35209 -

Credit Reporting Dispute

Mail:

Synovus

Attn: Customer Service – MS-130

800 Shades Creek Parkway

Birmingham, Alabama 35209 -

Mortgage Payments

Pay By Phone: 1-800-803-0803

Monday - Friday 8:00 AM - 5:00 PM CT (Federal holidays excluded)

Pay By Mail:

Synovus Bank Mortgage Payments

PO BOX 96490

Charlotte, NC 28296-0490

Pay in person at a Synovus Bank branch.

See branch hours on Synovus.com. -

Payoff Quote Inquiry

Call: 1-800-803-0803

Monday - Friday 8:00 AM - 5:00 PM CT (Federal holidays excluded)

See the Payoff section for more information about request requirements. -

Private Mortgage Insurance (PMI) cancellation

Written requests to cancel PMI can be mailed to the address below:

Synovus

Attn: Customer Service – MS-130

800 Shades Creek Parkway

Birmingham, Alabama 35209

See the Private Mortgage Insurance section for more information about cancellation requirements.

Update Borrower Info, Title Transfers and Deceased Borrowers

-

How do I request updates to borrower information?

Please call Customer Service at 1-800-803-0803 for more information about the documentation required for your specific request.

- Borrower name change (ex: due to marriage or divorce)

- Update or correct contact information

- Update or correct Social Security Number (SSN)

- Update or correct mailing address

- Consent to transfer title/assumption

- Successor-in-interest

- Notification that borrower is deceased

-

How long does it take for my name to be changed on my mortgage loan?

Your name will be changed on the loan within five (5) business days after receiving the required documentation. -

Can the title be transferred to an unrelated third party, LLC, corporation, or partnership?

No, the title generally cannot be transferred to an unrelated third party, LLC, corporation, or partnership. -

Can the title be transferred to a direct family member?

A title transfer may be requested. Call Customer Service at 1-800-803-0803 for more information. -

Can the title be transferred to a living trust?

Yes, the title can be transferred to a living trust if the borrower is the beneficiary and occupies the property. Call Customer Service at 1-800-803-0803 for more information and conditions. -

What if I've already transferred title and it's not approved by the bank?

A notice will be sent to you requesting documentation so that we may review for possible consent to the title transfer. It is important to note that without proper consent to the title transfer, the loan may be required to be paid in full or the property transferred back to the original owner.

Servicemembers Civil Relief Act SCRA

-

What is SCRA?

The Servicemembers Civil Relief Act (SCRA) expanded and improved the former Soldiers’ and Sailors’ Civil Relief Act (SSCRA). The SCRA provides a wide range of protection for individuals entering or called to active duty in the military or deployed servicemembers. It is intended to postpone or suspend certain civil obligations to enable service members to devote full attention to duty and relieve stress on the family members of those deployed servicemembers. Notify us if either you have been called to active duty, or you are the spouse or financial dependent of a person who has been called to active duty. Please contact Customer Service at 1-800-803-0803.

-

If I have questions concerning SCRA, who should I call?

To learn more about our accommodations under the SCRA, please contact Customer Service at 1-800-803-0803. Also, general information and a brief overview about the SCRA can be found on the Military OneSource website at www.militaryonesource.mil.

Note: Synovus does not provide legal advice regarding the Servicemembers Civil Relief Act.

General Information

-

How will I receive my year-end information for tax purposes and for my records?

You will receive a year-end IRS 1098 statement from Synovus showing the amount of reportable mortgage interest and mortgage insurance paid (if applicable) to Synovus. It will also show any property taxes we paid on your behalf. This statement will be mailed to you from Synovus no later than January 31. -

How can I order a verification of Mortgage (VOM)?

Please mail a written request that includes your loan number and the signatures of all borrowers on the account to the following address:

Synovus

Attn: Customer Service – MS-130

800 Shades Creek Parkway

Birmingham, Alabama 35209 - Will Synovus allow a Partial Release or Subordination of my property and if so, what is the fee?

Request received to Subordinate a Down Payment Assistant (DPA) loan /2nd Lien, partial release of property or roadway/easement must be approved. The fee is $250.00 and any expense for applicable appraisals/recording fee will also be charged in addition. Contact Customer Care at 1-800-803-0803 for details on this approval process. - If I chose to recast my loan, will there be a fee for this process?

The fee to recast is $250.00 per request. Contact Customer Care at 1-800-803-0803 for details on the approval process. - Will Synovus charge a fee to approve and process a transfer of ownership of the property to a Trust?

Yes, the fee is $250.00 if removal meets approved criteria. Contact Customer Care at 1-800-803-0803 for details on the approval process.

Payment Processing

-

How will I be billed for my mortgage payment?

You will receive a monthly statement that contains a payment coupon containing the details needed to mail a payment. -

How can I make a mortgage payment?

Pay By Phone: 1-800-803-0803

Monday - Friday 8:00 AM - 5:00 PM CT (Federal holidays excluded)

Pay By Mail:

Synovus Bank Mortgage Payments

PO BOX 96490

Charlotte, NC 28296-0490 -

How does Synovus handle automatic withdrawals?

You can set up automatic withdrawals with Synovus by calling 1-800-803-0803 or by completing the ACH Draft form. See the Monthly Automatic Drafts section below for more information. -

Can I use my credit card to make a payment?

Payments cannot be made by credit card. However, you can set up monthly payments to be automatically withdrawn from your checking or savings account. See the Monthly Automatic Drafts ACH section for more information. -

Can I send additional funds with my payment?

Yes, please notate the additional amount on your coupon to show “Additional Principal” or “Escrow Deposit”. You may also place this information in the memo section of your check. -

How can I pay off my current loan more quickly?

If your account is current, you can pay additional funds at any time and have the amount applied to your mortgage outstanding principal balance using the following methods:

- Notate the additional amount on your coupon and include coupon with mailed check.

- Notate your Account Number and “Additional Principal” in the memo of a mailed check.

- Designate on the Monthly Automatic Drafts ACH application the amount of the principal payment to be withdrawn in addition to your monthly payment. The additional principal designated will draft each month with the regular payment.

- Call 1-800-803-0803 to make a payment of additional principal. Please have your loan number, routing number, and checking or savings account number.

-

When is my mortgage payment considered late?

The due date of your monthly payment is reflected in your loan agreement and on your monthly statements. Any payment received after your grace period (reflected in your loan documents) will be assessed a late charge.

Your payment should be mailed in time to be received by us on or before your due date. Checks are processed once received; therefore, post-dated checks are not recommended.

If there is not enough time to mail your check, call 1-800-803-0803 to make a payment. Please have your loan number, routing number, and checking or savings account number ready. -

What is the late charge fee if my payment is late?

The fee charged for late payments is disclosed in your monthly statement . The amount of the late fee is usually a percentage of your total payment, a percentage of your principal and interest, or a set amount. Your loan agreement states how your late fee will be calculated. -

Can my monthly payment amount change?

Yes, your monthly payment amount could change for the following reasons:

Annual Escrow Analysis - At least once a year, we will analyze your escrow account, and if necessary, adjust the portion of your monthly payment we collect for real estate taxes, insurance, and other escrow items.

ARM Adjustment - If you have an adjustable-rate loan the interest rate, principal, and interest portion of your payment will change on a regular basis. You will receive a notice by mail regarding your initial ARM change approximately 45 to 60 days prior to the effective date of the new interest rate and payment amount. If the first ARM change is effective more than 1 year after the origination of your ARM note, you will receive an initial rate change and payment change notice within 210 to 240 days before the change date. To determine when your new principal and interest payment will become effective, please refer to your loan agreement. If you have an escrow account, the escrow portion of your payment may change also. -

I am having financial difficulties. What types of loan assistance programs are available to me?

Call Customer Service at 1-800-803-0803 for information about your options. -

My loan payment is automatically deducted from my checking account each month. If my monthly payment amount has changed, do I need to do anything to adjust the automated payment to deduct the new amount?

If you are enrolled for monthly automatic drafts (ACH), there is nothing required from you. If you have deductions setup through another bank (such as BillPay), contact that bank to adjust your deductions.

Payoff

- How do I payoff my mortgage loan? To pay your mortgage loan in full, a payoff statement is required. This statement will be prepared specific to your loan and will provide the exact amount required to pay the mortgage loan in full. The payoff statement provides the following detailed breakdown of the amounts due:

- Outstanding principal balance

- Amount of interest owed up to the effective date of the quote

- Escrow amount owed (if applicable)

- Outstanding fees owed (if applicable)

- Recording fees owed (if applicable)

- How can I order a payoff statement on my mortgage loan?

Call: 1-800-803-0803

Monday - Friday 8:00 AM - 5:00 PM CT (Federal holidays excluded)

Mail:

Synovus

Attn: Customer Service – MS-130

800 Shades Creek Parkway

Birmingham, Alabama 35209

In most instances, requests for payoff statements are processed within 24-48 hours of receipt.

If you are the borrower, you can call and request a payoff statement to be mailed to the address we have on record.

If you are the borrower and want to request a payoff by fax, please submit a signed written request with the following information to (205) 874-1432:

- Mortgage account number

- Effective date of the payoff quote (not a weekend or holiday)

- Return fax number, contact name, and contact phone number

- Designate any authorized third party (such as a title company)

If you are a third party (not on the mortgage loan) and want to request a payoff statement by fax, please submit a signed written request with the following information to (205) 874-1432:

- Signed authorization from the borrower to release payoff figures

- Mortgage account number

- Effective date of the payoff quote (not a weekend or holiday)

- Return fax number, contact name, and contact phone number.

-

My loan is paid in full, what are the next steps?

In accordance with state and other guidelines, we submit the Release of Lien to the recorder’s office in your county or parish within the specified timeline. Depending on the requirements of the applicable recorder’s office, some will mail the release information directly to you. Other recorder’s offices will mail the release information to us. Should we receive this information, we will forward it to you by mail. For further information regarding the process or timing specific to your county, please contact your local recorder’s office.

Please be sure our Customer Service department has your updated mailing address if you are moving from the property that was paid in full. -

I am a current customer. How do I refinance my loan?

The easiest way to apply for a mortgage refinance is online at Synovus.com/mortgage. Once you select a Mortgage Loan Originator (MLO) by entering your zip code or looking the MLO up by name, click “apply now”. The MLO will be notified immediately after you submit the application. Thank you for choosing Synovus.

Monthly Automatic Drafts ACH

-

How does the automatic draft (Automated Clearing House - ACH) program work?

Once you have enrolled with the ACH automatic draft program, your mortgage payment will automatically deduct from your designated checking or savings account each month. You can select when drafts are made each month on the ACH enrollment form . If no selection is made by you, drafts occur on your loan due date.

Synovus will send notification to your bank to transfer the exact amount of the mortgage payment. A record of the transaction will be included each month on your bank statement and your monthly billing statement from Synovus. If your payment increases/decreases, your ACH draft will automatically increase/decrease. -

What are the benefits of enrolling in ACH?

With this free service, you no longer write a check each month for your mortgage payment. No stamps, no envelopes, no worries, no hassle. You'll have peace of mind knowing your monthly mortgage payment was made automatically, on time, and through a secure method. -

Is there a charge for the ACH program?

There are no charges to enroll or use our ACH service.

Please be advised, however, that in the event you do not have sufficient funds in your account to cover the monthly payment amount on the transfer date, your bank may charge you an overdraft/insufficient funds fee. You should contact your bank to determine if this fee applies and the actual amount incurred.

Synovus will not be held liable or responsible for the payment of any overdraft charged or other bank fees resulting from an attempted transfer from your account containing insufficient funds.

Synovus will also assess an insufficient funds fee. You will remain liable and responsible for any monthly payments which remain unpaid from an unsuccessful attempted transfer from your account containing insufficient funds. -

How can I begin this convenient service?

It’s simple. You can:

- Call us at 1-800-803-0803 or fill out the automatic draft application/ authorization and send it via email or mail.

Please provide a voided blank check or a savings account deposit slip with the application. The application and your voided check or deposit slip gives Synovus the accurate information needed to begin the ACH service.

A confirmation letter indicating the date of the first scheduled ACH draft payment will be sent to you. Please continue to make the normal mortgage payments until you receive your confirmation letter providing you the effective ACH draft start date. -

Can I make additional principal payments and escrow deposits using the automatic draft program?

Yes, you can make additional payments using the following methods:

- Designate on the automatic draft application the amount of the principal payment to be withdrawn each month in addition to your monthly payment.

- Mail a check for the desired amount. Please include your mortgage account number and the words “additional principal” or “escrow deposit” on the memo line of your check.

- Call 1-800-803-0803 to make a payment. Please have your loan number, routing number, and checking or savings account number ready.

-

I make automatic payments using monthly automatic drafts ACH. Will you adjust my withdrawals if my mortgage payment changes over time?

If you use our automatic payment option, we will adjust your electronic withdrawal(s) to ensure your payment is made in full. -

Can I cancel the ACH service?

Yes, you may cancel the ACH service. Simply call 1-800-803-0803 or send in a written notice detailing your request to cancel. The request must be recieved at least one business day prior to the due date.

Escrow Processing

-

What is an escrow account?

When we open an escrow account for you, we pay all required escrow payments (i.e. property taxes, hazard insurance, private mortgage insurance, etc.) on your behalf using funds that accumulate in the account from monthly payments. This ensures your bills are paid in full and on time, without you having to save large amounts of money and keep track of due dates.

To determine the monthly escrow contribution required, we perform calculations to ensure that there are sufficient funds to pay your future property tax and insurance bills when they are due, while maintaining any applicable “cushion reserve”. Cushion Reserve, also commonly referred to as “minimum balance”, requirements are governed by Federal law, or by your loan agreement (security instrument) and applicable state law. The minimum balance is equal to two months of escrow payments unless state law, or your loan agreement, requires a lesser amount.

We take your annual property tax plus insurance premium expenses plus the cushion reserve and divide that amount by 12. This amount is added to your monthly mortgage payment.

We conduct an escrow analysis at least once each year to evaluate if your escrow account has an overage or a shortage and to ensure we are collecting the right amount to cover your projected taxes and insurance premiums. If these payments increase or decrease, we’ll recalculate your escrow payment, and any changes will appear on the escrow account disclosure statement we provide to you. -

What type of bills are paid out of an escrow account?

We collect funds and hold them in your escrow account to pay your real estate taxes and required insurance premiums. We do not collect funds for interim bills, homeowners association fees, non-required insurance, special or added tax assessments, or other types of non-real estate-based taxes unless they are included on real estate tax bills. We do not receive or collect for supplemental tax bills. -

What does it mean to have a “deficiency” in my escrow account?

A deficiency is the amount of a negative balance in an escrow account. This happens when a mortgage servicer (such as Synovus) has advanced funds to cover disbursements (such as property taxes, homeowners’ insurance, etc.) which cause a negative balance in the escrow account. -

What does it mean to have a “shortage” in my escrow account?

If we pay a tax or insurance bills that is more than anticipated an escrow shortage may occur. The shortage is the amount by which a current escrow account balance falls short of the target balance at the time of your escrow analysis.

If not addressed, a shortage can cause your escrow balance to fall below the minimum balance required.

Your options for resolving a shortage include:

-

Pay the shortage in full.

- A payment coupon is provided with your escrow analysis that includes the shortage amount due and the address where payments can be mailed. Please enclose the coupon with your payment.

- Call Customer Service at the number on your escrow account disclosure Statement/Escrow Analysis to make a payment.

- Pay the shortage over 12 months. We’ll automatically spread the shortage over the next 12 months and include it in your new monthly payment. No action is required if you choose this option unless you use a bill pay or third-party service to pay your mortgage. If you do, please notify your bill pay or third-party service provider of the change to your mortgage payment.

-

Pay the shortage in full.

-

Are there penalties if I do not pay my shortage in full?

No. Regardless of which option you select, you will not be charged any penalties or interest on your escrow account. -

I use a third-party bill pay service to make payments. What do I need to do if my escrow account has a shortage?

If you use an external payment program, please contact your payment administrator, and ask them to update your payment to reflect the amount on your escrow account disclosure statement/escrow analysis. -

If I pay my escrow shortage in full, why could my monthly payment still change?

Shortages result when there is an insufficient escrow account balance to cover prior account activity. Your new monthly payment amount is based on projected account activity, which reflects any increases or decreases to your taxes and/or insurance premiums. -

What does it mean to have an “overage” in my escrow account?

An escrow overage occurs when there is either additional funding placed in escrow during the annual year that is not required, or an escrowed item has decreased in premium amount. Escrow overage checks are issued, on all loans with an overage of $50 or more, within 30 calendar days of the analysis. If the overage is less than $50, Synovus has the right to apply the overage to your escrow account balance and lower the monthly escrow payments due accordingly. -

If my mortgage loan payment is going up, why did you send me an overage check?

Your new monthly payment amount is based on the most recent tax and insurance estimates we have available. The overage in your escrow account may be due to smaller than expected tax and/or insurance payments made last year. If your overage amount is $50 or more, we are required to send these funds to you rather than use them to decrease your new monthly payment calculation. -

If my escrow account review indicates an overage, can you keep the check and apply to future payments?

No, we are required to send these funds to you if the amount is $50 or more. However, you can always apply additional funds with your scheduled monthly payment. When you do so, please indicate on your payment coupon or on the memo line of your check how you would like those funds applied. -

Can I request a new escrow analysis if my insurance premium changes?

Yes, you can contact Customer Service at 1-800-803-0803 to request a mid-term escrow analysis. -

Where do I send my annual tax bills?

Mail:

Synovus

Attn: Customer Service – MS-130

800 Shades Creek Parkway

Birmingham, Alabama 35209 -

Where did you get the information regarding how much my property taxes or homeowners insurance payment will be?

We project your property tax and homeowner insurance payment amounts based on the most recent amounts from sources that may include your taxing authority, your insurance company, previous amounts paid by us or your previous mortgage company, or information provided to us when you closed your loan. -

Why did my taxes and/or insurance go up?

Explanations for increases in taxes and/or insurance are not provided to us by insurance and taxing agencies. Please contact your local taxing authority, or insurance company or agent for an explanation of any increase. -

Is a minimum balance required in my escrow account?

Minimum escrow balance requirements are governed by Federal law, or by your loan contract (security instrument) and applicable state law. These funds help to prevent the escrow account balance from being overdrawn if tax or insurance payments increase. This minimum balance is equal to two months of escrow payments unless state law or your loan contract requires a lesser amount.

Mortgage Insurance (PMI, MIP) is not included in this calculation. -

What should I do if I receive a tax bill?

A copy of your tax bill may be sent to you for reference. We will pay your required tax and insurance bills when they are due, regardless of your escrow balance. However, you may send additional funds to your escrow account at any time if you believe an escrow shortage will occur. -

I heard my property taxes and/or insurance are going up. Should I send additional funds with my shortage payment?

You may send additional funds to your escrow account at any time if you believe an escrow shortage will occur. However, we will pay your required tax and insurance bills when they are due, regardless of your escrow balance. -

What is the disbursement date for paying escrow account items such as premiums and taxes?

The disbursement date is the date on which Synovus pays an escrow item from the escrow account. Payments are made on or before the deadline/due date to avoid a penalty. - If I want to remove escrows from my monthly mortgage payment, is there a fee and what is the process?

*If your loan is 0-24 months, the fee is 0.125% of the outstanding principal balance with a maximum of $1,000.00. If your mortgage is greater than 24 months, the fee is $250.00.

*subject to meeting additional requirements for escrow removal.

Please contact Customer Care at 1-800-803-0803 for more details about this type of request.

Private Mortgage Insurance

-

What is the difference between Private Mortgage Insurance (PMI) and Mortgage Insurance Premium (MIP)?

PMI and MIP are both types of mortgage insurance. PMI is provided by a private sector company, while MIP is guaranteed by the Federal Housing Administration (FHA).

Whether you have PMI or MIP depends on the type of loan. If you have an FHA loan, you have a MIP. If you do not have an FHA loan and you put less than 20% down on your home, you have PMI. -

Can Private Mortgage Insurance (PMI) be cancelled?

The Homeowners Protection Act gives borrowers the right to request cancellation of mortgage insurance when you have reached the date the principal balance of your mortgage is scheduled to reach 80% of the original value of your home. You can also make this request earlier if you have made additional payments to reduce the principal balance to 80% of the original value of your home. Criteria you must meet if you want to cancel mortgage insurance:

- Request must be in writing

- Loan must be current

- Must not have had any 30-day late payments within the past 12 months

- Must not have had any 60-day late payments within the past 24 months

- An appraisal must be ordered to confirm the value of the property has not declined below the value of the home at the time you closed your loan. All appraisals ordered for the purpose of terminating PMI must be ordered by and delivered directly to the lender and are paid by the borrower.

Otherwise, PMI will automatically cancel when your balance reaches 78% (based on your original amortization schedule) LTV, if you’re current on your loan. -

Can Mortgage Insurance Premium (MIP) be cancelled?

MIP may be cancelled when your loan meets certain criteria, depending on when you either closed on your loan or applied for it.

- Closed July 1991 thru December 2000: You will have MIP for as long as you have the loan.

- Applied January 2001 thru June 2013: MIP will be removed when you reach 78% loan-to-value (LTV) and have paid the premiums for at least five (5) years.

- Applied after June 2013: If your original loan amount was less than 90% LTV, MIP will be removed after 11 years. If the loan amount was 90% LTV or more, you will have MIP for as long as you have the loan.

Insurance

-

What type of insurance do I need?

The terms of your mortgage require enough insurance to cover at least 100% of the estimated replacement cost for your home and any improvements to your property.

Your mortgage may require you to maintain one or more insurance policies, including:

- Homeowners insurance. Also referred to as hazard or fire insurance, this type of insurance provides protection in case of fire or other common disasters. Your homeowners insurance may also cover the contents of your home and provide personal liability coverage.

- Wind insurance. You need to insure your home against damage from wind and/or hail. These risks may be covered under your homeowners insurance policy or may require a separate wind policy, depending on the insurance provider you choose.

- Flood insurance. Federal law requires flood insurance for mortgaged properties located in special flood hazard areas, which are identified on flood maps produced by the Federal Emergency Management Agency (FEMA). If you choose to not maintain flood insurance on a structure, and it floods, you are responsible for all flood losses relating to that structure. Below are links that will provide helpful information to you regarding flood insurance:

In the event a notice of cancellation is received from your insurance provider, or if the insurance you provide does not meet the requirements of Synovus, we may secure limited lender-placed insurance coverage at your expense. You will probably pay higher premiums for less coverage than you would for insurance, which you can buy from the company or agent of your choice.

Insurance required by your loan agreement may not be enough to protect you financially. Ask your insurance agent if you have enough coverage to protect you from personal liability for accidents that occur on your property, and to replace your personal property if it's damaged, destroyed, or stolen. -

Why does Synovus require at least 100% replacement cost coverage?

As your lender, Synovus has a financial interest in the property, just like you do. We need to make sure that the home can be repaired or rebuilt if something happens to it. Replacement cost coverage ensures your home can be repaired to the original condition. -

Which insurance carrier may I use?

You can use the carrier of your choice. The insurer must be rated by the A.M. Best Company, as having a B or better general policyholder’s rating and a financial class size of at least III or a Demotech, Inc., minimum rating of A. -

What is the Insurance Mortgagee Clause?

A mortgagee clause ensures that the insurance company will pay Synovus if your mortgaged property is lost or damaged. The policy must contain a standard mortgagee clause in favor of Synovus Bank. The lender’s name, address and borrower’s loan number must appear on the policy exactly as the clause shown below:

Synovus Bank, ISAOA / ATIMA

Loan #

PO BOX 2033

Kennesaw, GA 30156 -

What name should be on my Hazard/Homeowners Insurance Policy?

The policy must show name(s) of insured identical to those shown on the loan agreement, and a property address corresponding to that shown on Synovus Mortgage records. -

What steps do I take when my property is damaged?

First, contact your insurance agent immediately and file a claim. You should also contact our Customer Service team at 1-800-803-0803 to notify us of the damages.

Note: Claim settlement checks include the lender as payee. The lender must endorse these checks before you negotiate them. -

I have received an insurance bill or cancellation notice, and I have an escrow account with Synovus. What should I do?

Please call Customer Service at 1-800-803-0803 to determine why you are receiving notices from your insurance company. -

I can't afford my insurance premium. What should I do?

If your insurance is not included in your monthly mortgage payment and you are unable to pay the premium, please call Customer Service at 1-800-803-0803 before your coverage expires, so we can discuss options for paying the premium on your behalf. Any amount that we advance on your behalf will be added to your future monthly mortgage payments. -

How can I cancel my Private Mortgage Insurance (PMI)?

Written requests to cancel PMI can be mailed.

Mail:

Synovus

Attn: Customer Service – MS-130

800 Shades Creek Parkway

Birmingham, Alabama 35209 -

Can I just let my policy lapse and get a new one later to save money?

In the event a notice of cancellation is received from your insurance provider, or if the insurance you provide does not meet the requirements of Synovus, your loan servicer may secure limited lender-placed insurance coverage at your expense. You will probably pay higher premiums for less coverage than you would for insurance which you can buy from the company or agent of your choice. -

What is Lender-Placed Insurance?

Lender-placed insurance is insurance coverage obtained by your loan servicer and covers only the structure.

The insurance may cover flood, fire hazard or wind. Personal liability or coverage of contents of your home (personal property) is not provided. The cost for lender-place insurance will be charged to you. To minimize the cost of insurance to you and to maximize the type and amount of coverage for your property, it is recommended that you secure your own insurance coverage from the company or agent of your choice. Unearned premiums on lender-placed insurance will be refunded to your when you provide evidence of acceptable insurance. -

Will Synovus purchase lender-placed insurance without my knowledge?

No. If we find a problem with your insurance, we'll send you multiple letters with information about next steps -

How will I be billed for lender-placed insurance?

If Synovus purchases lender-placed insurance on your behalf, we will adjust your monthly mortgage payments to cover the cost of the premium we advanced. -

Can I cancel lender-placed insurance?

Yes. When you provide proof of acceptable coverage, Synovus will cancel the lender-placed policy and charge you only for the time it was in place. -

Can my monthly payment amount change?

Yes, your monthly payment amount could change for the following reasons:

Annual Escrow Analysis - At least once a year, we will analyze your escrow account, and if necessary, adjust the portion of your monthly payment we collect for real estate taxes, insurance, and other escrow items.

ARM Adjustment - If you have an adjustable-rate loan the interest rate, principal, and interest portion of your payment will change on a regular basis. You will receive a notice by mail regarding your initial ARM change approximately 45 and 60 days prior to the effective date of the new interest rate and payment amount. If the first ARM change is effective more than 1 year after the origination of your ARM note, you will receive an initial rate change and payment change notice within 210 and 240 days before the change date. To determine when your new principal and interest payment will become effective, please refer to your loan agreement. If you have an escrow account, the escrow portion of your payment may change also.

Statements and 1098/1099’s

-

How will I receive my year-end information for tax purposes and for my tax records?

You will recieve a year-end IRS 1098 statement from Synovus showing the amount of reportable mortgage interest and insurance paid (if applicable) to Synovus. It will also show any property taxes we paid on your behalf. This statement will be mailed to you from Synovus no later than January 31. -

When will my mortgage statement be mailed to me?

Mortgage Statements are mailed monthly. -

How do I obtain copies of my mortgage statement or 1098/1099?

For copies, please contact Customer Care at 1-800-803-0803.

Adjustable-Rate Mortgages

-

How is the interest rate calculated on an ARM loan?

The calculated interest rates for ARMs are based on an index rate plus a margin. ARM loans typically calculate the interest rate on adjustment by adding a margin to a specific published index. Published indexes may include the weekly one-year Treasury bill, the London Interbank Offered Rate (LIBOR) until it is discontinued on 6/30/23, or the Secured Overnight Financing Rate (SOFR). Changes in the index may cause changes in your interest rate. The margin that will be added to that index rate is stated in the ARM note. -

What is the ARM adjustment period?

The period between rate changes is called the adjustment period. With most ARMs, the interest rate and monthly payment change every month, quarter, year, 3 years, or 5 years. -

What is an interest rate cap?

An interest rate cap limits the amount your interest rate can change at each adjustment. There can be two types of caps:

- Periodic change cap limits the amount the rate may increase or decrease at each change.

- Life of loan cap specifies the highest or lowest that your interest rate can be over the life of the loan.

-

Can I convert my loan from an ARM to a fixed rate loan?

If your loan documents state that you have a “fixed rate conversion option” at the top of your adjustable-rate note, you may be eligible to convert your rate. You may request information on the conversion procedure by contacting Customer Service at 1-800-803-0803. If your loan documents do not allow this option, please contact us about refinancing to a fixed rate. -

Where can I find more information about ARM loans?

Call Customer Service at 1-800-803-0803 regarding your adjustable-rate mortgage, or refer to your loan agreement.

Mortgage Servicing Transfers

-

If my lender sells or transfers the servicing of my loan, what does that mean?

When the servicing of a loan is sold, it means that another lender will be taking your payments and handling your escrow account. The original terms and conditions of your mortgage loan will remain the same. You will receive a goodbye letter from Synovus outlining the details of your transfer. -

Why was the servicing of my mortgage sold or transferred? Does my lender have the right to sell or transfer my loan to an investor?

The practice of selling or transferring loans is very common in the mortgage industry. Lenders may keep your loan in their portfolio, or they may sell or transfer the servicing of your loan to an investor.

Be assured the terms of your loan will remain the same. When a loan is transferred, you will be notified by the selling company 15 days prior to the transfer and by the purchasing company within 15 days of the transfer date. -

What are the names of some investors that my loan might be sold to?

Fannie Mae and Freddie Mac are two of the largest investors in the country that purchase mortgage loans.