Cross Border: Should You Consider Crypto B2B Payments?

Cryptocurrency is gaining traction as a payment option. More than 15,000 businesses now accept Bitcoin, including 2,300 in the U.S.1 Whole Foods, Microsoft, Starbucks, The Home Depot, Etsy, and major restaurant chains like Subway and KFC are among large corporations that accept Bitcoin either directly or through a third party.

Multinational companies are already using crypto for B2B payments.

According to a recent survey, 44% of corporate respondents are also using crypto for B2B payments, including cross border.2 Ninety percent of the participants said they use the digital currency for cross-border payments, while 65% use it for vendor remittances.3 Cross-border B2B payments are expected to reach over $56 trillion by 2030.4

Global demand for goods and services is driving the need for increasingly diverse payment methods. With its inherent speed, security, and transparency, crypto offers a simple means for businesses to accept and send payments faster and more cost-effectively. Ninety percent of survey respondents saw “simplifying cross-border payments” as cryptocurrency’s main benefit. Transaction speed (75%) and enhanced security (64%) were other perceived benefits.5

Crypto is a fast, secure payment option.

Details of every crypto transfer or transaction is validated and recorded on a decentralized ledger — called a “blockchain” — that stores information. While the data can be publicly viewed, this method of recording transactions doesn’t allow single entities to manipulate or control the data. Online crypto transactions are secure and make counterfeiting nearly impossible.

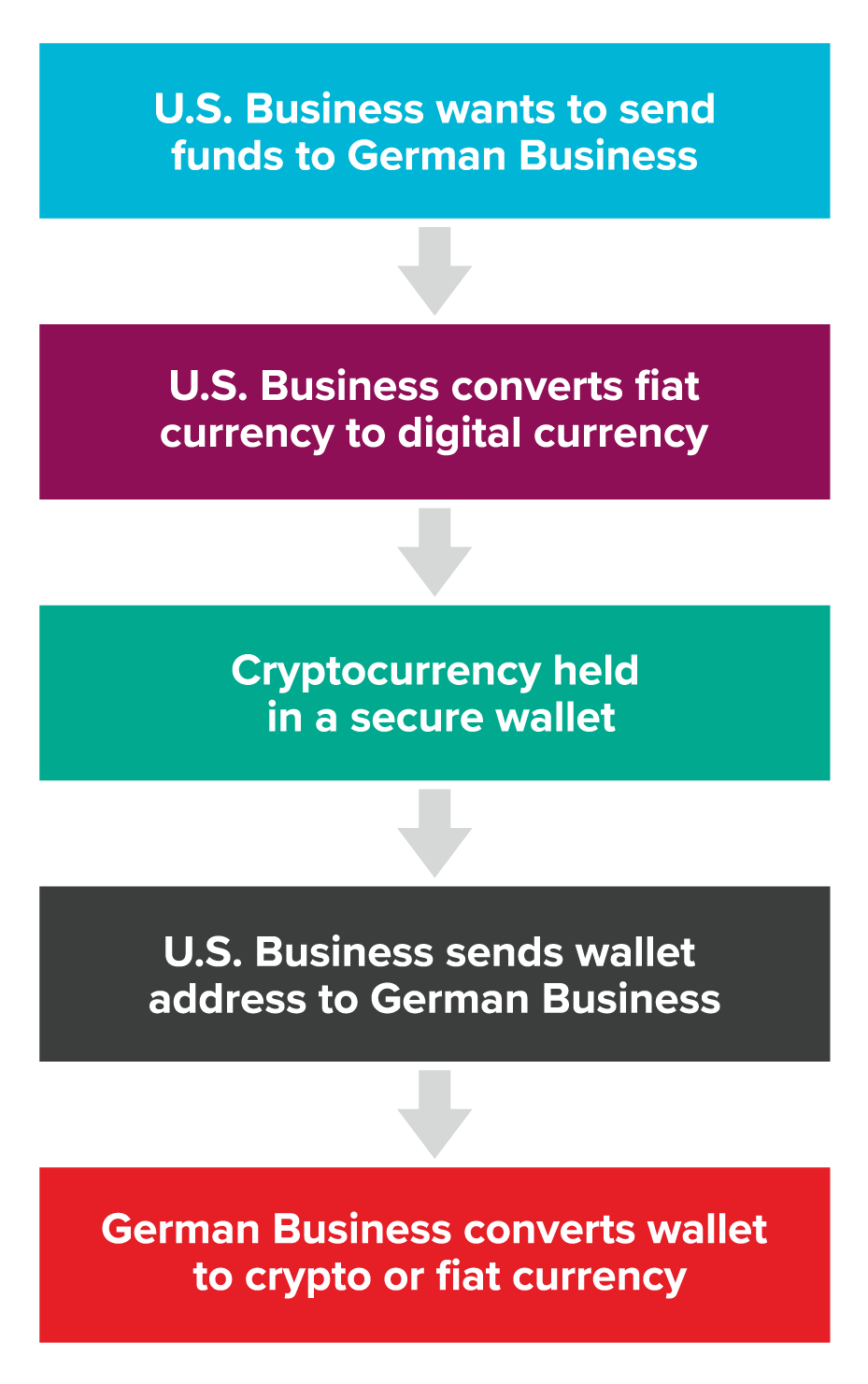

Figure 1 is an example of how a U.S.-based corporation would use crypto to make B2B payments to a company in Germany.

Figure 1

As global adoption continues, it’s clear crypto has the potential to become a major B2B payment solution. Acceptance of the currency (82%) and the desire to better control fluctuating currency rates (52%) was the reason most of the corporate survey participants switched from traditional B2B payments to crypto.6

Mainstream crypto adoption is still an uphill battle.

For all the promise crypto offers, there are still barriers to global adoption, including regulations, technology and scalability.

- Regulatory

Fraud and recent crypto business collapses further complicate attempts to globally regulate the digital currency. Each country sets standards, including how crypto is categorized (i.e., legal tender), and some are more restrictive than others. For example, China completely banned crypto due to perceived financial stability and fraud risks, as well as energy use. Canada, the UK, Switzerland and El Salvador have much more open views and have adopted policies to further stabilize and integrate cryptocurrencies into their financial systems. The United States reached a major milestone in 2024, approving Bitcoin ETFs, but still believes further oversight is needed to protect investors and users. - Technology

The blockchain is a progressive technology with tremendous potential as a foundation for unified transactions across multiple financial systems. However, the glut of decentralized networks, applications and platforms make reaching that goal challenging as it would require standardization. - Scalability

The goal of every cryptocurrency exchange is to increase usage. Each exchange processes at different speeds – some faster than others. That said, bringing together disparate platforms, methodologies, currencies and users would increase volume, affecting performance and speed.

Even with the obstacles it presents, governments, businesses and consumers recognize that cryptocurrency offers opportunities to further diversify payment options.

Is cryptocurrency the right B2B payment solution for you?

Cryptocurrency is a dynamic, intriguing technology. But whether it’s a good choice depends on your organization’s objectives. Corporations that are considering crypto as a payment option, including cross border, should track its developments and carefully weigh the rewards and risks.

PROS

Doesn't require expensive, complex technology or hardware.

To begin exchanging cryptocurrency, all that’s needed is an internet-connected computer or mobile device. POS hardware or a plugin, or other software to process crypto payments in your physical location, or online e-commerce platform is required to accept crypto as payment. If your business plans to hold and store any cryptocurrency, you'll also need a crypto wallet.

Lower transaction fees.

Corporations often complain about high credit card processing fees. Ranging from just over one percent (1.15%) to just over three percent (3.3%) in 2023, fees can be substantial.7 Cryptocurrency exchanges process, convert and hold digital currency for individuals or businesses at flat or other fees that are usually less than one percent. Straight peer-to-peer transactions, with no third party, involve no fees.

Prevents chargebacks.

Global chargeback volume is expected to total 337 million by 2026.8 There's no third-party in crypto transactions, so transactions are irreversible and only the party receiving the funds can request a refund.

CONS

It’s extremely volatile.

Cryptocurrency value is based on market demand. Because of its relative newness and minimal regulation, value can be highly volatile — worth $750 or $19,000 in one year, depending on when it was purchased — versus fiat currency. This instability can be risky for businesses and can make pricing goods and returns tricky. In addition, crypto is currently treated like stock, so any appreciation is subject to capital gains taxes.

Crypto exchanges are vulnerable to hackers.

Transaction records in the blockchain are impenetrable, but cryptocurrency exchanges, where coins are converted and stored, can be hacked. Criminals can also infiltrate wallets and steal coins if they know a user's private key. Unlike traditional currency, crypto balances are not FDIC-insured, so the government isn’t obligated to assist in reclaiming your losses.

Currency conversion costs might be prohibitive.

It's true cryptocurrency offers significant savings in fees as compared to card processing. But crypto carries currency-conversion fees cross border. For companies that choose to convert coins to fiat currency, high conversion rates could negate any savings from lower card processing fees.

Digital currencies and the blockchain make moving funds much faster. But with opportunity comes risk. Be sure you have the right solutions for seamless, secure payments.

If you'd like to learn more about integrating cryptocurrencies into B2B payment solutions, simply complete a short form and a Synovus Treasury & Payment Solutions Consultant will contact you with more details. You can also stop by one of our local branches.

Payments

Modernizing Government Payments with Digital Solutions

Payments

Intelligent Automation Supercharges Straight-through Processing

Payments

How to Reduce Foreign Exchange Risk and Costs

-

Expert Financial Strategies for Public Schools and Colleges Facing Rising Costs and Enrollment Declines

Is your institution facing declining enrollment? These financial strategies for public schools and colleges will help address rising costs and intense competition for students.

-

Interest Rates News: First Quarter 2026

See the most recent FOMC rate developments for Q1 2026, including key forecasts and practical borrowing strategies. Explore how adjustments in interest rates can affect your loans, mortgage options and overall business expansion plans.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- Crypto.com, “Who Accepts Bitcoin Payments in 2024?” Back

- GoodFirms, “Cryptocurrency Adoption in B2B Payments: GoodFirms Survey,” September 9, 2024 Back

- Ibid Back

- Statista, “Value of Total Cross-Border Payments Market Worldwide in 2023, With a Forecast for 2030,” November 28, 2023 Back

- GoodFirms, “Cryptocurrency Adoption in B2B Payments: GoodFirms Survey,” September 9, 2024 Back

- Ibid Back

- WalletHub, “Average Credit Card Processing Fees,” June 5, 2024 Back

- Mastercard, “Chargeback Trends and Outlook: 2023 Report” Back