Business Resilience Guide: Effective Continuity Planning to Mitigate Disruptions

“Expect the unexpected” is a phrase you often hear. But with enterprises facing such business disruptors as natural disasters, cyberattacks, network or production downtimes, the best advice is “expect and prepare for the unexpected.”

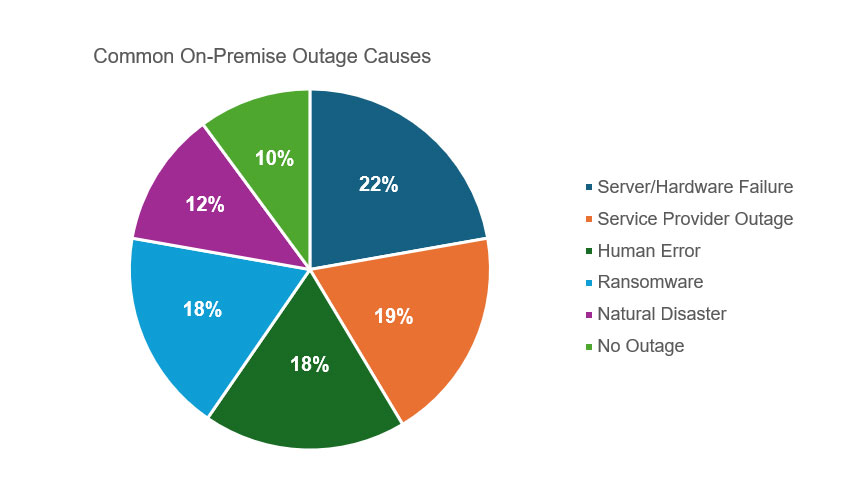

Nine out of 10 organizations experienced operational downtime or outages over the past twelve months. What is the cost of an outage? For large corporations it was as high as $27,750 per minute or more than $1.4 million per hour in 2024.1

Outages from human error, as well as server and hardware failure, may be preventable with training and early detection, respectively. But whatever the potential disruptors may be, you simply can’t afford to ignore the risk of downtime and subsequent lost revenue due to lack of continuity planning.

Prevention is key. Preparing for these occurrences requires a comprehensive business continuity plan that assesses risks, outlines response strategies, ensures timely recovery and maintains business resilience.

Ask questions and set clear objectives during continuity planning.

A business continuity plan (BCP) that mitigates the impacts of an emergency is critical. If you have an existing BCP, you should review it each year to ensure it addresses evolving risks. Five key steps will aid in drafting a plan for recovery from disruptions of any kind.

- EVALUATE. Determine how a disruption would affect operations and stakeholders, including employees, customers, shareholders and vendors. Start with basic, but relevant questions when continuity planning.

- How will we manage operations if critical systems are down?

- Depending on the emergency, which departments and employees should be part of the recovery team(s)?

- Do we have adequate staff to support company needs now and near term?

- Do we have enough supplies or inventory to meet customer needs?

- Can partners provide the support needed to swiftly ramp up operations? If we don’t have partners, can we identify and engage them in future incident responses?

- How can we adapt to any lingering effects of this or subsequent crises to increase business resilience?

- PROTECT. Fraud prevention is imperative for safeguarding corporate assets. Cyberattacks, particularly ransomware, can completely shut down operations and leave companies without access to systems and data. Build a strong security posture, applying the tools necessary to protect your networks, communications, e-commerce, banking and other systems. Even organizations experiencing disruptions unrelated to security are susceptible to fraudsters who continually seek to exploit any vulnerabilities they can find. When continuity planning, be aware of fraud schemes so you can prevent further damage and increase business resilience.

Securing access to banking systems, enabling uninterrupted payment workflows and strengthening monetary fraud controls is a critical component of continuity planning that ensures operational resilience. Evaluate current financial protocols, identify vulnerabilities and implement safeguards to support uninterrupted financial operations during times of crisis.

- Set up systems to automatically back up your data at regular intervals to reduce the risk of human error.

- Standardize procedures across all departments to ensure clean data is available for quick restoration.

- Choose cloud services with strong security measures to protect sensitive information and prevent unauthorized access.

- Ensure that your backup systems allow remote access so employees can retrieve necessary data even while working offsite.

- INSURE. Insurance helps shield corporations from the financial fallout of unforeseen incidents, providing a safety net to absorb losses. Cybersecurity insurance, for example, offers targeted protection against digital vulnerabilities such as data breaches and ransomware attacks. Comprehensive coverage supports not only the restoration of critical systems but also addresses fraud-related losses so organizations can focus on rebuilding without being overwhelmed by financial setbacks.

- CAPITALIZE. Timely access to capital is essential when managing through a crisis. Carefully manage cash flow so adequate funds are available to continue operations. What are simple liquidity management strategies to increase business resilience?

- Cut costs and expenses.

Reducing expenses can help to preserve capital. From operating overhead to shipping, during continuity planning take a hard look at fixed versus variable costs to determine what can be eliminated. Identify line items that will make a significant impact, as well as low-hanging fruit.

- Prioritize and negotiate payables as needed.

Depending on cash reserves, it might be necessary to reprioritize invoice payments during a crisis. Call vendors to discuss interim payment arrangements.

- Step up receivables.

Accelerating payments brings in much-needed cash faster. Calculate and promptly collect receivables. Can you shorten terms or offer discounts for early payment? Bear in mind, you may be asked to extend the same considerations to your customers as you’re asking vendors to extend to you.

It’s important to know when and how much you’ll be paid to maintain business resilience. Contact customers to ask about their ability to pay. You should also ask your financial institution about tools that can help securely expedite receivables and manage payables during continuity planning.

- Identify viable funding options.

Understand your liquidity and how much you’ll require to move forward, both short- and long-term. Call your lenders to reevaluate your credit risk and understand the financing options — loans, lines of credit, etc. — available to you. If taking a loan isn’t possible, seek investors or sell shares.

- Cut costs and expenses.

Nine out of 10 organizations experienced operational downtime or outages over the past twelve months.1

- INNOVATE. Challenges often present opportunities. Did you change course during a previous emergency? Would that approach work again or spur further creative approaches to increase business resilience? Continue to explore.

- Is there now or will there be pent-up demand for your product and services after working through this disruption?

- How has your customer base changed?

- What interim products or services can you offer?

- Are there alternative delivery methods you can use?

- Would partnerships with other companies or suppliers help to expand your distribution network if needed?

After assessing your operational needs and goals, write or update the BCP.

A comprehensive BCP helps mitigate risks, safeguard assets and increase consumer trust. Including key components in business continuity planning ensures you meet critical objectives.

- Risk Assessment and Business Impact Analysis

The plan must define potential risks, such as natural disasters, power outages, cyber threats or health crises that could disrupt operations and reduce business resilience. A business impact analysis (BIA) identifies critical business functions, their dependencies and the consequences of downtime. The BIA reveals the vulnerabilities within the organization and the cost implications of disruptions to guide prioritization in continuity planning.

- Recovery Objectives

Define the maximum allowable downtime for business operations and establish the acceptable amount of data loss during a disruption to minimize impact.

- Resource Allocation

List the resources needed to maintain operations and business resilience during disruptions, including equipment, facilities, personnel and financial reserves. Specify the roles of individuals or teams responsible for implementing the BCP. This may include assigning a crisis management team to oversee response and recovery efforts.

- Emergency Response Procedures

Include procedures for responding to immediate emergencies, such as evacuations, physical safety measures, and containment efforts for incidents like fires or cyber breaches.

- Regular Training and Awareness Programs

Conduct training sessions to familiarize employees with the BCP. Regular practice drills, emergency response exercises and role-specific training ensure readiness.

- Communication Plan

During disruptions, keep employees informed about protocols, providing clear instructions and contact details for key personnel. Also outline communication strategies for clients, stakeholders, suppliers and the media during continuity planning. Transparency and timely updates during crises can preserve reputation and trust, while increasing business resilience.

- Data Backup and IT Continuity

Set a schedule to regularly back up data to secure offsite or cloud-based locations so it is recoverable during system failures. Include strategies to maintain critical IT infrastructure, such as network redundancy, alternate systems and cybersecurity protocols.

- Business Continuity Strategies

Identify backup locations and remote work arrangements for essential operations if primary facilities become inaccessible. Develop contingency strategies for suppliers or partners to ensure uninterrupted operations and business resilience.

- Maintenance and Testing

Continuously revise the BCP to account for evolving risks and business changes. Perform regular tests of the continuity plan, such as simulations or tabletop exercises, to identify gaps and improve efficacy.

- Legal and Regulatory Compliance

Ensure that the BCP satisfies industry regulations, legal requirements, and standards such as ISO 22301 for business continuity management systems.

Effective continuity planning increases business resilience.

A comprehensive BCP prepares corporations for unforeseen challenges. The BCP safeguards operations, protects critical infrastructure and ensures compliance with legal and regulatory standards.

If you’d like to learn more about continuity planning, complete a short form and a Synovus Treasury & Payment Solutions Consultant will contact you with more details. You can also stop by one of our local branches.

Operations

How to Ensure Resilient Financial Operations During Crises

Operations

Unlocking Revenue Growth with Data-Driven Decision-making

Operations

Techniques for Increasing Supply Chain Resilience

-

Behind the Deal: The Rising Fraud Threat in Mergers and Acquisitions

Protect your business from M&A fraud in 2026 with expert advice, strong response plans, and best practices for secure, trustworthy deals.

-

Expert Financial Strategies for Public Schools and Colleges Facing Rising Costs and Enrollment Declines

Is your institution facing declining enrollment? These financial strategies for public schools and colleges will help address rising costs and intense competition for students.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- Enterprise Management Associates, Inc./Big Panda, “IT Outages: 2024 Costs and Containment,” April 2024 Back