Consumer Confidence Down, Prices and Interest Rates Up

How consumers feel about economic conditions influences buying behavior, especially how much they are willing to spend for goods and services. Shifts in this measurement (known as consumer confidence) dramatically impact businesses, especially those selling directly to consumers. In December 2023, private consumer spending accounted for 68% of GDP.1

Is consumer confidence up or down?

The short answer is that consumers are pessimistic. The Conference Board’s Consumer Confidence Index fell to 106.7 in January 2024 after three months of increases. The Present Situation Index followed suit, falling to 147.2 and the Expectations Index dropped to 79.8.2 Each index represents consumer views of varying cross-sections of the economy.

- The Consumer Confidence Index examines how consumers view inflation, stock prices and interest rates, as well as purchase intent and vacation plans.

- The Present Situation Index illustrates how consumers rate their household financial outlook relative to current business and labor conditions.

- The Expectations Index measures whether consumers believe income, business and labor will improve in the next six months.

The indices are based on responses to The Conference Board’s Consumer Confidence Survey® which polls 36 million consumers each month.

Higher prices and interest rates, as well as global instability worries consumers.

The Federal Reserves’ efforts to lower inflation seem to be working but are, unfortunately, driving up interest rates, an action that isn’t favorable to consumers. Typically, consumers put off borrowing for homes, renovations and cars during high-interest rate periods.

As they witness continuing global and political unrest, consumers are uneasy about its impact on businesses and the overall economy. According to The Conference Board, consumers who believe business conditions are better is only 21.2% which isn’t much higher than the 17.1% who rated them as “bad.” Only 14.8% expect conditions to improve in the next six months. Conversely, 41.3% said jobs are plentiful but only 17.3% expect opportunities to increase.3

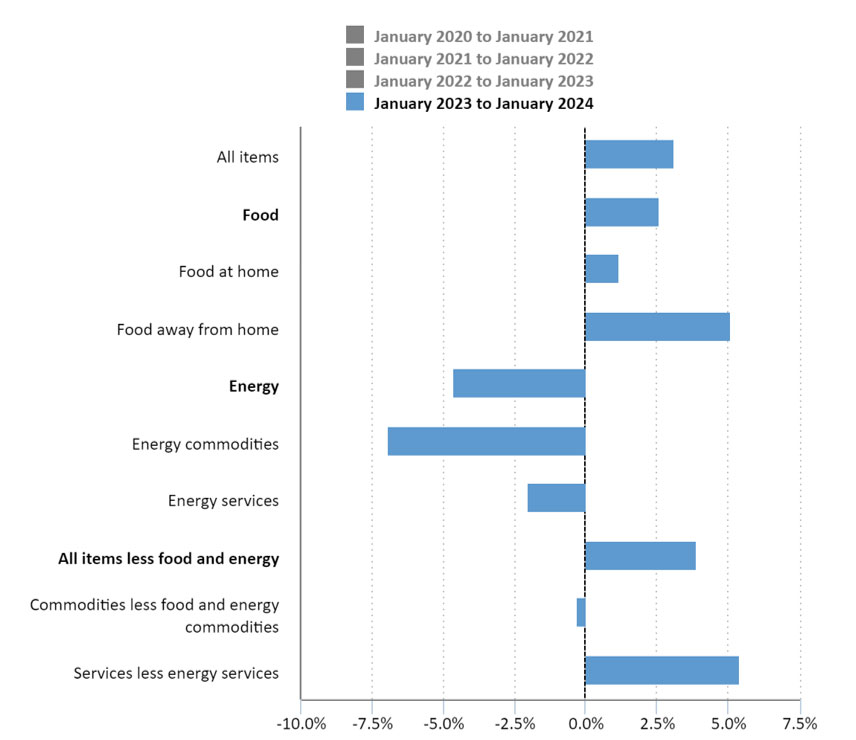

Naturally, these views influence consumer spending. When comparing their present economic conditions to future expectations, consumers aren’t optimistic. Only 16.9% think their incomes will rise.4 However, the Consumer Price Index (CPI) for everyday essentials is steadily increasing. Over the 12-month period since January 2023, the CPI rose 3.1%.5

The higher costs of essentials are very concerning to consumers. According to a Gallup poll, 63% said they believe high prices are creating financial hardships for their households.6

Consumers are cost cutting to beat higher prices.

Buying behavior among consumers is changing. While many enjoyed splurging on holiday gifts, some are still feeling the pinch from inflation and expect costs to continue rising this year. They could be right. Chief Economist Mark Zandi, Moody’s Analytics, estimated consumers spent $734 more per month last year than two years ago.7

Uncertain of the nation’s economic stability, consumers are adapting their spending habits to combat higher prices. According to a recent McKinsey survey, they are prioritizing essentials like fresh produce and non-alcoholic beverages over semi-discretionary and discretionary items. For example, 55% will spend less on toys but 33% will spend more on baby supplies.8

Consumers realize they’ll need to make concessions to get the things they need. Compromises among the 77% of respondents who traded down in the last few months include changing brands or retailers, adjusting quantities or delaying purchases until later.

Although consumers are focused on cost cutting to ensure they have adequate resources to purchase essentials, it doesn’t mean they won’t spend on non-essential items. In fact, the McKinsey study revealed some plan to spend the same or even more than before in some categories like pet care (81%).

Consumer credit card debt is increasing.

Credit cards are the preferred consumer payment method. As living expenses increase, so does credit card usage and debt. How bad is consumer credit card debt? Even with a median interest rate of 21%, consumers drove the average credit card balance to an all-time high of $6,360 in 2023.9 This card spending wasn’t for luxuries however. When faced with expenses they’re unable to pay, 20% of consumers said they’ll use available credit card balances.10

“Buy Now, Pay Later” (BNPL) is another payment option that is increasing in popularity. For example, BNPL to pay for gifts during the 2023 holidays increased 14% from the previous year. Insider Intelligence/eMarketer predicts BNPL transaction value in the U.S. will increase from $80.8 billion in 2024 to $124.8 billion in 2027.11

Even with higher expenses, consumers will still reward themselves.

After extended periods of isolation during the pandemic, consumers began placing higher value on experiences than material things. When social restrictions eased, they traveled to see loved ones and friends, as well as to enjoy family leisure time together.

Costs are increasing in almost every spending category, but consumers still long for satisfying experiences. Some find fitness and outdoor activities, entertainment and travel rewarding. These consumers won’t let high prices keep them from splurging. Categories where spending will increase or remain the same include:12

- Fitness and wellness (84%)

- Entertainment/activities

- At home (79%)

- Sports and outdoor equipment (69%)

- Home improvement and gardening (69%)

- Entertainment away from home (67%)

- Personal care services (76%)

- Travel

- Cruises (69%)

- International flights (69%)

- Domestic flights (67%)

- Short-term apartment or house rentals (66%)

- Hotel/resort stays (63%)

- Dining

- Meals at quick-service restaurants or takeout (67%)

- Meals at sit-down restaurants (66%)

- Food delivery from an app (63%)

Consumers are indeed adapting buying behaviors to better align with household income. But that doesn’t mean they won’t enjoy themselves.

Consumers expect businesses to provide more value when raising prices.

The rising cost of goods is causing shoppers to examine the value of their purchases. Factors like package and serving size, as well as quality also influence consumer spending. Shoppers still want to “get what they pay for” and expect brands to take actions to balance price vs. value.

Offering larger sizes with lower per serving/use prices is at the top of the wish list for 36% of respondents to a recent Nielsen survey.13 Charging less for smaller product sizes or only moderately reducing sizes when raising prices were also mentioned as options businesses should consider. Some consumers are even willing to accept lower quality items with no price change.

Cater to customers when confidence is down.

Now is the time to really know your customer – beyond just demographics. What do they typically buy? How have higher prices changed the way they shop?

Automation, artificial intelligence and other advanced technologies enable more personalized interactions with customers for increased satisfaction. So, even in tough times, you can align your business strategies with buyer behavior to attract and keep customers.

Know how and where consumers shop.

It's common for consumers to bounce from mobile apps to websites, to physical stores before they ever make a purchase. And in between, they're on social media asking friends for recommendations. So, it’s important to know the social spaces your customers and prospects frequent and create a connected, omnichannel experience that keeps your business top of mind.Offer discounts and incentives.

Most consumers are cost cutting and looking for deals. Brand loyalty is softening as they carefully consider how much to spend. If you don’t usually offer print and/or digital coupons, or special pricing you could tip the scales in your favor if you do now.Vary product sizes and price points.

Eliminating wasted product is usually another tactic for price-conscious shoppers. They may buy smaller sizes or fewer items if they can get them at a lower price. Or they may be a higher volume if the per unit cost is lower. As the Nielsen survey suggests, companies have an opportunity to re-evaluate product sizes and price points to closely align with consumer expectations for value.Accept a variety of payment options.

Consumers now have multiple payment methods at their disposal, including digital wallets, cryptocurrency, peer-to-peer payment apps, and BNPL. Be sure you can accommodate any payment method and channel they choose whether online, mobile, contactless, or unattended options. An all-in-one payment gateway with consolidated channel management, supported by your bank or merchant services provider, can help easily integrate multiple payment methods for your business.Build positive word of mouth.

Consumers take review scores very seriously – 60% think the number of reviews is important and 49% trust them as much as a personal recommendation.14 Deliver a positive customer experience, then encourage patrons to leave reviews to share with others. Remember to also carefully monitor your business’ net promoter score and reply to feedback in a timely, professional manner. An integrated customer engagement solution can provide the customer analytics to support best practices and simplify social channel monitoring.

It’s important to understand how consumer spending changes with economic conditions. For a complimentary review to identify opportunities you might be missing, simply complete a short form and a Synovus Merchant Services Consultant will contact you with details. You can also stop by one of our local branches.

Market and Industry Insights

Managing Interest Rate Risk When Cost of Money is High

Market and Industry Insights

Mastering the Healthcare Revenue Cycle with Automation

Market and Industry Insights

U.S. Cash Crops Hungering for Growth

-

A Smaller World, After All: Technology that Makes Sense of Global Trade

Global trade is increasingly complex. Learn how international trade platforms can help your company manage risk.

-

Strategies to Achieve Business Growth in 2025

Organizations are optimistic about the future. These corporate growth strategies will help to achieve your goals in 2025.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- CEIC Data, “United States Private Consumption: % of GDP,” December 2023 Back

- The Conference Board, “US Consumer Confidence Retreated in February,” February 27, 2024 Back

- Ibid Back

- Ibid Back

- U.S. Bureau of Labor Statistics, The Economics Daily, “Consumer Prices up 3.1% from January 2023 to January 2024,” February 22, 2024 Back

- Gallup, “Economic Mood Improves, but Inflation Still Vexing Americans,” January 30, 2024 Back

- The Washington Post, “The Fed is Curbing Inflation, But Consumers Say They’re Still Paying Too Much,” September 24, 2023 Back

- McKinsey & Company, “An Update on US Consumer Sentiment: Consumers See a Brighter Future Ahead,” February 29, 2024 Back

- TransUnion, “Bankcard Balances Surge Past $1 Trillion as All Risk Tiers Drive Up Their Credit Card Balances,” February 15, 2024 Back

- Ibid Back

- The Financial Brand, “Buy Now, Pay Later Needs to Pay Off in 2024,” January 25, 2024 Back

- McKinsey & Company, “An Update on US Consumer Sentiment: Consumers See a Brighter Future Ahead,” February 29, 2024 Back

- Nielsen Consumer LLC, “NIQ 2024: Navigating the 2024 Pressure Points to Growth,” January 2024 Back

- Search Engine Journal, “18 Online Review Statistics Every Marketer Should Know,” January 12, 2023 Back