How is the CFO Role Changing?

As business leaders respond to the realities of an uncertain economy, one thing is clear: Organizations must adapt and CFOs will play a critical role in that change. Even before the financial fluctuations began, CFO responsibilities were shifting away from only overseeing accounting functions.

The role of CFO is now much more strategic.

Working collaboratively with other C-suite members and corporate boards, CFOs are empowered to lead strategies that increase organizational resilience and better position their companies to capitalize on emerging opportunities.

Growth is a mandate for CFOs.

Even as companies contend with increased cost of money and lingering supply chain issues, they must create more value and growth. CFOs believe it can be done. A recent survey indicates that, with an average optimism level of 68.5 (on a scale from 0 to 100), most CFOs are extremely hopeful about their firms’ financial prospects — even more so than the overall economy. These leaders expect 5.8% revenue growth this year.1

Growth, however, requires more than just optimism. It requires vision and sound strategy that calculates opportunities to drive value as well as risks. CFOs are laser focused on four key areas — cost optimization, technology transformation, capital management and talent — to help their companies achieve more competitive, dynamic and profitable business models.

-

Cost optimization counterbalances and prioritizes spending.

In a recent survey of senior finance leaders, 55% ranked controlling costs among their top three priorities.2 While CFOs are hopeful about reaching business goals, rising costs of goods and services, as well as overall inflation make profitability harder to achieve. Realizing the economy can’t be controlled, many are looking to reduce spending. Supply chains and manufacturing are specific areas of cost concern for 65% of C-suite executives, along with labor and overhead (52%), and sales/marketing (45%).3

With expense management software, finance professionals can track costs from procurement to payment in real-time, as well as create an audit trail. Reporting and analytic capabilities can pinpoint opportunities for savings. In addition, expense management software often features open architecture for integration with human resource, enterprise resource planning and other systems for tracking and controlling costs. -

Technology transformation leads to greater productivity.

Investments in modern technological tools increase operational efficiency. For example, automating routine accounting and compliance tasks streamlines processes, while reducing errors. Companies are also able to eliminate manual workflows, which frees up finance professionals to devote attention to more strategic initiatives.

However, technology is more than just a tool for automation. With added revenue pressures, CFOs need to make critical decisions much faster. How is the business performing? Where do risks and threats lie? What new markets should be explored to gain a competitive edge? These are all questions that CFOs can readily answer with the precise analysis and reporting generative artificial intelligence (Gen AI) offers. Gen AI is machine learning that observes and replicates patterns found in existing data to create new subject matter. Trending use cases include:4- Forecasting, budgeting, financial reporting Market intelligence and customer insights

- Market intelligence and customer insights

- Strategic problem solving

- Fraud detection and prevention

- Contract management

Technology gives companies access to rich, real-time data and insights, helping to align the business around an informed roadmap. -

Capital management ensures flexibility.

The high cost of debt places more pressure on corporate cash flow. In a Q1 2024 survey of CFOs, only 18% considered debt financing as an attractive option. As stock prices rise and interest rates remain high, equity financing is increasingly attractive, surging from 19% to 37% in just one quarter.5

In an unpredictable economy, an informed capital management strategy carefully weighs assets, liabilities, debts, and investments and takes steps to successfully weather changes.- Proper forecasting and monitoring will ensure adequate capital to cover short-term expenses.

- Accelerate receivables for timely collection of funds owed and improves liquidity.

- Determine whether portfolio allocations are properly aligned to risk tolerance and can meet both short- and long-term needs.

- Consider interest-rate hedging and futures for more predictability.

Effective capital management enables corporations to better manage market uncertainties and take advantage of strategic opportunities. -

Finance executives are building a deep talent pool.

Ninety percent of finance executives will turn their attention to recruiting and retaining talent this year.6 As CFO responsibilities expand beyond accounting, so will the skillsets needed for other finance professionals. CFOs realize the importance of sharpening competencies in key areas.

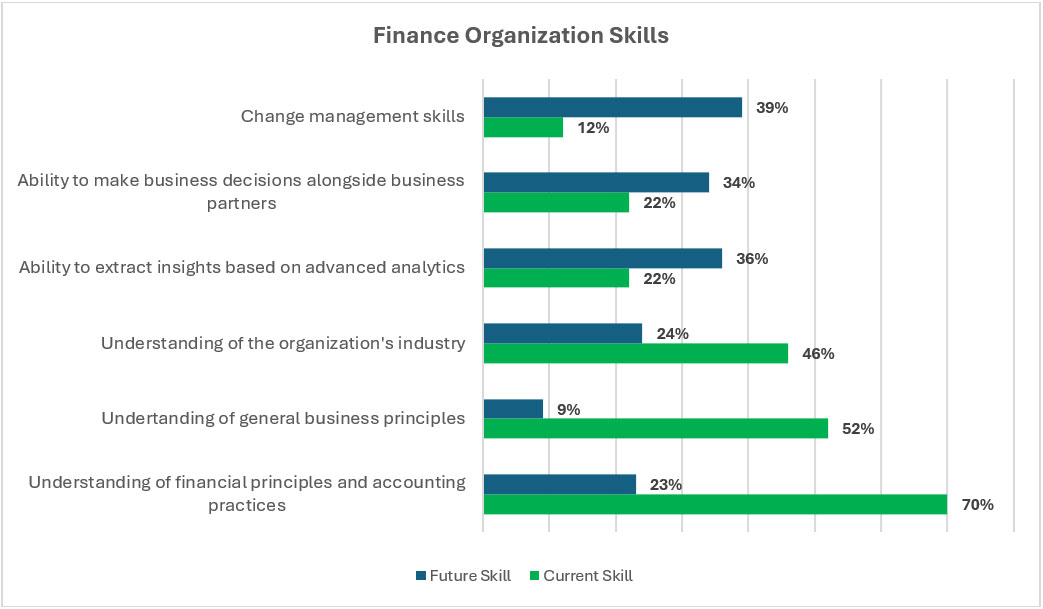

A McKinsey & Company survey revealed many CFOs believe staff currently possess the general business, functional and industry skills needed for their roles. However, these finance leaders indicated expertise in other areas is necessary for future growth.

Source: McKinsey & Company, “CFOs’ Balancing Act: Juggling Priorities to Build Resilience,” August 2023

CFOs are placing emphasis on the ability to manage change, apply advanced analytics, and make business decisions in their search for talent that can drive more value for their organizations.

As technology advances, demand for experienced professionals will only increase. For example, 65% of finance leaders use traditional AI for reporting according to KPMG. Generative AI is the next frontier, as 72% of CEOs already view it as a “top priority” in their organizations. Nearly half of finance leaders have either implemented or are testing the technology, while 37% are researching or planning to deploy.7 Data scientists, AI researchers, deep learning and algorithm engineers, as well as chat bot developers are among the most sought-after talent in the Gen AI field.

The role of CFOs is evolving

Overseeing financial performance is a key component of CFO duties. The modern CFO, however, is now engaged in driving value throughout the organization. With vision and purpose, CFOs will play a more strategic role than ever, helping to guide the company through periods of uncertainty, protecting the company’s stability and creating a flexible foundation for future success.

To see how we help corporate Finance teams reach their goals, complete a short form and a Synovus Treasury & Payment Solutions Consultant will contact you with more details. You can also stop by one of our local branches.

Finance and Treasury

A Smaller World, After All: Technology that Makes Sense of Global Trade

Finance and Treasury

Strategies to Achieve Business Growth in 2025

Finance and Treasury

Cash Flow Management and Investing When Interest Rates Change

-

How to Prevent Phishing and Other Business Fraud

Last year, phishing was the leading fraud claim and the second costliest in FBI investigations. Corporations must know how to prevent phishing to avoid fraud losses.

-

A Smaller World, After All: Technology that Makes Sense of Global Trade

Global trade is increasingly complex. Learn how international trade platforms can help your company manage risk.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- Federal Reserve Bank, “What Landing? CFOs’ Outlook Improves in First Quarter of 2024,” March 27, 2024 Back

- Grant Thornton, “CFOs Ramp Up Sales as Economic Optimism Rises,” April 15, 2024 Back

- Boston Consulting Group, “The CEO’s Guide to Costs and Growth: Strategic Priorities and Opportunities in 2024,” January 2024 Back

- KPMG, “Why Finance Should Lead the Adoption of Generative AI,” 2024 Back

- Deloitte, “CFO SignalsTM,” Q1 2024 Back

- Oracle, “CFO Priorities for 2024: AI, Automation & Strategic Hiring,” May 15, 2024 Back

- KPMG, “Why Finance Should Lead the Adoption of Generative AI,” 2024 Back