Chip technology enhances security for your credit and debit card.

Better Fraud Protection

The embedded chip offers greater protection against fraud when you use your card at chip-enabled terminals. The chip generates a unique transaction code, making it harder to duplicate the card and use it for unauthorized in-store purchases.

Accepted Around the World

Use your card in all the places you always have, including merchant locations and for online and phone purchases. Your card is welcome in the U.S. and internationally.

Easy to Use

When a chip terminal is available, simply insert your card with the chip facing up and follow the prompts to complete your transaction. If the merchant doesn't have a chip terminal, you can continue to swipe your card to pay as you always have.

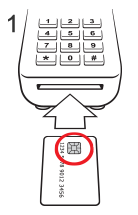

Chip-enabled cards are easy to use.

1. Insert your card "chip first" into the chip-enabled terminal.

2. Leave the card inside the terminal throughout the entire transaction. Follow the prompts on the terminal.

3. Remove your card when prompted to take your receipt.

How do I get my chip-enabled card?

If you have a personal or business credit or debit card with us already, and haven’t received your chip card, you don’t have to do anything, it will be on the way soon! If you don’t have an account with us, visit any Synovus division branch to get information about our products and to apply for your chip card.

As always, you are covered by Zero Liability protections1

Your personal and Business Platinum Visa® and MasterCard® credit and debit cards remain covered by Zero Liability protections1. This means you aren’t responsible when your card or card information is used to make unauthorized purchases. All you have to do is use reasonable care in protecting your card from unauthorized use, and report any unauthorized transactions to us immediately. Whether you are using your card at a chip-enabled terminal, online or swiping it at a terminal that is not yet chip-enabled, you are covered by Zero Liability protections if your card information is lost, stolen or compromised.

Each card owner and authorized user will have a unique card number

Each chip card must have a unique card number, so every person who has access to a joint account will have a separate card number. Because every card has its own number, we don’t have to reissue all your cards when only one has been lost, stolen or compromised. We can replace only the affected card while the other card(s) can continue to be used without interruption.

We're here to help

To learn more about chip card technology, visit your local branch.