How CFOs are Shifting the Finance Paradigm for Greater Business Impact

As business leaders respond to the hard realities of an ongoing pandemic, one thing is clear: This global event dramatically increased the need for organizational change. Even before the crisis, the role of CFO was evolving from overseeing accounting functions to a more strategic one.

Working hand-in-hand with CEOs, other C-suite members and corporate boards, CFOs are now empowered to lead strategies that increase organizational resilience and better position their companies to capitalize on emerging opportunities. CFOs are laser-focused on four key areas — growth, digital transformation, data and analytics, and workforce and labor — to create more competitive, dynamic and profitable business models.

Survival isn’t enough. Companies must create growth.

With devastating supply chain hits and reduction in revenue, the struggles of 2020 taught many hard lessons. CFOs recognize that just surviving isn't enough. To remain strong, companies must create growth. Even in this unpredictable environment, CFOs believe it can be done. A recent survey indicates that, with an average optimism level of 71 (on a scale from 0 to 100), most CFOs are extremely hopeful about their firms’ financial prospects.1

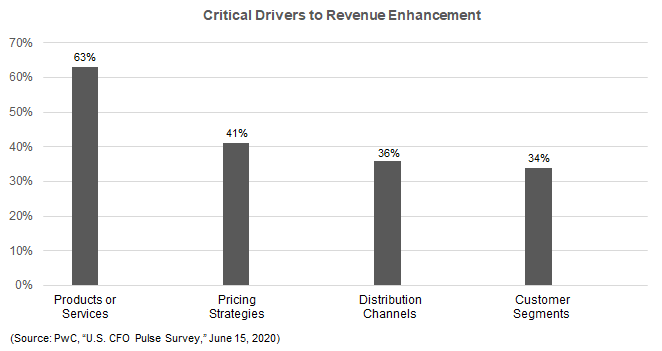

Profit margins and driving revenue are always top of mind, even more so during difficult times. But growth requires more than just optimism. It requires a plan. Among the most effective ways CFOs believe they can overcome the challenges of sparking growth in an unstable economy are examining and retooling products and services, pricing strategies, marketing plans, distribution channels, and customer segments.2

Early in the pandemic, savvy businesses were able to quickly adapt their products, services and strategies to meet the changing needs of their customers. Restaurants switched to delivery-only models, while manufacturers joined in the production of desperately needed PPE. Such innovation will continue to be an essential factor in corporate growth.

Digital transformation is leading the way to greater productivity and profitability.

Technology investments can increase operational efficiency. This is especially true when applying automation to everyday processes. Though only about 34% of finance functions were automated in 2018, 77% of CFOs are leading efforts to improve efficiency through digital technology.3

Automating routine compliance and accounting tasks and controls enables corporations to reduce both errors and costs, while efficiently streamlining processes. In addition, eliminating manual workflows frees up finance professionals to devote more attention to enhancing company profitability.

Discerning finance professionals realize technology is more than just a tool for automation; it is also an enabler of long-term strategic planning. Realizing they must overcome current and future barriers to growth, CFOs are horizon scanning, scenario testing, developing business models and other potential revenue-impacting tasks, supported by a veritable army of specialized applications and tools.

Data and analytics are facilitating improved decision-making.

With added revenue pressures, CFOs need to make critical decisions much faster. But they must also gain consensus across multiple business units, and 76% say their organizations “will struggle to meet objectives” without “one version of the truth.”4 Analytics helps to illuminate that “truth,” while data tells the story.

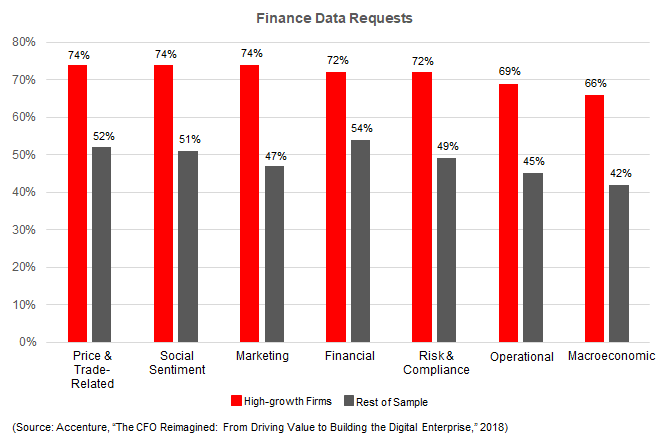

How is the business performing? Where do risks and threats lie? What new markets should be explored to gain a competitive edge? These are all questions that CFOs can readily answer with precise reporting. In fact, CFOs in high-growth firms are increasingly fielding these kinds of questions from colleagues who need granular insight.

CFOs have tremendous responsibility for guiding their companies’ financial performance. But they fully expect to share the load, as well as the results. Sixty-seven percent are willing to train non-finance colleagues in reporting, planning, budgeting and forecasting.5

Access to rich, real-time data and insights helps align the business around an informed roadmap, positioning all parties for success in reaching organizational goals.

Modern times require modern skills.

Labor quality and availability was cited as the second most pressing concern in Duke University’s Q4 CFO Survey.6 As finance responsibilities expand beyond accounting, companies must be able to respond with staffing at the appropriate skill levels.

Just three years ago, CFOs anticipated a rapid change in the skillsets needed for the future. Sixty-three percent of respondents to a Deloitte CFO survey thought they would be spending more time on analysis, prediction and decision support in the future.7 That future is now.

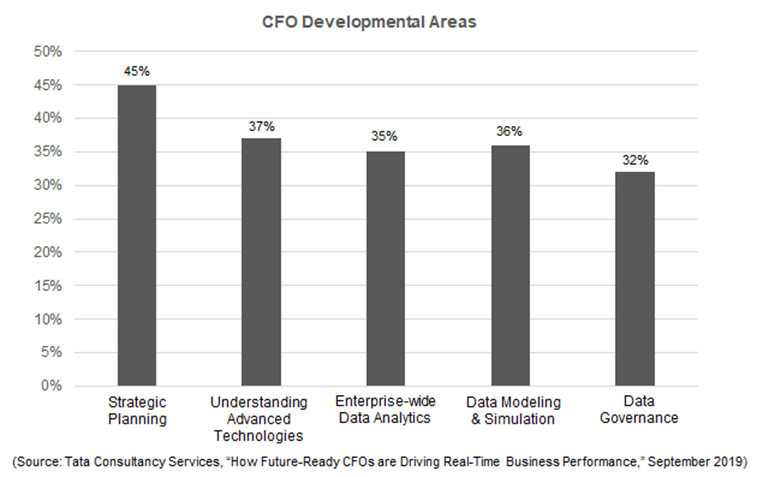

Strategy, technology, analytics, risk management – even cybersecurity – are highly sought-after skills in many industries. CFOs realize the importance of sharpening competencies in these key areas if they are to successfully lead more evolved financial organizations.

The demand for analytical and technical skills will only increase as the business environment becomes more sophisticated. Finance professionals are already getting the training they need and preparing for knowledge transfers to team members – all to the benefit of the organizations they serve.

Though we are living in unprecedented times, the challenges we face offer new opportunities to expand beyond business as usual. With clarity of purpose and vision, CFOs will lead the way.

To see how we help Finance teams reach their goals, contact Synovus Treasury and Payment Solutions, your Treasury Consultant, or Relationship Manager.

Finance and Treasury

Maintaining Positive Cash Flow with Digital Payments

Finance and Treasury

Reaching Economic Stability in an Uncertain Economy

Finance and Treasury

Is Crypto Over?

-

Business Problems CEOs Will Face in 2024

Will the 2024 business outlook be a repeat of last year’s? These are the seven problems that CEOs are tackling.

-

Maintaining Positive Cash Flow with Digital Payments

Automated accounts receivable and accounts payable simplifies processing, enhances reporting and helps maintain positive cash flow.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- Duke University Fuqua School of Business, “The CFO Survey,” December 22, 2020 Back

- CNBC Global CFO Council, “How CFOs Feel About 2021 Hiring and Spending with Vaccine on the Way,” December 2, 2020 Back

- Accenture, “The CFO Reimagined: From Driving Value to Building the Digital Enterprise,” 2018 Back

- ibid Back

- ibid Back

- Duke University Fuqua School of Business, “The CFO Survey,” December 22, 2020 Back

- The Wallstreet Journal, “Bridging the Finance Talent Gap,” March 19, 2019 Back